FDV explained: what it is and how it moves crypto prices

What is FDV and why does it matter?

FDV (fully diluted valuation) is a statistical representation of the maximum value of a crypto project on the assumption that all of its tokens are already in circulation.

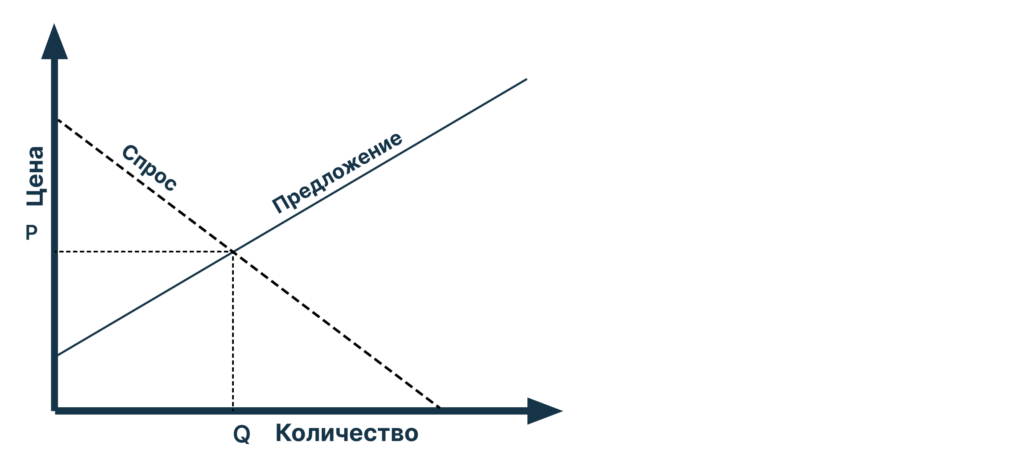

In recent years, startups have often released only a small fraction of their total supply. A limited float makes tokens scarce, shoring up prices early on. Bullish market sentiment, hype around a project and news of big-name backers can add fuel to the fire.

Under a project’s monetary policy, more tokens gradually come to market. If demand fails to grow in step, the asset’s price falls.

Investors who ignore future changes in token supply can take losses.

