Week in Review: John McAfee’s death by suicide after extradition ruling as regulators tighten on Binance

John McAfee died by suicide after the extradition ruling; bitcoin price fell below $30,000 amid new restrictions by Chinese authorities, regulators in Japan and the United Kingdom pressed Binance, and other events marked the week.

Bitcoin price fell below the $30,000 mark

On Monday, June 21, the price of the first cryptocurrency fell below the $34,000 mark.

On the following day the flagship’s price continued to slide, breaching the $30,000 level. On Bitstamp the price at its low reached $28,600.

By week’s end the price had recovered, moving above $35,000, but volatility remained high.

Experts linked the price drop to new restrictive measures by Chinese authorities against cryptocurrencies. MicroStrategy CEO Michael Saylor, in an interview with Bloomberg noted, that the main driver of the market at present is the mass exodus of miners from China.

More and more experts speak of a transition of the leading cryptocurrency into a bear market. CryptoQuant head Ki Young Ju justified his conclusion with the Whale Capitulation Index.

JPMorgan analysts also reiterated a negative forecast for the price of digital gold and did not rule out drops to $25,000 before a trend reversal. They also noted that the market overall mirrors the 2017/2018 cycle.

«Continued pressure on cryptocurrency markets continues to resemble the 2017/18 cycle in some ways…” — JPM pic.twitter.com/fC1sAgsP0r

— Sam Ro 📈 (@SamRo) June 26, 2021

Investment director Scott Minerd of Guggenheim Partners offered a more radical forecast — that before the next bull market the price of the first cryptocurrency could fall to $15,000 or even $10,000.

The crackdown on miners in China, which Saylor described as a trillion-dollar mistake by authorities, also hit Ethereum. The network’s hash rate as of June 25 had fallen by 20% from the May 20 peak.

Analysts at Glassnode noted that the main on-chain activity metrics in the blockchains of both leading cryptocurrencies hit fresh lows after the May correction.

On June 21 the price of the second-largest cryptocurrency fell below the $2,000 mark and during the week could only test the key level.

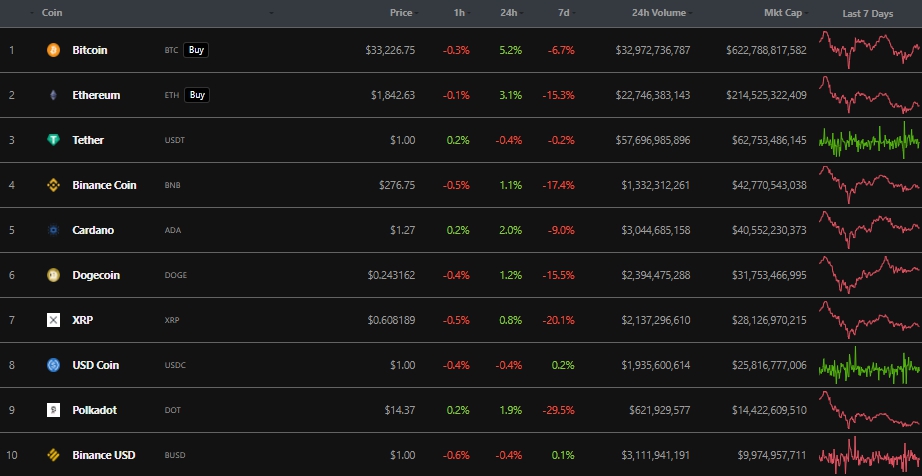

Over the past seven days, all leading altcoins lost more than the flagship, according to CoinGecko. Ethereum fell 15.3%, XRP — more than 20%, and Polkadot traded down almost 30%.

Bitcoin dominance continues to recover, reaching 45.9% — a week ago the figure stood at 43.5%.

