Bitfinex Outlines Conditions for a New Altcoin Season

New crypto ETFs are needed for this to happen.

The altcoin season will not commence until new cryptocurrency ETFs are approved, according to analysts at Bitfinex.

Over the past month, Bitcoin’s dominance has decreased by 6%. Typically, a decline in this metric indicates a potential start of an altcoin season.

However, experts believe it will only occur towards the end of the year, following the restoration of stable inflows into digital gold-based funds and the launch of new investment instruments.

“These products will create a sustainable demand, independent of short-term price fluctuations, and lay the groundwork for a market-wide revaluation,” they explained.

The view of Bitfinex analysts contrasts with the forecast from Coinbase Institutional. Earlier, experts noted that current market conditions suggest an imminent start of a full-scale altcoin season, expected to begin as early as September.

Meanwhile, in July, CryptoQuant author and on-chain analyst Timo Oinonen pointed to the end of the era of “mass altcoin seasons.”

When Are the New ETFs?

The SEC is reviewing over 70 applications for the launch of exchange-traded funds based on various cryptocurrencies. Previously, Bloomberg analyst Eric Balchunas predicted a “summer of altcoin ETFs.”

In July, the regulator lowered barriers for cryptocurrency investment products. The Commission proposed listing standards focused on derivative markets. Balchunas called this rule a “pretty significant event,” as it paves the way for ETFs on about a dozen altcoins.

In the same month, the U.S. saw the launch of the first exchange-traded fund based on Solana with a staking feature — the REX-Osprey Solana Staking ETF (SSK). Nevertheless, the SEC continues to delay decisions on other applications from companies like 21Shares, Bitwise, and BlackRock, which are seeking approval for altcoin-based investment products.

Balchunas and his colleague James Seyffart expect the regulator to approve new ETFs by the end of 2025. They believe that structures focused on Litecoin, Solana, and XRP are most likely to appear in the U.S.

Here are mine and @EricBalchunas‘ most recent odds on spot crypto ETF approvals by the end of 2025. We expect a wave of new ETFs in this second half of 2025. pic.twitter.com/H3pxJhqMy3

— James Seyffart (@JSeyff) June 30, 2025

Advice for Issuers

REX Financial CEO Greg King warned that cryptocurrency ETF issuers should carefully select assets for new funds. According to him, much of the market outside the top 20 cryptocurrencies by capitalization remains “highly questionable.”

REX Financial CEO Greg King believes Solana is the story of stablecoin’s future over Ethereum. He speaks with @EricBalchunas on “ETF IQ” https://t.co/aVEoiSkzfo pic.twitter.com/iQx9g4oYJg

— Bloomberg TV (@BloombergTV) August 25, 2025

“We are unlikely to see an explosive growth in ETF applications for various altcoins, but instead, there will be many funds on specific assets,” he said.

King explained that the current situation resembles the story with Bitcoin and Ethereum-based instruments, where dozens of companies simultaneously launched identical products. He believes the same will happen with Solana and other promising coins, including meme coins.

REX Financial has already filed applications to launch ETFs based on Bonk, Official Trump, and Dogecoin. Earlier, Balchunas stated that such funds have “very good chances” of approval from the SEC.

Really good chance this exists at some point. First we’ll get slew of active crypto ETFs (eta Winter 2025). Active meme coin-only likely 2026 tho. The return dispersion (and lack of sell side coverage) ripe for active. Could produce next star manager. Who knows. https://t.co/9CcEc4xmev

— Eric Balchunas (@EricBalchunas) June 7, 2025

Altcoins Aid Bitcoin

Meanwhile, Draper Associates founder Tim Draper stated that altcoins “contribute to the improvement of Bitcoin.” In an interview with CNBC, he noted that these coins serve as testing grounds for new technologies and enhancements.

According to him, competition is beneficial for the market. However, digital gold continues to dominate, consistently increasing its share. Draper compared it to Microsoft in the Web2 era.

“The same thing is happening now with Bitcoin. Teams of all these small tokens are experimenting and doing interesting things, and all the best developers are transferring these ideas to the first cryptocurrency — it has a gravitational pull. Other coins will appear, which will flare up like one-day stars, but overall we are witnessing a powerful trend towards Bitcoin,” he stated.

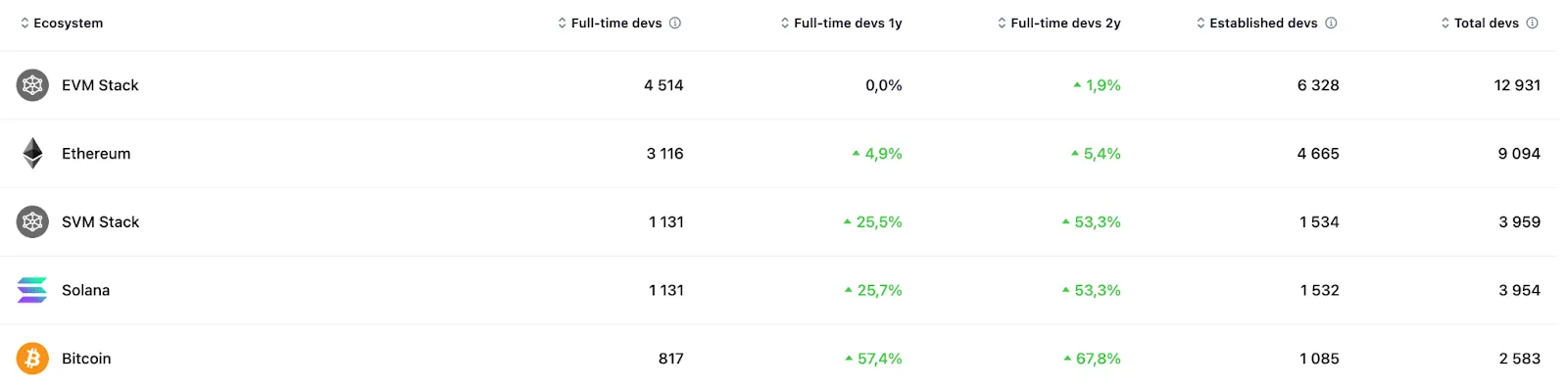

However, data from Electric Capital paints a different picture. The flagship cryptocurrency network employs 2,583 developers, while the Ethereum platform has 9,094.

Earlier in August, Bitfinex analysts reported a decline in demand for altcoins.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!