Glassnode analysts weigh the arguments for and against the end of Bitcoin’s bear phase

On-chain activity in the Bitcoin network remains subdued, and long-term investor behavior is steady. Based on these and other observations, Glassnode analysts presented bullish and bearish scenarios for the future development of the situation.

#Bitcoin is trading on the edge of a large on-chain volume support level, with a high volatility move likely just over the horizon.

This week, we analyse the Bull and Bear cases using the full suite of on-chain metrics.

Read more in The Week On-chain👇https://t.co/y9dPumGjJZ

— glassnode (@glassnode) July 19, 2021

In considering the bearish scenario, they noted the unlocking of about 31,900 GBTC shares from Grayscale Investments (GBTC) by the end of July.

Last week, the instrument’s discount to NAV ranged from -11% to -15.3%. Experts did not rule out that maintaining such a situation could trigger capital outflows from the Bitcoin spot market.

The block size fell by 15-20%, the mempool freed. The volume of on-chain value transferred remained 65.8% below the April peak (14-day moving average) — $5.3 billion vs $15.5 billion.

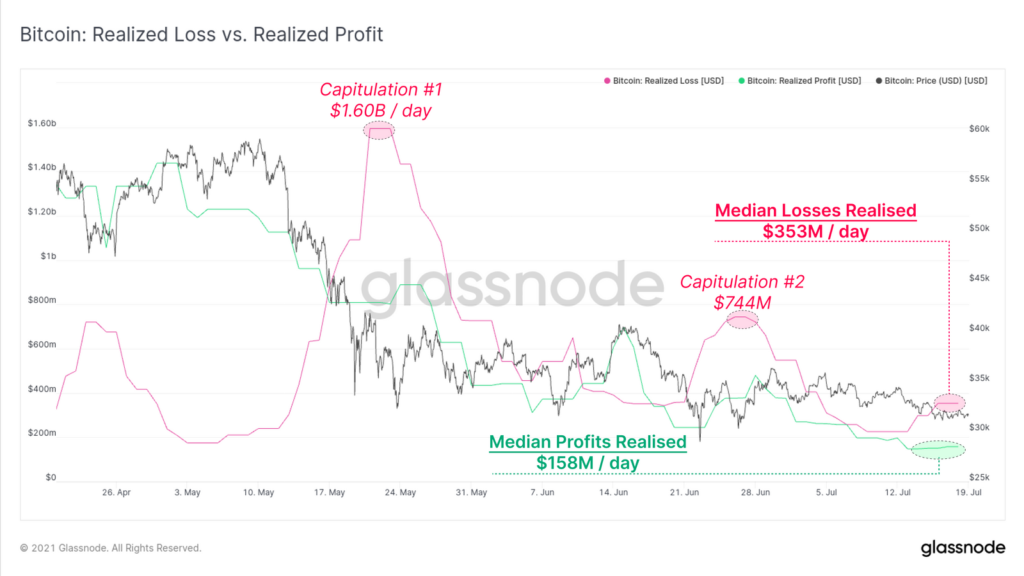

According to the analysts, the volume of transactions was dominated by coins sold at a loss. Last week, on average per day the figure stood at $353 million versus $158 million realized with a profit. This dominance trend has persisted since May.

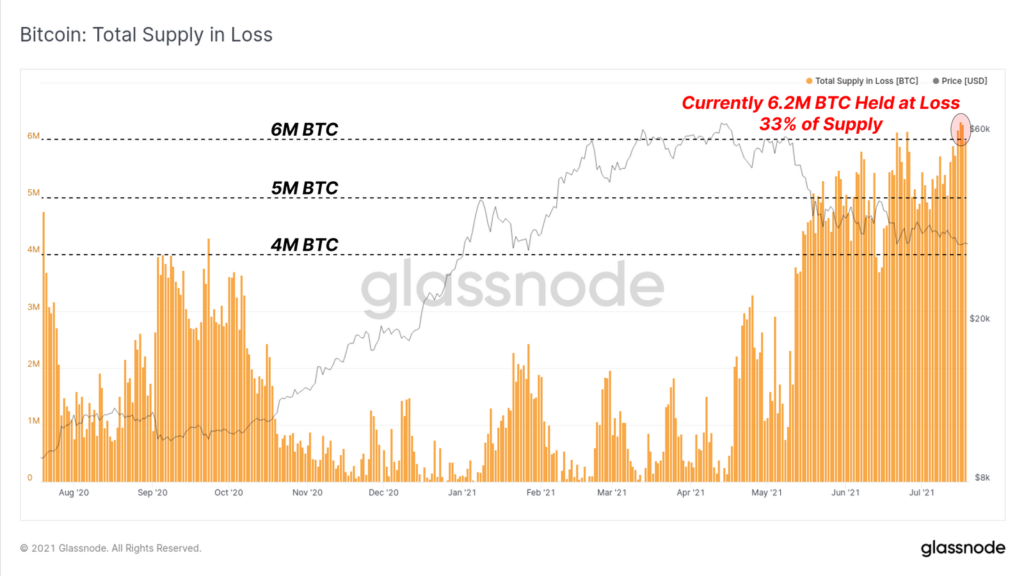

According to analysts, about 33% of market supply (6.2 million BTC) is currently held by holders at a loss. Glassnode explained that this volume could potentially limit price recovery and intensify selling.

