Why Bitcoin Is Rising: Fundamental Drivers, Opinions, and Forecasts

The year 2020 proved not only tumultuous but also extraordinarily successful for bitcoin investors. Fueled by global uncertainty, turbulence in financial markets and currency devaluations, the price of the world’s first cryptocurrency approached December 2017 levels.

The 2020 rally differs substantially from the previous one. This ForkLog piece will shed light on the most plausible reasons for the current rally.

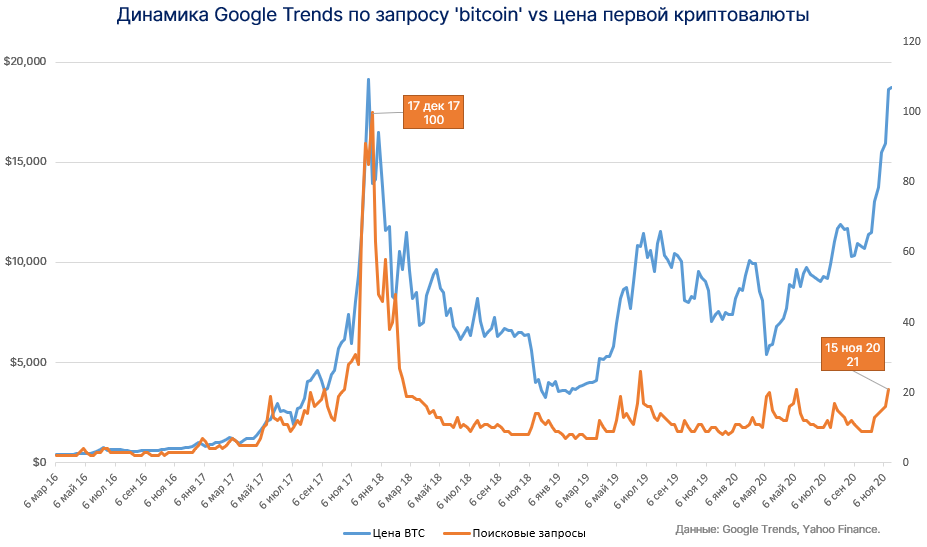

- The current bitcoin rally visually resembles the 2017 episode, but differs markedly in the context of fundamental factors.

- Institutional interest in the first cryptocurrency is growing, as shown by investment volumes, the emergence of new large market participants, and activity on regulated exchanges.

- Bitcoin rhetoric has markedly improved — more opinion leaders describe bitcoin as a store of value and a savings vehicle.

In Spite of Google Trends

From the start of the year, digital gold has risen 158% — from just above $7,000 to $18,550 (as of November 22). Over the same period gold prices rose by 23%, and the S&P 500 index quotes by 10%.

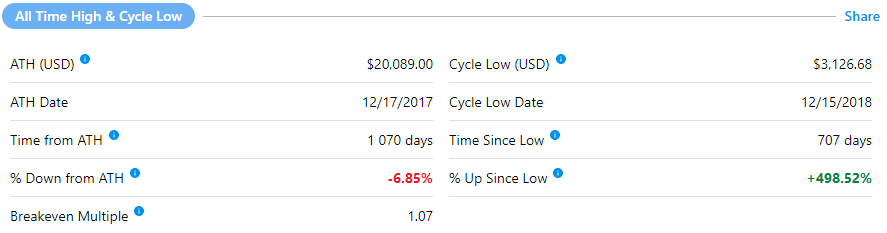

At the time of writing, bitcoin was only 6.85% below its all-time high of $20,089 recorded nearly three years ago.

The price trajectory of bitcoin’s movement closely resembles the 2017 rally, when a large portion of the community was obsessed with the “ICO fever.” Back then the market infrastructure was not ready for institutional money, and JPMorgan Chase chief Jamie Dimon called bitcoin a “fraud” and threatened to fire “stupid crypto traders.”

