Analyst Questions Ethereum’s Overheating Concerns

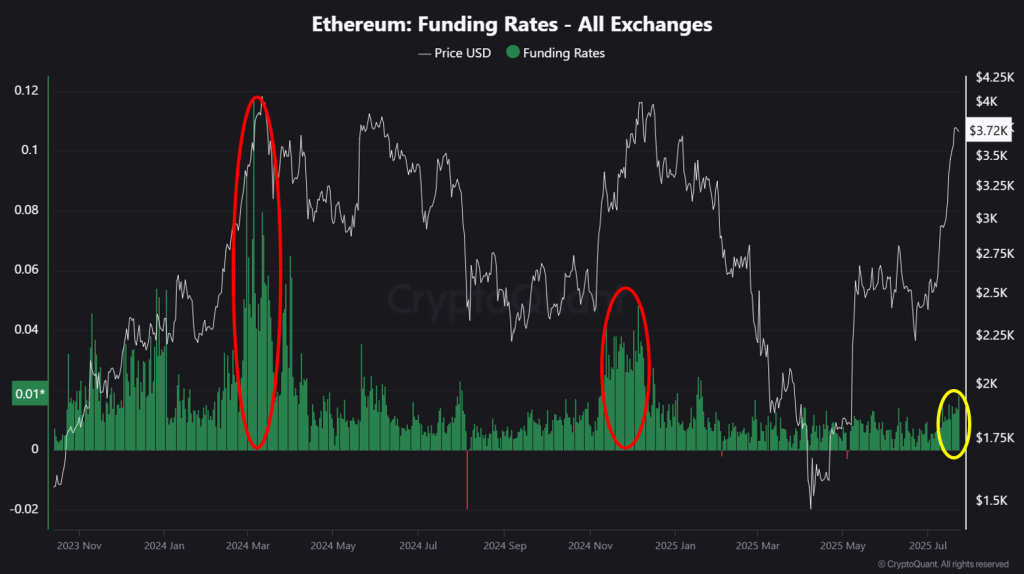

The price of Ether has surged sharply, suggesting a potential short-term correction. However, in a broader context, signs of being overbought are still distant, noted CryptoQuant contributor known as Crypto Dan.

“Current levels are significantly below the overheated values of the futures market in March and November 2024. Any potential correction is likely to be moderate and short-lived,” the expert shared.

Crypto Dan believes that within the broader market cycle, Ethereum has shown “very sluggish” dynamics. In his view, despite the growth phase, the asset has reached an oversold zone and “clearly marked the bottom.”

“Therefore, it is highly likely that in the second half of 2025, the asset will continue to grow,” the expert opined.

He added that other altcoins traditionally follow Ether’s dynamics.

