Week in Review: Bitcoin Price Plunges as Bitfinex and Tether Settle Dispute with New York Prosecutor

The Bitcoin correction sparked the week’s largest liquidation volume, Bitfinex and Tether settled their dispute with the New York Attorney General, and MicroStrategy added to its digital-gold holdings by $1.02 billion, among other developments of the week.

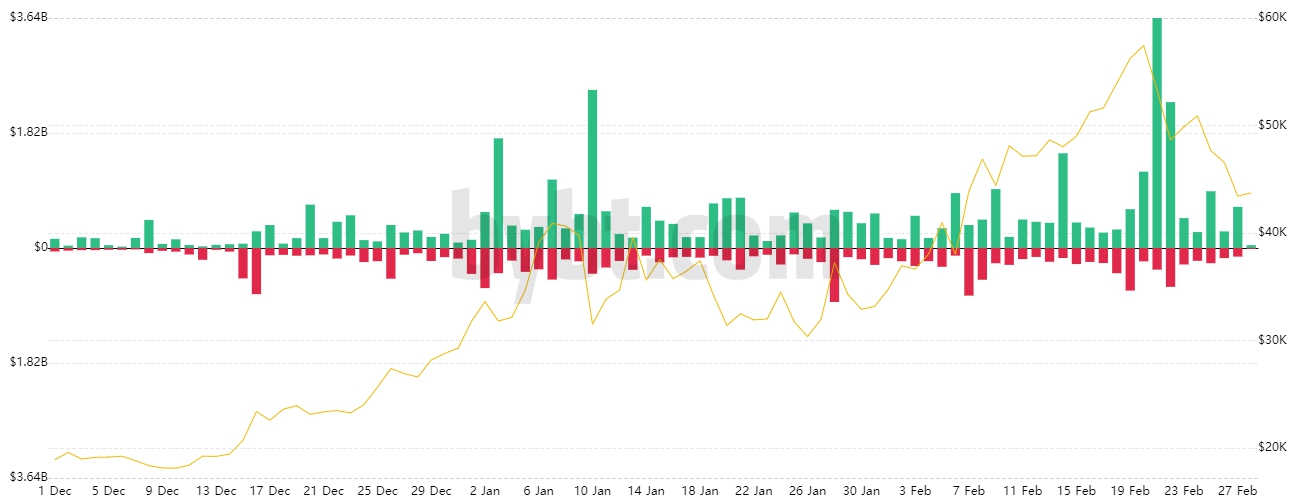

Bitcoin price plunges from its highs, triggering a record liquidation volume

On Monday, February 22, the price of the leading cryptocurrency began to correct after hitting an all-time high above $58,000 the previous evening.

The decline to $52 500 led to liquidations on the futures market of positions totaling $750 mln. Bitcoin’s market cap fell below $1 trillion.

By evening, the price had slid to $47 500, and total liquidations surpassed $3.5 billion.

Data: Bybt.

On Tuesday, after rebounding to $55 000, quotes retraced to around $45 000, triggering a second wave of liquidations totaling $2.5 billion.

Despite a midweek return to around $50 000, as of writing they had slipped to around $44 000.

Data: Trading View.

According to CryptoQuant CEO Ki Young Ju, the drop in Bitcoin’s price is linked to unfavorable macroeconomic conditions for the cryptocurrency, rather than a drop in institutional demand or miners selling.

However, analyst Lex Moskovski noted that, according to Glassnode data, on February 26 miners began accumulating Bitcoin for the first time since December 27 and ceased to be net sellers.

Miners have stopped selling and started accumulating #Bitcoin

Yesterday was the first day since Dec, 27 when Miners Position change turned positive.

Miners were selling their bitcoins for two months.

