CME improves standing among exchanges amid institutional interest in Bitcoin futures

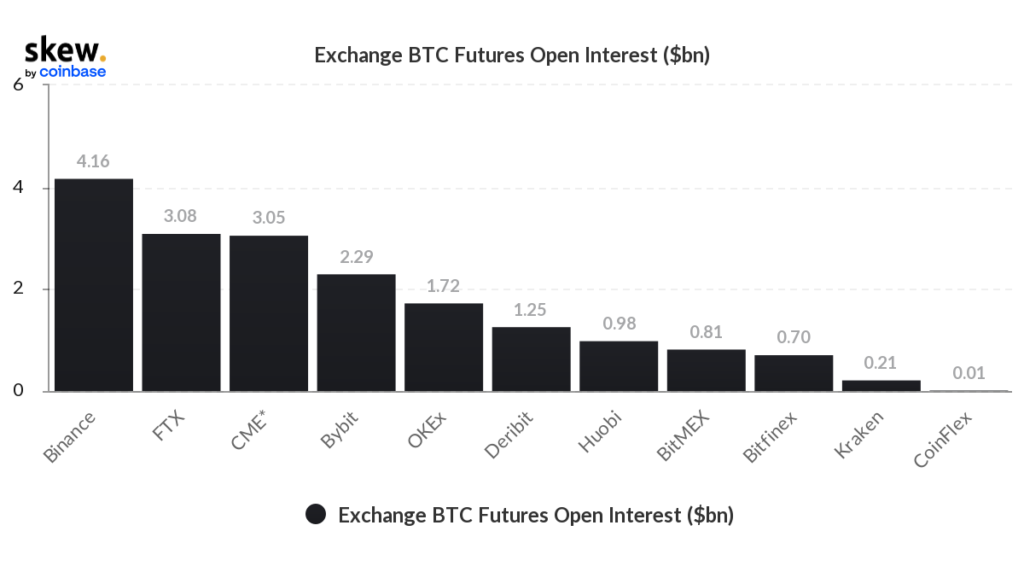

The Chicago Mercantile Exchange (CME) moved from fourth to third place in the ranking of the largest platforms by open interest in Bitcoin futures.

According to Skew, at the time of writing the CME’s open interest stood at $3.05 billion, FTX at $3.07 billion, and Binance, which sits in first place, at $4.18 billion.

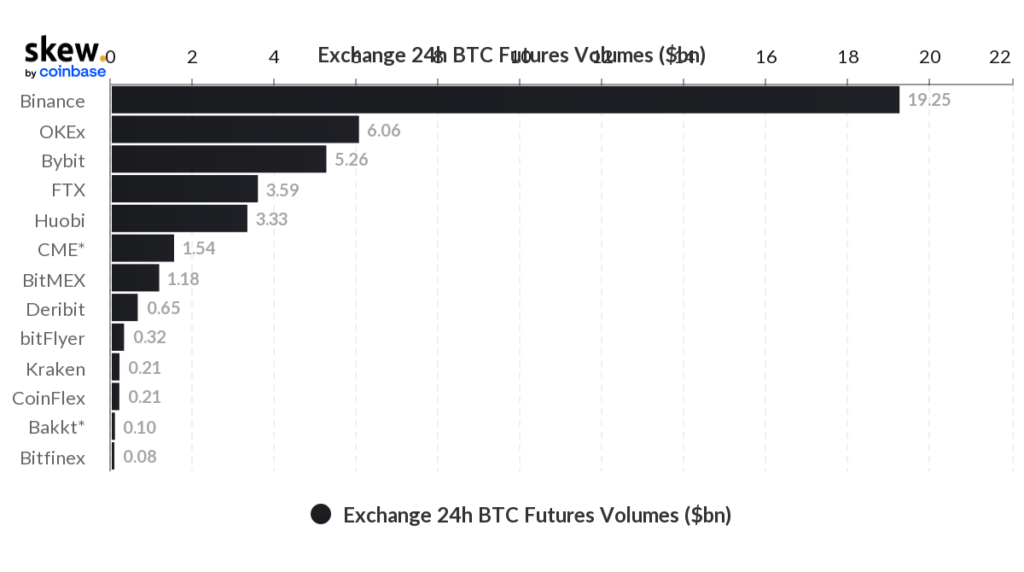

In terms of trading activity over the past 24 hours, the CME with $1.54 billion ranks sixth. The leader Binance has this figure 12.35 times higher — $19.02 billion.

The CME’s improved standing is supported by growing confidence among institutional investors that the SEC will approve the bitcoin-ETF. The futures basis relative to the spot price, annualised on monthly contracts, has exceeded the corresponding measure on unregulated platforms.

#bitcoin futures basis is widening ahead of regulatory decision later this month on pending futures-based ETF proposals pic.twitter.com/fGwlYac3zL

— Coinbase Institutional (@CoinbaseInsto) October 6, 2021

Earlier Bloomberg forecasted the bitcoin ETF’s approval by the SEC by the end of October.

In September, SEC Chairman Gary Gensler confirmed that the regulator would consider applications to launch this instrument if they are based on CME futures and comply with the Investment Company Act of 1940.

Follow ForkLog on VK! VK

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!