Bitcoin hits fresh yearly high; Bitcoin Cash splits into two chains and other events of the week

As the week draws to a close, we recall Bitcoin’s ascent to a new high this year, Bitcoin Cash splitting into two chains, Ethereum’s ‘unannounced hard fork’ and other key events.

Bitcoin price

On Thursday, 12 November, the price of the first cryptocurrency rose above the psychological level of $16,000, and into Friday night it topped a new year-to-date high at just under $16,500.

In the following days Bitcoin corrected, slipping back on lighter trading volumes to around $15,700, but by week’s end it was again hovering around the $16,000 mark.

BTC/USD chart from TradingView (Bitstamp).

Over the past seven days the rise stood at 7.9%. Market capitalization — $296.3 bln, dominance index — 63.7%.

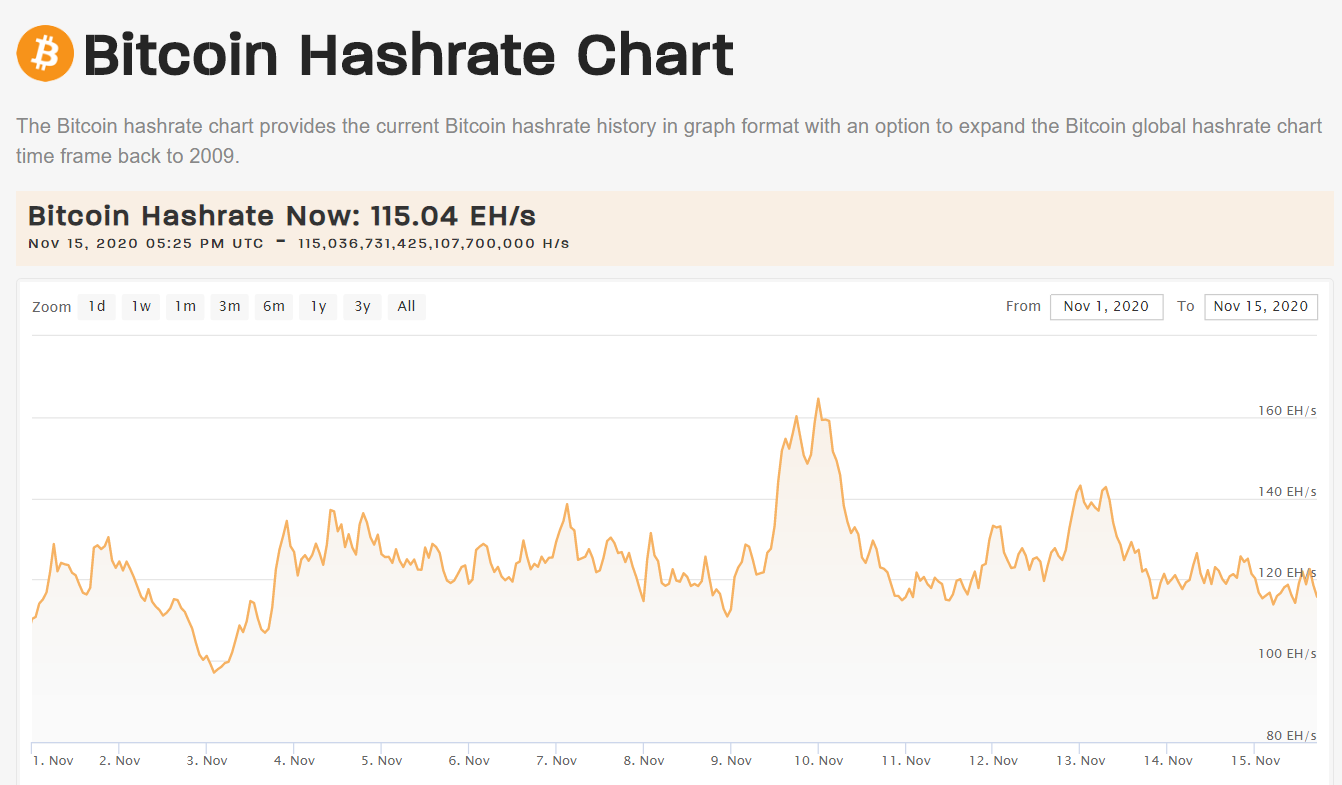

A sudden surge in Bitcoin’s hash rate preceded the year-to-date rally — the network’s hash rate increased from 112.6 EH/s to 164.5 EH/s in a single day. By the end of Sunday this metric had fallen to 115.04 EH/s.

