Standard Chartered Urges Bitcoin Investment

Jeffrey Kendrick, head of digital asset research at Standard Chartered, has advocated for the purchase of Bitcoin, forecasting its rise to $120,000 by the second quarter. This was reported by The Block.

The expert’s target for the end of 2025 is $200,000, attributed to investors reallocating capital from US assets to the leading cryptocurrency.

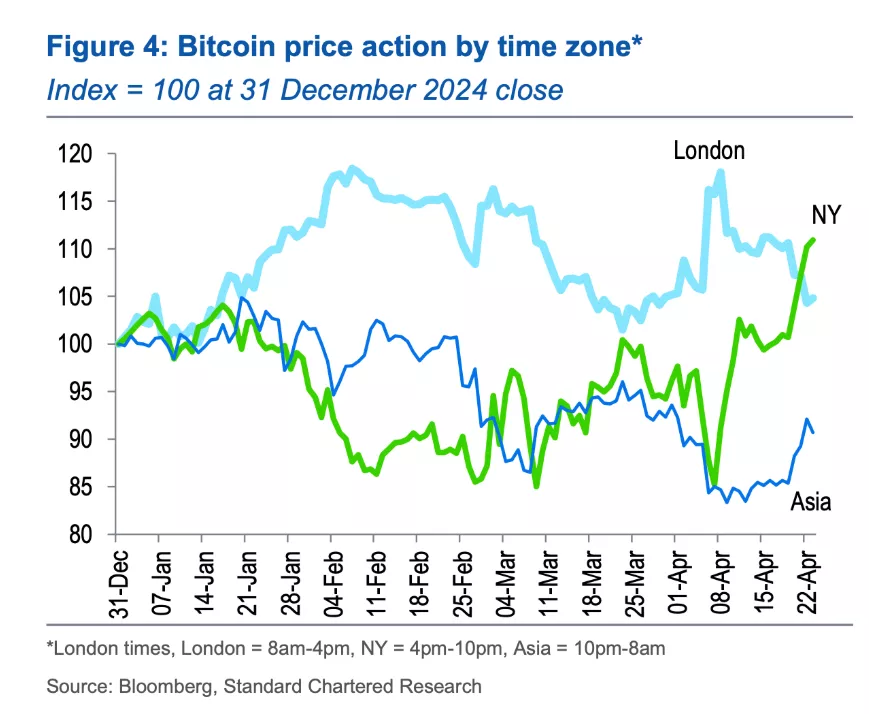

Kendrick noted that data on purchases at different times of the day and the accumulation by large holders support this theory. For instance, the US Treasury bond premium reached a 12-year high, strongly correlating with Bitcoin.

Moreover, analysis of the time of day indicated that US investors are seeking assets outside the country. Last week saw significant inflows into ETFs, also pointing to a shift in interest towards digital gold, Kendrick emphasized.

Following President Donald Trump’s announcement of a temporary suspension of tariffs, American investors began purchasing the leading cryptocurrency en masse. Kendrick noted that prior to this, Bitcoin had fallen alongside tech stocks but then showed strong performance.

This divergence in correlation suggests that investors are opting for more reliable assets. Additionally, similar purchases are observed among Asian traders, reinforcing the trend.

Kendrick also highlighted active purchases by whales with balances exceeding 1,000 BTC. They accumulated Bitcoin both during the tariff-induced downturn and the subsequent recovery linked to risks of losing independence of the Fed.

The analyst expects the price increase of the leading cryptocurrency to continue into the summer, driven by growing interest from institutional investors, May ETF reports, and potential adoption of stablecoin legislation in the US.

Bitcoin vs Gold

The expert believes Bitcoin has become a more reliable asset for hedging against financial system risks. While gold also serves this purpose, Kendrick is confident in the greater efficiency of the digital asset due to its decentralized nature.

Gold remains the better hedge against geopolitical risks and traded more stably during tariff escalations, given its lower correlation with risky assets, the researcher noted.

Earlier, Standard Chartered estimated the capitalization of stablecoins to reach $2 trillion by 2028.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!