Week in Review: Bitcoin slips below $42,000 as China tightens crypto crackdown; US sanctions Suex exchange

Bitcoin price slipped below $42,000 amid China’s crackdown on the crypto industry and Evergrande’s potential default; Twitter rolled out a Lightning Network-based donations feature in digital gold; the US Treasury sanctioned Suex, among other developments this week.

The price of Bitcoin fell below $42,000 amid China’s crackdown

The leading cryptocurrency opened the week with a drop below $43,000. The price was likely influenced by a potential default by the Chinese developer Evergrande, which has accumulated debt of $309 billion.

On September 24, reports spread on further crackdowns by China on the crypto industry. The National Development and Reform Commission of China said that mining consumes too much energy and its contribution to the economy is “insignificant.”

At the same time, a notice appeared on the People’s Bank of China (PBoC) website stating that the operation of platforms that exchange digital assets with each other or for fiat is illegal.

The restrictions also apply to foreign companies providing services to residents of mainland China. Bitcoin exchanges Binance and Huobi have already stopped registering new users on the mainland, and mining pool SparkPool ceased serving clients in the region.

That same day, PBoC director of the Payments and Settlements Department Wen Xinxian stated that regulators view cryptocurrencies as a threat to the traditional financial system.

The price of digital gold reacted by slipping below $42,000. At the time of writing, the asset was trading near $43,200.

Circle CEO Jeremy Allaire urged other countries not to imitate China. A similar view was voiced by US Republican Senator Pat Toomey. He said Beijing’s actions open new opportunities for the United States in the crypto industry.

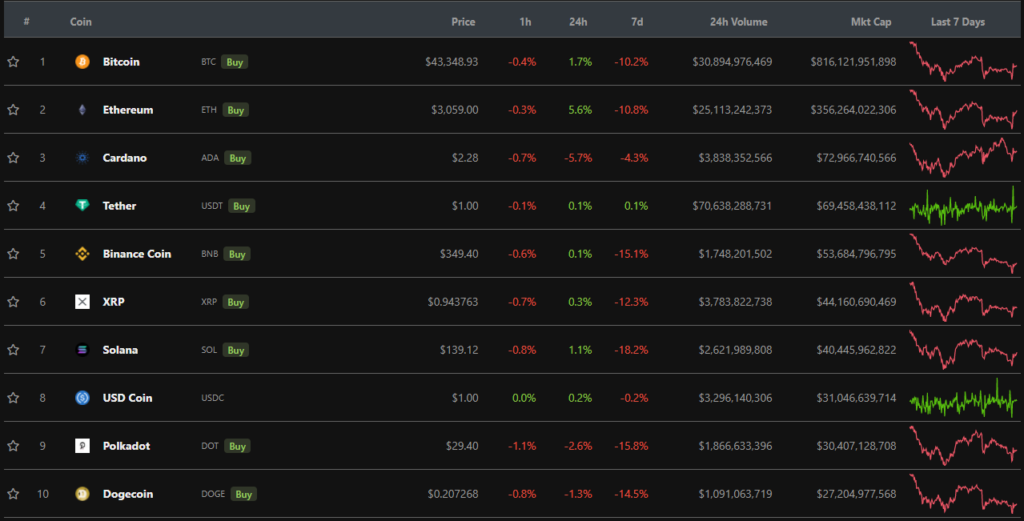

By week’s end, all top-10 cryptocurrencies by market cap were in the red. The biggest loser was Solana (SOL), down more than 18%.

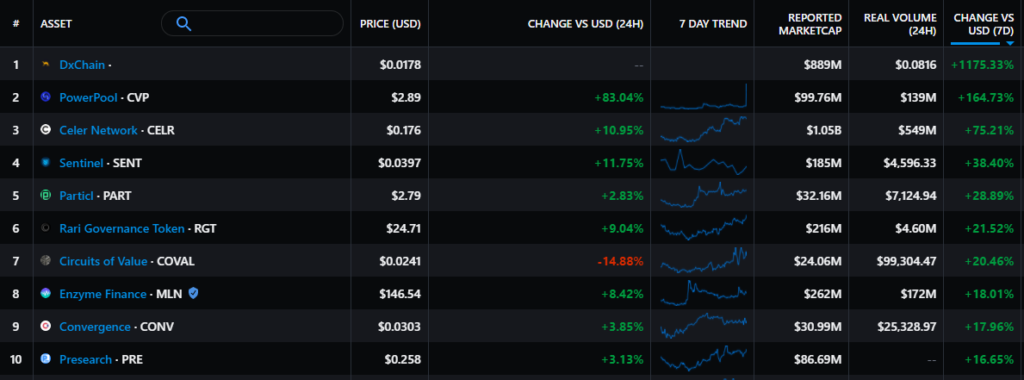

According to Messari, the strongest gainer was PowerPool’s CVP token, which markets itself as “a solution for accumulating governance rights in Ethereum-based protocols.” Its price rose 164%, and its market cap reached $99.8 million.