Source: Coinwarz.

Also this week, analyst PlanB confirmed his confidence in the Stock-to-Flow (S2F) model for Bitcoin. Based on it, he forecasts Bitcoin reaching levels of $100,000–$288,000 by December 2021.

Arcane Assets’ IT director Eric Wall proposed to him a $1 million bet. He is convinced that the model will ‘break’ by 2025. The challenge could be taken up by any S2F proponent, Wall said.

Analyst Willy Woo believes Bitcoin is only at the start of a new bull run. He arrived at this conclusion based on the RSI (Relative Strength Index) chart for Bitcoin, which, in his view, is just starting to warm up.

Green circle denotes where we are in this macro cycle. Start of the main bull run (in case it isn’t already obvious).

BTC’s on-chain Relative Strength Index is just warming up.

Red verticals are the halvenings, providing the bullish supply shock impulse. pic.twitter.com/HudOgAAezv

— Willy Woo (@woonomic) November 11, 2020

Bitcoin Cash network split into two chains

On Sunday, 15 November, the Bitcoin Cash network (the sixth-largest by market capitalization) conducted the planned hard fork. The largest client in the BCHABC camp failed to win community support.

The update was planned for 12:00 UTC, but activation occurred with a delay of almost two hours. It happened at 14:13 UTC on block 661,447, which became the last joint block for Bitcoin Cash ABC and BCHN. Four minutes later Antpool found block 661,448, which supported BCHN exclusively.

The first post-fork block in the BCHABC chain was found at 15:55 UTC, the second at 17:07 UTC. By this moment BCHN was at block 661,669. The expected split of the network into two separate blockchains can thus be considered accomplished, and BCHN—as expected—will inherit the BCH ticker.

BCH has split into two separate chains — BCHN and BCHABC — with BCHN mining the first block and leading for the #BCH ticker. pic.twitter.com/Og6rKzKjgu

— Bitcoin Cash | P2P Electronic Cash (@bch_pls) November 15, 2020

Details of the fork and the history of the community’s dispute can be read via this link.

Ethereum network experienced an ‘unannounced hard fork’

On 11 November, Infura and several other Ethereum infrastructure services faced outages. This caused delays in ETH and ERC-20 quotes, and some exchanges halted withdrawals.

Later it emerged that the outages were related to consensus bugs in older versions of the Geth client. Because part of the network had not updated to the latest version, on block 11234873 the Ethereum network split into two chains.

(1/2) Ok, so what happened today on #Ethereum🦄:

1. At some point Ethereum developers introduced a change in the code that led today to a chain split starting from block 11234873 (07:08 UTC)

2. Those who haven’t upgraded (@Blockchair, @infura_io, some miners, and many others)… pic.twitter.com/mbRYFU5tgn

— Nikita Zhavoronkov (@nikzh) November 11, 2020

Despite the fix via software update, Blockchair’s Zhavoronkov stressed that what happened should not be underestimated and should be viewed as one of the most serious problems Ethereum has faced since the The DAO incident four years ago.

Geth developer Peter Szilágyi agreed that technically this could be called an ‘unannounced hard fork.’ In a follow-up conference call he stated that disclosure of vulnerabilities exposes the system to risk. In his words, such information could reach attackers and give some projects an undue competitive advantage. For example, such an advantage could have been enjoyed by Infura in the case of an early disclosure.

DeFi news

- The market capitalization of the stablecoin DAI exceeded $1 bn.

- Polychain Capital invested in the yEarn Finance (YFI) token.

- MyEtherWallet added support for the DEX-aggregator 1inch.

- Balancer attracted seven-figure sum through a token sale.

- Opinion: Ethereum 2.0 will not cope with DeFi load.

- Value DeFi project lost $6 mn in a flash loan attack.

- A hacker withdrew $2 mn from the DeFi protocol Akropolis.

- CipherTrace: DeFi protocol losses from hacks this year exceeded $99 mn.

PayPal launches bitcoin buying and selling for US users

On Thursday, 12 November, PayPal announced the opening of access to Bitcoin and several altcoins for its American customers. Among the supported cryptocurrencies are Bitcoin, Bitcoin Cash, Ethereum and Litecoin.

