Coronavirus crisis and markets: has Bitcoin finally proven its status as a safe-haven asset?

ForkLog magazine invites readers to review the results of a second quarter that was far from the best in world economic history. In the article we examine GDP dynamics of various countries, stock indices, as well as gold and Bitcoin prices. We also gather forecasts regarding the recovery of business activity and the return of major macroeconomic indicators to pre-crisis levels.

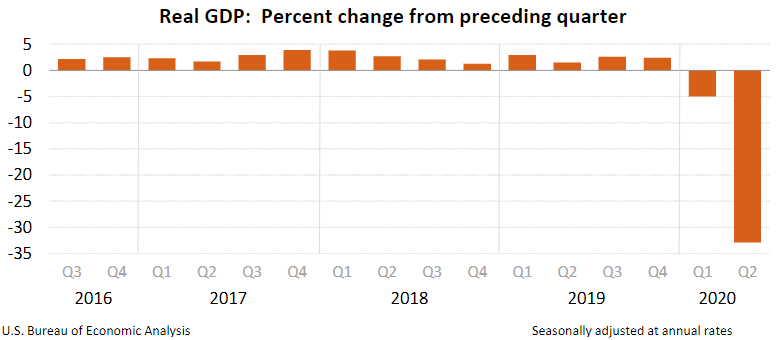

- In the second quarter, US GDP fell by a record 32.9%. Not much better do the key macro indicators look for most other economies.

- Russia’s GDP contracted by 8.5%. Compared with the second quarter of last year, the EU economy shrank by 15%. In several Asian countries the decline exceeded 10%.

- Fueled by aggressive monetary and fiscal measures, stock indices are rising confidently despite a downturn in the real sector.

- Gold prices exceeded a historic high, but Bitcoin has shown a more impressive trajectory since the start of the year. One of the most obvious reasons for Bitcoin’s rise is demand from large players.

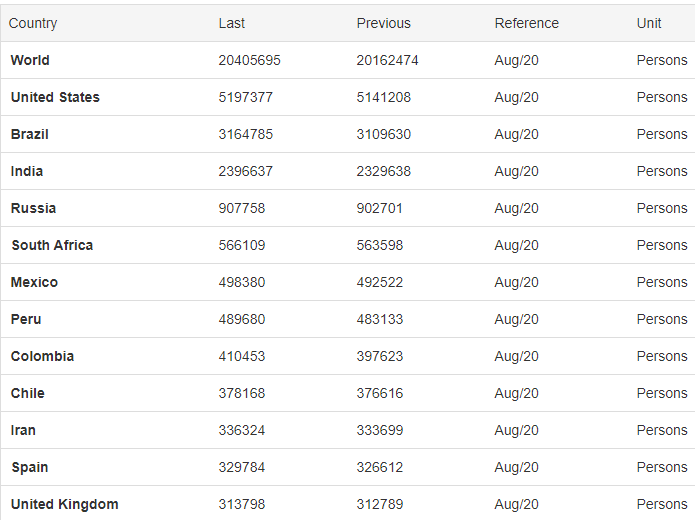

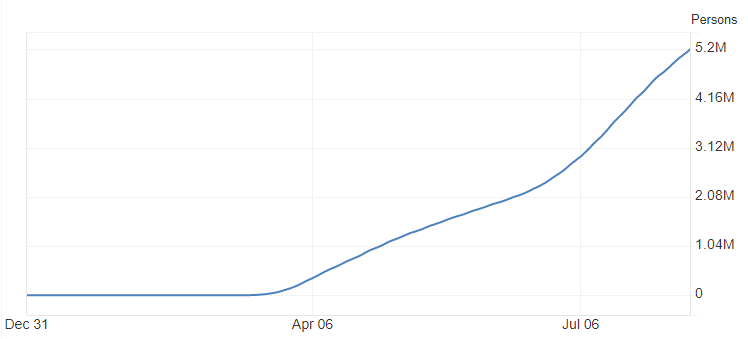

The suspension of many businesses and entire sectors due to the pandemic plunged the global economy into an even deeper recession. The sharpest drop in business activity occurred in countries with a high number of COVID-19 infections, including the United States.

To revive business activity, many countries continue to pump monetary mass into markets, employ fiscal stimulus, and provide generous financial aid to companies and households. This eases the consequences of lockdowns but leads to budget deficits, overheating of financial markets, depreciation of national currencies, and, as a result, inflation.

The triumph of Keynesianism, tempered by quantitative easing (QE) and other “innovations”, has further spurred demand for gold, traditionally considered a safe asset, as well as for Bitcoin. The correlation of the latter with the precious metal has been rising since the start of the year, growing.

A crisis unlike any other

The global economy’s situation surpassed the pessimistic expectations of many authoritative organisations, including the International Monetary Fund (IMF). In its June update the IMF writes:

«The COVID-19 pandemic has had a more negative impact on economic activity in the first half of 2020 than anticipated, and, according to the forecast, the recovery will be more gradual than previously projected».

Analysts at the IMF say that low-income households are particularly hard hit. This threatens substantial progress in reducing extreme poverty achieved globally since the 1990s. World economic growth is expected only next year — about 5.4%.

McKinsey data show that last year tourism accounted for 10% of global GDP. This year tourist arrivals are expected to fall by 80%, risking 120 million jobs.

#Tourism made up 10% of global GDP in 2019. This year, with tourist arrivals set to plummet by 80%, 120 million jobs are at risk.

Reopening the #travel industry will require government-sector collaboration never seen before, in four big ways 🛫 https://t.co/bO6H2Qo6lL pic.twitter.com/y40tQTD3b4

— McKinsey & Company (@McKinsey) August 6, 2020

«In countries struggling to contain the infection, a longer period of self-isolation will lead to additional weakening of economic activity», — IMF experts emphasized.