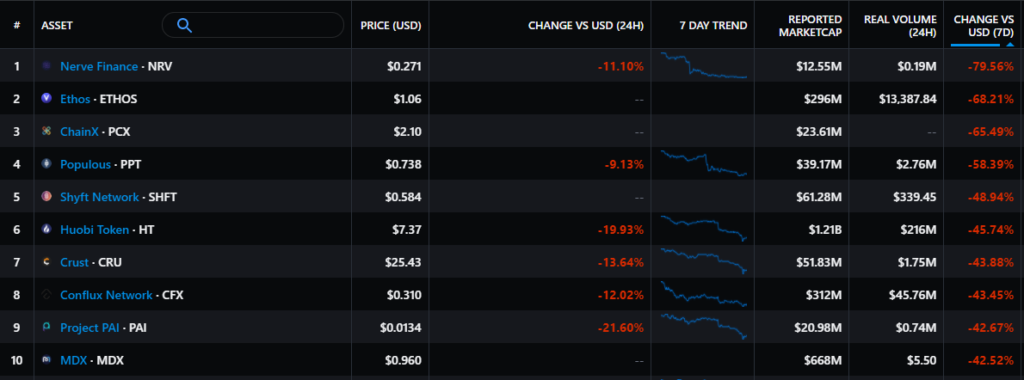

More than any other, the token of the Nerve Finance automated market maker (NRV) declined. Its price fell by almost 80%, and its market cap stood at $12.5 million.

The market capitalization of the cryptocurrency market stood at $2 trillion. Bitcoin’s dominance index rose to 40.7%.

Twitter allows content creators to receive Bitcoin donations

iOS users of the Twitter app have gained the ability to receive donations via the Lightning Network. To do so, they need to link a third-party service such as Cash App to their profile.

The United States imposed sanctions on the Bitcoin exchange Suex with offices in Moscow and Saint Petersburg

The U.S. Department of the Treasury added the cryptocurrency exchange Suex, with offices in Moscow and Saint Petersburg, as well as 25 addresses on the Bitcoin, Ethereum and Tether networks, to its sanctions list. The department says that funds for at least eight ransomware operators, scam projects and dark-net marketplaces flowed through Suex.

Russian national Vasily Zhabikin confirmed his ties to the exchange, though he said that the U.S. Treasury had targeted the company in error. The co-owner, Yegor Petukhovsky, said he planned to defend the business’s reputation. It later emerged that Zhabikin was dismissed from his top-management role at NUUM, the neobank backed by mobile operator MTS.

Analytical firm Elliptic studied Suex transactions and concluded that more than $370 million related to cybercriminals passed through it. At the same time Chainalysis linked Suex operations to the now-closed cryptocurrency exchange WEX, totaling several millions of dollars.

The situation was commented on by Binance CEO Changpeng Zhao, who said the company had also participated in the investigation. During the audit the exchange identified several accounts linked to Suex addresses and removed them from the platform.

The day before, Binance without warning blocked a user’s account. The platform later explained that the user allegedly sent funds to a Suex address. The user himself denies making transfers in favor of the exchange or dark-net marketplaces.

Ukraine proposes tax on profits from cryptocurrency operations

The bill amending the Tax Code describes the taxation of virtual assets (VAs), income disclosure and the tax payment procedure. Under it, the taxable base is the profit earned from selling a VA or from any other disposition.

A service provider’s profit is taxed at 5% provided the company has no other income besides VA-related activities. For individuals, a 5% tax and an additional 1.5% military tax are also set.

At the same time, the National Bank of Ukraine sees risks to the hryvnia from the spread of cryptocurrencies, though stated a commitment to innovation.