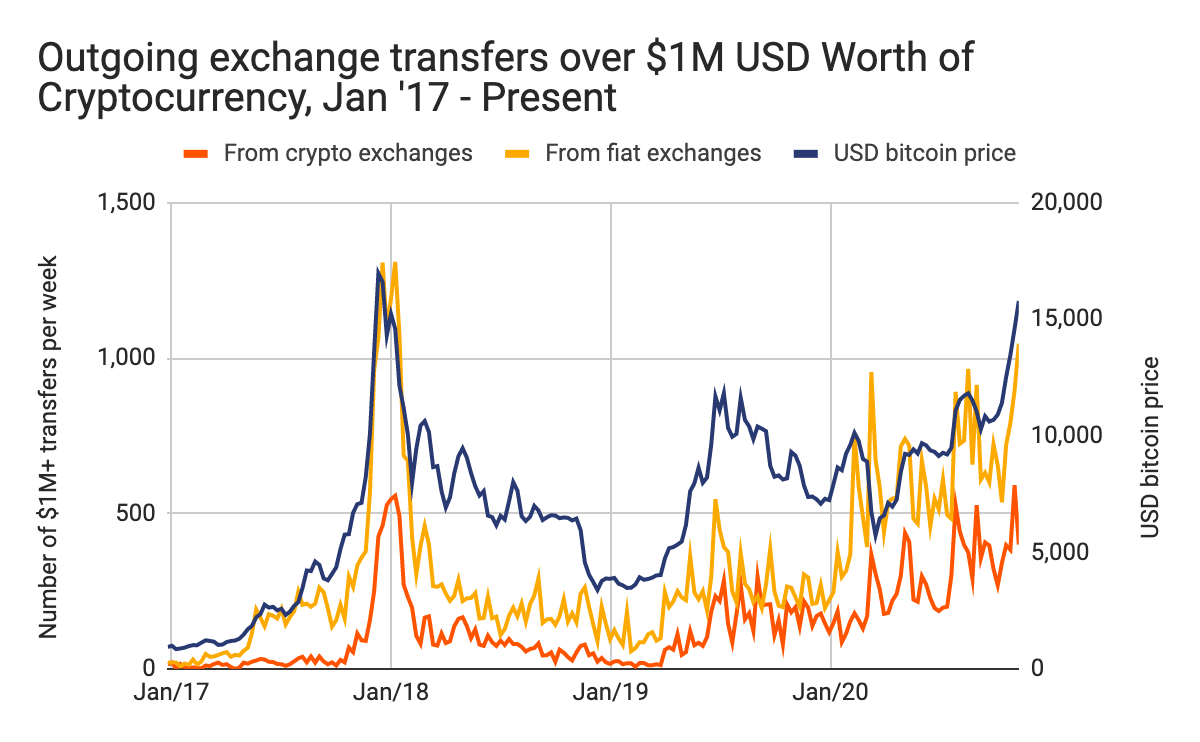

The price of any asset rises when demand exceeds supply. The chart above is evidence that the current rally is driven not only by ordinary users.

The Halving: A Growth Driver

In the Bitcoin protocol, there is a four-year halving that halves the rate of coin issuance to miners. The most recent halving made bitcoin even scarcer, especially against the backdrop of many fiat currencies depreciating due to unprecedented monetary and fiscal measures by authorities.

A tightly limited supply and the regular reduction in emission create the groundwork for longer-term growth for the cryptocurrency, provided demand remains unchanged or grows.

Against the backdrop of global uncertainty and eroding trust in traditional markets, complemented by heavy monetary pumping, bitcoin has become attractive to large investors with a long horizon.

This thesis is supported by the Chainalysis study. Analysts note that miners have only 3.4 million BTC left to mine. 77% of already mined and unspent coins (14.8 million BTC) are held on “illiquid” wallets, from which on average less than a quarter of the assets obtained move.

Since hitting the 2017 price peak, on so-called investor wallets the number of bitcoins has increased by almost 3 million.

