Where to track cryptocurrency prices

Key points

- The crypto market is highly varied, and pinning down an average market price for a single digital asset can be tricky. A range of services help track cryptocurrency prices and simplify market analysis, including trading-data aggregators, news sites, portfolio trackers, exchanges and more.

- Each tool has its quirks. Aggregators compile information from many sources, but with a delay. Exchanges show price moves in real time, yet their quotes may diverge from other platforms.

- Beyond prices, many apps offer features to help you stay on top of the market, such as mobile price alerts and watchlists.

Where to find crypto prices

There are at least several types of price sources for crypto assets:

- exchanges and trading platforms;

- aggregators of cryptocurrency trading data;

- investment-portfolio trackers;

- analytics and news portals.

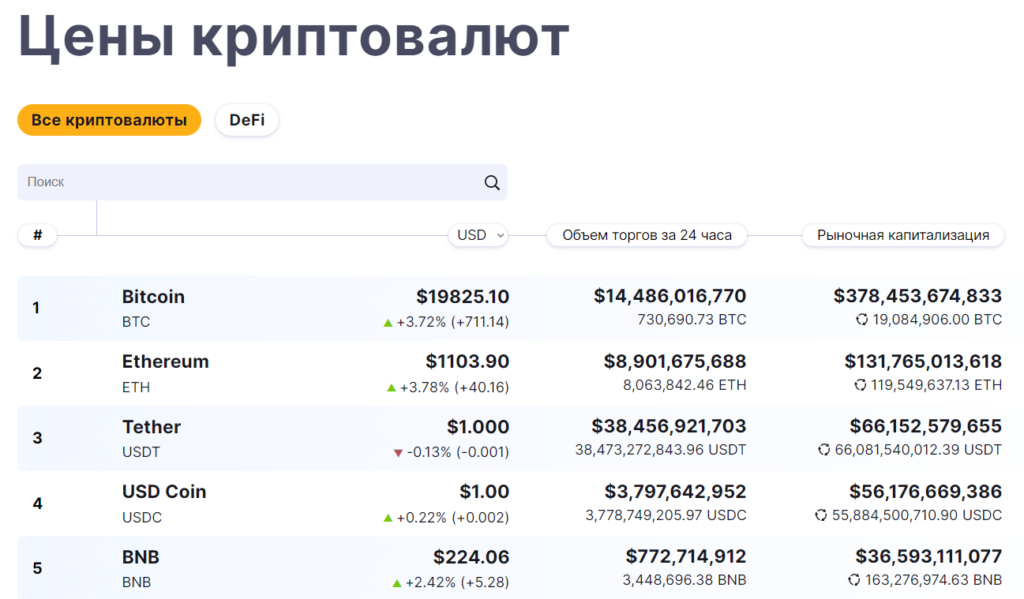

ForkLog provides up-to-date online crypto prices. A dedicated section lists real-time quotes for the 100 most important coins. You can also find trading volumes and the current market capitalisation of each cryptocurrency.

All metrics can be displayed in different currencies: US dollars, hryvnia, tenge, roubles and others.

Each morning the ForkLog Telegram channel publishes a summary of 24‑hour price changes for the ten largest coins. Throughout the day the editorial team tracks market developments and reports on notable events.

Why are trading-data aggregators so popular?

CoinMarketCap is one of the best-known aggregators of data on bitcoin and other digital assets. It helps with preliminary market analysis, including finding prices.

Founded in 2013, it compiles comprehensive market data: cryptocurrency prices from many venues, volumes by asset and metrics for individual trading platforms.

For convenience these data are organised on CoinMarketCap in a specific order. For example, the home page shows the top 100 digital assets by market capitalisation.

The site offers numerous rankings by criteria such as 24‑hour trading volume, price performance and other parameters. The overall list of cryptocurrencies can be segmented by category: DeFi, NFT, metaverses and the like.

Each crypto asset has a separate page with additional information: number of holders, circulating supply and other metrics. It also lists all venues where the asset trades.

Users can register for extra features, such as alerts about various events related to a cryptocurrency—for example, when it hits a specified price.

Beyond CoinMarketCap there are other aggregators, including CoinGecko, CryptoCompare and CoinCodex. They have similar interfaces and functions, but specific price readings can differ because of distinct sources and methodologies.

What are crypto investment trackers good for?

If you hold several cryptocurrencies, specialised mobile apps can help you track the value of your overall portfolio.

In an investment-tracking app you enter the purchase price and size of your crypto positions. Using its own data sources, the app will show real-time portfolio value and cumulative profit.

Trackers also offer tools for analysing performance and visualising data.

Apps with such functionality include, for example, CoinStats and CoinTracker.

What sets TradingView apart?

Standing somewhat apart from other price-tracking tools is TradingView. It is a kind of social network where users can not only watch quotes for all manner of assets (not just cryptocurrencies) but also build and annotate charts. Many experienced traders use TradingView to share forecasts and market observations.

To view a crypto price against the dollar, type a pair such as BTC/USD into the search bar and select a source. The platform shows data from more than 50 exchanges, though some feeds are delayed due to limitations imposed by trading venues. Real-time data are available only with a paid subscription.

TradingView supports price alerts. By default, 15 notifications are available. You can monitor price changes in both the mobile and desktop versions.

A clear drawback is the lack of aggregated data for most crypto assets: the service tracks a digital asset’s price only from a single, specific source (for example, a centralised exchange).

Why check prices on an exchange?

Only exchanges update cryptocurrency prices in real time, because this is where trading actually occurs.

Another advantage of exchanges is access to tools that aid analysis and trend-spotting, including the order book and the trade tape.

If you use a particular trading platform, it makes sense to treat it as your primary source for crypto prices.

How often are crypto prices updated?

Different services refresh prices at different intervals. Aggregators typically have longer update cycles—sometimes several minutes—so crypto prices there are provided with a slight delay.

CoinGecko updates data subject to rate limits set by providers. Metrics such as price, trading volume and market capitalisation are refreshed every 1–10 minutes, while on‑chain data (mining difficulty, transactions per second, etc) change hourly. CoinMarketCap does not disclose this information.

Unlike aggregators, bitcoin and other crypto prices on a centralised exchange update in real time. TradingView is also very fast.

Why do prices differ across platforms?

The market for digital assets is still young. It also has far more trading apps and platforms than the traditional financial market, and it is fragmented. For these reasons, the price of the same cryptocurrency can vary markedly from one source to another.

Exchanges can also influence quotes. On each venue, the asset’s price is determined by the last trade and by supply and demand.

It is best to focus on data from the largest, most liquid exchanges with high turnover. That is where most trading occurs.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!