Ethereum trading volume surpasses Bitcoin’s

For the first time in a prolonged period, trading turnover in the second-largest cryptocurrency has exceeded that of digital gold, analysts at CryptoQuant said.

“The spot ETH/BTC ratio crossed 1 for the first time since June 2024,” the researchers emphasised.

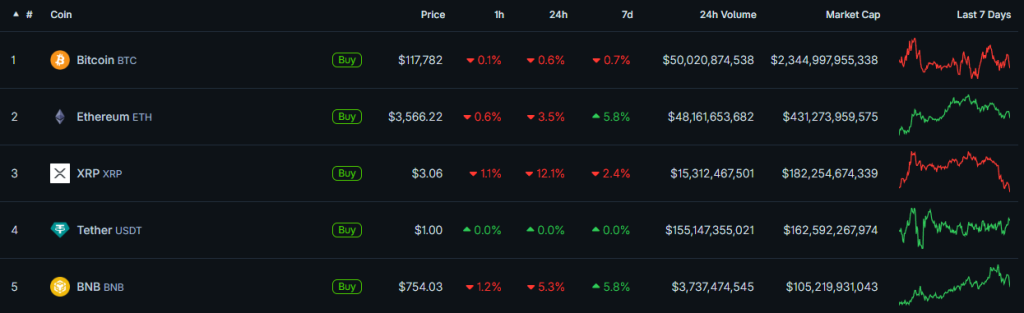

Over the past 24 hours, Ethereum has fallen by roughly 3% against bitcoin. The rally stalled after a sustained push toward $4000. At the time of writing, ether’s volume-weighted average price is around $3566.

Santiment analysts, however, are confident the uptrend will resume.

📊 Ethereum’s price ratio vs. Bitcoin has fallen -5.8% in the past 60 hours. A major FOMO-driven $ETH trading volume spike, just like we saw in the beginning of May, ended up foreshadowing a local top. If trading & social volume fall the rest of the week, this would be a strong… pic.twitter.com/8plhJsxJKe

— Santiment (@santimentfeed) July 23, 2025

“The Ethereum rate versus bitcoin has declined by ~5.8% over the past 60 hours. A FOMO-driven spike in ETH trading volumes, similar to the surge at the beginning of May, preceded a local top. If trading and social activity continue to fall through the rest of the week, this could signal a new wave higher amid retail profit-taking,” they explained.

Drivers of the correction

Presto Research analyst Min Jeong believes the market pullback came without an obvious trigger — more akin to profit-taking:

“It looks more like a pause or profit-taking, especially considering that Ethereum is still up 7% on the week and Dogecoin 12%.”

CoinW chief strategy officer Nassar Al-Achkar voiced a similar view:

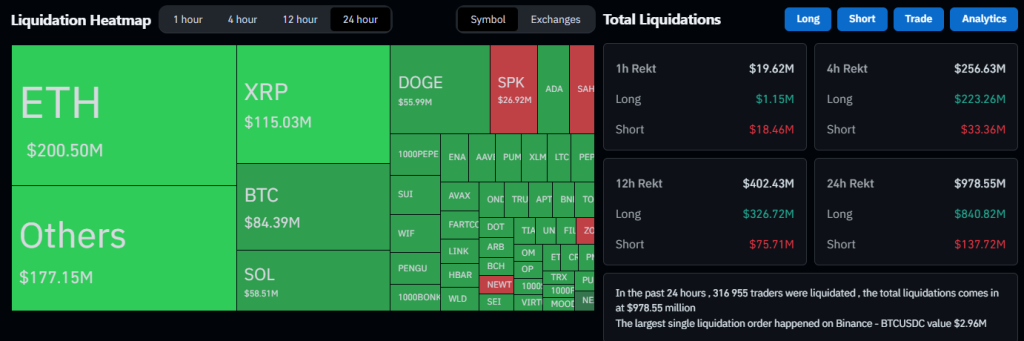

“The sharp price pullback is tied to temporary profit-taking after the recent rally, amplified by liquidations of leveraged positions and rotation out of altcoins amid anticipation of ETF decisions.”

Kronos Research investment director Vincent Liu said the correction is largely driven by “a cascade of liquidations [highly leveraged longs] and thinning liquidity”.

Altcoins remain under pressure amid waning retail interest. Traders are focused on geopolitical risks, inflows into institution-oriented ETFs and key technical support levels, said LVRG Research director Nick Rak.

In Min Jeong’s view, the broader picture remains broadly stable:

“Cryptocurrencies continue to see demand from corporate treasuries. Traders are closely watching upcoming reports from major technology companies and macroeconomic signals.”