Over the same period on trader wallets, characterized by higher liquidity, this metric declined. Chainalysis believes that market speculators provide supply for “new investors”.

As long-term holders of the first cryptocurrency, analysts singled out institutional investors and corporations. They pointed to purchases by Paul Tudor Jones, Square and MicroStrategy. For such buyers bitcoin is a hedge against inflation and other macro risks.

In Chainalysis they concluded that purchases of bitcoin in 2020 compared with 2017 are more strategic than speculative. Analysts forecast a flow of other institutional investors and further mainstream adoption. This would occur if the first cryptocurrency confirms its status as an effective instrument for hedging macroeconomic risks.

It is also worth noting the related tendency toward gradually reducing selling pressure from miners in the context of halving.

There is also an unpopular view regarding the halving’s impact on bitcoin’s price. According to Coin Metrics co‑founder Nick Carter, there are other significant drivers of bitcoin’s rise.

“I don’t think the halving affected bitcoin’s price. It’s an event that was known from day one. I think catalysts lie outside the market or in infrastructure,” said Carter.

The expert agreed that the current rally is more sustainable than three years ago.

“The MicroStrategy Effect” and Institutional Interest

In August, analytics software provider MicroStrategy bought 21,454 BTC (~$250 million at the time of the deal), becoming the first publicly traded company to allocate part of its capital to bitcoin. In response, Nasdaq-listed shares of MSTR jumped in the moment by 14.6%.

In September CEO Michael Saylor announced additional purchases of 16,796 BTC ($175 million at the time). He assessed the company’s total investment in bitcoin at $425 million, including fees and expenses.

As of November 21, the bitcoins purchased by MicroStrategy are valued at $714 million. That means investments in cryptocurrency rose by 68% — or $289 million — in a few months. Yet the company shows no inclination to crystallise gains — Saylor promised not to sell bitcoins in a century.

These investments sparked significant resonance in the community and beyond — to many, MicroStrategy added a “plus in karma” to bitcoin. The analyst at Quantum Economics called the development the “MicroStrategy effect,” which began a wave of institutional pursuit of bitcoin.

In early October, the payments company founded by Jack Dorsey announced the purchase of bitcoins worth $50 million, accounting for roughly 1% of Square’s total assets.

Another high-profile manifestation of the “MicroStrategy effect” was the news of launching by PayPal the ability to buy and sell bitcoin. The company said the new feature would promote global use of cryptocurrencies and pave the way for central bank digital currencies.

CEO Dan Schulman believes that ultimately bitcoin will be used more for everyday payments than as a store of value.

In November PayPal opened access to bitcoin and several altcoins for US customers. By the first half of 2021 the feature will be available to users in other countries.

Pantera Capital representatives are convinced that PayPal’s support for bitcoin, combined with active purchases via Square’s Cash App, has a material impact on bitcoin’s scarcity and, thus, on the asset’s price.

According to the company’s estimates, Cash App accounts for 40% of all bitcoin purchases. The recent PayPal launch of a direct cryptocurrency purchasing service is already having a significant market impact, according to the report.

According to Pantera Capital’s calculations, PayPal users buy about 70% of all bitcoin issued. This is evidenced by rising volumes on the regulated exchange itBit, backed by PayPal partner Paxos.

Researchers contend that PayPal and Cash App customers are already removing all daily mined bitcoins from circulation.

“Where will Cash App users source their coins? This reminds us of supply constraints and inflexibility. They will buy them at higher prices,” concluded the analysts.

Recently, Coinbase’s head of Institutional Sales Brett Tejpaul emphasised the importance of PayPal and other large players backing the crypto space.

“For banks, hedge funds and charities sitting on the sidelines, PayPal’s arrival is a signal. It spurs a second wave of institutional adoption of digital assets,” said Tejpaul.

The value of assets held in Coinbase’s custody service has risen from $6 billion in April to $20 billion now. Tejpaul cited the Tagomi acquisition and partnerships with JPMorgan and Deloitte as why the growth accelerated.