ETF Inflows Continue

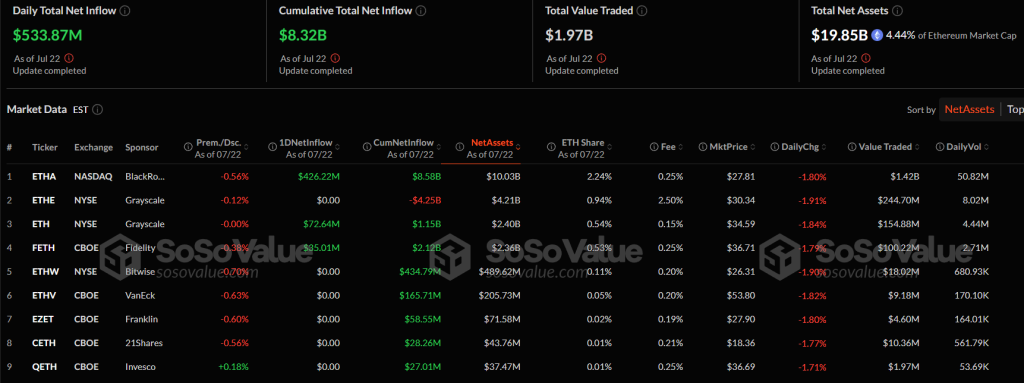

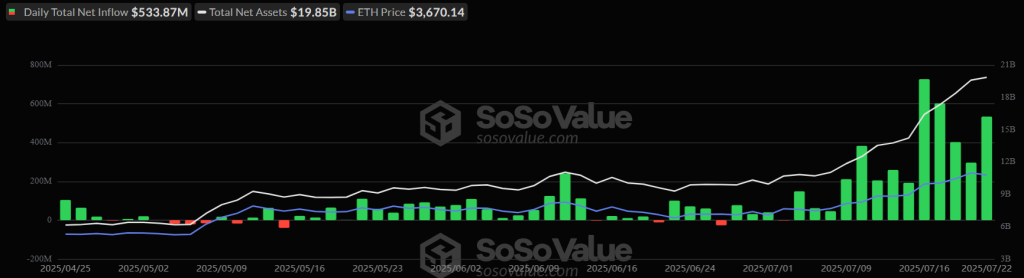

Net inflow into spot Ethereum ETFs as of July 22 amounted to $533.9 million — the third-largest figure since the initial launch of these financial instruments.

The daily inflow volume into BlackRock’s flagship ETHA exchange-traded fund was $426.2 million. Figures for Grayscale’s ETH and Fidelity’s FETH were $72.6 million and $35 million, respectively.

The chart below shows that only twice did inflow volumes exceed the aforementioned figure: on July 16 — $726.7 million and July 17 — $602 million.

The capital inflow into ETFs reflects growing investor demand for alternatives to Bitcoin. Amid the decline in the dominance index of the first cryptocurrency, Kronos Research’s investment director noted:

“The [price] momentum of ETH is likely to persist in the medium term if current conditions remain unchanged.”

Nick Rak, head of LVRG Research, suggested that institutions remain optimistic about Ethereum. He emphasized that inflows into spot ETFs have reached record levels, and “digital asset reservation strategies offer a second chance to those who missed Bitcoin’s historic rise.”

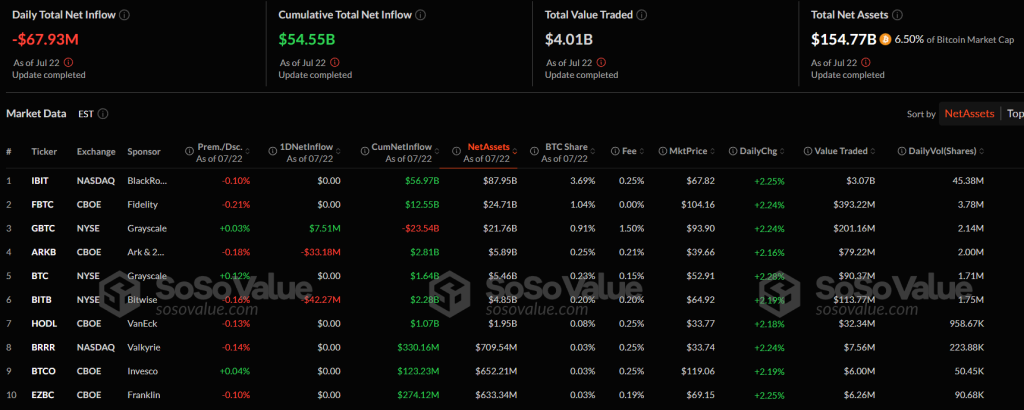

Notably, as of July 22, exchange-traded funds based on the first cryptocurrency showed a total outflow of $67.93 million.

“We are witnessing the usual flow of funds from Bitcoin to Ethereum — this often occurs before a surge in altcoin growth […]. Bitcoin has already grown significantly this year. Therefore, for investors who feel they missed the moment or are seeking the next opportunity, Ether becomes a logical next step,” noted Presto analyst Min Chong.

At the time of writing, the second-largest cryptocurrency by market capitalization is trading around $3670. Over the past seven days, the asset has increased by 15.45%, and over the month — by 62.6%, according to CoinMarketCap.

Developers of Ethereum have scheduled a major Fusaka upgrade for early November.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!