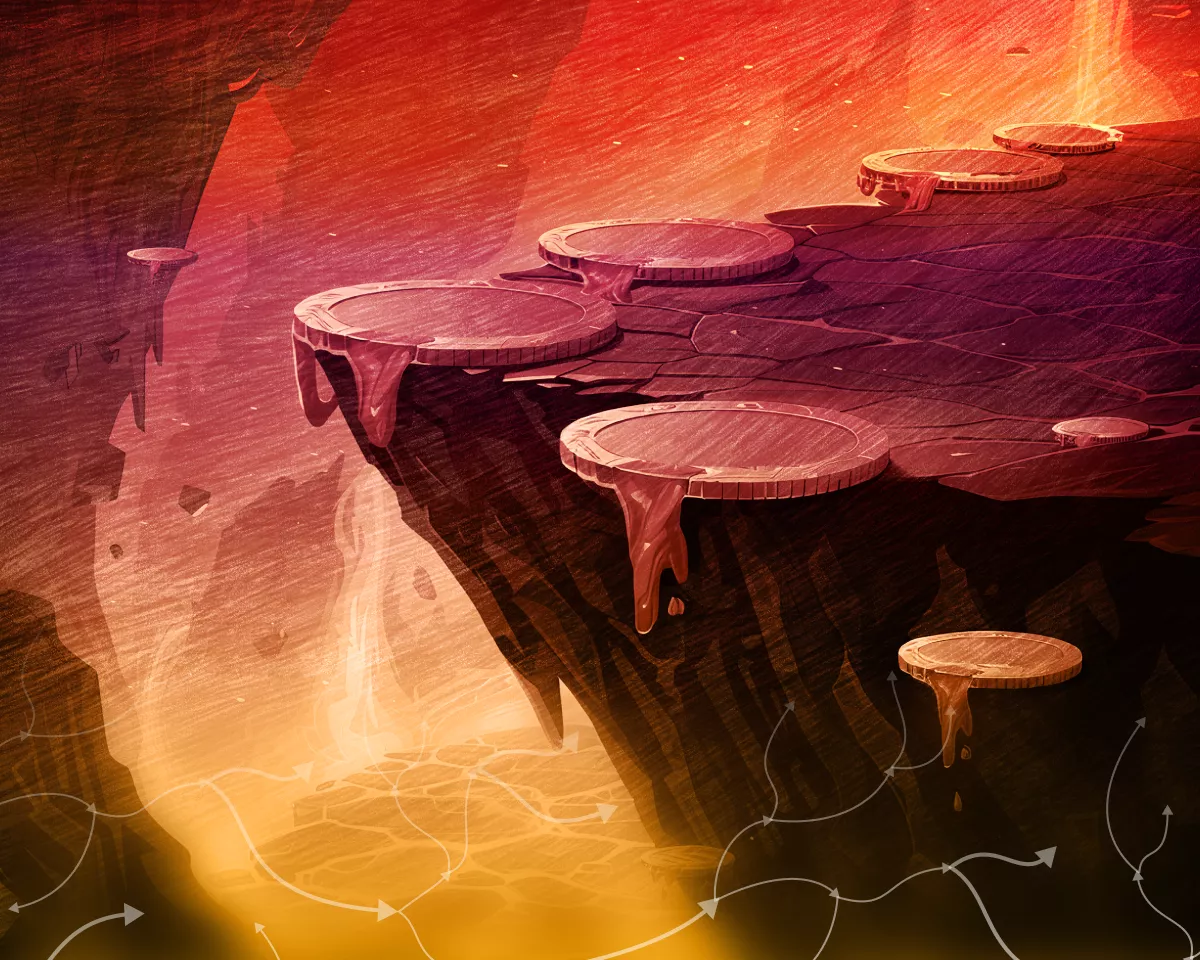

The chart below shows the sharp decline in MC/FDV — the ratio of market capitalisation to fully diluted valuation.

Over the past three years the imbalance has worsened markedly. A reading of 12.3% means a vast number of new-project tokens will flood the market in future. According to Binance Research, to keep prices stable the growing supply would need to be absorbed by roughly $80 billion of demand.

According to an analyst known as flow, over the past six months 80% of tokens from new Binance listings declined in value relative to their first trading day.

How is FDV calculated?

The metric considers total supply, not just circulating assets. Information on monetary policy can be found in project documentation, in the Tokenomics tab on CoinGecko pages, on Etherscan, in token smart-contract details, and so on.

FDV is computed by multiplying the current price of a cryptoasset by its total (or maximum, i.e., Total Supply) issuance. The latter includes tokens awaiting distribution via unlocks, but excludes coins removed from circulation through burning. By analogy, think of the total number of a traditional firm’s shares outstanding in public markets.

In essence, FDV is the hypothetical market capitalisation of an asset if all tokens (except those burned) were circulating in the crypto ecosystem.

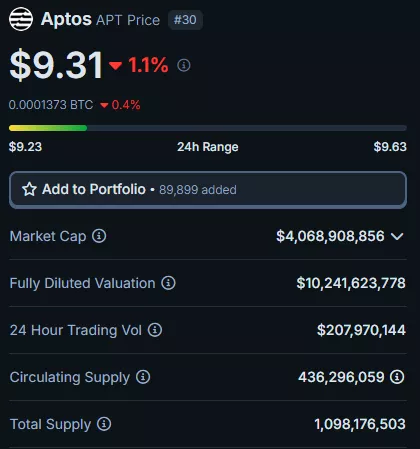

For instance, as of 29 May 2024 the price of Aptos is $9.3, with a total supply of 1,098,176,503.

APT’s FDV = $9.3 × 1,098,176,503 ≈ $10.2 billion. Its market capitalisation is $4.06 billion.

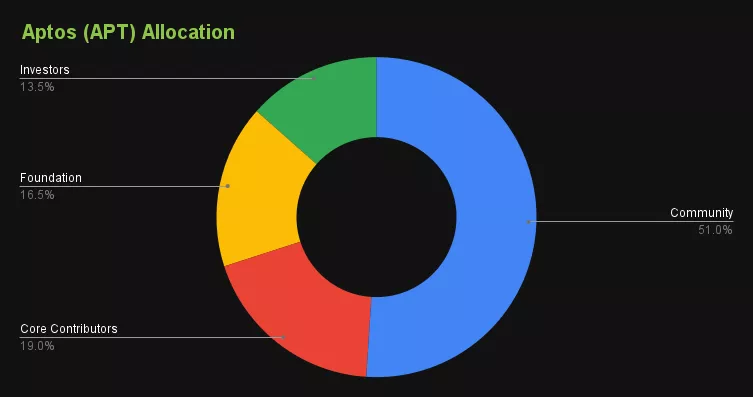

For deeper analysis, the same CoinGecko page’s Tokenomics tab shows Aptos’s allocation.

