Where to keep USDT ahead of a bear market: a comparison of platforms offering up to 14%

In 2025, bitcoin rose above $120,000. Some investors started buying altcoins, while more conservative ones looked to lock in profits in stablecoins.

Simply holding fiat and stablecoins means forgoing additional returns. Contemporary services offer 2%–14% annual yields while waiting for the next bear market.

We reviewed three categories of platforms for passive income: centralised exchanges with conservative rates, specialised earn services with higher yields, and DeFi protocols for seasoned crypto investors. Here is what suits different types of users.

Exchanges

CEX remain the first choice for most investors thanks to ease of use and deep liquidity. As of July 2025 they offer yields from 5%, along with temporary sign-up bonuses. Among those popular in the CIS and Eastern Europe:

- Binance. Up to 13% on flexible USDT deposits. The higher rate applies only to balances up to 200 USDT; above that, yields drop to 5%. A key benefit is instant liquidity from flexible deposits;

- MEXC. 11% on flexible deposits. New users receive a bonus rate of 600% for two days;

- OKX. Flexible USDT deposits at 5% and 10% for new users for 180 days, plus the option to earn via DeFi protocols Aave and Compound by delegating funds to the exchange;

- Kraken. 5.5% APY on USDT with no minimum deposit. Payouts are weekly.

DeFi protocols

In decentralised finance, experienced users can find higher yields than on CEX. The chief advantages are non-custody and the absence of KYC checks. Funds are governed by smart contracts rather than a centralised organisation.

Risks matter, though: even battle-tested projects may contain vulnerabilities. A recent study found that scammers also reuse old domains of inactive dapps still listed on platforms such as DeFi Llama and DappRadar.

Among the leading by total value locked (TVL):

- Aave — a lending protocol operating across 17 blockchains. In July 2025, USDT yields ranged from 3% to 10%, depending on the pool. When large players withdraw liquidity, rates can spike. The protocol has stood the test of time;

- Morpho — adds a P2P layer atop Aave and Compound, directly matching lenders and borrowers. This enables about 4%–10% through more efficient capital allocation. In June 2025, Morpho V2 launched with fixed-rate support;

- Sky Protocol (formerly MakerDAO) — one of DeFi’s oldest protocols, launched in 2017. Following its rebranding, it offers 4.5% via the Sky Savings Rate (SSR);

- Ethena — offers around 10% on the synthetic stablecoin USDe. During periods of high market activity, yields can reach 15%–25%.

Specialised earn services

For users dissatisfied with CEX rates but unwilling to spend time mastering DeFi, specialised earn services offer a middle path.

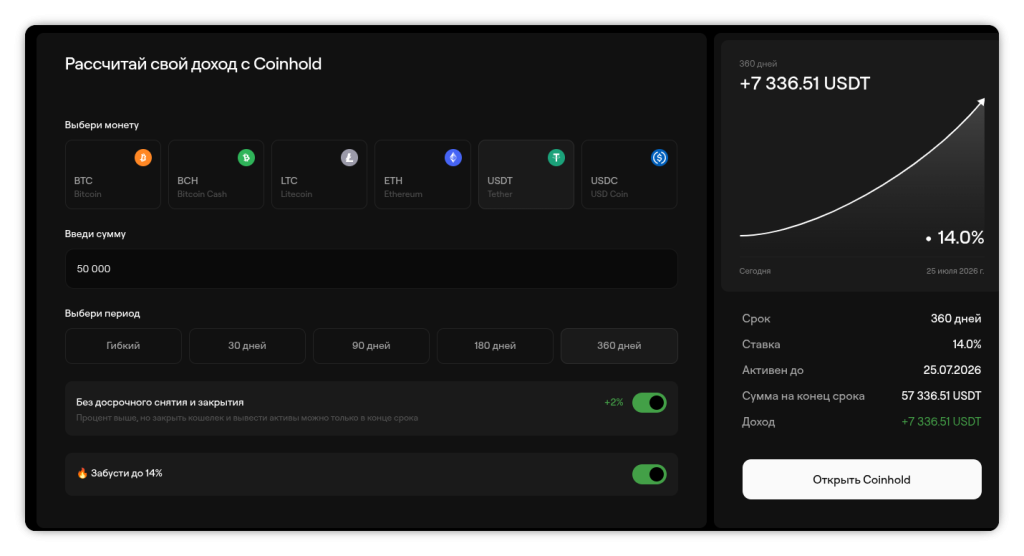

For example, Coinhold from the EMCD mining pool offers up to 14% on USDT with monthly compounding. The platform has operated since 2017 and serves over 400,000 users.

“Our commission revenue provides high yields for Coinhold, and specialists implement a conservative asset-management strategy — we avoid high-risk DeFi, external venues and do not invest in dubious coins,” the page of Coinhold says.

Interest on Coinhold accrues daily. Compounding occurs every 30 days.

How to choose the right platform

When choosing where to place stablecoins, consider two key factors:

- Risk–return trade-off. A conservative approach offers 2%–4% on flexible deposits. Moderate risk (5%–14%) is available via EMCD Coinhold with a fixed rate or time-limited promotions such as the Telegram Wallet integration with Ethena, offering up to 20% APY. Higher yields involve newer DeFi projects, requiring technical expertise and a higher tolerance for risk.

- Liquidity needs. Assess how quickly you may need funds. For instant withdrawals and trading, flexible CEX products are preferable. EMCD Coinhold offers both flexible USDT deposits at 5% and fixed terms from 30 to 360 days (8%–14% APY).

Conclusions

The right platform for earning on USDT depends on objectives, technical skills and risk appetite.

Exchanges suit active traders who value liquidity. Yields are relatively modest; for such users, trading rather than savings income is the primary goal.

Coinhold from EMCD is a sensible choice for those seeking a balance between yield and accessibility. Returns of up to 14% exceed the rates on top exchanges.

DeFi protocols can offer higher yields but require technical know-how and a willingness to accept ““Wild West”” conditions — with scant regulation and the risk of manipulation.

Splitting funds across several platforms according to liquidity needs remains the safest approach.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!