Options traders bet on bitcoin rising to $115,000–$120,000

- The options market points to a potential volatility spike for the leading cryptocurrency over the next three days as investors may react to news from the Las Vegas conference.

- Technical analysis does not rule out a pullback in bitcoin to $100,000.

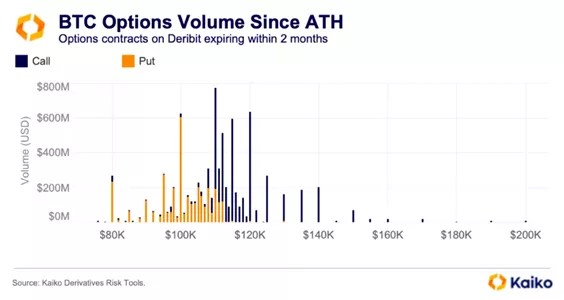

In bitcoin options expiring in June–July, activity is concentrated in calls with strikes at $115,000 and $120,000. The largest turnover was in contracts with $110,000 expiries, according to Kaiko.

? #Bitcoin hit a new #ATH of last week, but with muted volumes & low leverage, caution still rules the market.

In our latest Data Debrief we break down tha rally in ten charts:

?BTC hit $112K on May 22, despite risk asset selloff

✅Spot volume ($20B+) just half of Dec… pic.twitter.com/eJG9vx0HXd— Kaiko (@KaikoData) May 26, 2025

Separately, specialists noted that since hitting new highs, there has been heavy trading in $100,000-strike puts. Since May 22, volumes in such contracts have exceeded $600 million.

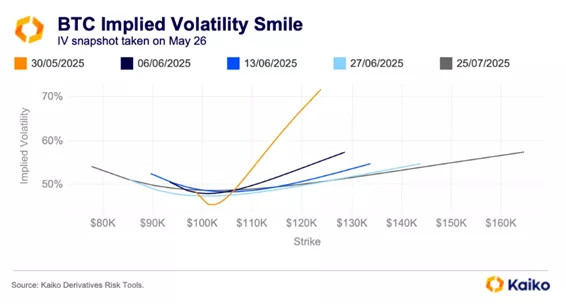

The picture looks more optimistic in options expiring on May 30.

On longer time frames, the setup is more balanced, with no clear bearish or bullish skew. In other words, consolidation around current levels is likely over the coming weeks, Kaiko said.

The specialists noted a significant decline in downside risk owing to a rise in inactive wallets and increased corporate purchases of the leading cryptocurrency.

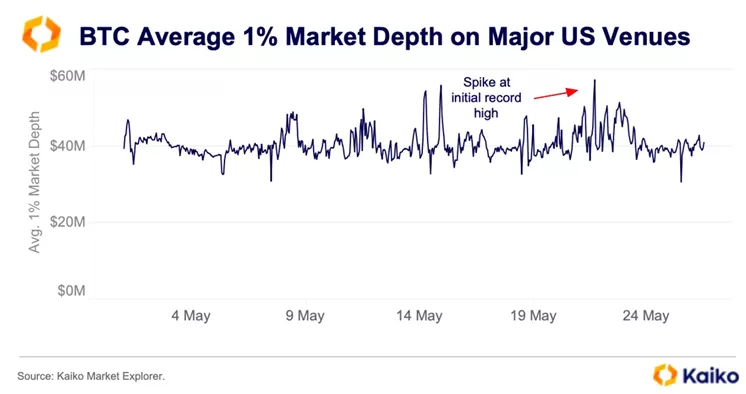

The flip side is the potential for rapid reductions in bitcoin positions if volatility spikes. The effect is tempered by high average market depth on CEX.

Las Vegas conference — a risk for bulls?

Kaiko also flagged the bitcoin conference in Las Vegas (Nevada, USA) from May 27 to 29, which could constrain liquidity and exacerbate price moves.

QCP Capital noted that J.D. Vance, Michael Saylor, Donald Trump Jr. and Eric Trump will attend the event. Like their peers at Kaiko, the analysts highlighted possible near-term swings in prices — supported by the dynamics of implied volatility in options.

Asia Colour — 27 May 25

1/ $BTC stayed range-bound between $107K and $110K last Friday, even as equities ripped higher. Spot ETF flows held firm, offering support. But front-end implied volatility remains elevated, pointing to deeper concerns under the surface.

— QCP (@QCPgroup) May 27, 2025

As a precedent, the experts cited July 2024, when after U.S. President Donald Trump’s speech at the bitcoin conference in Nashville (Tennessee) prices plunged by 30% in just two days.

While a comparable drawdown appears unlikely, positioning implies a defensive stance, the experts clarified.

“Bitcoin will remain range-bound in the near future. After the event, implied volatility is expected to decline as risk premia fade,” the review says.

Pullback to $100,000?

CoinDesk suggested the price of digital gold could break out of its bullish channel toward support at $100,000 while keeping positive prospects on the medium-term time frame.

The scenario is indicated by a bullish divergence on the 30-day RoC indicator and the MACD histogram moving into bearish territory.

Medium-term optimism keeps the “golden cross” intact after the 50 DMA crossed the 200 DMA from above to below.

Earlier, Matrixport recommended partially taking profit on bitcoin longs.

Earlier, CoinDesk presented six charts of various metrics confirming a solid foundation for bitcoin to break above $100,000.

Standard Chartered urged buying the leading cryptocurrency and forecast its price to rise to $120,000 in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!