Experts assess bitcoin’s risks and potential for investors

- Analysts urged companies to revisit their strategies and brace for a sharp crypto-market correction.

- Bitwise said that a moderate allocation to bitcoin (up to 5–10% of a portfolio) can boost investment returns.

Economist and author of The Bitcoin Standard Saifedean Ammous said the first cryptocurrency is nearing the top of its bull cycle. After that, the asset could fall by 80%, he said.

He advised companies investing in bitcoin to prepare for such a scenario.

“Shaky ground”

The expert stressed that the digital gold is on “very shaky ground”. Ammous urged corporate investors to revisit their strategies if their business models would not withstand such stress.

“I think we are approaching a very shaky top and a subsequent drop,” he emphasized.

Historically, the bitcoin price peak has arrived 12–18 months after the halving, he said. Ammous allowed that the price could still rise to $200,000 in the current cycle. However, he noted that since the bottom the asset has already gained more than 600%.

TV host and Heisenberg Capital founder Max Keiser also questioned whether new corporate entrants can withstand bitcoin’s typical bear‑market volatility.

The @Strategy clones have not been tested in a bear market.@saylor never sold, and just kept buying, even when his BTC position was under water.

It’s foolish to think the new Bitcoin Treasury @Strategy clones will have the same discipline.

— Max Keiser (@maxkeiser) May 31, 2025

He cited Strategy founder Michael Saylor, who kept buying the first cryptocurrency even during drawdowns. He doubted that his followers will show the same discipline.

Rethink strategy

CIO Bitwise Matt Hougan urged investors to rethink how bitcoin fits into traditional portfolios. In his view, such a rethink can raise returns while reducing risk.

Hougan stressed that bitcoin should not be added in isolation. It should be considered in the context of an investor’s overall risk budget.

Bitcoin is known for high volatility—three to four times the swings of the S&P 500. Yet its low correlation with equities and bonds allows it to improve overall portfolio metrics, Hougan said.

5% in bitcoin

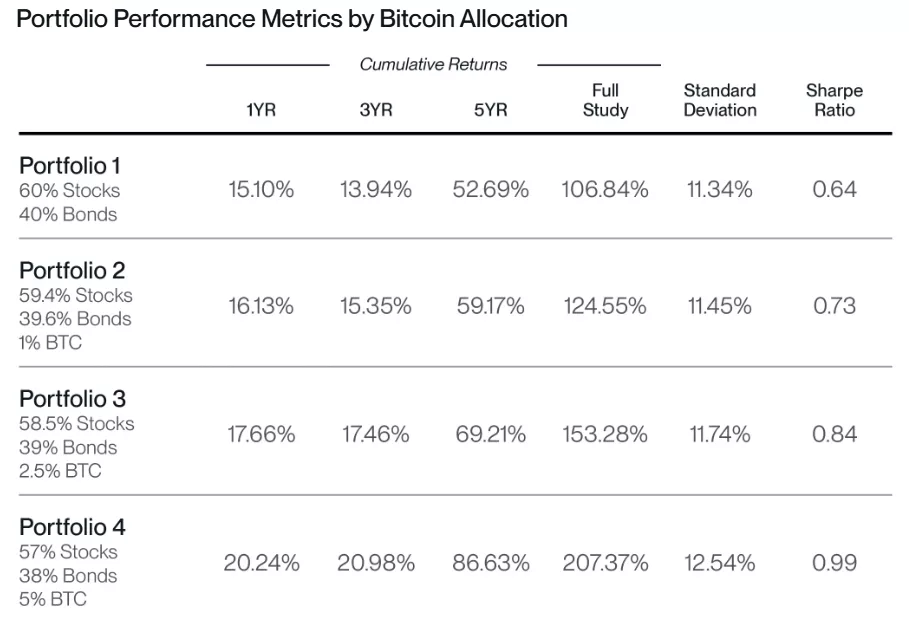

As an example, the Bitwise CIO cited data from 2017 to 2024. Allocating 5% of a portfolio to bitcoin (by trimming equities to 57% and bonds to 38%) lifted cumulative returns from 107% to 207%. Volatility rose only slightly—from 11.3% to 12.5%.

Hougan acknowledged that many market participants manage their personal portfolios differently. They often prefer so‑called barbelled structures: large allocations to cryptocurrencies and to fiat or money‑market funds, with only a minimal share for other assets.

According to the expert, if an investor devotes 5% to bitcoin and simultaneously increases the share of bonds by 5%, that would theoretically reduce equity risk. Historical data show that such a comprehensive adjustment would have delivered higher returns than a standard 60/40 portfolio.

Hougan emphasized that further optimization—say, a portfolio of 40% equities, 50% bonds and 10% bitcoin—could produce even higher returns and lower risk compared with the initial example (simply adding 5% BTC).

In May, Bernstein experts predicted that companies’ holdings of the first cryptocurrency would rise to $330 billion by 2029.

Later, Standard Chartered assessed the impact of corporate bitcoin strategies on digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!