Grayscale crypto funds attract record $3.26 billion in Q4

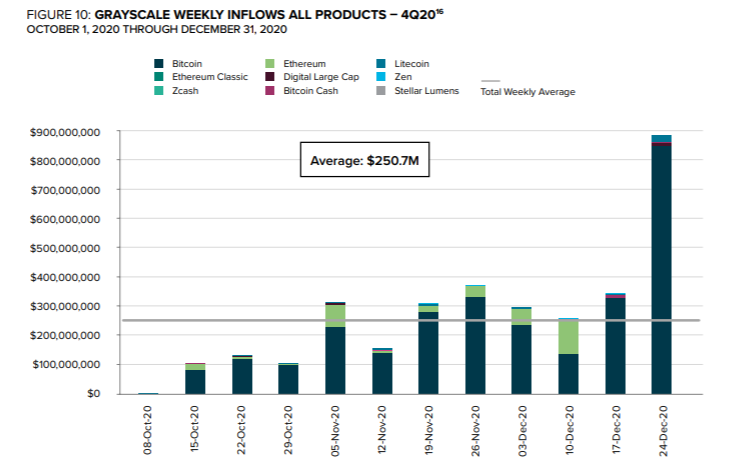

Investors’ inflows into Grayscale Investments’ cryptocurrency funds in the fourth quarter reached a record $3.26 billion.

4Q REPORT: Last quarter, we saw a total investment into Grayscale products of $3.26 billion — an average weekly investment of $251 million. Read more about our record-breaking quarter here. #GoGrayscale https://t.co/T4sMVQhcDe pic.twitter.com/zvsPtFkNrN

— Grayscale (@Grayscale) January 14, 2021

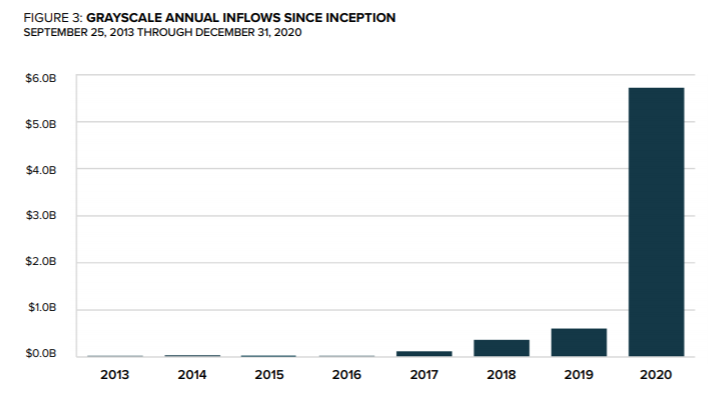

In the third quarter, inflows amounted to $1.05 billion. For the year 2020, the company attracted $5.7 billion, 4.75 times the combined total for 2013-2019 of $1.2 billion.

Over the year, assets under management at Grayscale Investments rose from $2.0 billion to $20.2 billion.

Source: Grayscale Investments.

Source: Grayscale Investments.

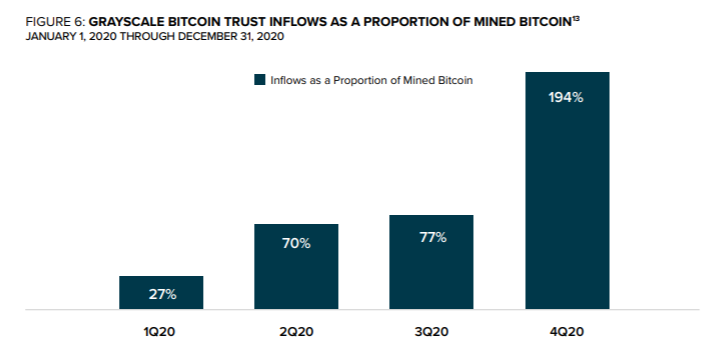

Grayscale’s client positions in the Bitcoin Trust rose during 2020 from $1.8 billion to $17.5 billion. GBTC’s growth in Q4 was proportional to 194% of Bitcoin’s issuance during the period.

Source: Grayscale Investments.

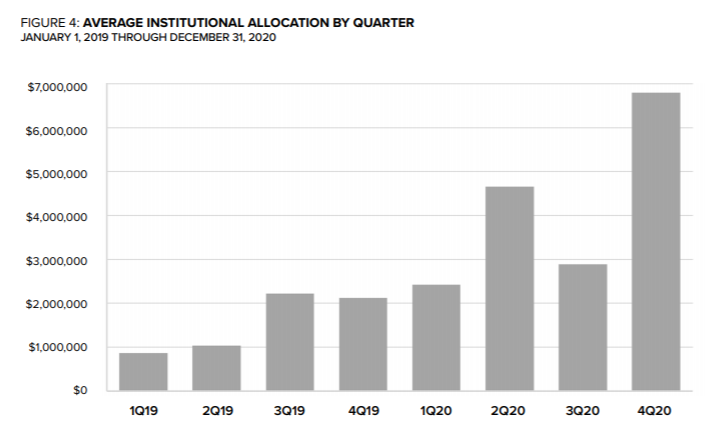

Institutional investors increased the average investment size. The metric more than doubled from $2.9 million in July–September to $6.8 million in October–December. Institutions accounted for 93% of inflows in Q4 (87% came from GBTC).

Source: Grayscale Investments.

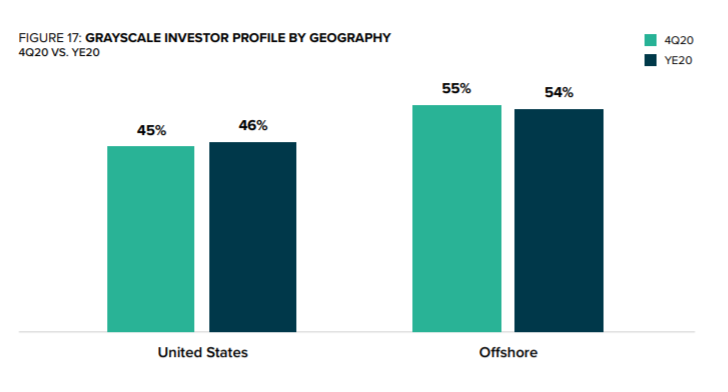

Remaining inflows into Grayscale products were provided by accredited investors, family offices and pension funds. The United States accounted for 45% of the total.

Source: Grayscale Investments.

According to latest data, total assets under management at Grayscale Investments stood at $27.7 billion.

01/14/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $27.7 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $ZEC pic.twitter.com/bRD1skyTRN

— Grayscale (@Grayscale) January 14, 2021

In January, Grayscale Investments resumed accepting deposits in several crypto funds after suspension at the end of 2020.

Earlier the company announced the liquidation of an XRP-based investment trust.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!