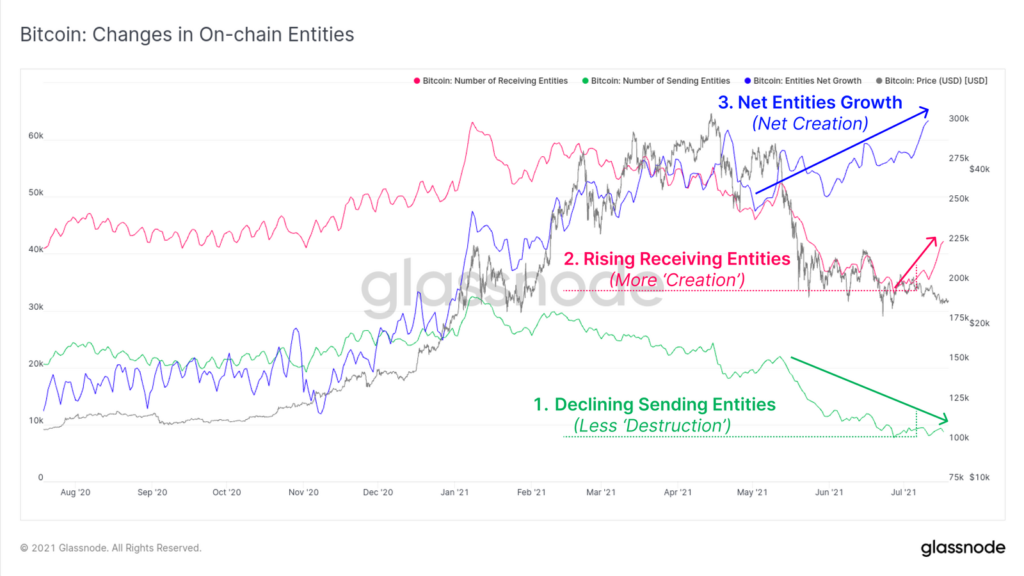

In evaluating the bullish scenario, the analysts began with assessing on-chain activity distribution metrics by the number of addresses. The graph below presents a holistic picture indicating a rising trend in coin accumulation.

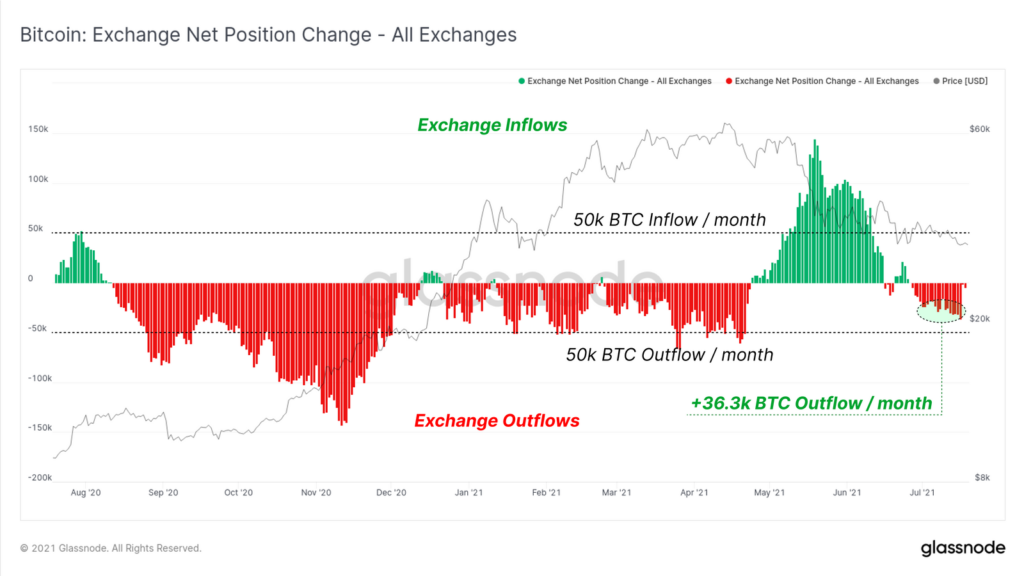

The trend is supported by a persistent outflow of coins from exchange wallets since mid-May. The cumulative total over the last month reached about 36,300 BTC.

