Kaiko: ‘Liberation Day’ Fuels Investor Pessimism in Crypto Markets

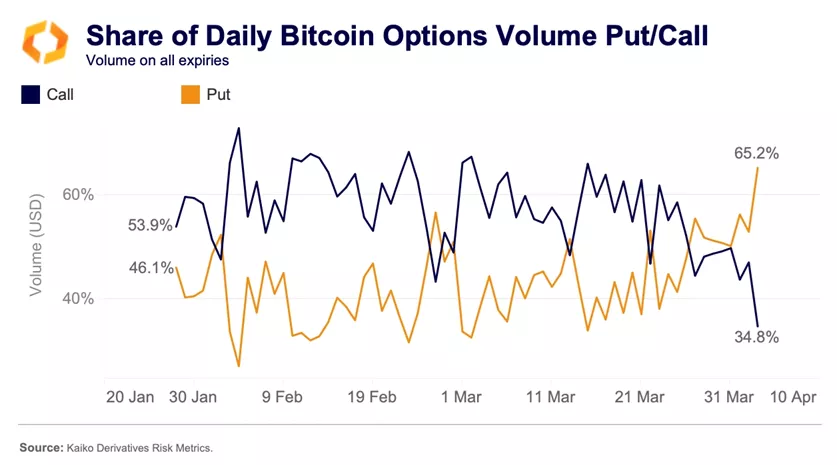

- Interest in Bitcoin put options dominates for May-June, while calls are focused on December expirations.

- Market participants anticipate a retaliatory move from Beijing in response to Trump’s actions, posing a threat to the current rally.

Bitcoin derivatives markets show weak demand for bullish positions following President Donald Trump’s ‘liberation’ tariffs, as investors reassess their prospects for 2025, according to a Kaiko report.

In our latest Data Debrief:

? Post-tariff market rout.

✅USDC market share hits an all-time high.

? Volumes on Korean platforms tumble.Read the full analysis here?https://t.co/Ucbr9ZKXeM pic.twitter.com/051xKTFDFG

— Kaiko (@KaikoData) April 7, 2025

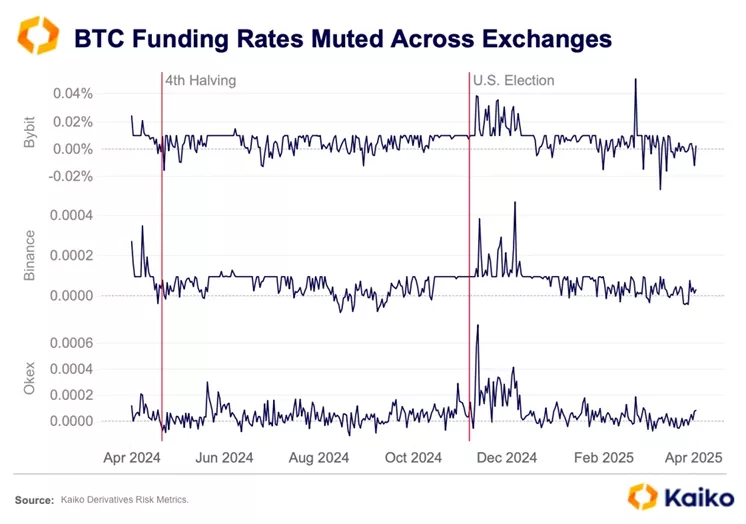

Experts noted minor fluctuations in funding rates, slightly above zero, indicating low leverage levels following recent liquidations.

In the options market, interest has shifted towards puts, accounting for 65.2% of trading volume, indicating increased demand for downside protection.

