Circle Expands USDC Adoption with Bybit and Ant Group Partnerships

Circle, the issuer of the USDC stablecoin, has entered into a revenue-sharing agreement with the cryptocurrency exchange Bybit. Simultaneously, fintech giant Ant Group is preparing to integrate the asset into its own blockchain platform.

Partnership with Bybit

The terms of the deal with the exchange remain undisclosed. However, such agreements are part of Circle’s strategy to promote USDC. The issuer shares a portion of the interest income from its reserves with platforms, incentivizing the adoption of the stablecoin.

Circle has similar arrangements with other major platforms. For instance, the company shares 50% of the income from USDC reserves with Coinbase. Binance received a one-time payment of $60.25 million and continues to receive monthly payments. The reward size depends on the USDC balance on the exchange and is linked to the SOFR rate.

One source from CoinDesk claims that Circle has revenue-sharing agreements with several trading platforms.

Deal with Ant Group

The collaboration with Ant Group will provide USDC access to the company’s global payment infrastructure. Ant International, the international division, plans to implement the stablecoin for treasury operations and cross-border payments.

Integration will occur once USDC obtains the necessary regulatory status in the United States. The exact timeline remains unspecified.

Last year, Ant processed transactions exceeding $1 trillion, a third of which went through its blockchain. According to Bloomberg sources, Ant International is also applying for licenses to operate with stablecoins in Singapore and Hong Kong.

“Stablecoin Summer”

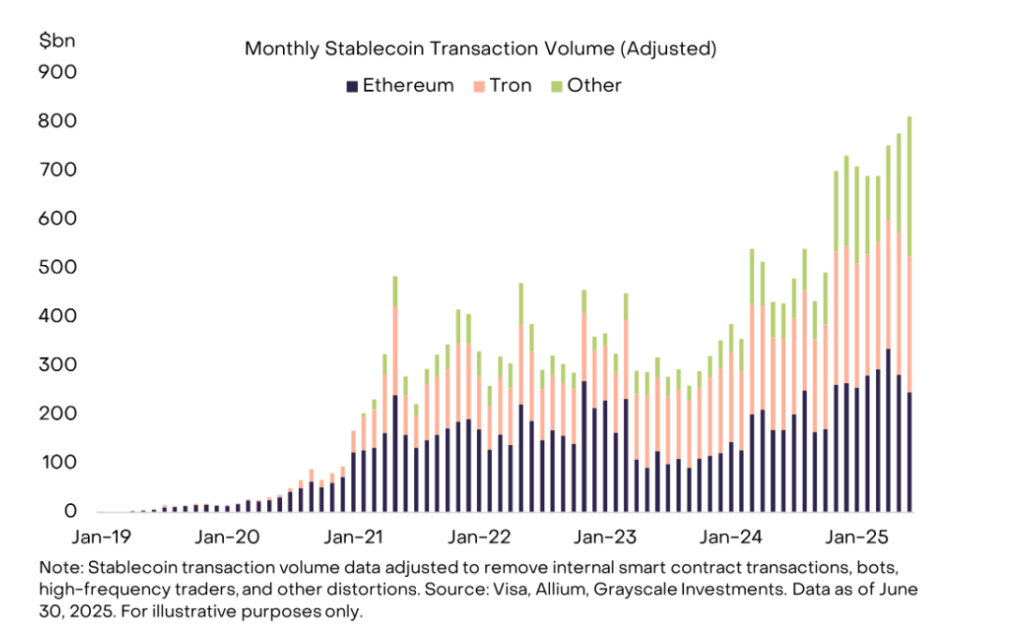

These developments occur amid a general rise in interest in the sector, dubbed “stablecoin summer” by industry analysts at Grayscale. According to Visa estimates, the monthly transaction volume using such assets reaches $800 billion.

Circle itself is also thriving. Following its IPO the company’s shares (CRCL) rose from $31 to $181 by the end of June.

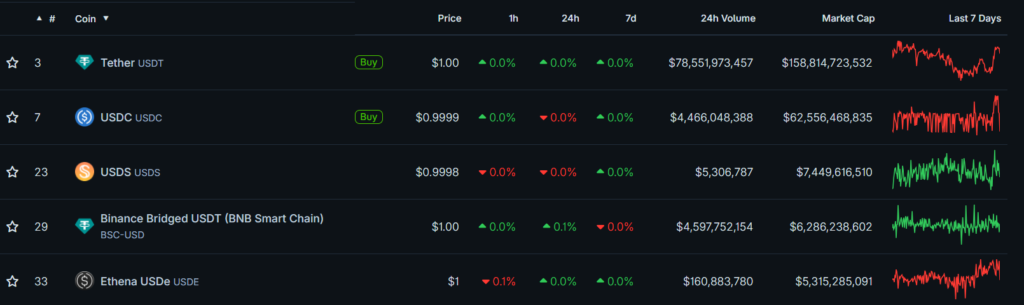

USDC’s market capitalization stands at $62.5 billion, while its main competitor, Tether’s USDT, reaches $158 billion.

Additionally, on June 17, the US Senate passed the GENIUS Act, establishing a legal framework for stablecoins. The document sets requirements for reserves, AML procedures, and audits.

Earlier, Circle submitted a request to the US Office of the Comptroller of the Currency for a national trust bank license.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!