Bullish. pic.twitter.com/S89iBcz4k3

— Lex Moskovski (@mskvsk) February 27, 2021

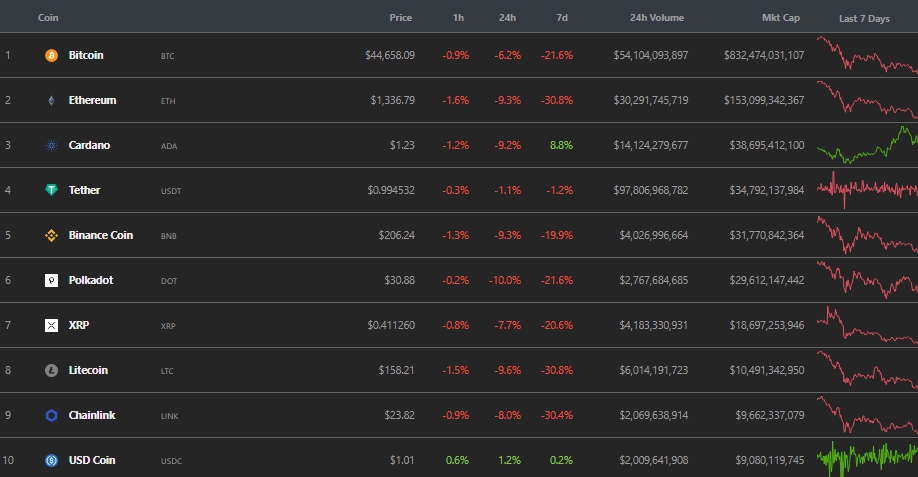

По итогам недели из ведущих криптовалют в зеленой зоне оказалась лишь Cardano — монета обновила исторический максимум цены и поднялась на третью строчку рейтинга по рыночной капитализации (по CoinGecko).

Data: CoinGecko.

Cryptocurrency market capitalization fell below $1.4 trillion, while Bitcoin’s dominance index remained around 60%.

Lawmakers in the State Duma say crypto should be legalized before tax rules

To introduce taxation on cryptocurrencies, transactions with them must be legalized. This was stated by Pavel Krasheninnikov, head of the State Duma Committee on Legislation.

He noted that the Russian authorities do not yet have a definitive position on cryptocurrency:

«On one hand, it is not recognised as an asset, on the other hand, the government has introduced a bill that it should be taxed. We tell them: decide — either you tax it, and thus it is an asset, or, if you say it’s not an asset, then do something», — he said.

Ukrainian court orders blocking access to ForkLog, its GitHub subdomain and LiveJournal

On February 25, the Holosiivskyi Court in Kyiv ordered to seize intellectual property rights for 426 sites and block access to them. ForkLog magazine was among them.

Deputy Interior Minister Anton Gerashchenko said that a citizen named Andrey Pan filed a police complaint over information published on the sites. Gerashchenko also called the court ruling “unfounded,” and the criminal case was later closed. The High Council of Justice of Ukraine will review Judge E.G. Plahotnyuk’s competence.

It also emerged that Andrey Pan previously used the surname Prochukhan. Under that name he appears as the organizer of numerous fraud schemes and pyramids. He is linked to MMM-2011, Formula Money — Golden Ratio / Formula Money Invest (FD Invest), Questra World and A.G.A.M.

Bitfinex and Tether settle dispute with New York prosecutor

The cryptocurrency exchange Bitfinex and Tether entered into an agreement with the New York State Attorney General (NYAG) over the company’s financial operations tied to a loss of $850 million.

Under the settlement, Bitfinex and Tether will pay $18.5 million to the state of New York. The companies did not admit wrongdoing.

Tether also agreed to hand over NYAG reporting on the collateralisation of the USDT stablecoin. The agency acknowledged the repayment of Bitfinex’s debt to Tether.

«The Attorney General’s Office essentially concluded that we could have done a better job illuminating these events», said Tether.

SEC approves Coinbase direct listing application

On Thursday, February 25, the U.S. Securities and Exchange Commission (SEC) approved the application of the cryptocurrency exchange Coinbase for a direct listing of its shares, per the Form S-1 filed in December 2020.

Coinbase chose Nasdaq as the venue for its stock-market debut.

In the Form, Coinbase disclosed risk factors for investors. These included the disclosure of the identity of Bitcoin’s creator Satoshi Nakamoto and competition from the decentralized finance (DeFi) sector. Other risks cited included “negative sentiment around Bitcoin or Ethereum,” as well as “unpredictable media coverage” and “the crypto-asset trend.”

Also in the filing were the company’s major shareholders. Among them were venture firm Andreessen Horowitz, Coinbase CEO Brian Armstrong, co-founder Fred Ehrsam and the hedge fund Paradigm led by him.

Share of fees in Ethereum miners’ revenue exceeds 50%, miners split into two camps over EIP-1559

Ethereum miners’ revenues in February reached a new record, exceeding $1 billion by February 23. More than half of this came from transaction fees.

Glassnode analysts noted that this pattern is characteristic of the year’s start, previously seen during the so-called DeFi summer in 2020.

Miners themselves split into two opposing camps due to the EIP-1559 proposal. It envisages burning part of the transaction fees and aims to reduce volatility in gas fees.

The third-largest Ethereum pool, F2Pool, backed the upgrade proposal. Opposed were the operators of the largest and second-largest pools — Sparkpool and Bitfly.

As of now, more than 50% of Ethereum’s total hash rate is held by those opposed to EIP-1559.