Among these countries first and foremost are the United States, which lead in GDP and exert a significant influence on the global market.

The US economy in the second quarter fell by 32.9%. This is the steepest quarterly drop since World War II, highlighted by Deloitte’s chief economist Ira Kalish.

Previously, the US GDP had never fallen by more than 10% in a single quarter. Before 2020, the largest economy had shown the longest period of growth in its history, lasting 11 years with an average annual growth of 2%.

The coronavirus pandemic forced the closure of many businesses, including plants and factories, cafes and restaurants, shops, and kept millions at home.

«All this has severely hurt consumer and business spending», — emphasised an economist.

Consumer spending in the US fell in the second quarter by 34.6% year-on-year. The decline occurred despite a 44.9% rise in real disposable income, supported by generous transfers from the federal government.

«The gap between spending and income means many households are saving less. The savings rate rose from 9.5% in Q1 to 25.7% in Q2», — Deloitte explained.

In the second quarter, the export of goods fell by 67.6% and imports dropped by 48.8%.

«The only GDP component to show significant growth was government spending», — Kalish noted.

Deloitte noted that the US economy is heavily influenced by a second wave of the coronavirus, and consequently GDP in Q3 could be very negative. With substantial employment declines, household incomes are likely to fall further. This will lead to a further drop in aggregate demand and economic contraction.

Charlie Bilello, CEO of Compound Capital Advisors, provided data on the US budget deficit.

US Budget Deficit (Billions)…

2020 (est): -$3,700

2019: -$984

2018: -$779

2017: -$665

2016: -$585

2015: -$442

2014: -$485

2013: -$680

2012: -$1,077

2011: -$1,299

2010: -$1,295

2009: -$1,413

2008: -$459

2007: -$161

2006: -$248

2005: -$318

2004: -$413

2003: -$378

2002: -$158— Charlie Bilello (@charliebilello) August 10, 2020

In 2020 the deficit is projected at about $3.7 trillion, up 276% from 2019’s $984 billion.

As noted earlier, authorities in many countries have been actively providing funds to businesses and households to ensure adherence to quarantine measures under the banner “Stay at home.” This encourages social distancing intended to curb the virus’s spread. Yet it has done little to stop COVID-19 from spreading at accelerating rates.

«The result has been a slowdown in economic activity, as people’s fear of the coronavirus leads to reduced spending and lowers mobility», — Deloitte noted.

In the US Congress there is a debate over another round of aid to businesses. The Democratic Party insists on encouraging social distancing among the population that is not yet returning to work.

The Republicans, by contrast, are confident in reviving business activity and resuming operations. Their plan includes limited unemployment insurance, subsidies for newly opened small businesses, and other measures that are not radical in nature.

The Democrats, on the other hand, argue for higher unemployment insurance spending, expanded aid to states and local authorities, and additional favorable loans for businesses that stay closed.

In essence, to curb the spread of the virus, the Democrats advocate effectively halting nearly the entire US economy. The Republicans believe that reducing unemployment benefits will spur people to return to work.

The Federal Reserve (the Fed) remains committed to aggressive monetary measures to support markets and business activity in the country. Fed Chair Jerome Powell stressed that the US economy is weakening, as shown by consumer spending and employment data. He believes there is a high probability that GDP will not grow in the third quarter.

Powell also suggested that the best way to curb the virus spread is social distancing. He believes that the timing of market reopenings depends on that.

«Since the Fed has cut rates nearly to zero, purchased a vast amount of assets, and injected liquidity, there is little more it can do», — Deloitte noted.

This view is reinforced by Powell’s remarks about the key role of fiscal measures in solving problems that are beyond the central bank’s reach.

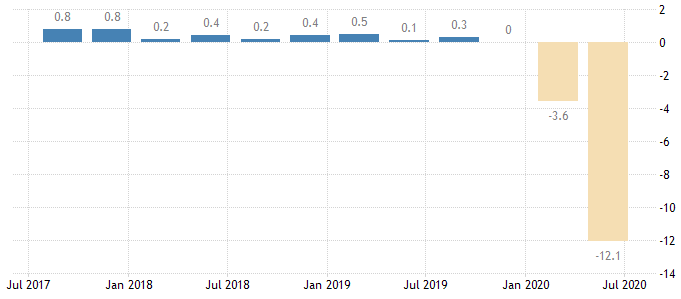

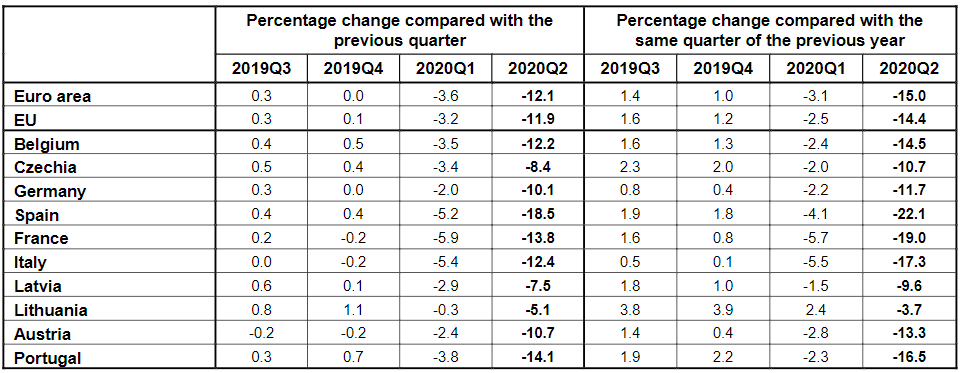

The EU economy also suffered the fastest drop in its history. The Eurozone’s quarterly GDP fell 12.1% and the EU-wide GDP fell 11.9%. Year-on-year declines were 15% and 14.4% respectively.