Below is APT’s distribution among ecosystem stakeholders.

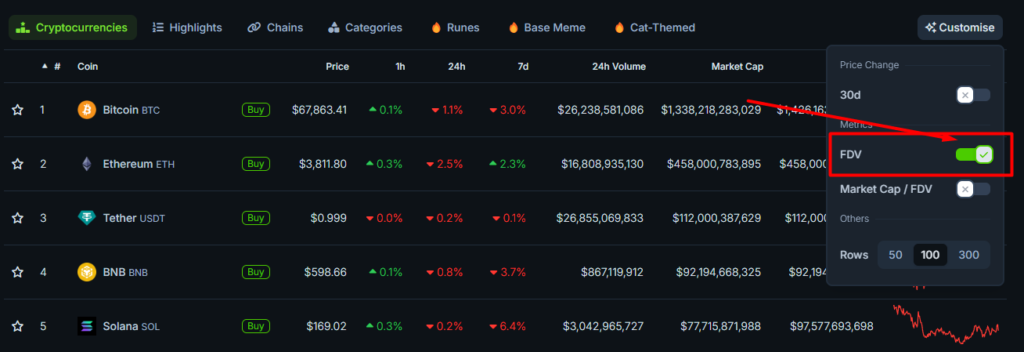

On CoinGecko’s main page, select Customize and enable FDV. Alongside prices, market caps, trading volumes and other data, the rankings will then display fully diluted valuations.

For some coins, FDV data are unavailable because their issuance is uncapped.

The service also supports the Market Cap/FDV metric, which indicates how closely market capitalisation aligns with fully diluted valuation. For example, if Market Cap/FDV is 1 or close to it, all or nearly all coins are already on the market (typical for many memecoins).

How to compare assets by FDV and other key measures?

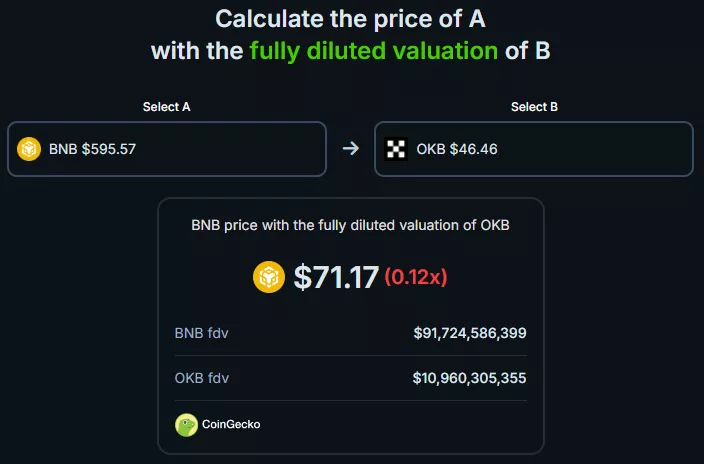

CoinGecko offers a handy comparison tool for FDV and market capitalisation.

To gauge potential, it is sensible to compare coins within the same sector or adjacent categories.