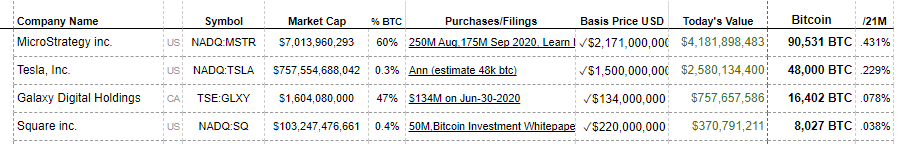

Square and MicroStrategy bolster Bitcoin bets

Payments company Square, led by Jack Dorsey announced an additional purchase of Bitcoin worth $170 million in Q4 2020.

That amount bought about 3,318 BTC.

With the prior $50 million Bitcoin purchase, Square had allocated around 5% of its cash reserves to Bitcoin as of December 31, 2020.

Software maker MicroStrategy wired $1.02 billion raised from the sale of convertible bonds into Bitcoin. The company bought 19,452 BTC at an average price of $52,765. In total it holds 90,531 BTC.

The Bitcoin Treasuries portal, tracking bitcoins held by public companies, updated its data on Square and MicroStrategy and added Tesla data. The portal lists the electric-car maker as owning 48,000 BTC. Tesla has not officially confirmed this.

Data: Bitcoin Treasuries.

In the Bitcoin investment by the automaker, comments came from Microsoft co-founder Bill Gates, who urged potential investors not to follow the company’s example:

«I’m not particularly optimistic about Bitcoin, and my overall view is: if you have less money than Elon [Musk], you’d probably want to be more cautious», said Gates.

Vice-chairman of Berkshire Hathaway’s board, Charlie Munger, answering what he thought was crazier — Tesla’s $1 trillion market cap or digital gold at $50,000, said:

«I can’t tell which is more mad — the rise of one thing or the rise of another.»

He added that Warren Buffett’s Berkshire Hathaway does not plan to buy Bitcoin due to its high volatility.

However, Wedbush Securities, while bitcoin neared its all-time high, noted that Tesla’s potential bitcoin profits are higher than from selling electric cars in 2020.

Later, Wedbush noted that the company’s stock price now hinges on the price of digital gold.

NFT Market Could Grow Severalfold in 2021

Canadian analytics firm NonFungible projected substantial growth in the NFT market in 2021.

According to the report, NFT overall market cap reached $338 million by the end of 2020. Messari Research analyst Mason Nystrom suggested the figure could grow two- to fourfold in 2021.

Only on February 22 did users spend over $60 million on NFTs, excluding high-priced items. Pieces such as CryptoPunks have sold for 90–400 ETH.

Among other noteworthy deals in the sector this week:

- The creator of the Nyan Cat meme sold it on an NFT auction for 300 ETH.

- A user resold Beeple’s artwork featuring Donald Trump for $6.6 million. It changed appearance after the U.S. elections.

- Russian performance artist Petr Davydchenko opened an NFT auction with a live bat in his mouth at the doors of the European Parliament.

Ukrainian Monobank halts SEPA transfers from Binance

Ukrainian online bank Monobank since February 24 stopped SEPA transfers from the cryptocurrency exchange Binance.

The bank credited foreign intermediary banks for the decision — Monobank said they block transfers related to Binance.

ForkLog also reported:

- The Fed system experienced a glitch. The community reminded of Bitcoin’s network resilience.

- The number of cryptocurrency users surpassed 100 million.

- Craig Wright demanded that developers restore access to bitcoins stolen from MtGox, and the Tokyo District Court approved the exchange’s rehabilitation plan.

- DeFi project 1inch launched a governance token on Binance Smart Chain.

- Elon Musk commented on rumors of an SEC investigation regarding his Dogecoin tweets.

- MASK Network will conduct an airdrop of 1.86 million tokens.

- Unknown transferred 2,189 BTC, dormant since 2013, and two days later a movement of 1,000 BTC from 2010 appeared.

What to read and watch?

In a new ForkLog piece, we explored what Bitcoin on Ethereum is and why it matters.

In traditional digests, the magazine summed up key events in cybersecurity and artificial intelligence for the week, while a broader review of the biggest crypto investment deals covered a longer period. The roundup of major crypto investment deals spanned a wider window.

On Monday, February 22, ForkLog’s Ethereum focus featured a chat with developer Andrey Sobolev about the second version of the protocol, hard forks, and the recent surge in network fees.

This week, in collaboration with Tezos Ukraine, we released a series of workshops on Tezos smart-contract development:

- In Part I, blockchain developer Anastasia Kondaurova talked about the FA1.2 token standard on Tezos and the features of the functional language Ligo.

- In Part II, blockchain developer Mikhail Zaikin discussed the BCD explorer, the PyTezos library, and working with smart contracts directly from a browser.

- In Part III, co-founder and CTO Korny Vasylchenko explained how to read and write arbitrary data on the Tezos blockchain and how to build decentralized apps and their front ends.

Subscribe to ForkLog’s Telegram news: ForkLog Feed — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!