In the previous quarter there was also a significant fall, though not as sharp as in the second quarter. The drop stood at 3.6%.

As in many other regions, the European downturn in the first half of 2020 was driven by lockdown restrictions aimed at containing the spread of COVID-19. Easing began only in May.

«In Europe one can expect relatively strong growth in the third quarter. In the United States, that is unlikely, as a major outbreak is already weighing on consumer spending and mobility», — Deloitte reported.

Among EU countries, the largest drop was in Spain (-22.1%), followed by France and Italy (each around -19%). Germany’s GDP fell 11.7%.

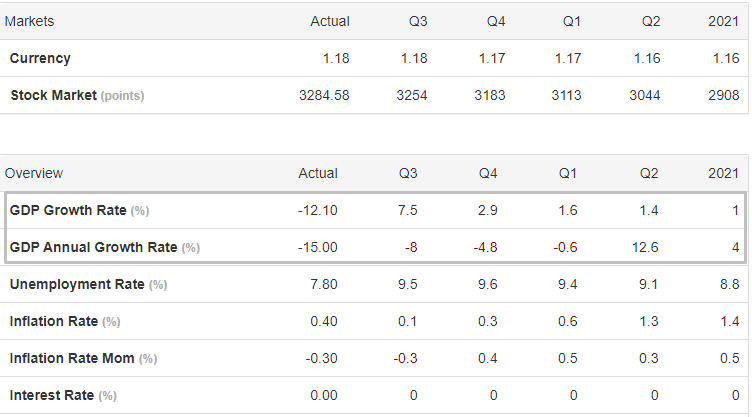

According to Deloitte’s forecast, the EU economy will return to pre-crisis levels by 2023. Trading Economics forecasts that by the third quarter of this year the EU economy will begin to recover, with only a modest rise in inflation. The ECB’s key rate will stay at zero.

As for the United States, analysts forecast the following:

— a robust recovery of the US dollar index, which had fallen, apparently due to the Fed’s aggressive policy;

— a correction of the stock market that has clearly diverged from the real economy due to active government intervention in the market mechanism (monetary and fiscal measures, notably QE and bailouts);

— a confident rebound in the economy in Q3, clearly driven by a low-base effect, and a moderate rise in subsequent periods;

— a decline in unemployment;

— near-zero policy rate and inflation;

— a worsening trade balance (a growing negative balance due to imports exceeding exports);

— growth in the national debt;

— a shrinking share of the fiscal deficit in GDP;

— a rise in business and consumer confidence indices.

It would seem that the era of ultra-low rates will not end soon. This implies that authorities in developed countries will continue to use unconventional monetary tools like QE, as well as various fiscal stimuli that drive depreciation of national currencies and demand for safe assets.

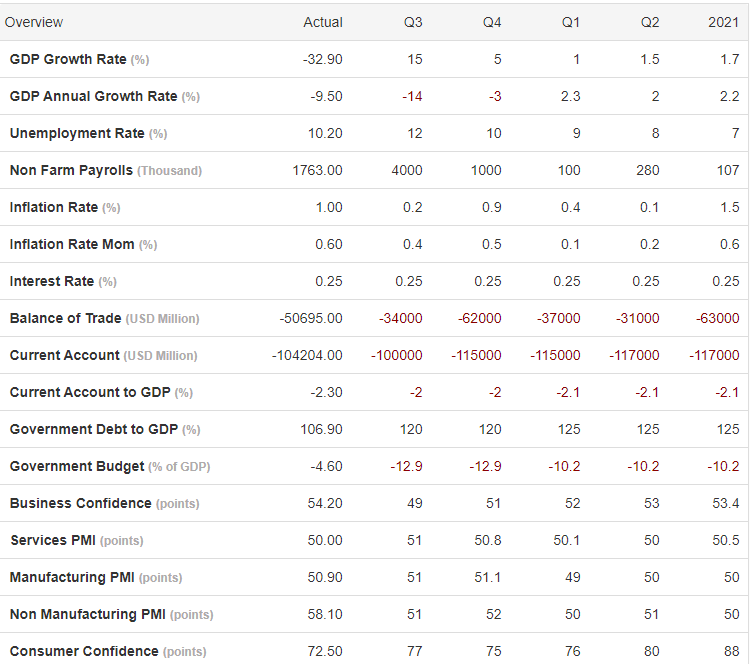

Russia’s economy

In the second quarter Russia’s GDP fell by 8.5% — the sharpest pullback since Q3 2009.

