CryptoQuant Identifies Bitcoin’s Entry into a Caution Zone

The current trend of net realised profit for the leading cryptocurrency does not suggest the formation of a macro peak, but it does indicate entry into a “caution zone,” according to CryptoQuant.

Experts urge monitoring changes in the metric:

- consistent realised profit — increases the risk of a correction;

- decrease in profit-taking — the first signal of a cycle transition.

Analysts believe that in the short term, increased volatility can be expected.

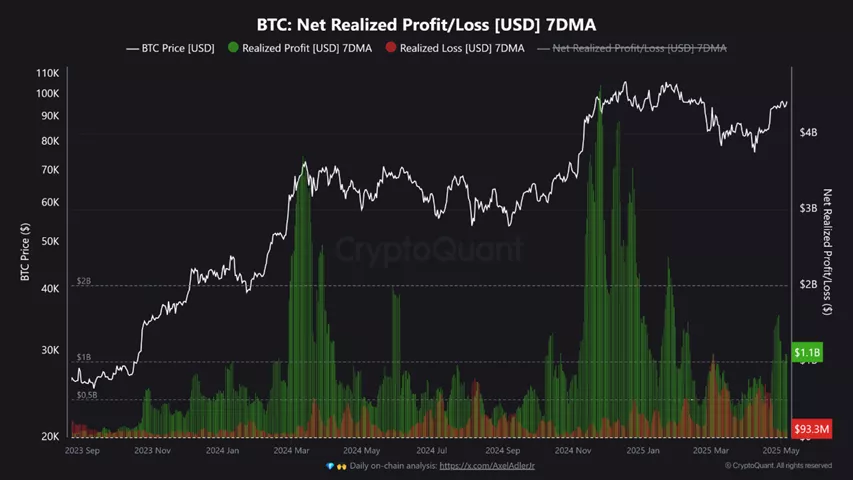

Currently, Bitcoin’s net realised profit/loss (7 DMA) has remained positive since the beginning of 2024, reaching $1 billion per day.

According to experts’ observations, even after the recovery of quotes following the decline in March-April 2025, users are “unloading” portfolios, locking in gains, albeit at a slower pace compared to November-December 2024.

“This historically corresponds to late-stage bull market behaviour. During this period, profit realisation predominates, even as the price continues to rise,” the commentary states.

In the past, such a phase often preceded a local peak or sharp correction, especially when the pace of closing positions in profit remained high and steady.

Since the launch of spot ETFs in January 2024, the market structure has changed, but investor psychology has not, analysts emphasised.

Earlier, Glassnode noted the risks of a sell-off as Bitcoin approaches $100,000.

Back in Standard Chartered, they urged buying the leading cryptocurrency and forecasted its price increase to $120,000 in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!