Week in Review: Elon Musk Pumps Bitcoin, Reddit Users Push Dogecoin to a New High

Elon Musk sparked a Bitcoin rally on Twitter, one of his tweets was immortalised on the blockchain of the cryptocurrency, XRP’s price surged after Ripple’s response to the SEC lawsuit, Robinhood found itself at the centre of the GameStop stock saga, and other events of the week.

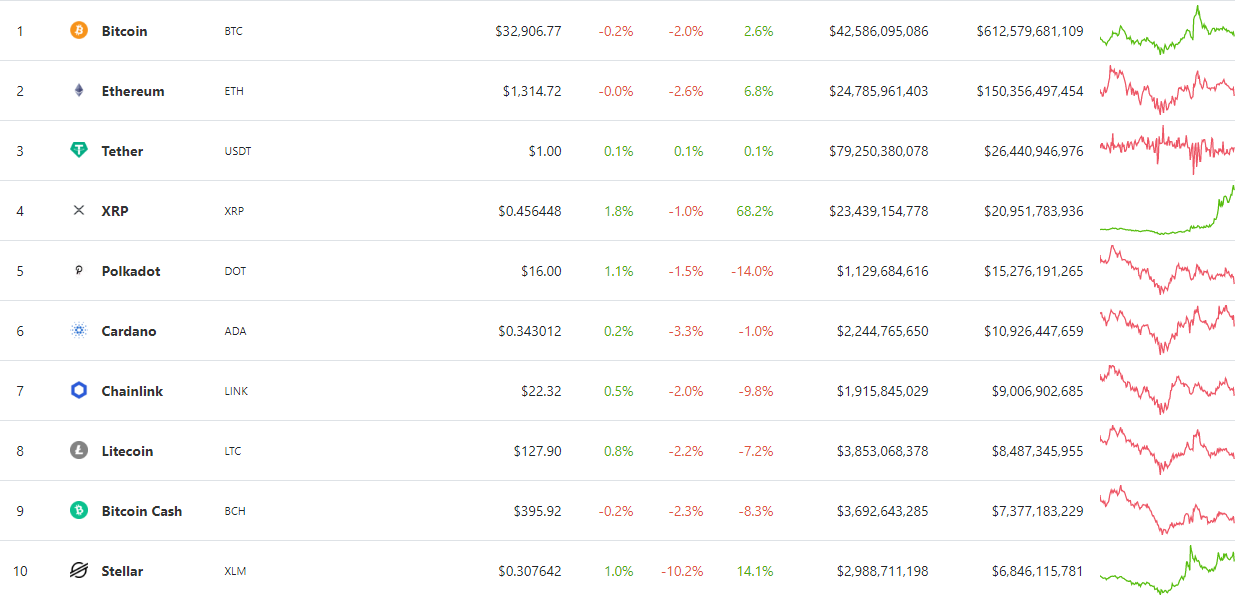

Crypto market capitalisation tops $1 trillion again after Bitcoin, Dogecoin and XRP rallies

On Wednesday, January 27, the price of the first cryptocurrency fell below $30,000. On the Bitstamp exchange the price dropped to $29,150. As on January 22, the decline proved temporary—the price quickly recovered.

CryptoQuant CEO Ki Yong Ju called the price move a “slip.” The expert noted that [simple_tooltip content=’represents the difference with Binance in spot prices’]”Coinbase Index”[/simple_tooltip] at that time exceeded $66, which corresponded to bullish sentiment among major players.

On Friday, January 29, Tesla and SpaceX founder Elon Musk placed the bitcoin hashtag in the description of his Twitter account with 44 million followers. The price of digital gold over the course of an hour rose by 20%, peaking at $38,600.

By the time of writing, quotes had returned to levels seen before the Friday pump.

Data: TradingView.

Analyst Willy Woo argues we are witnessing the first major consolidation of Bitcoin during the 2021 bull market. He defined its price range from $29,000 to $56,000.

While we are in the first great consolidation of the 2021 bull market, here’s a bunch of charts to get the feel of where we are in this bull cycle.

👇

— Willy Woo (@woonomic) January 30, 2021

Glassnode analysts, based on two on-chain metrics forecasted the end of the correction and the formation of a new upward price impulse for the flagship cryptocurrency.

Guggenheim Partners’ Investment Director Scott Minerd remained true to his forecast of a Bitcoin price decline — in the near term the asset will not hold above $30,000, he says.

On Friday, another pump hit the crypto market — in 24 hours meme-cryptocurrency Dogecoin (DOGE) rose by 1000% and reached a new all-time high at $0.078 (CoinGecko). The rapid rise was driven by members of the r/SatoshiStreetBets community on Reddit. The subreddit calls itself the crypto analogue to the r/WallStreetBets group, which allegedly stands behind the triple-digit rise in GameStop stock despite the expectations of major market players.

“The favorite cryptocurrency” was supported by Elon Musk, who posted a tweet hinting at it.