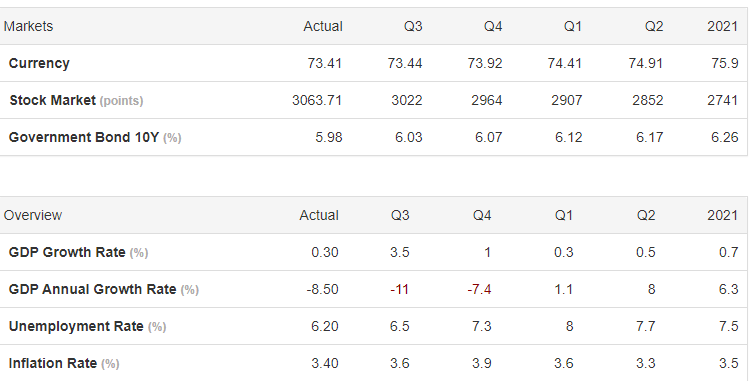

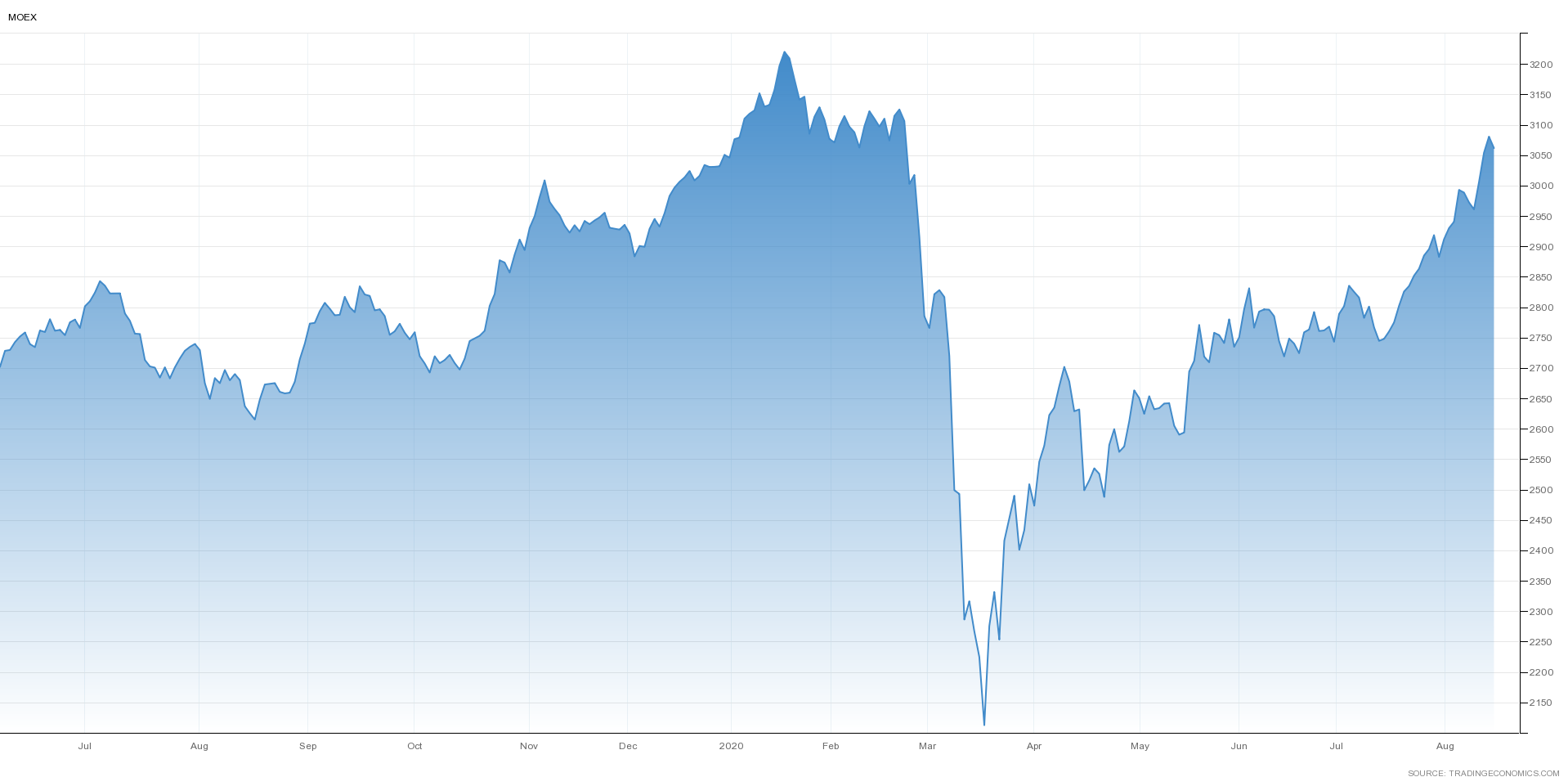

Source: Trading Economics

In the previous period growth slowed to 1.6%.

According to the Ministry of Economic Development’s report “Business Activity Picture”, during the height of quarantine measures in April the Russian economy contracted 12% year-on-year.

At the year’s end, GDP is expected to shrink by 5% according to the ministry. They do not expect a V-shaped recovery: 2021 growth is projected at only about 2.8%.

«Russia’s GDP is expected to rebound to the 2019 level by the fourth quarter of 2021, with growth in 2022 around 3%», — Maxim Reshetnikov, minister of economic development of Russia, said.