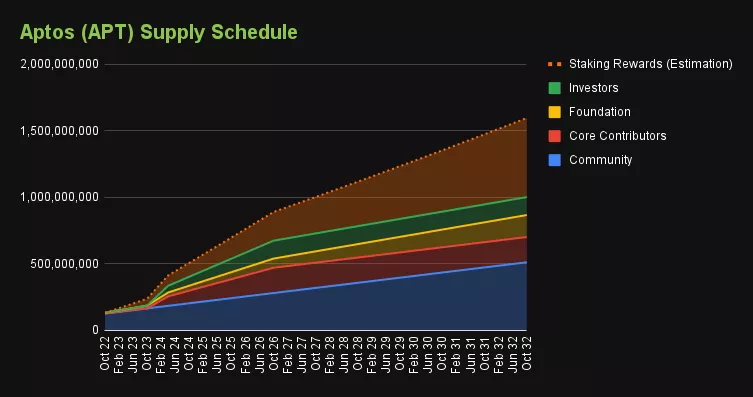

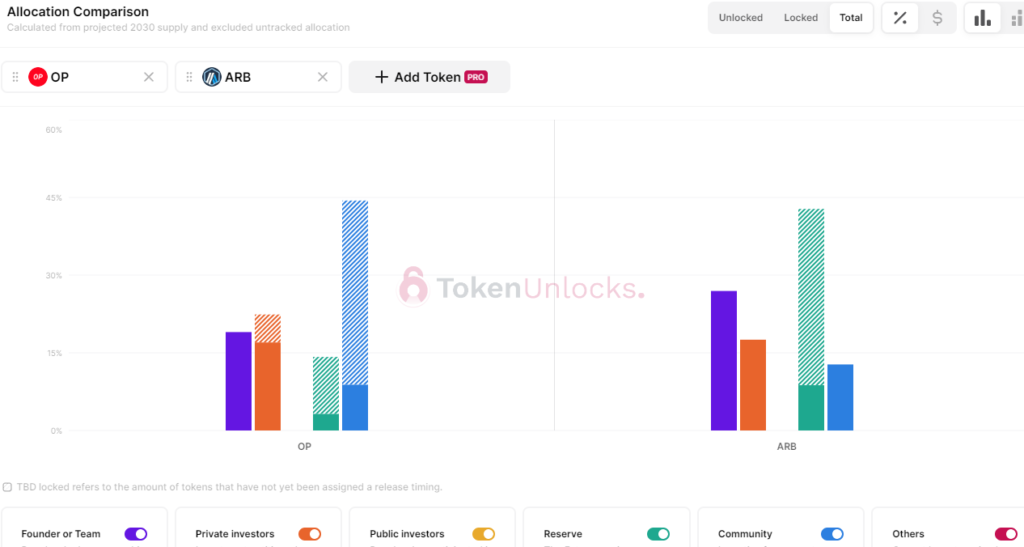

For deeper analysis, use the TokenUnlocks tool, which shows future token inflows to the market broken down by ecosystem participant groups.

Upcoming unlocks across projects are listed on the relevant DeFi Llama page.

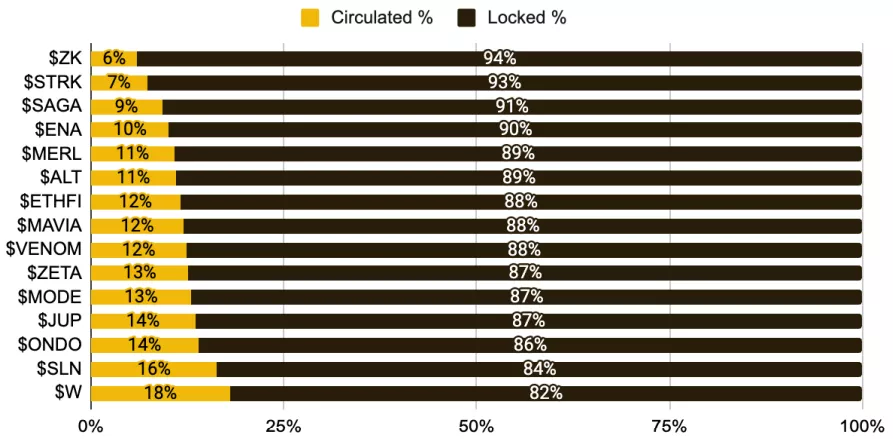

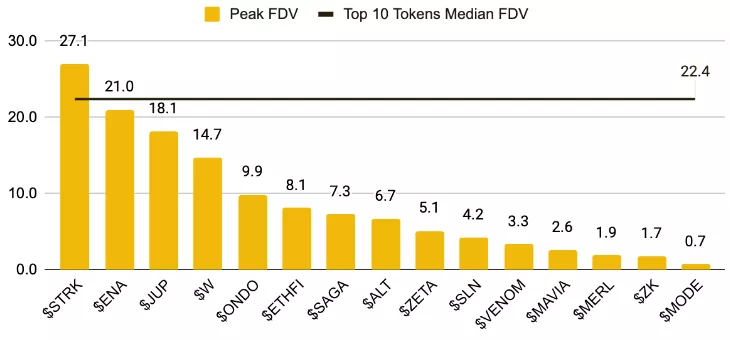

Useful insights also surface in research. In one report, Binance Research highlighted a set of recently launched coins with extremely high FDVs relative to their circulating supply.