— Elon Musk (@elonmusk) January 28, 2021

Later he posted a tweet that users linked to Bitcoin and Dogecoin:

“Looking back, it was inevitable.”

The phrase immortalised on the blockchain of the first cryptocurrency, was placed in block #668 197.

With a new price record, DOGE vaulted into the top ten cryptocurrencies by market capitalisation, but after a correction it dropped out. At the time of writing the coin sits in 16th place in CoinGecko’s ranking.

In the wake of the rally, it was invested in by porn star Mia Khalifa. At the time of the tweet, users guessed that she did this at the price peak. Khalifa later confirmed their guesses. DOGE trades around $0.03.

On Saturday, January 30, XRP from Ripple suddenly jumped 60% and surpassed $0.50. The token returned to the fourth place by total market value. This came amid the company filing its response to the SEC lawsuit, though on Twitter some suggested that “XRP used the same rocket fuel as Dogecoin yesterday.”

Data: CoinGecko.

By the end of the week, the cryptocurrency market capitalisation stood at just over $1 trillion, with Bitcoin’s dominance index at 61.2%.

Robinhood at the centre of the GameStop, Dogecoin and Reddit traders scandal

The crypto-friendly platform Robinhood found itself at the centre of a financial scandal, which threatens a review of Wall Street’s market practices.

The situation around GameStop and AMC Entertainment shares, hedge funds, and the Reddit community has drawn attention from the US Congress and prosecutors’ offices.

On November 29, 2020, a member of the r/WallStreetBets subreddit discovered that Melvin Capital held short positions in GameStop (GME). After this, users decided to buy these shares to prevent large players from sinking the company.

On December 1, the price of GME hovered around $16, but from January 12 it began to rise sharply. The peak came on January 28, when the New York Stock Exchange price exceeded $469. On Friday, January 29, the closing price was $325.

The GameStop stock pump proved costly for Melvin Capital. The Wall Street Journal reports that as of January 25 the fund had lost 30% of its capital. It was backed by market maker Citadel and hedge fund Point 72 Asset Management with $2.7 billion. The total losses of short-sellers on GME this month are estimated at over $19.75 billion.

Citadel’s close ties to Robinhood include the mobile platform. In June, a subsidiary of the market maker accounted for more than 35% of Robinhood’s revenue, according to the Financial Times. Many r/WallStreetBets participants used the same platform to buy GameStop shares.

On January 28, Robinhood restricted trading of several assets, including GME and AMC.

In a Robinhood blog, the company promised to reintroduce restricted trading on January 29. One r/WallStreetBets participant said the limit was up to five shares.

On Friday, January 29, Robinhood halted deposits and cryptocurrency trading due to an “abnormal market situation.”

Earlier, Robinhood had blocked trading of Dogecoin (DOGE).

The community erupted with anger at the platform’s actions. Subreddit participants organised a campaign to lower the Robinhood app’s rating in Google Play Store.

However the situation did not only bring negative reviews for Robinhood. On January 28 a group of investors filed a class-action lawsuit against the company, accusing it of “willful and conscious” depriving private traders of the opportunity to invest.

Senate Banking Committee chair Sherrod Brown called for a review of stock-market rules. Representative Paul Gosar urged the U.S. Justice Department to investigate the GameStop and Robinhood incident.

The SEC said it would take a closer look at companies like Robinhood. The agency did not name the platform directly, but hinted at prices of “certain stocks.”

Grayscale files for six new investment trusts

On January 27, asset manager Grayscale Investments filed applications to register six new trusts: based on Aave, Polkadot, Cosmos, Monero, EOS and Cardano.

The requests were addressed to Delaware’s Division of Corporations. The investment products were registered by Delaware Trust Company (DTC). According to the documents, DTC is Grayscale’s legal representative in the state.

In December the company filed applications to register five new trusts based on Chainlink, Tezos, Basic Attention Token, Decentraland and Livepeer.

The Grayscale head Michael Sonnenshein noted that obtaining approval does not necessarily imply the appearance of an investment product on the market.

On January 25 the company said it had donated $1 million to Coin Center, an organisation promoting and defending the cryptocurrency industry’s interests. It also pledged to raise up to $1 million in donations during February 2021.

Coinbase to go public via direct listing

The largest American cryptocurrency exchange Coinbase said it would go public via direct listing.

In December 2020 the platform filed with the SEC an S-1 form for an initial public offering (IPO).

On January 28, 2021, Coinbase representatives clarified that the company would go public via direct listing of Class A common stock.

“The S-1 form will become effective after the SEC completes its review process, taking into account market and other conditions,” the company said.

Ripple responds to SEC suit, and Brad Garlinghouse calls 2020 a landmark year for the company

Ripple filed a response to the SEC lawsuit. It asserts that the accusations of issuing unregistered securities are based on an “unprecedented and ill-considered legal theory.”