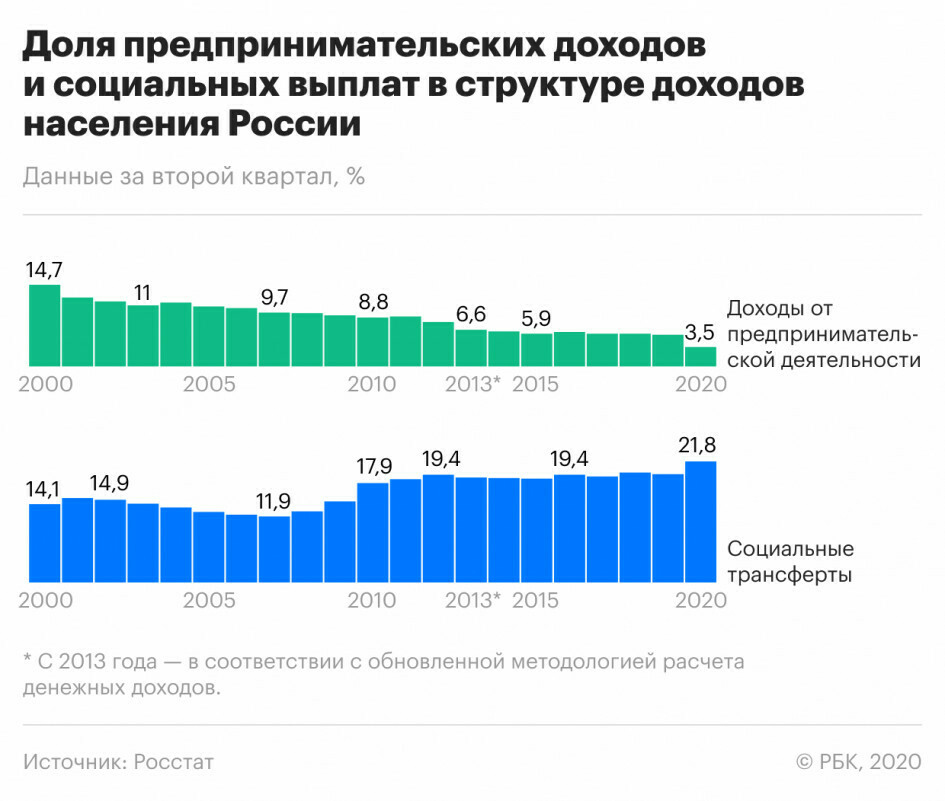

The share of entrepreneurial income in Russians’ earnings in Q2 2020 fell to 3.5%.

Rosstat notes this is the lowest figure in 20 years: in Q2 2000 it stood at 14.7%, in 2010 at 8.8%, in 2015 at 5.9%. From 2000 to 2019 the figure never fell below 5.7%.

The fall in incomes is attributed to pandemic-related restrictions and the threat of a second wave, said Vladimir Tikhomirov, chief economist at BCS Global Markets.

According to Trading Economics forecasts for Russia:

— the ruble will continue to devalue in the coming quarters;

— the Moscow Exchange index will trend downwards;

— from Q3 this year the economy will begin to recover, but soon slow down.

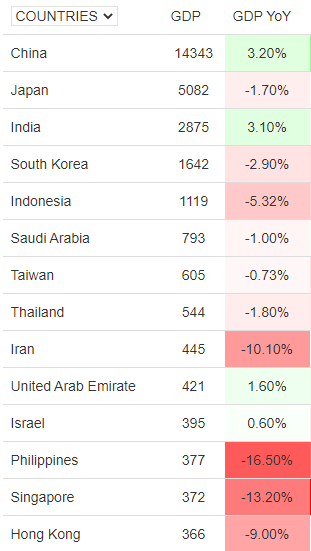

Among major Asian economies, notable declines in Q2 occurred in the Philippines (-16.5%), Singapore (-13.2%), Hong Kong (-9%), and Iran (-10.1%).

China, from where the outbreak began, showed a 3.2% growth. However, according to Charlie Bilello, data from the authoritarian country do not reflect reality.

Financial markets

The S&P 500 index, buoyed by strong monetary and fiscal measures, recovered to mid-February highs prior to the market collapse.

