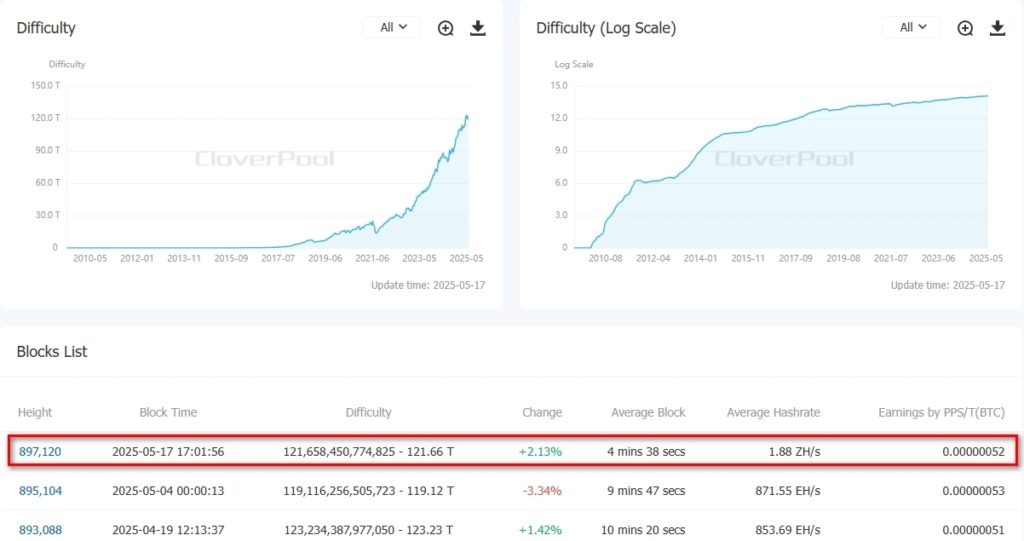

Bitcoin Mining Difficulty Rises by 2.13%

The latest recalculation has seen the difficulty of mining the leading cryptocurrency increase by 2.13% to 121.66 T.

The metric has not returned to its all-time high of 123.23 T, from which it fell by 3.34% during the previous adjustment about two weeks ago.

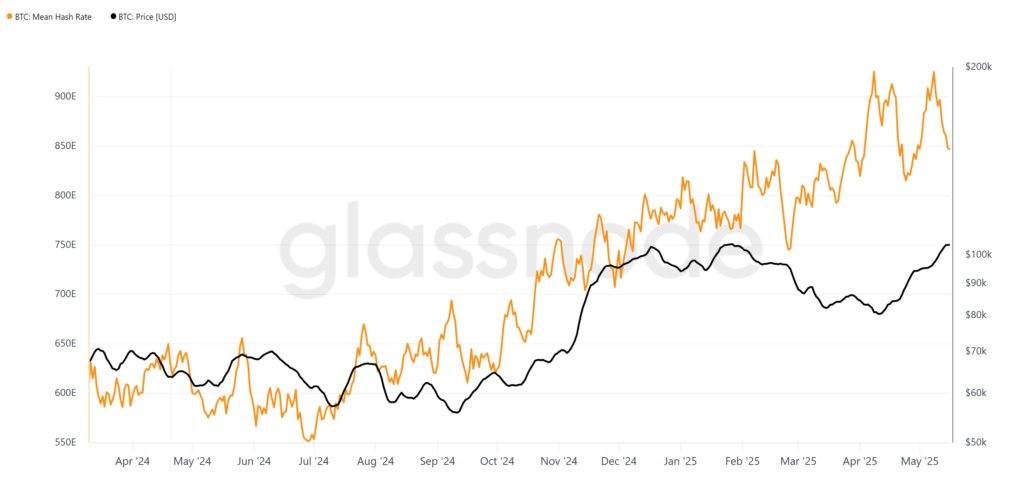

According to Glassnode, on May 8, the hash rate (7 DMA) tested the record level of 925.4 EH/s recorded a month earlier. At the time of writing, the value had decreased to 846.2 EH/s.

Data from Hashrate Index indicates that amid the cryptocurrency rally in the first half of May testing $105,000, the hash price recovered to around $55-56 per PH/s per day.

The mining profitability metric has moved away from the local April low of ~$40 per PH/s per day, yet remains over 10% below the values seen in December 2024.

Industry experts observed that in April, major public companies in the sector increased their Bitcoin sales, selling about 70% of the coins mined. The shift away from last year’s popular HODL strategy among miners was already evident in March.

Analysts have identified a risk factor for network security in the significant divergence between cryptocurrency price dynamics and hash rate. CryptoQuant viewed the trend as a sign of strong fundamentals for the leading cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!