Crypto Funds Overtake Traditional ETFs

Half of the 20 most successful ETFs in the United States are linked to cryptocurrencies, noted Nate Geraci, president of NovaDius Wealth.

1,300+ ETFs have launched since beginning of last yr…

10 of top 20 are crypto-related (incl top 4 overall).

5 spot btc ETFs, 2 spot eth ETFs, 2 mstar ETFs, & 1 leveraged eth ETF. pic.twitter.com/m11lrDuY1T

— Nate Geraci (@NateGeraci) August 10, 2025

According to him, since January 2024, 1300 new funds have emerged in the US market. The most successful in terms of funds raised are those based on digital assets. The list includes:

- iShares Bitcoin Trust ETF (IBIT) by BlackRock — $57.4 billion;

- Fidelity Wise Origin Bitcoin Fund (FBTC) — $12.1 billion;

- iShares Ethereum Trust (ETHA) — $9.6 billion;

- Bitwise Bitcoin ETF Trust (BITB) — $2.3 billion;

- Fidelity Ethereum Fund ETF (FETH) — $2.2 billion;

- ARK 21Shares Bitcoin ETF (ARKB) — $2.2 billion;

- Grayscale Bitcoin Mini Trust ETF (BTC) — $1.6 billion;

- 2x Ether ETF (ETHU) — $1.6 billion;

- Defiance Daily Target 2x Long MSTR ETF (MSTX) — $1.5 billion.

Also making the top list is YieldMax MSTR Option Income Strategy (MSTY) with a total inflow of $7.2 billion. This fund is not directly linked to cryptocurrencies but is tied to Michael Saylor’s Strategy shares, which actively invests in Bitcoin.

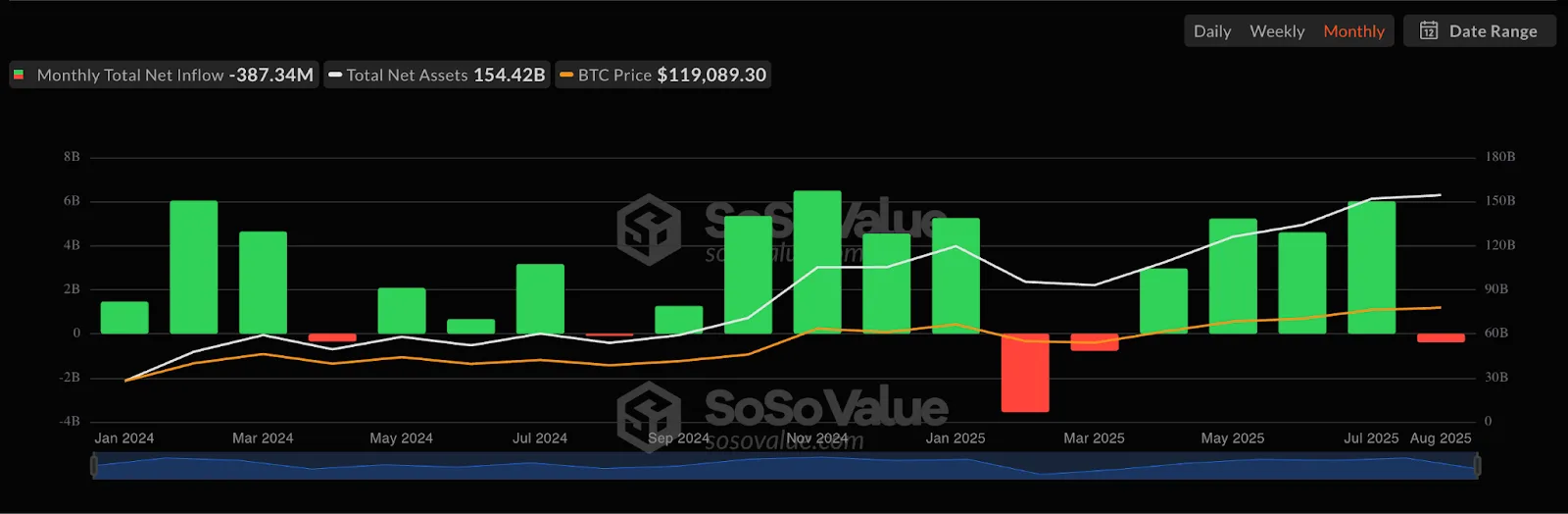

Inflow Dynamics

In July, spot Ethereum ETFs set a record for monthly capital inflow, reaching a historic $5.4 billion.

Since the beginning of August, fund inflows have totaled $1.19 billion, with $1.02 billion recorded on August 11 — a record for a single day. At the time of writing, ETH-ETF manages $25.71 billion, representing 4.77% of the supply of the second-largest cryptocurrency by market capitalization.

In July, Bitcoin ETFs attracted $6.02 billion. In August, the situation changed: over $643 million was withdrawn in the first week, resulting in a negative net monthly inflow so far.

Over the past 14 days, Bitcoin ETFs have received a total of $424.8 million.

Earlier, on August 9, two of the most prestigious US universities — Harvard and Brown — reported purchasing shares of exchange-traded funds based on the first cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!