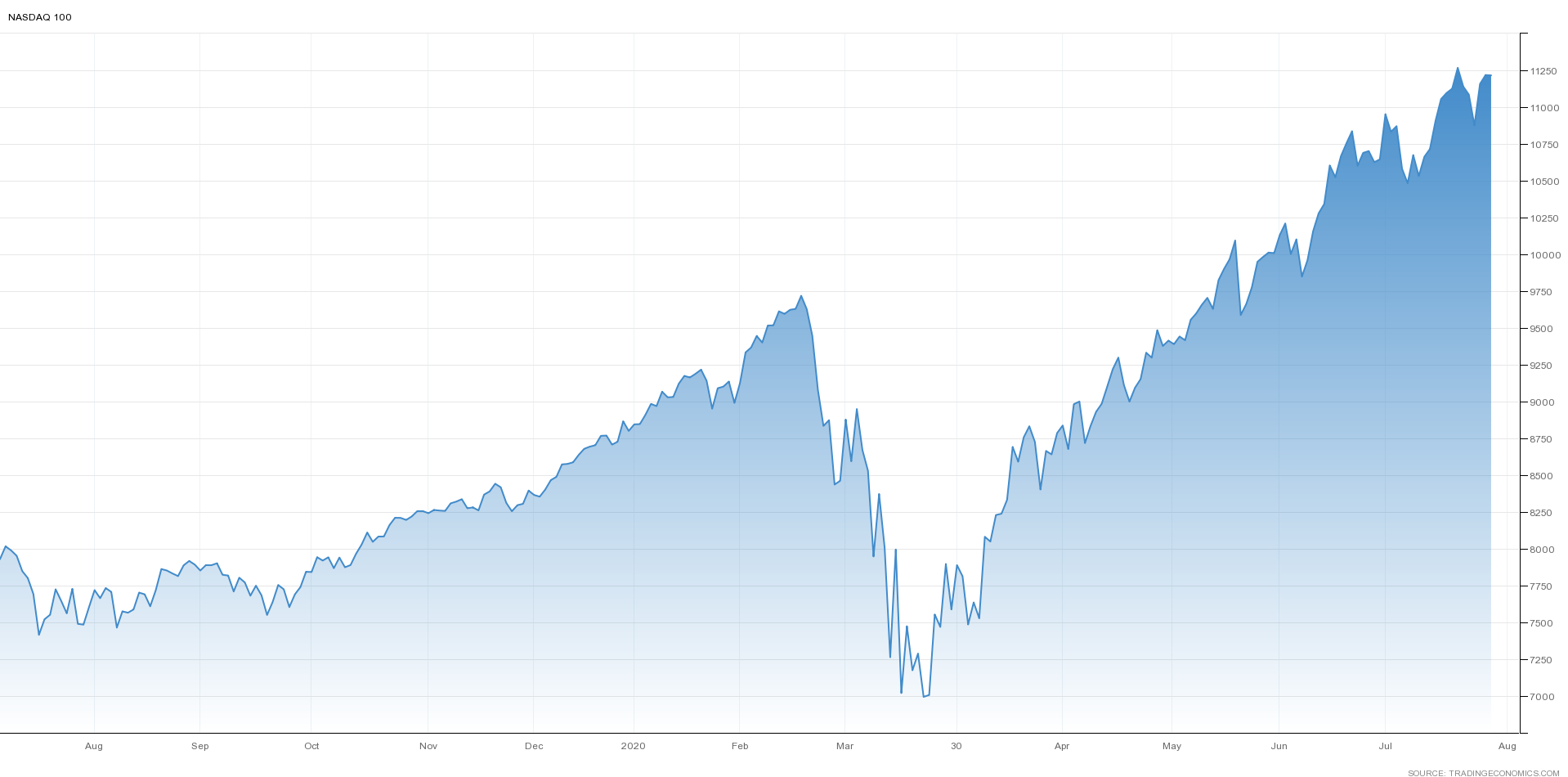

Despite the record collapse of the US economy, the Nasdaq 100 index not only recovered but rose to unprecedented highs.

It is clear that Nasdaq 100 and the so-called S&P 500 barometer have significantly diverged from reality, apparently due to government interference in the functioning of the free market.

Advocates of the Austrian school argue that state intervention distorts price signals and reduces efficiency in the allocation of resources.

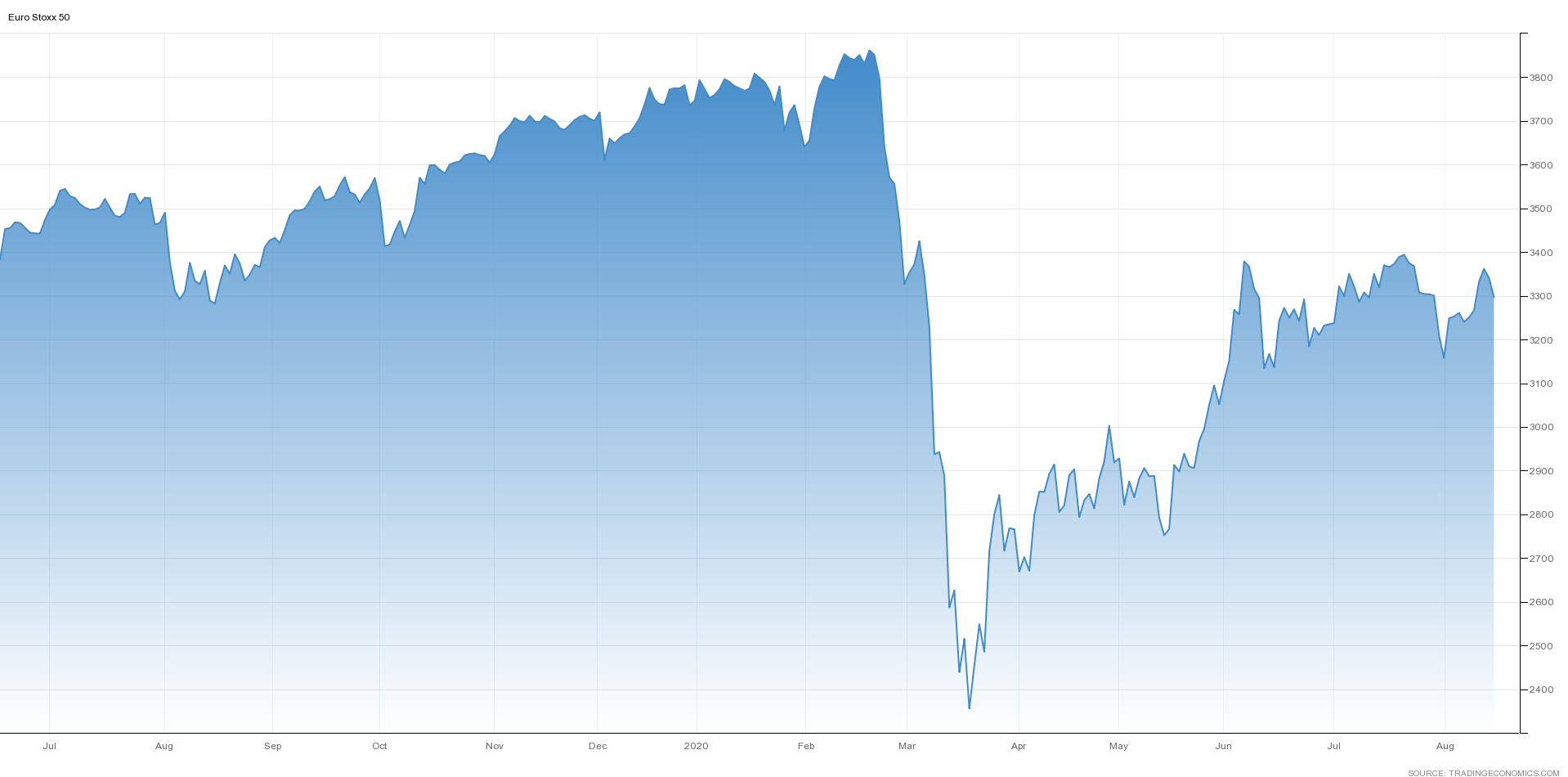

The European Euro Stoxx 50 Index also recovered confidently after its March lows, but, unlike Nasdaq and S&P, it has not approached February 2020 levels.