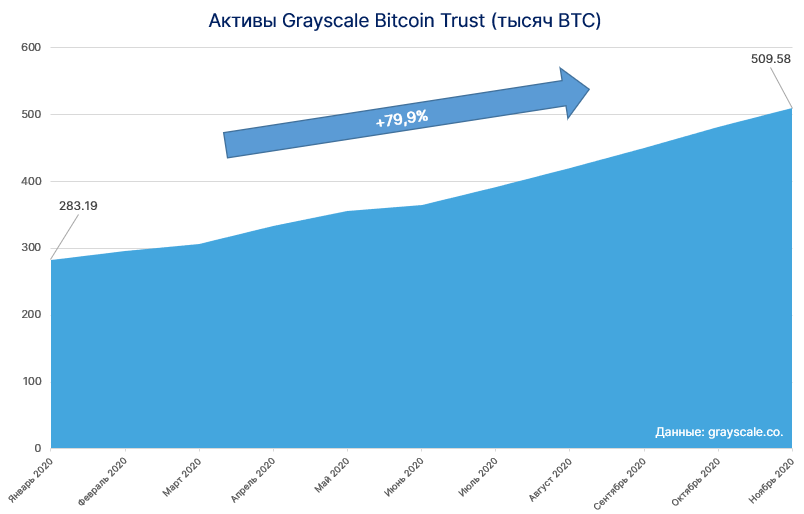

Evidence of the demand from large players for bitcoin and bitcoin-based products is also visible in the performance of Grayscale Investments’ crypto assets — on 18 November the firm said assets under management had for the first time surpassed $10 billion.

Just two days later, the total assets under management at Grayscale reached $11.3 billion.

11/20/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $11.3 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/UwfKviJNaK

— Grayscale (@Grayscale) November 20, 2020

The most sought-after product for the firm remains the bitcoin trust GBTC. It accounts for $9.65 billion, or 85% of total assets.

According to the Bitcoin Treasuries site, the value of public companies’ investments in bitcoin has surpassed $14.15 billion. On Grayscale Investments’ wallets alone, 2.43% of the total bitcoin supply is stored. The combined figure for companies listed on Bitcoin Treasuries stands at 4.01%.

Demand from big players is likely driven in large part by bitcoin being perceived as a digital store of value in today’s environment. Bitcoin offers not only inflation hedging but also potential to boost the return of a diversified investment portfolio.

4% of the total bitcoin supply in the hands of large corporations is a notably high share. With around 18.5 million BTC in circulation and about a few million coins lost forever, the real market supply is likely under 17 million BTC.

Investing corporations like MicroStrategy tend to pursue a long-term horizon and show no intent to crystallise gains in the near term or even over the coming years.

Thus, rising demand from long-term investors with a low time preference [simple_tooltip content=’A tendency of economic agents to prefer consumption today over the distant future.’]time preference[/simple_tooltip] may help relieve selling pressure and tighten the market’s available supply of bitcoin.

Inflationary pressures from central-bank monetary injections in the medium to long term could also positively affect bitcoin’s prospects and bolster its status as a safe-haven asset competing with gold.

Test for a Safe-Haven Asset

The inflationist policy of central banks, pitched as a remedy for the pandemic’s economic impact, has eroded trust in fiat currencies across the board.

In 2020 investors flocked to gold, traditionally viewed as a safe harbour in macroeconomic uncertainty. Interest surged for an even scarcer asset — bitcoin.

As a result, the correlation between bitcoin and gold rose, reviving discussions around the hypothesis of a safe-haven asset.

A tight statistical correlation with the stock market gradually waned after the March panic and the surge in prices.

Noted author of the best-seller Rich Dad Poor Dad, Robert Kiyosaki predicted a fall in bitcoin’s price in line with gold and silver in response to vaccine news. In practice, from November 6 to 17, bitcoin rose by 13.4%, while the most popular precious metal fell by 3.6%.

