What Does the Herfindahl-Hirschman Index (HHI) Tell Us About the Cryptocurrency Market?

Who devised the concept?

The idea behind the Herfindahl–Hirschman Index (HHI) traces back to Albert Hirschman’s 1945 book “National Power and the Structure of Foreign Trade”, in which the German economist described how large actors shape the level of market competition.

Hirschman argued that selective state investment in key sectors—such as infrastructure, energy and heavy industry—was essential for economic development.

In 1950 the American economist Orris Herfindahl expanded on his German colleague’s ideas in his doctoral dissertation, “Concentration in the U.S. Steel Industry”. Whereas Hirschman applied his concept to imports and exports at the country level, Herfindahl used it to study competition within a specific industry.

Over time the HHI became a convenient tool for assessing market concentration worldwide. It has been adopted by government antitrust authorities as well as various economic institutions.

What does the HHI measure?

The HHI is a statistical measure of market concentration in a given industry.

It helps investors and analysts spot signs of monopolisation and gauge competition. In crypto, the HHI highlights which companies—or their assets—are likely to wield significant market power.

The index may miss dominance by individual players at the regional level, such as local exchange leaders. It also does not account for volatility, network effects or regulatory shifts typical of the blockchain industry.

The closer a market is to monopoly, the higher its concentration and the lower the level of competition. A single-firm industry (an absolute monopoly) has an HHI of 10,000 points.

If thousands of firms share the market equally, the index nears zero, indicating almost perfect competition.

In the US Department of Justice and Federal Trade Commission’s “Merger Guidelines”, markets are classified by HHI as follows:

- below 1,000 — a competitive environment with many participants and no dominant players;

- 1,000 to 1,800 — a moderately concentrated market with several firms exerting greater influence;

- 1,800 to 10,000 — a highly concentrated market with the risk of an oligopoly or monopoly.

Mergers that raise the HHI by more than 100 points in highly concentrated markets typically draw scrutiny from antitrust authorities.

The index’s main virtue is its simplicity and the small amount of data needed for calculation. Its chief drawback is that it cannot capture all market idiosyncrasies, which means it may not always reflect the true balance of an industry.

How is the HHI calculated?

The HHI is computed by squaring each project’s market share and summing the results. The final value ranges from 0 to 10,000 points, with higher numbers indicating greater concentration.

The expanded formula looks like this:

HHI = S12 + S22 + S32 + Sn2

where Sn is firm n’s percentage share, expressed as a whole number rather than a decimal.

Consider a hypothetical young market with four firms. List their shares in percentage terms, square them and add them up:

- company A — 5%;

- company B — 15%;

- company C — 35%;

- company D — 45%.

Calculating the HHI:

HHI = 52 + 152 + 352 + 452 = 25 + 225 + 1225 + 2025 = 3500

The HHI is 3,500, consistent with high concentration given the small number of participants.

A small group of firms in an industry does not always reflect the true level of market concentration, which underscores the HHI’s value as an analytical tool.

Assume an industry has 20 firms:

- company A has a 48.59% market share;

- the remaining 19 have 2.71% each.

In this case the HHI is 2,500, indicating a highly concentrated market.

Now suppose:

- company A controls 35.82% of the market;

- the remaining 19 each have 3.38%.

Here the HHI is exactly 1,500, consistent with a moderately concentrated market.

How is the HHI used in crypto?

On March 1, 2024, SpingerOpen published a study whose authors sought, using cryptocurrencies, to test Friedrich von Hayek’s theory of private money. One of their key indicators was the HHI.

To measure concentration in the crypto market, the authors used monthly market-cap data for 101 coins from January 1, 2016 to August 31, 2022. The assets analysed covered more than 90% of the market.

The dynamics showed the following:

- in January 2016 the HHI was close to 8,000, signalling high concentration;

- January 2018 — the index hit an all-time low below 2,000, indicating relatively strong competition;

- after 2018 concentration increased, hovering around 4,000;

- 2021 — the HHI again fell to about 2,000.