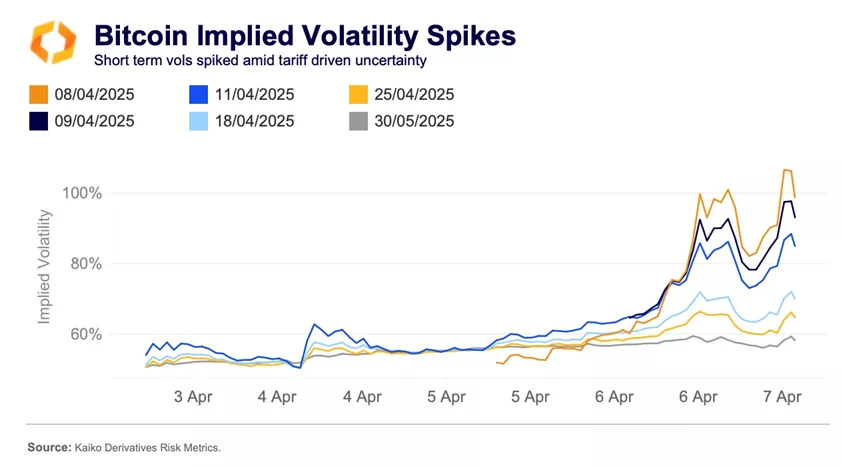

Uncertainty following President Trump’s announcement of ‘reciprocal tariffs’ has led to increased implied volatility across all near-term expirations.

Specialists noted significant demand for puts with strikes at $70,000 and $60,000, driven by heightened macroeconomic uncertainty.

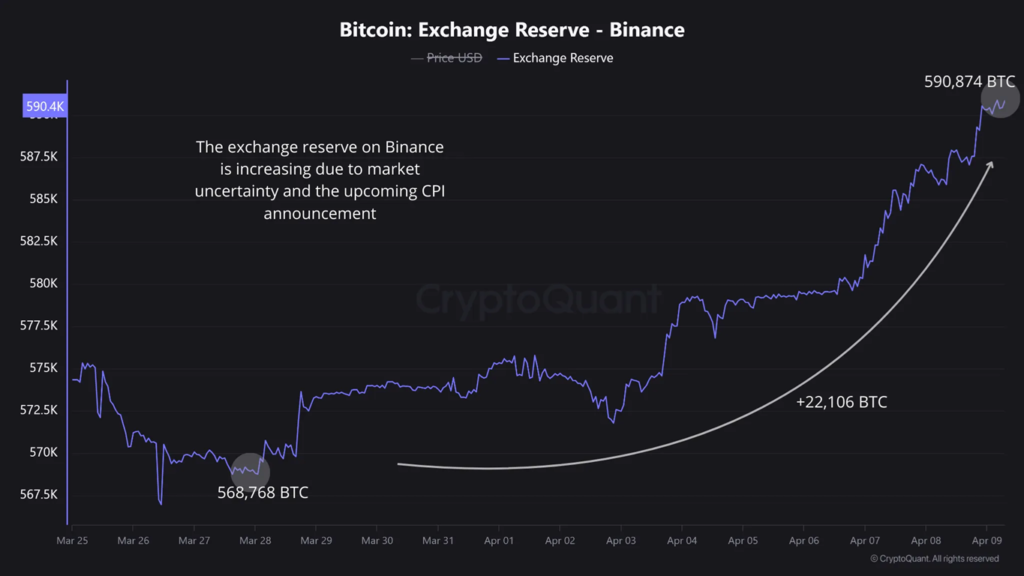

In CryptoQuant, similar conclusions were drawn regarding the underlying causes of current market sentiment. They recorded an increase in Binance’s Bitcoin balance by 22,106 BTC over the past 12 days, from 568,768 BTC to 590,874 BTC.

Fragile Truce

QCP Capital noted the weakening of the yuan against the US dollar to 7.3498, marking an 18-year low. The depreciation followed Trump’s announcement of a temporary maintenance of tariffs at 10%. Tariffs on Chinese imports remained at 104%.

Asia Colour — 10 Apr 25

1/ If “Make America Wealthy Again” were a stage production, last night was its dramatic crescendo. President Trump paused planned tariff hikes for 90 days, while introducing a blanket 10% tariff on all countries except China. Markets loved it — the S&P…

— QCP (@QCPgroup) April 10, 2025

Experts reminded that the devaluation of the national currency maintains the competitiveness of Chinese exports amid tightening trade policies.

Market participants anticipate a retaliatory move from Beijing, threatening to derail the current rally and transform it into a classic bull trap.

Analysts urged caution, noting the predominance of put purchases for May-June, which may indicate market makers offloading ‘unwanted positions.’

Specialists pointed to positive prospects in the longer term due to the concentration of December call purchases with a strike at $100,000.

As reported in Glassnode, an on-chain analysis of digital gold was conducted following Trump’s tariff hikes.

Earlier, former BitMEX CEO Arthur Hayes stated that new US tariffs could trigger a capital shift into digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!