The Bank of Russia was “categorically opposed” to cryptocurrencies and added several sector companies to the blacklist

Director of the Bank of Russia’s Department for Financial Monitoring and Currency Control Ilya Yasinsky stated that due to high volatility, digital currencies cannot be considered by citizens as an investment instrument. He stressed that the regulator is “categorically opposed” to cryptocurrencies.

Earlier this week the Bank of Russia identified signs of illicit activity on the financial market in 105 companies, among which was found several cryptocurrency projects.

Polish prosecutors confirm arrest of ex-WEX head Dmitry Vasilyev

The Warsaw District Prosecutor’s Office commented on the detention and arrest of the former owner of the WEX cryptocurrency exchange, Dmitry Vasilyev. A representative said he was detained on August 11 under an Interpol warrant at Kazakhstan’s request.

The court ordered temporary custody for 40 days – until September 21. The prosecutors clarified they are studying Kazakhstan’s extradition request, but a decision has not yet been made.

On September 20, an unknown person sent all the funds held in the WEX wallet, totaling 9,916 ETH (just over $30 million), to a new address. As of September 26, it remains awaiting confirmations due to low gas prices.

Hackers attacked DeFi protocols and Bitcoin.org

On September 20, a hacker hacked the pNetwork protocol and withdrew 277 BTC, exploiting a vulnerability in the codebase of the tokenized Bitcoin pBTC.

The next day, the Vee.Finance lending platform was breached. The hacker withdrew 8,804.7 WETH and 213.93 WBTC for a total of about $35 million.

In the early hours of September 23, unknown individuals gained unauthorized access to Bitcoin.org, the oldest information resource about Bitcoin, and posted on its homepage a fraudulent cryptocurrency giveaway advertisement. By that evening, the project team had remedied the attack and restored access to the site.

Court extends the detention of Finiko founder Kirill Doronin

On September 21, the Vakhitovsky District Court of Kazan extended the pre-trial detention of Finiko founder Kirill Doronin for two months—until November 28.

The defense urged to change the measure to house arrest, citing that the accused has two young children and a pregnant wife. However, given the gravity of the crime and the defendant’s Turkish citizenship, the court rejected the request.

A group of anonymous analysts published a report stating that Finiko attracted more than $2 billion in Bitcoin and ERC-20 tokens from its investors. Meanwhile, at least $500 million remained with the founders.

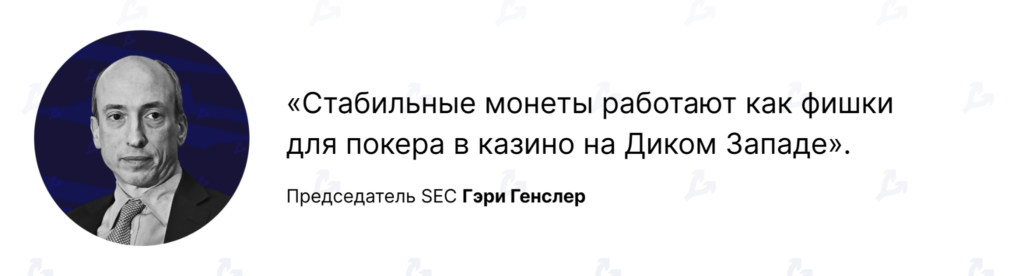

Gary Gensler described stablecoins as poker chips in a crypto‑casino

The official noted that in many cases there is nothing behind cryptocurrencies and that they are a highly speculative asset class. He reiterated his belief that the vast majority of them meet the definition of securities, which are regulated by the SEC.

Also on ForkLog:

- Coinbase will propose a regulatory framework for the industry to US lawmakers.

- Turkish President Recep Tayyip Erdoğan stated that he would crack down on cryptocurrencies.

- French NFT fantasy‑football platform Sorare completed a $680 million Series B funding round.

- Dapper Labs raised $250 million from Google and a16z.

What else to read and watch

In a new feature we explore the nuances of Miner Extractable Value—the profit a miner can gain by including, excluding, or changing the order of transactions at will in the blocks they create on the Ethereum network.

In traditional digests, we compile the week’s main events in the areas of cybersecurity and artificial intelligence.

For the most significant news in venture capital, see our “Institutional Almanac”.

On September 20, in a live broadcast we discussed the price of Bitcoin and cryptocurrency regulation in Russia. Guests included GMT Legal managing partner Andrey Tugarin, as well as traders Ton Weiss and Vladimir Koen.

Read ForkLog’s bitcoin news in our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!