Bitcoin Price Falls Below $117,000 Following US Inflation Data Release

After reaching a historic high of over $123,000, the leading cryptocurrency fell nearly 4% in a day, according to CoinMarketCap.

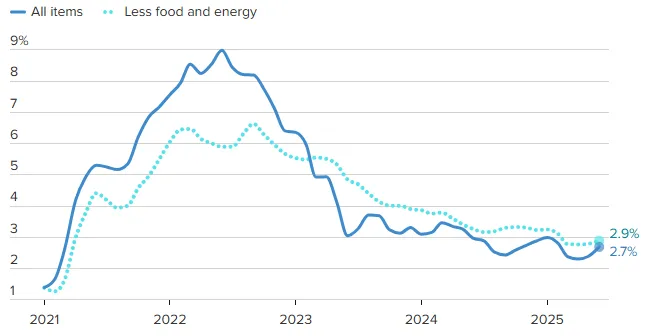

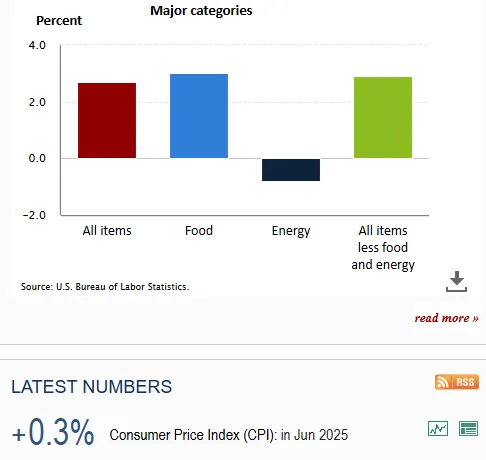

Inflation in the US has accelerated: the consumer price index rose to 2.7% for the month.

The previous figure was 2.4%.

The price of Bitcoin continued to decline:

At the time of writing, the market leader is trading around $117,000.

“After the rapid movement from $108,000 to $122,000, some correction is natural. […] Now, attention should be paid to the $116,300 mark as the nearest psychological level, where significant liquidations are observed,” noted Nansen analyst Nikolai Sondergaard.

Inflation Data

The market is likely preparing for the release of June’s US inflation data, which could influence expectations of rate cuts this year.

The forecasted core consumer price index is expected to rise by 3–3.1% year-on-year. A higher figure could dampen market participants’ risk appetite and intensify the cryptocurrency correction, shared Bitfinex analysts in a conversation with The Block.

“Exceeding the figure (for instance, above 3.2%) could delay the Federal Reserve’s policy easing, weaken market sentiment, and increase borrowing costs. This would strengthen the dollar and reduce interest in non-yielding assets like Bitcoin, which, judging by past reactions to Consumer Price Index (CPI) releases, could extend the correction by 5–10%,” experts noted.

If the overall figure is below 2.5% and the core approaches 2.9%, it could restore bullish momentum and push Bitcoin’s price back above $120,000. A similar trend was observed in May, amid the release of more moderate data.

Long-term inflation expectations continue to be a key market influence. Several forecasts suggest a higher CPI level in 2025 due to trade tariffs. This could limit the rally potential driven by rate cuts, Bitfinex analysts noted. However, they emphasized the resilience of cryptocurrencies and growing investor interest, as evidenced by the steady inflow of funds into ETFs.

Sondergaard noted that discrepancies in inflation data increase market uncertainty:

“Platforms like Truflation indicate a potential decline, while traditional sources expect stability or growth,” he said.

The expert noted that at this stage, a decrease in inflation could be seen as a positive signal, while its increase could be moderately negative, especially given concerns about the delayed effect of tariffs.

Bitcoin’s market capitalization has exceeded the GDP of countries like Canada ($2.2 trillion) and Brazil ($2.1 trillion).

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!