“Among other things, this theory ignores the fact that XRP performs a number of functions not characteristic of securities, — says the 93-page document. — For example, XRP acts as a medium of exchange — the digital currency is currently used in cross-border and domestic transactions, moving value between jurisdictions and facilitating the settlement of trades. This is not a security and the SEC has no authority to regulate it.”

Ripple sought information on why the agency does not classify Ethereum, which “also performs a function as a medium of exchange,” as a security.

The document also mentions “China’s control” over Bitcoin and the second-largest cryptocurrency by market capitalisation.

The company argues that the regulator’s claims require swift progress, since XRP has lost almost half of its market value since the lawsuit. As a result, retail holders of the token, not affiliated with Ripple, have suffered losses the SEC claims to protect.

“The SEC’s mission includes maintaining order in the markets. However, the agency’s overreach has sown chaos,” said Ripple.

Against regulatory headwinds, legal actions against the company and its leadership continue to pile up. A Florida resident filed a class-action suit against Ripple, accusing the firm and CEO Brad Garlinghouse of violating state securities laws and illicit enrichment. The investor put about $100 into XRP, which turned into $50 after a month.

Yet the head of Ripple says the year just ended was “remarkable” for the company, whose products remain in high demand from clients. RippleNet processed more than 3 million transactions — five times more than a year earlier. The On-Demand Liquidity (ODL) payment system, in which XRP is used as an intermediate currency, showed a 12-fold year-on-year growth. The annual transaction volume was around $2.4 billion, Garlinghouse notes.

RippleNet’s General Manager Ashish Birla said the company is in talks to use the XRP Ledger as the basis for national digital currencies (CBDCs). He believes this would be a “serious boost for the adoption of Ripple’s technology.”

Tatneft sees mining of cryptocurrencies at the enterprise as a promising avenue

The Russian oil company Tatneft expressed interest in the possibility of earning additional profit from cryptocurrency mining. The corresponding project won at a youth forum organised by the company.

The idea’s author is Irek Kiramov, an engineer at the network control center. He says one of Tatneft’s problems is an excess of power capacity.

“In mining, the main cost item — more than 85% — is electricity. You can diversify production and mine not only oil but also cryptocurrency. For the company it could become another growth point and bring additional profit,” he said.

Kiramov has already registered the project in the automated Edison system and plans to participate in its implementation.

More than 50 young specialists took part in the forum. Tatneft selected the top six projects it is prepared to implement.

A bug in Apple devices exposes access to Bitcoin wallets

A vulnerability discovered in Apple devices allows remote access. It potentially threatens cryptocurrency wallet users.

Apple has already released updates for iOS 14.4 and iPadOS 14.4. They are available for models from iPhone 6s, iPad Air 2, iPad mini 4 and iPod touch (7th generation).

Coinbase’s lead engineer Pete Kim urged Apple users to urgently update their OS to protect their cryptocurrency wallets.

According to him, there is no evidence that the vulnerabilities were used to target cryptocurrency users specifically.

Jihan Wu steps down from Bitmain CEO role

Bitmain co-founder Jihan Wu announced his departure from the company’s CEO position after protracted disputes with Micree Zhan.

Under previously approved by shareholders agreements, Zhan bought almost half of Wu’s Bitmain shares for $600 million. Wu will also receive the BTC.com pool with the BitDeer cloud platform and mining farms outside China.

Cryptocurrencies get a dedicated Davos session

organizers of the World Economic Forum in Davos devoted a dedicated session to the cryptocurrency industry titled “Rebooting Digital Currencies,” which took place on January 25 and 28.

Silver Lake co-founder Glenn Hutchins, who spoke at the event, rejected the notion that Bitcoin is convenient for criminal activity — this runs counter to the core characteristics of the blockchain technology underlying it.

Bank of England Governor Andrew Bailey expressed doubts about the ability of existing cryptocurrencies to function as a means of payment in the long run.

ForkLog also wrote:

- At Ukraine’s nuclear power plant a mining centre will be built for 9 million hryvnias.

- A Moscow investor invested $550,000 in software development for a Bitcoin exchange and discovered it on the network.

- In Abkhazia mass raids were carried out to shut down mining farms.

- The Bernie Sanders meme in mittens was immortalised in collectible NFT cards.

- Ukraine’s president Volodymyr Zelensky was offered to issue a national token and tokenize state assets.

- Navalny’s team received more than 3.5 BTC during protests on January 23.

- Reddit and Ethereum Foundation will scale Ethereum.

- Bitcoin sceptic Janet Yellen chaired the U.S. Treasury.

- Visa chief unveiled the company’s approach to cryptocurrency.

What to read and watch next?

ForkLog examined whether blockchain and artificial intelligence are compatible and whether blockchain can be used to create and disseminate AI models.

On January 25, on ForkLog Max Bit, Vladimir Koen spoke with a trader and asset manager about Bitcoin, altcoins, the traditional market, and key events.

Our YouTube channel also features a video about how Bitcoin is redefining experts.

Subscribe to the Forklog channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!