Bitcoin Tests $105,000 Amid US-China Trade Deal

The price of the leading cryptocurrency briefly surged to $105,700, before a subsequent correction brought it back to around $104,500.

The sharp price movement in Bitcoin followed the US administration’s announcement of a 90-day “truce” in the trade war with China. The two nations agreed to mutually reduce tariffs for this period: the United States from 145% to 30%, and China from 125% to 10%.

JUST IN: Treasury Secretary Scott Bessent announces a US-China deal for a 90-day tariff cut on goods from both nations https://t.co/VvWOXWJS2x pic.twitter.com/K3BGElwzZ4

— Bloomberg TV (@BloombergTV) May 12, 2025

Prior to the announcement of the Geneva negotiations’ outcome, some experts speculated that the agreement could act as a catalyst for cryptocurrency growth.

“We believe institutional investors are less hesitant to invest in Bitcoin and digital assets as trade uncertainty comes to an end and the likelihood of rate cuts increases,” said BTSE’s COO Jeff Mei in a comment to Cointelegraph.

Jupiter Zheng from HashKey Capital echoed this sentiment.

“The US-China deal could signal stability in global markets, potentially prompting investors to seek growth opportunities and channel capital into alternative assets,” the analyst noted.

Conversely, trader Daan Crypto anticipated a possible Bitcoin correction following the agreements between the world’s two largest economies.

$BTC Has outperformed stocks since “Liberation” / Tariff Day on the 2nd of April.

It held up incredibly strong during a sharp sell off on stocks in April.

It then also proceeded to outperform as the markets bounced and tariffs were implemented.

Back then people were wondering… pic.twitter.com/gfvfH80TVP

— Daan Crypto Trades (@DaanCrypto) May 11, 2025

“Theoretically, if trade uncertainty was what drove digital gold’s price up, the asset should stop appreciating after the US-China deal,” the expert explained.

Vincent Liu, Investment Director at Kronos Research, told The Block that Bitcoin’s rise is supported by “strong technical momentum.” The cryptocurrency is trading above its 50- and 200-day moving averages, he explained.

“Growing institutional adoption and a favorable outlook for 2025 suggest a possible path to another all-time high,” the expert added.

However, BTC Markets analyst Rachel Lucas pointed out that Bitcoin’s relative strength index (RSI) indicates overbought conditions.

“This doesn’t necessarily mean an immediate reversal, but it increases the likelihood of some short-term cooling or sideways movement. Retesting and consolidating above the key psychological level of $100,000 would be a healthy development and could lay the groundwork for further growth,” she emphasized.

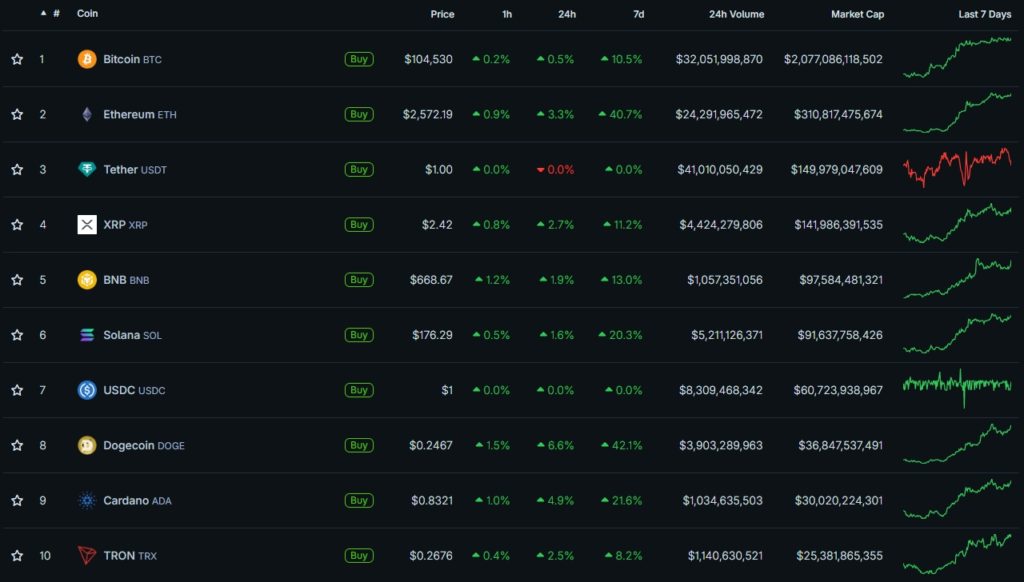

Despite the short-term spike, the price of the leading cryptocurrency has remained largely unchanged over the past day. Some leading altcoins have shown better performance.

In terms of weekly growth, Dogecoin and Ethereum have outperformed digital gold by about four times, with the latter gaining around 10% over the period.

“We are witnessing a classic rotation as Bitcoin dominance reaches levels last seen before the 2021 bull market, and capital begins to flow into altcoins,” suggested Presto Research analyst Min Jung.

As reported, Standard Chartered urged investors to buy the leading cryptocurrency and forecasted its price increase to $120,000 in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!