Crypto Fund Inflows Surge to $6.7 Billion Since Start of Year

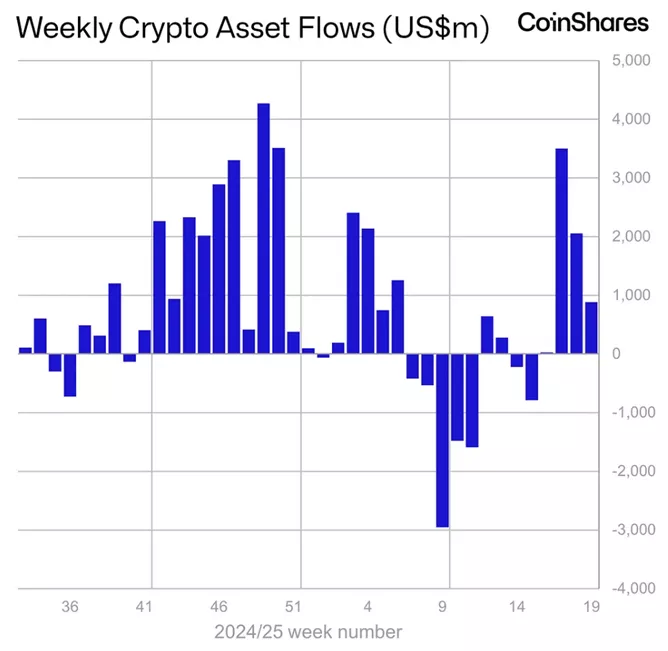

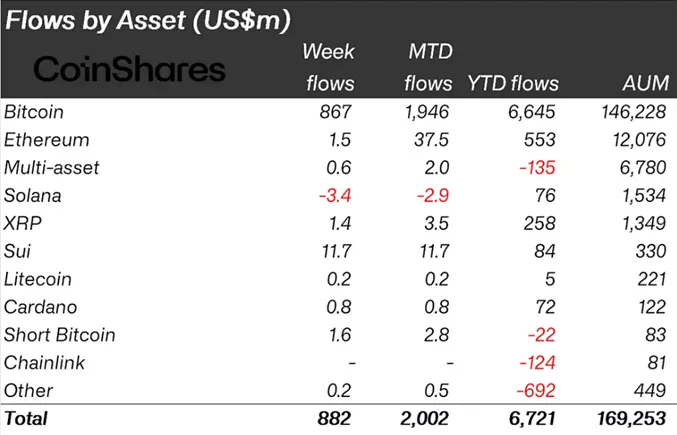

Between May 3 and May 9, net inflows into cryptocurrency investment funds amounted to $882 million, compared to $2.03 billion in the previous period, according to a report by CoinShares.

This positive trend has continued for the fourth consecutive week.

Total inflows since the beginning of the year have risen to $6.7 billion. At its peak in February, the metric reached $7.3 billion.

AUM increased to $169.3 billion.

Analysts attributed the trend to a combination of factors: a global increase in money supply, stagflation risks in the US, and the approval of the first cryptocurrency as a reserve asset by several US states.

Inflows into digital gold-based instruments slowed from $1.84 billion to $867 million, while those based on Ethereum decreased from $149.2 million to $1.5 million.

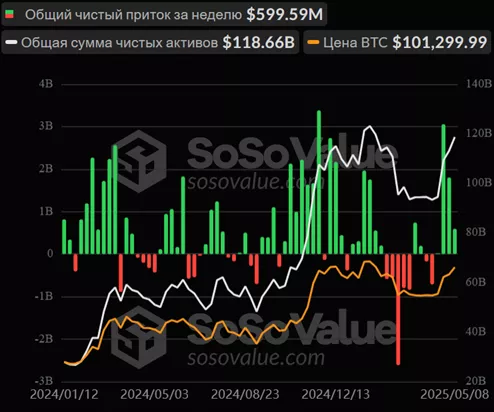

The segment of US spot Bitcoin ETFs recorded an inflow of $599.6 million. A week earlier, investors had added $1.81 billion to these products.

Among altcoins, XRP ($1.4 million) and Sui ($11.7 million) stood out. The latter outpaced Solana in fund inflows since the start of the year — $84 million compared to $73 million.

Earlier, on May 8, Ethereum prices surged by 22% following the activation of the Pectra hard fork.

On May 12, Bitcoin tested $105,000 amid a US-China trade deal.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!