“There is growing demand for bitcoin from investors who previously hedged inflation and dollar weakness by buying precious metals,” suggested analysts at Deutsche Bank.

Investors who prefer bitcoin to gold are not only skeptical; Citi bankers are not doubting either. They believe bitcoin could reach $318,315 by the end of 2021 as it secures the status of digital gold in the twenty-first century.

The managing director at Citibank, Tom Fitzpatrick, noted that COVID-19 and the related monetary and fiscal measures have created a market environment similar to the gold market in the 1970s. Developed countries have signalled they will not shy away from aggressive money-printing until GDP and employment rebound.

Michael Sonnenschein of Grayscale Investments is confident that the rise in bitcoin investors demonstrates the asset’s viability as a class.

“I think by buying and including bitcoin in a portfolio, investors understand — this is a store of value, inflation insurance, digital gold, and a new form of money that is far better suited to today’s digital world than traditional stores of wealth like gold,” said Grayscale’s managing director.

Analysts at JPMorgan Chase found that the Grayscale bitcoin trust is attracting more funds than gold-backed ETFs. The main reason is rising demand from institutional players.

“We previously noted substantial potential for long-term growth if bitcoin competes more effectively with gold as an ‘alternative’ currency,” said the analysts.

Stanley Druckenmiller, the Quantum fund veteran and former colleague of George Soros, invested part of his managed capital in the cryptocurrency. He suggested that bitcoin could ultimately be a superior store of value to gold.

“I own far more gold than bitcoin. But, frankly, if bets on gold work, bets on bitcoin are likely to work better. The market for the latter is smaller, less liquid and carries a bigger beta,” noted the billionaire.

Druckenmiller predicted a drop in the US dollar’s value over the next three to four years and an increase in bitcoin’s appeal as a capital-preservation asset.

Legendary trader Paul Tudor Jones told his clients that trading bitcoin futures could serve as a hedge against current central-bank policies that are printing money to fight the pandemic.

“To maximise profits, you have to own the fastest horse. If you want my forecast, I would bet on bitcoin,” Jones emphasized.

In his view, bitcoin is a store of value. The billionaire argues that the asset has proven its resilience against four criteria: purchasing power, liquidity, portability and reliability.

Jones, who has allocated up to 2% of his assets to digital gold, sees substantial upside for bitcoin.

“There are a lot of smart, savvy people who truly believe in bitcoin. It’s like investing with Steve Jobs and Apple or early Google,” said Tim Tudor Investment head.

Mexican billionaire Ricardo Salinas Pliego, who has allocated 10% of his funds to bitcoin, is convinced that the cryptocurrency “protects citizens from asset expropriation by the state.”

Earlier, the founder of Grupo Salinas posted a video showing waste bags with Venezuelan bolivars.

Para iniciar con el #Bitcoin, les comparto un video tomado en un país latino donde los bancos tiran el dinero a la basura (el papel moneda no vale nada) es por eso que siempre es bueno diversificar nuestro portafolio de inversiones 😌.

Esto es la expropiación inflacionaria! 🤦🏻♂️ pic.twitter.com/ahblQW6AhO

— Ricardo Salinas Pliego (@RicardoBSalinas) November 17, 2020

“I’m sharing a video from a Latin country where banks throw money away (paper money is worthless). So diversifying investment portfolios is always a good idea,” wrote the businessman.

A More Sustainable Pace than 2017

Coin Metrics co‑founder Nick Carter named several fundamental differences between the current bitcoin rally and what happened three years ago.

He noted that in 2017 the market was driven by retail investors who moved from bitcoin into other crypto assets and participated in ICOs. Large players could not easily enter the market due to a lack of infrastructure.

“Back then there were no qualified custodians, prime-brokerage was just gaining traction. Essentially, there was no lending market, and CME had just launched futures,” Carter recalled.

He says that access to the institutional market has become “more comfortable” over the past three years.