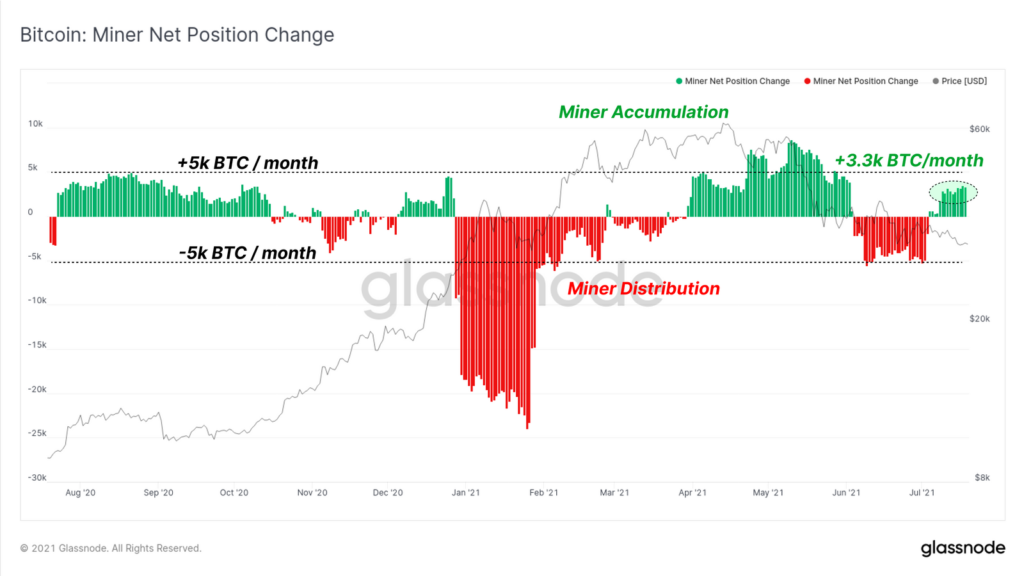

Miners are not exerting downward pressure on Bitcoin. In the last month they accumulated 3,300 BTC.

Analysts suggested that the exceptional profitability of continuing-operating players more than compensates for the sales of those who temporarily left the industry due to Chinese authorities’ repression.

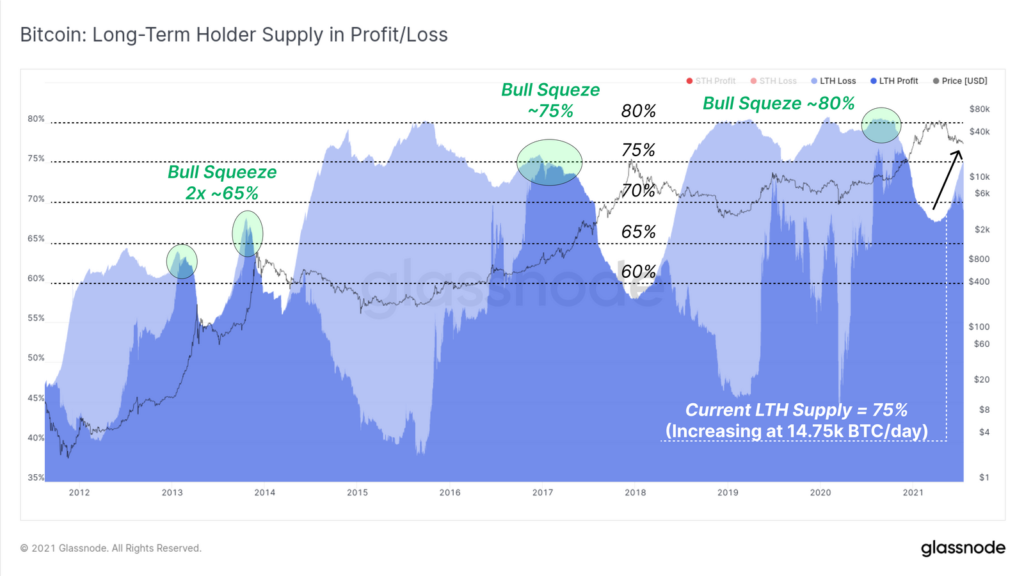

According to specialists, if the current pace of coin maturation (14,750 BTC daily) continues, about two months from now long-term investors will hold roughly 80% of the market supply.

The potential reduction of coins available on the market occurs from a much higher base than in 2018-2019. Holders have accumulated 75% of the issue (69% in profit, 6% in loss).

ForkLog published an analysis of on-chain indicators in the context of the current market situation.

As reported, market makers hedged against the risks of Bitcoin falling below $20,000 by year-end.

Follow ForkLog’s news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!