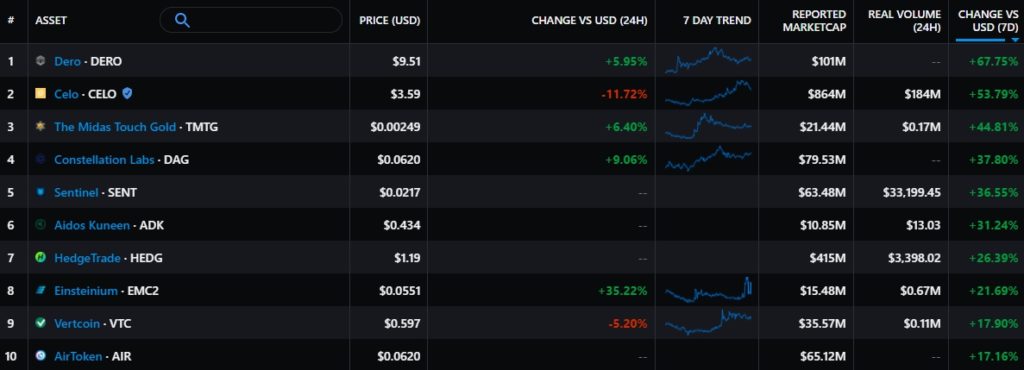

According to Messari, among the week’s top gainers, the Celo project token ranked second with around a 54% gain. The asset’s market capitalization reached $864 million. Only the token Dero rose more, by about 67.75%.

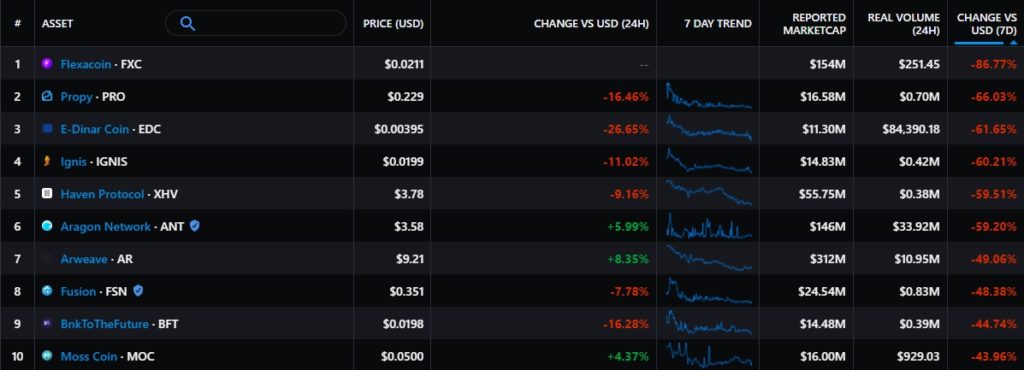

Over the week the price of Flexacoin fell by 86.77%, marking the largest drop among digital assets. The native token of Polkadot’s experimental Kusama network — KSM — continued to slide, ranking 14th on the list, down about 43%.

John McAfee died by suicide after extradition ruling to the US

On June 23, the Spanish Supreme Court allowed the extradition of John McAfee, who was in custody in a prison. A few hours later he was found dead in his cell.

His lawyer said the 75-year-old entrepreneur hanged himself.

Law enforcement arrested McAfee at the request of American authorities in October 2020. The U.S. Securities and Exchange Commission charged him with promoting ICO projects, and the U.S. Department of Justice with tax evasion.

«Europe should not extradite those accused of non-violent crimes to a country where the judicial system is so unjust, and the prisons so harsh that a defendant would rather die than end up there», — Edward Snowden criticized the Spanish court’s ruling.

Readers can recall ForkLog’s coverage of the remarkable life of one of the Bitcoin industry’s most prominent and controversial figures.

China bans banks and payment systems from participating in bitcoin transactions

The People’s Bank of China (PBOC) held a meeting with representatives from financial institutions. The regulator banned them from participating in cryptocurrency transactions and told them to crack down on such activity.

Delegates from several of the largest banks and the Alipay payment system attended the meeting.