Cryptocurrency transactions will be automatically converted to fiat. This means merchants won’t have to leave their familiar traditional rails.

To roll out the new feature, PayPal, in partnership with Paxos, obtained a limited license from the New York State Department of Financial Services.

PayPal also confirmed the ability to use cryptocurrencies to pay for goods and services at 26 million point-of-sale locations on the platform. The weekly buying limit, previously planned at $10,000, has been raised to $20,000.

ECB cites plausible timelines for digital euro

ECB President Christine Lagarde stated that the regulator will not rush the launch of its own CBDC. If a decision is made, it could take two to four years.

She said Europe ‘could quite possibly’ begin moving toward a digital euro, but the ECB still needs to answer a number of questions, including anti-money laundering and user privacy issues.

“If the decision proves cheaper, faster and safer for users, we should study it. If it would contribute to monetary sovereignty and greater autonomy for the euro area, we should study it. If it would simplify cross-border payments, we should study it,” Lagarde said.

She stressed that CBDC development will take a long time, and cited the People’s Bank of China, which has been working on the digital yuan for several years.

Meanwhile, Deutsche Bank urged authorities in Europe to speed up CBDC development. Officials at the Bundesbank say the COVID-19 pandemic accelerated a ‘digital money revolution’, the long-term consequence of which would be the replacement of cash with national digital currencies (CBDCs). Analysts argue that in the current geopolitical climate this move would strengthen the euro.

Belarusbank launches cryptocurrency exchange service

The largest bank in Belarus, Belarusbank, together with WhiteBird introduced a service for buying and selling cryptocurrencies using Visa cards.

The service is part of the bank’s digital transformation program and became available on 13 November. For now it can be used only by citizens of Belarus and Russia, with plans to expand the list of countries and supported cryptocurrencies in the future.

In 2019 Belarusbank announced plans to create a cryptocurrency trading exchange on its platform.

Russia proposes jail terms for undeclared bitcoins

The Russian Finance Ministry prepared a new version of amendments to the Criminal and Criminal Procedure Codes related to cryptocurrencies. They provide for multi-million ruble fines and prison terms for systematic failure to report to the tax authorities when conducting cryptocurrency operations at large sums.

Owners of digital currencies face up to three years in prison if they fail to report to the tax authorities about cryptocurrency operations worth at least the equivalent of 45 million rubles. Individuals and organizations must report to the Federal Tax Service about obtaining digital currency, transactions with it and wallet balances if annual operations exceed 600,000 rubles. Previously, the threshold stood at 100,000 rubles. Crypto exchanges and miners must send information about cryptocurrency operations to Rosfinmonitoring.

The need for criminal punishment for non-declaration of cryptocurrencies is due to high money-laundering risks, stated Deputy Finance Minister Aleksey Moiseev. He said the inability to verify Bitcoin’s origin by default makes them ‘gray capital’.

Experts called the proposed measures ‘inadequate’ and warned that a large portion of traders in Russia would fall under them.

ForkLog exclusives

This week ForkLog presented a report on the state of the cryptocurrency industry in October 2020, gathering all the key events and statistics from the past month. Don’t miss it!

We published a translation of the article ‘Following the Flows: A Look at Miner Online Payments’, which describes the Coin Metrics methodology for quantitatively assessing the assets held by Bitcoin miners. Its feature is the separation of miners’ activity from mining pools, allowing a more accurate assessment of coins at their disposal.

Mining pool Slush Pool shared with readers useful information on how to ensure privacy and security when mining Bitcoin. This issue is becoming increasingly relevant as governments seek to regulate or directly control mining.

We also discussed the regulatory framework Dия City, developed by Ukraine’s Ministry of Digital Transformation to attract IT professionals, and explored the role cryptocurrencies might play in the country.

ForkLog on YouTube

The DeFi sector continues to attract not only users but also scammers. Exit scams, fake crypto tokens, giveaways — according to experts, this level of fraud in the DeFi space signals a peak. In ForkLog’s latest video, the story of the dark side of DeFi’s popularity in autumn 2020.

Decentralised technologies underpin automated management of production, economy and other aspects of life — the realities of tomorrow: our guest, Sergey Lonshakov, a blockchain and IoT solutions developer and the architect of ‘Robonomics’, believes this is just around the corner.

Subscribe to ForkLog’s news on Telegram: ForkLog FEED — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!