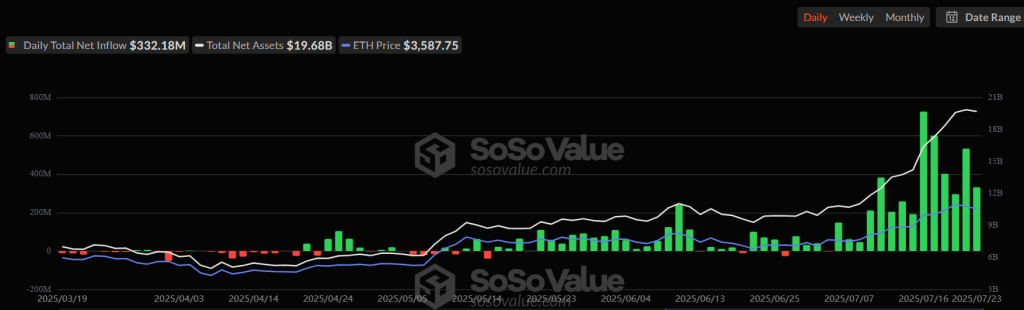

Two weeks of inflows into Ethereum ETFs

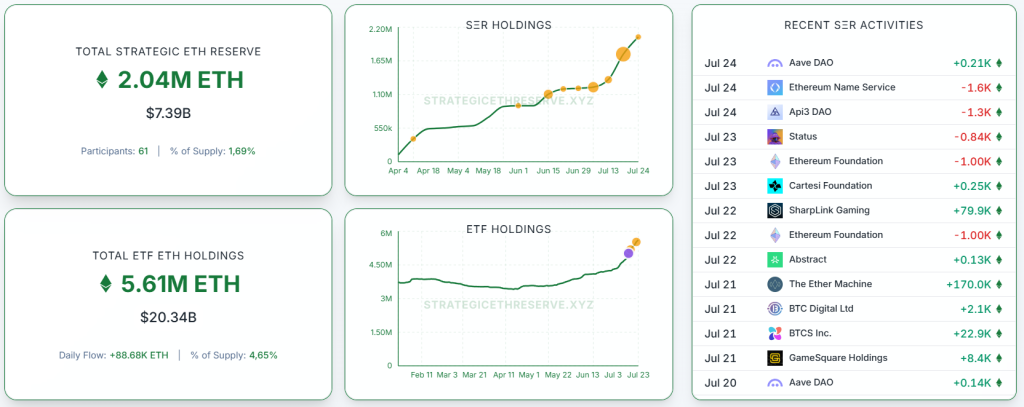

Net inflows into spot ether exchange-traded funds have continued for 14 straight days. The chart, however, shows volumes have tapered over roughly the past seven trading days:

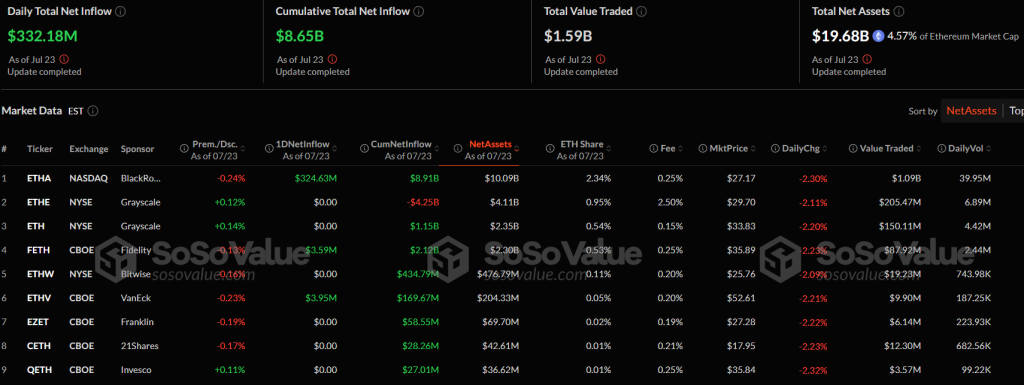

On July 23, net inflows came to $332 million. The flagship BlackRock fund ETHA accounted for about $325 million.

Cumulative net inflows since the products launched in July last year have reached $8.65 billion. Funds hold $8.65 billion in assets — 4.57% of Ethereum’s total supply. Notably, spot bitcoin ETFs have seen outflows for a third straight day — in the past 24 hours alone investors withdrew $86 million.

Is ether in vogue?

Meanwhile, corporations continue to add to reserves — the total Ethereum on balance sheets has exceeded 2 million ETH.

The most active on this front are:

- SharpLink Gaming — +91.43% over the past 30 days;

- Bitmine Immersion Nech — +84.29%;

- Bit Digital — +335.53%;

- BTCS Inc. — +282.11%.

Sixty-one companies follow this strategy, holding 1.69% of the total supply of the second-largest cryptocurrency.

Earlier, a CryptoQuant analyst known as Crypto Dan predicted a short-term correction, but doubted a longer-term trend change in Ethereum’s price.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!