The PBOC confirmed the ban on regulated institutions’ involvement in digital-asset transactions, originally imposed in 2017.

The regulator required banks to check whether OTC brokers use their services to facilitate peer-to-peer exchanges for Chinese traders. Accounts of such users must be blocked, and information about them passed to regulators.

Banks and payment systems must comply with customer-identification requirements and upgrade their internal-monitoring algorithms to better analyse cryptocurrency transactions.

Pavel Durov returned 72% of investments in Telegram Open Network to billionaire Jakobashvili

The founder of Wimm-Bill-Dann, private investor David Jakobashvili said that he received 72% of the funds invested in the blockchain project Telegram Open Network (TON).

«[Pavel Durov] returned the money, as we agreed. Or I would have left the money for a year and would have received 110%, but I got 72%, as agreed», – Jakobashvili told the publication.

The billionaire emphasised that he supports the Telegram team and believes they are victims of political pressure from the United States.

Japanese regulator issues another Binance warning; UK regulator bans activity in country

The Financial Services Agency (FSA) of Japan issued another warning to the Binance crypto exchange for operating in the country without a license.

The primary aim of the notice is investor protection. The document does not specify whether the regulator intends to press any claims against the trading platform.

In 2018 the FSA had already warned Binance to obtain a license to continue operating in Japan.

In the United Kingdom the Financial Conduct Authority (FCA) banned Binance Markets Limited from carrying out any regulated activity in the country without prior written clearance.

The regulator’s order listed the steps Binance Markets Limited must take by the close of business on 30 June 2021:

- post conspicuously on its website and other channels a notification of the prohibition;

- remove or, if not possible, provide instructions for removing all current promotional campaigns;

- provide written confirmation of the steps taken.

The FCA also required the firm to store data on British users onshore and to be ready to hand over information to the regulator on request after July 2.

Meanwhile the firm announced a cessation of servicing users in Canada’s Ontario. Binance attributed this to “efforts to comply with regulatory rules.”

Also the bitcoin exchange confirmed its involvement in Ukrainian law-enforcement operation to identify individuals linked to the Clop and Petya extortion cases.

In this context, Binance on June 24 launched its platform for non-fungible tokens (NFTs).

Binance NFT users were able to take part in the inaugural premium auction Genesis, purchase pieces released under the 100 creators program, and trade tokens on the marketplace.

The initial lots on the Genesis auction included Andy Warhol’s work and Salvador Dalí’s “The Divine Comedy: Rebirth”.

An anonymous buyer purchased “Three Self-Portraits” as an NFT for $2.8 million in the stablecoin BUSD.

Andy Warhol’s Three Self-Portraits #NFT just sold for $2,800,000 BUSD — Congratulations to the lucky owner of this piece of art history! @apenftorg pic.twitter.com/VnSigINuO9

— Binance NFT (@TheBinanceNFT) June 27, 2021

Nabiullina called cryptocurrencies the most dangerous savings strategy

Russia’s central bank chief Elvira Nabiullina stated that the most dangerous savings strategy is “speculative crypto assets”.

Their price is highly volatile, and losses can be “simply colossal,” she said.

“The central bank never gives advice on where to invest, but in this particular case – this is definitely not the place to invest,” added Nabiullina.

Developers set timelines for activating the London hard fork on the Ethereum network

On June 24 the London update was activated on the Ropsten test network, on June 30 it will occur on the Goerli testnet, on July 7 in the Rinkeby testnet, and after that, absent any faults, in the mainnet after 300-400 thousand blocks. Tim Beiko shared this as a rough guide.

The developer urged interested parties to review the specifications and update their nodes in testnets. During the trials, developers will test network resilience to outages under conditions of heightened on-chain activity.

In addition to the London hard fork details, Beiko announced work on ETH1-ETH2 merge code on the ETH2 side. He promised forthcoming specifications for the first version of the protocol.