Carter noted that large players are oriented toward long-term holdings as a hedge against inflation driven by unprecedented monetary measures.

Analyst Willy Woo agrees with Carter on the differences since 2017.

Who has been buying this rally? It’s smart money… High Net Worth Individuals. You can see the average transaction value between investors taking a big jump upwards. OTC desks are seeing this too.

Bitcoin is still in it’s stealth phase of its bull run. pic.twitter.com/3q41pmNVP9

— Willy Woo (@woonomic) November 9, 2020

China’s interest in digital gold and related products is also evident from state media coverage. CCTV reported on the rally, noting that factors such as bitcoin developers’ activity and ecosystem investment dynamics are more advanced than during 2017’s bull run.

CCTV, China’s Official TV Channel: #Bitcoin price surpasses $17.5k, up 70% in less than 50 days. Compared with 2017’s bull market, bitcoin’s network, development and investment eco-system are now far better. The recent rise is driven by institutional funds. pic.twitter.com/yZqzGU5veM

— cnLedger (@cnLedger) November 18, 2020

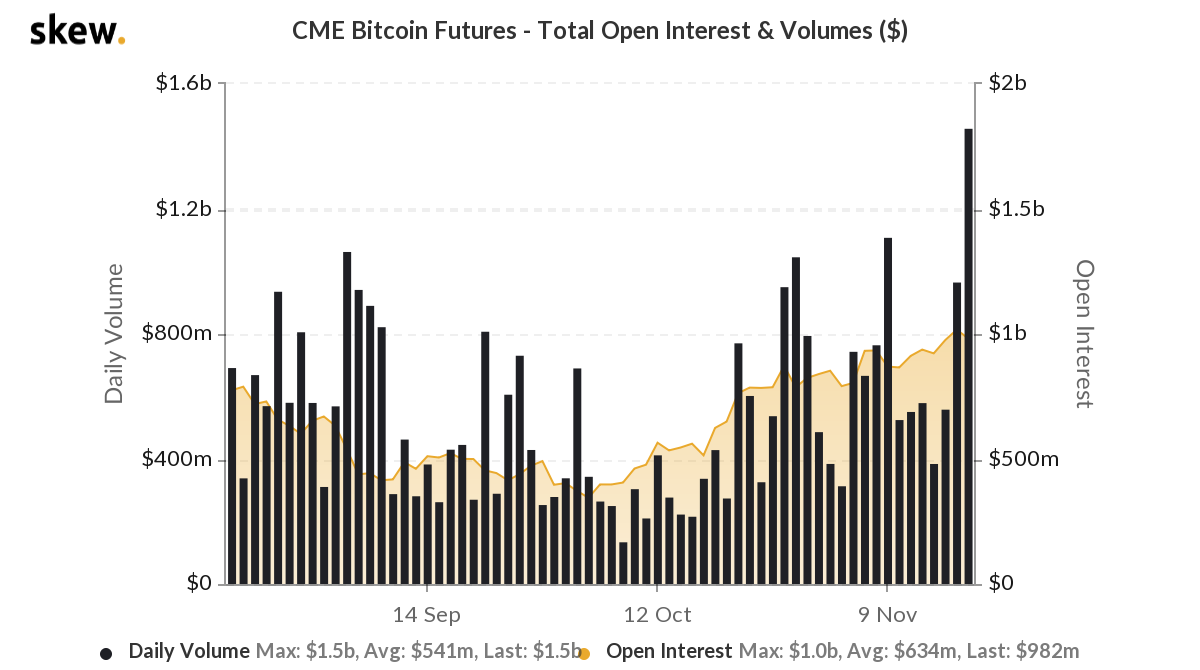

On the demand side from large players for bitcoin and related products, CME open interest neared a record of $1 billion last week.