NASDAQ 100’s dynamics were mirrored by the Moscow Exchange index as well.

Gold and Bitcoin

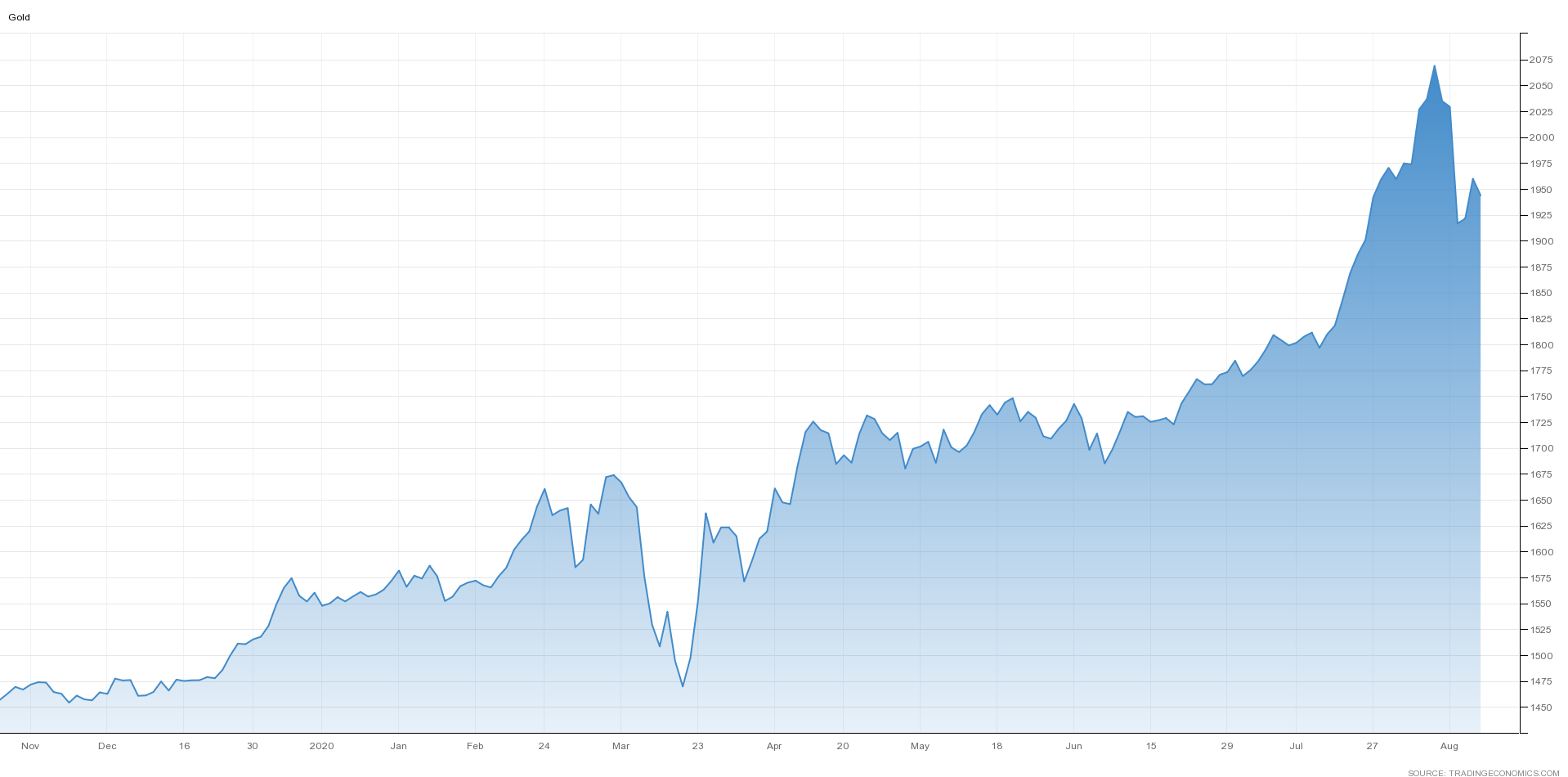

Amid the coronavirus crisis, demand for gold — traditionally considered a safe asset during periods of social and economic upheaval and global turbulence — rose as expected.

In early August the precious metal hit a new record, rising above $2,000 per troy ounce. Having started 2020 around $1,500, gold surged to unprecedented heights.

As for digital gold, debates continue on whether Bitcoin should be regarded as a safe asset. The main arguments for this thesis are its strictly limited supply and its resilience to censorship due to the decentralized nature of the asset. Critics of the “safe-haven” theory point to Bitcoin’s high volatility and its frequent correlation with equity markets.

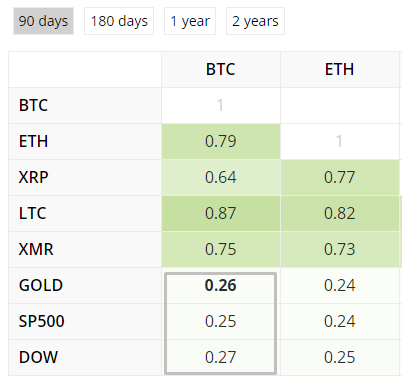

According to BlockchainCenter, the 90-day correlation of Bitcoin with gold, Dow Jones, and the S&P 500 is roughly at the same level.