An artificially constrained float creates scarcity, pushing up prices and FDV. At their peak, such readings can rival those of established leaders.

The chart below shows how, at one point, STRK’s fully diluted valuation exceeded the median FDV of the top-10 tokens (excluding BTC, ETH and stablecoins).

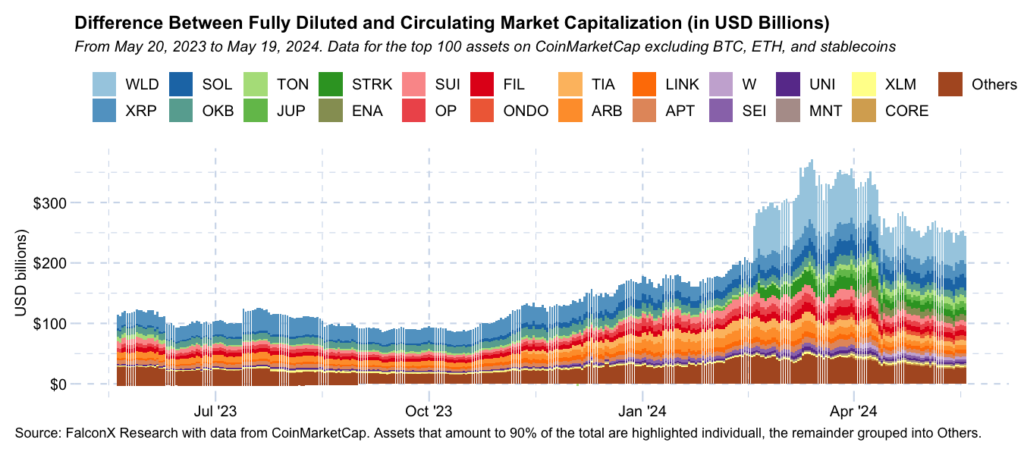

The gap between FDV and market capitalisation among the top-100 CoinMarketCap projects is sizeable — $250 billion. Ninety percent of that comes from 22 tokens; Worldcoin (WLD) alone accounts for 19%.

How does FDV differ from market capitalisation?

Market capitalisation and fully diluted valuation are related but not identical.

Market cap is the product of circulating tokens and price. When price rises, market cap increases directly.

FDV is the product of token price and total supply, including coins not yet on the market.

If all a project’s coins are circulating, market cap and FDV are equal.

Some low-cap projects are due to unlock large token tranches soon. In such cases, FDV and issuance parameters become key drivers of future price.

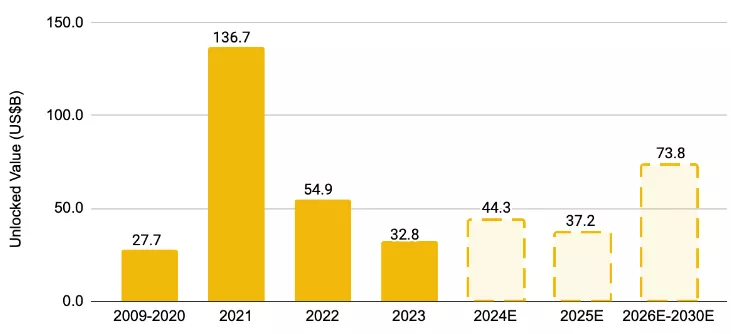

According to the Token Unlocks report, cumulative token unlocks will amount to about $155 billion by 2030.

Why do many new crypto projects have high FDV?

With the market in a bullish phase, investor activity has revived. The inflow of capital has also amplified the role of venture funds in setting valuations for new projects. By the time tokens hit public markets, prices are often inflated. Hype around the latest “Ethereum killers” is further stoked by big funding rounds featuring well-known industry players.