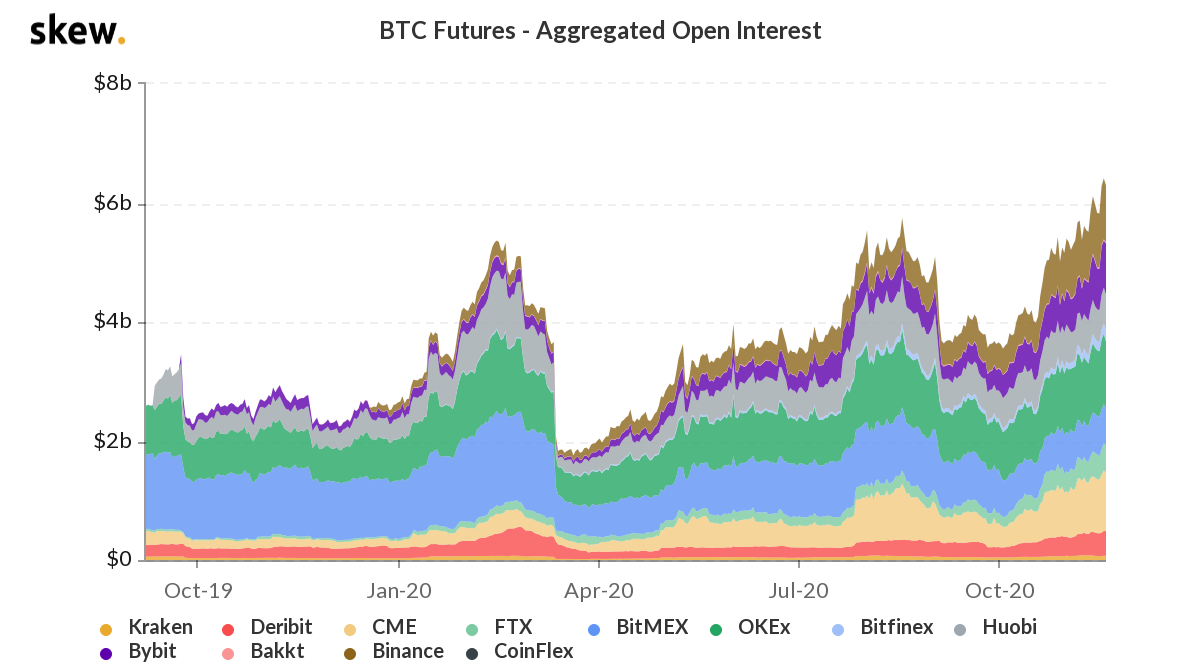

Aggregate open interest in the bitcoin futures market also reached a historic high.

Unstoppable Growth of DeFi

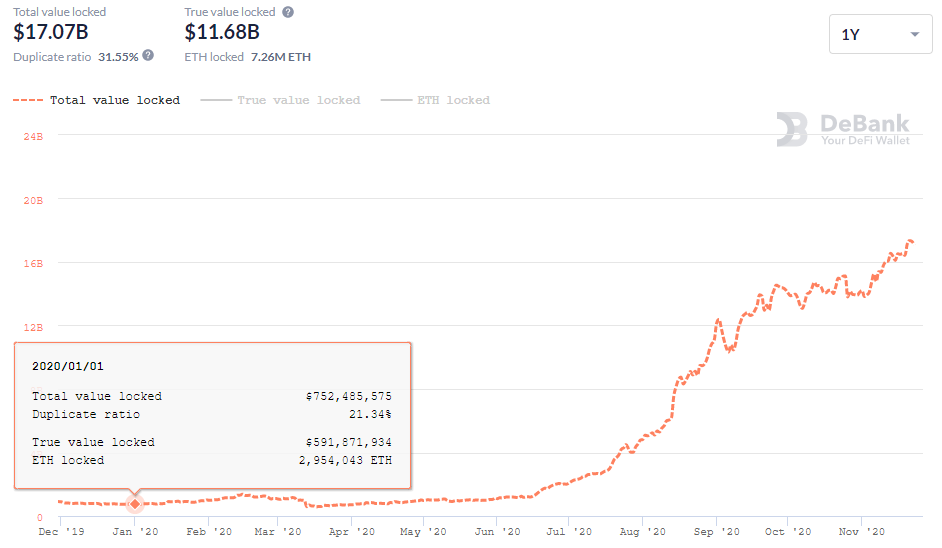

The decentralized finance (DeFi) segment continues its exponential growth. From the start of the year the total value locked (TVL) has grown 22-fold.