The study suggests substantial shifts in crypto-market structure since 2016. During the first crypto boom, new entrants reduced concentration.

Excluding stablecoins, the asset class showed greater concentration, ranging between moderate and high levels.

The HHI also featured in a study of university students’ preferences when investing in digital assets, helping to identify the most popular cryptocurrencies and the reasons for their choice.

The HHI has wide applications in crypto. It can be used to quantify the monopoly power of meme-coin issuers, assess the degree of decentralisation in staking, or gauge the concentration of governmental power in stablecoins.

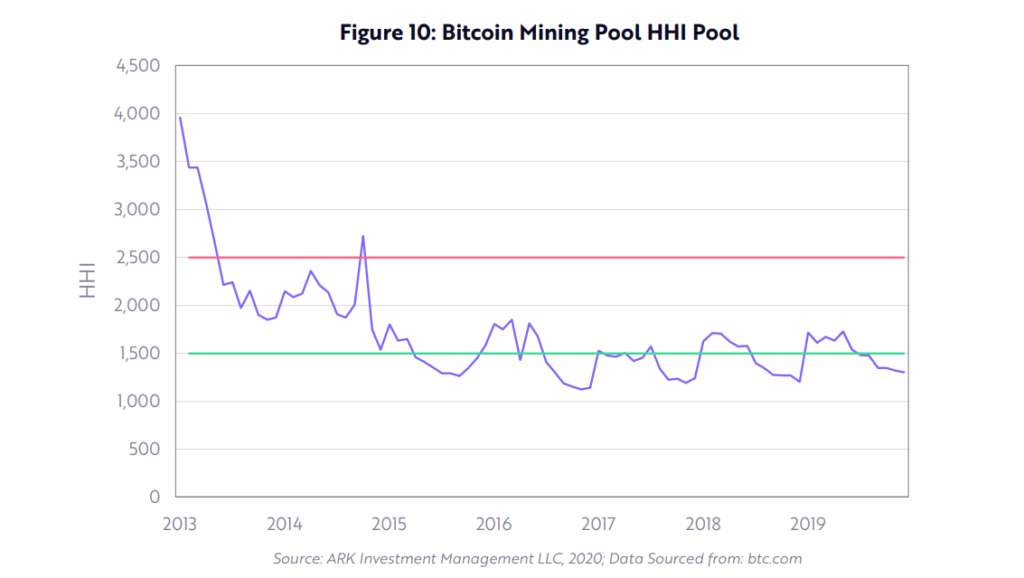

In 2020, Ark Invest used the HHI to show Bitcoin mining’s shift towards decentralisation.

Other uses of the HHI include:

- crypto-exchange dominance. A high HHI for Binance and Coinbase signals concentrated trading. That may point to risks of market manipulation and insufficient competition;

- stablecoin concentration. The HHI can assess the shares of USDT, USDC, DAI and flag systemic risks of monopoly;

- token distribution. The HHI helps detect whales—large token holders;

- the meme-coin market. If Dogecoin and Shiba Inu dominate the segment, the HHI will show concentration. A high reading may lead to volatility and sharp price swings.

What are the index’s shortcomings?

The HHI has limitations in conditions of high volatility and complex market structures. It does not always reflect local monopolies, network effects or cross-chain interactions.

Its principal weakness is the difficulty of defining the relevant market correctly and realistically.

For example, the HHI might be applied to an industry with ten firms, each with roughly a 10% share—suggesting vigorous competition. Yet a single firm could command 80–90% of sales in a specific sub-segment. In that case it would be a de facto monopolist, which the index would not reveal.

Geography poses another challenge. In practice, each firm may enjoy a regional monopoly despite the global market looking competitive overall.

To use the HHI properly, additional factors should be considered and the boundaries of the segment under review defined precisely.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!