Anthony Scaramucci calls latest Bitcoin correction a ‘buying opportunity’

Investors should take advantage of the latest correction in the digital-asset market to bolster their positions, as cryptocurrencies have fundamental potential for further growth. SkyBridge Capital founder Anthony Scaramucci told CNBC.

Not to worry on market sell-off: This is a buying opportunity https://t.co/fZMwS2W2M7

— Anthony Scaramucci (@Scaramucci) November 27, 2021

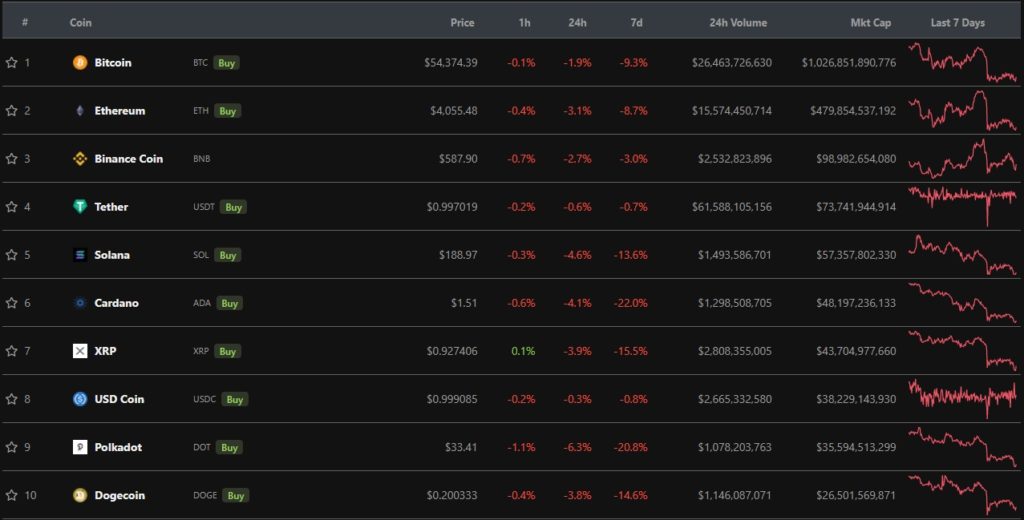

On Friday, November 26, Bitcoin fell below the $55 000 level. The next day the price of the leading cryptocurrency continued to fall, briefly reaching $53 500 (on Binance). At the time of writing, the asset was trading near $54 300.

Bitcoin dragged the rest of the market along. According to CoinGecko, all digital assets in the top 10 by market capitalization ended the week in the red. The biggest declines were Cardano (-22%) and Polkadot (-20%).

The correction came amid fears about a new COVID-19 variant, which raised the prospect of governments imposing new restrictions.

Economist Alex Krüger noted that the traditional market reacted to the news in a similar fashion. He also emphasised that cryptocurrencies performed better than some other assets, such as the oil complex and small-cap stocks.

This happened today in global markets pic.twitter.com/DCuVPH8cGs

— Alex Krüger (@krugermacro) November 26, 2021

According to Scaramucci, what is happening should be viewed as a “Black Friday” and taken advantage of the opportunity. He noted that the prospect for further growth in crypto prices is indicated not only by fundamental factors but also by monetary policy of the ФРС.

«If you, like us, believe in long-term fundamentals, then now is the time to buy. I simply think that risk is decreasing in the current environment. The volatility of Bitcoin and other cryptocurrencies is taking people out of the game. It also washes out some leverage, which, in my view, creates a foothold for a decent first quarter», — explained he.

Scaramucci emphasised that he regards the market reaction as “healthy”. He called what happened “therapeutic bleeding”. At the same time he said that Bitcoin cannot currently be used as an inflation hedge:

«I do not think Bitcoin is currently a tool for protecting against inflation. I think, in the long run, it could become one if you hold billion-dollar wallets and Bitcoin itself stays in a stable trading range. Right now it is more like Amazon stock in 2000, because it is too volatile».

As reported, on November 26, Salvadoran President Nayib Bukele said that the country’s sovereign Bitcoin fund took advantage of the cryptocurrency’s drop and purchased an additional 100 BTC. With the new investment, its balance stands at 1220 BTC.

Subscribe to ForkLog news on VK.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!