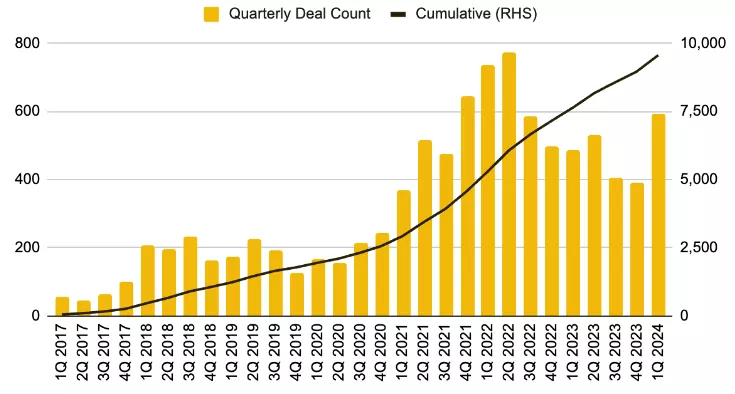

Another factor: as the bull phase develops, sentiment improves. That, in turn, spurs deal-making and lifts expected returns.

The chart below shows a 52% quarter-on-quarter rise in venture deal count in the first quarter of 2024.

More money flowing into the industry inevitably inflates valuations. By the time tokens go public, prices may already be high. Large private rounds can set multi-billion-dollar starting points, making it harder for public-market participants to profit from future gains.

Binance Research argues it is rational for investors to keep allocating during bull rallies — higher valuations improve VC performance. Projects themselves also benefit from raising sizable sums, which provides working capital without heavy dilution.

Why fundamental analysis matters

In today’s market, investors must be selective. The odds of generating durable returns by scooping up “hot” tokens are low, as many projects debut with lofty valuations. Much of the prospective upside is likely already captured by early backers.

Market participants should scrutinise projects and craft their own strategies, aligned with individual risk tolerance.

Key aspects to focus on:

- tokenomics: unlock schedules and vesting periods directly affect market supply. Without commensurate demand growth, excess selling pressure depresses prices;

- valuation: FDV in isolation says little. It is more useful to compare ratios (for example, Market Cap/FDV, FDV/TVL) over time;

- product: consider the product’s life-cycle stage and product/market fit. Track user activity, address growth and transaction trends;

- team and community: founders’ experience and contribution, and the community’s engagement.

Projects should make decisions with a long-term horizon.

Tokenomics

Launching with a low float and high FDV can initially trigger a price spike due to scarcity. Subsequent unlocks, however, may unleash heavy selling pressure, hurting loyal holders. Weak post-launch performance can also deter newcomers.

Token distribution and unlock schedules should be carefully designed. To mitigate inflation risk, teams can consider burning mechanisms, aligning vesting with defined milestones, and increasing the initial circulating supply at TGE.

Product

A viable product is key to value creation, user retention and sustainable growth. Having at least an MVP before a token launch helps investors and users understand the project’s value proposition and product/market fit.

A sizable user base can support a successful TGE, build trust and attract investors. Over time, a quality product bolsters a token’s intrinsic value and, with it, the market price.

What else can address high FDV?

Binance Research’s study on the consequences of high FDV for many new tokens sparked debate in the community. Responding to numerous posts criticising the trend, the largest crypto exchange adjusted its criteria for listing candidates, including for Launchpool and Megadrop.

Binance’s main points:

- projects with small to mid-sized capitalisations from any sector are eligible;

- a moderate circulating float at TGE;

- relatively low allocation to users outside the core community;

- focus on projects with strong product/market fit, self-sustaining business models and growing user bases;

- priority for innovative startups with an MVP that comply with regulatory standards.

Rob Hadick, a general partner at Dragonfly, recommended increasing the share of liquid tokens at launch by using a “variable supply” approach to foster healthier dynamics and price discovery.

A market participant known as Wassielawyer proposed an innovative idea:

“Perhaps coins with low circulating supply and high FDV should switch to price-based unlocks rather than time-based ones.”

Davo, who calls himself the “chief janitor” of the Solana-based platform Drift, suggested another potential remedy: launch tokens at the valuation implied by the most recent private round.

“A project that launches with a low FDV, allowing the community to buy [tokens] at reasonable prices, will be far more antifragile and resilient,” the expert noted.

He added that this approach helps avoid artificially inflated prices and can ensure early followers benefit if the venture succeeds.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!