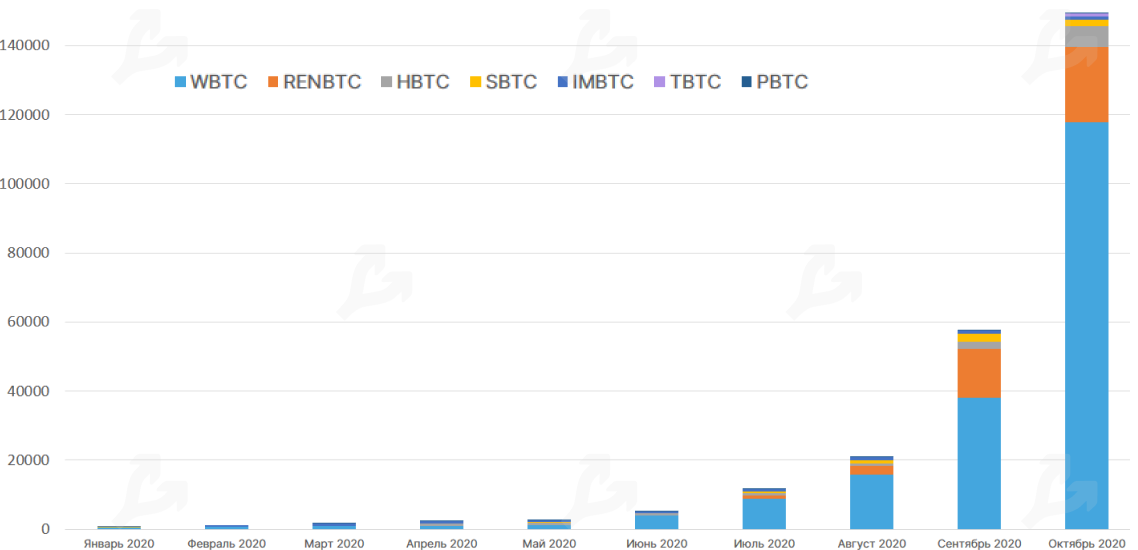

Alongside DeFi, the segment of Ethereum-backed bitcoin tokens is also growing.

According to Dune Analytics, as of November 23 there are 152,333 bitcoins on Ethereum. This amounts to 0.716% of the total bitcoin supply.

Protocols such as WBTC, renBTC and HBTC give holders access to the rich DeFi ecosystem, limiting the supply of bitcoin and, therefore, contributing to price growth.

Conclusions

The current bitcoin rally indeed differs from what happened in late 2017 in many respects. Involvement of large players, absence of unbridled hype, the perception of digital gold as a store of value and hedge, and various on‑chain metrics all point in that direction.

The rhetoric around bitcoin has changed so much that even outgoing SEC chief Jay Clayton admitted that bitcoin could be viewed as a store of value and a means of settlement, countering the inefficiencies of current payment systems.

From the outflow of funds from centralized exchanges to the growing accumulation on noncustodial wallets and the rising number of addresses, bitcoin investors appear to favour long‑term storage over speculation, and the number of market participants is increasing.

PayPal, with its vast customer base, is also expected to play an important role in broadening the adoption of digital gold.

If bitcoin continues to be perceived as a hedge against negative macroeconomic trends, one can expect further influx of institutional players. This would imply greater integration of bitcoin with traditional financial markets, intensifying competition for the scarce asset and supporting further price growth.

Subscribe to ForkLog news on Telegram: ForkLog FEED — all the news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!