MicroStrategy further bought 13 005 BTC

The analytics software company MicroStrategy purchased 13 005 BTC for about $489 million.

In total MicroStrategy holds 105,085 BTC worth about $2.74 billion. Their average purchase price is $26,080.

Paraguay unveils bill to legalize Bitcoin

Paraguay could become the next country after El Salvador to recognise Bitcoin as legal tender. The bill will be presented to the country’s parliament on July 14, said congressman Carlitos Rejala.

The legislator noted that the initiative has the backing of a number of very important businesses in Paraguay.

Crackdowns on miners in China boost supply of used ASIC devices

The volume of second-hand mining hardware put up for sale rose sharply as the government moved to halt operations by key miners.

The situation forced ASIC maker Bitmain to pause equipment sales. It did not affect contracted shipments.

Mining company executives told clients that the decision was driven by an influx of second-hand gear. Bitmain declined to comment on market pressure amid the market’s struggle to clear stock.

According to Kevin Zhang, vice president of U.S. mining firm Foundry, by the end of June roughly 90% of Chinese crypto-mining enterprises will shut down equipment due to prohibitive measures.

Representatives from Bitmain at a client meeting in Chengdu, the Sichuan capital, shared experiences of doing business abroad and offered assistance.

The company also expanded its service network outside China to shorten turnaround times for servicing equipment.

Another ASIC miner manufacturer, Canaan Creative, launched its first Bitcoin mine in Kazakhstan.

Mining company BIT Mining Limited announced successful delivery of the first batch of equipment to the country.

A logistics firm from Guangzhou, China reported shipping a 3-ton batch of Bitcoin miners to the United States.

Jack Dorsey and Elon Musk hint at discussing cryptocurrencies

Jack Dorsey invited Elon Musk to discuss the topic at The B Word event on July 21. The entrepreneurs exchanged several messages on Twitter.

“Well, let’s do this,” Musk replied, adding a winking emoji.

Dorsey also invited Bitcoin skeptic Peter Schiff to join the discussion. In response, he simply reaffirmed his commitment to gold.

El Salvadoran authorities to distribute $30 in Bitcoin to residents

President Nayib Bukele unveiled the Chivo cryptocurrency wallet. After registering in the app, every adult resident will receive $30 in bitcoin.

On June 24 Bukele in Peter McCormack’s podcast confirmed that altcoins will not become a competitor to the first cryptocurrency in the country. In his words, it would be difficult to sustain two assets as a means of payment.

“So, it will be Bitcoin and the dollar,” he noted.

The American operator of crypto ATMs Athena Bitcoin has already announced plans to deploy 1,500 devices in El Salvador.

Meanwhile the opposition initiated legal proceedings regarding the law’s recognition of Bitcoin as legal tender, calling it unconstitutional and harmful for the country.

ForkLog also wrote:

- Sotheby’s will accept cryptocurrency for payment of a rare diamond.

- Fireblocks faced a lawsuit over an alleged loss of 38,178 ETH.

- Andreessen Horowitz launched its third crypto fund worth $2.2 billion.

- Authorities in South Korea seized $47 million in cryptocurrency for tax evasion.

- A study: the United States recovered $2.5 billion in fines from crypto-industry participants.

- Bitfarms’ shares fell by 7% on their first day of Nasdaq trading.

- The bear who warned of a crypto-market collapse had warned of a crash.

- In the Fed described the stablecoin Tether as a “challenge” to financial stability.

What else to read

Against the backdrop of debates about the environmental impact of the network’s operation, ForkLog examined whether Bitcoin mining is viable with solar energy.

The magazine looked at the most popular indicators intended to help compare various DeFi projects and assess the intrinsic value of assets in decentralized applications.

We offer to recall the most notable recent news from the rapidly developing sector in our Defi column, The DeFi Chronicle.

The week’s most notable developments in the fields of cybersecurity and artificial intelligence technology are gathered in our traditional digests.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!