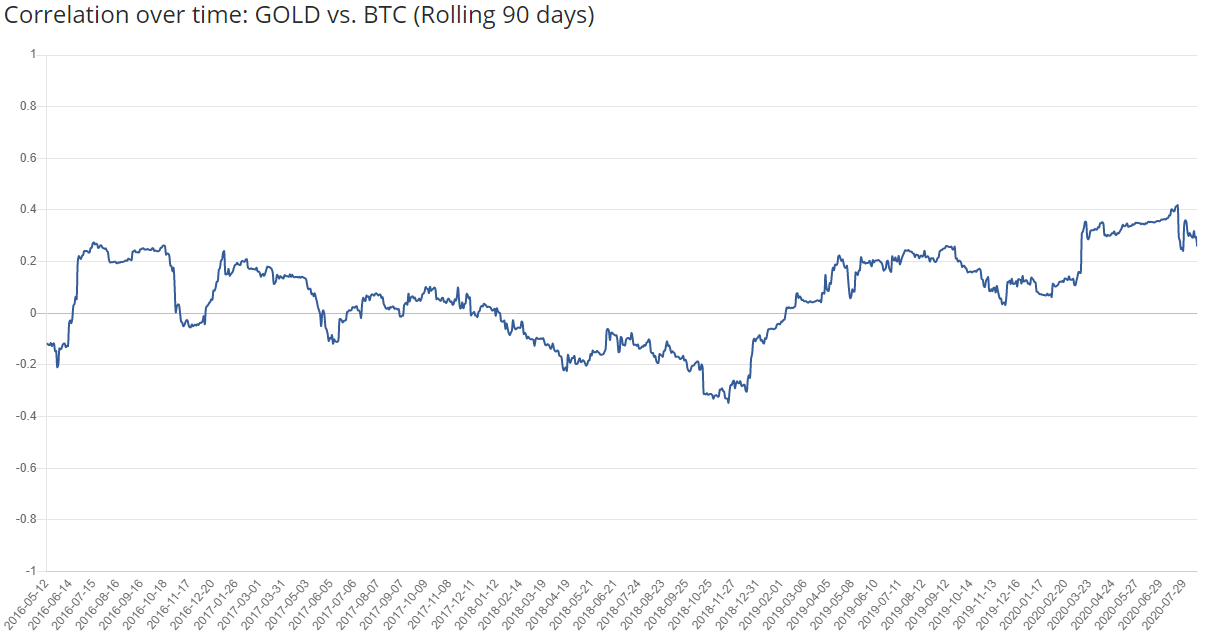

From the start of the year, the price correlation between gold and the first cryptocurrency has strengthened noticeably. The metric reached a five-year high.

The correlation of Bitcoin with the stock market likewise rose sharply from the start of the year, perhaps reflecting panicked markets amid the coronavirus. However, during July and the first half of August the metric fell significantly.

Bitcoin began the year at $7,178 (Bitstamp close price on 1 Jan 2020) and, at the time of writing (16 Aug 2020), traded around $11,870. Bitcoin’s rise of about 65% over this period substantially outpaced gold (+38%) and the S&P 500 (+3.5%).

It is possible that one of the key drivers of Bitcoin’s ascent is demand from institutional investors, hedge funds, and other large players. This is helping to mature the industry, foster broader adoption, and integrate more closely with traditional markets.

Evidence of demand for Bitcoin and financial products built on it includes the open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) and the growing popularity of BTC-based options.

In Q2, inflows into crypto funds from Grayscale Investments reached a record $905.8 million. About 84% of the capital raised came from institutional investors, among which hedge funds dominated.

Recently, Grayscale CEO Barry Silbert reported $217 million inflows into funds in a single week. Total assets under management at Grayscale Investments are now approaching $6 billion.

Trader and founder of the Tudor Investment Corporation, Paul Tudor Jones, holds 1-2% of his assets in BTC. He sees trading Bitcoin futures as a hedge against current central-bank money printing in response to the pandemic.

The asset, he argues, has passed a test on four criteria: purchasing power, liquidity, portability, and reliability. He likens Bitcoin to gold in the 1970s when inflation swept US markets.

«We are witnessing the birth of a store of value. Only time will tell whether this will succeed», — Jones said.

MicroStrategy became the first Nasdaq-listed company to invest in Bitcoin. The amount invested equates to about $250 million at the time of the deal.

CEO of the Sanders Morris Harris investment firm expressed the view that Bitcoin—or perhaps some other cryptocurrency—will soon be sought after as a safe-haven asset.

Representatives of Fidelity Investments called Bitcoin an “inspiring store of value” and an “insurance policy” against problems in the financial system.

Experts at PricewaterhouseCoopers and Elwood Asset Management Services expect further growth in the number of crypto hedge funds and in total assets under management (AUM).

«There are about 150 active hedge funds specialising in crypto assets. About two-thirds of them (63%) were launched in 2018 and 2019. The average AUM rose in this period from $21.9 million to $44 million», — the companies’ report states.

PwC’s Henry Arslanian says that in the coming years hedge funds will serve as a gateway to the crypto industry for institutional investors.

Also important for the industry is the development of custodial solutions. Last month the Office of the Comptroller of the Currency, part of the US Treasury, allowed national banks and federal savings associations to custody cryptographic keys for cryptocurrency wallets.

Shortly thereafter interest in providing Bitcoin custody services emerged among US banks ranked fifth and seventh by assets — Bancorp and PNC Financial Services Group.

Visa Inc. also voiced readiness to support the development of digital currencies. In particular, the company has shown interest in stablecoins.

Thus, reduced legal uncertainty is attracting truly large players into the industry. Given also the evident interest of millennials and the likely new government rescue packages, demand for a quantitatively limited Bitcoin should continue to rise. This should have a positive impact on BTC’s price.

Will a “new store of value” emerge and will Bitcoin become a widely recognised safe asset? Only time will tell.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full stream of news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!