Glassnode flags positive shifts in Bitcoin’s fundamental metrics

Against a backdrop of waning activity in the Bitcoin derivatives market, constructive medium- and long-term trends are emerging, according to Glassnode analysts.

Over the last five years, #Bitcoin derivatives have expanded and matured significantly.

Perpetual swap futures have emerged as the industries preferred instrument for trading and price discovery.

Read our analysis on the dominance of perpetual swaps👇https://t.co/rVL5jAUnTJ

— glassnode (@glassnode) April 25, 2022

Over the last 12 months, trading volumes, implied volatility and spreads to the spot market have fallen to historical lows. This was driven by price consolidation since mid-January.

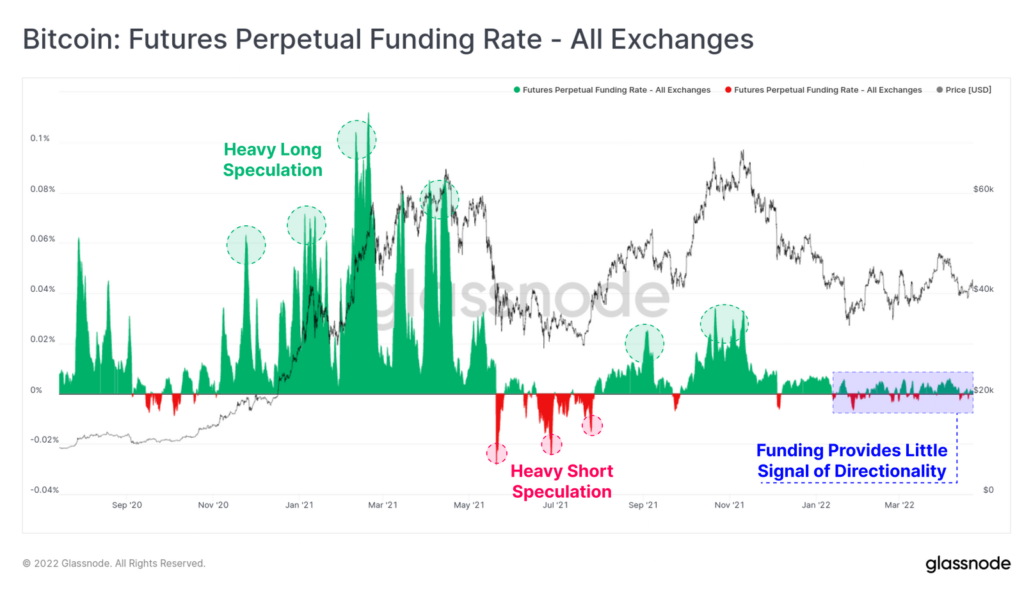

The funding rate on perpetual contracts has swung sharply relative to the preceding months, which were characterised by periods of active long and short accumulation.

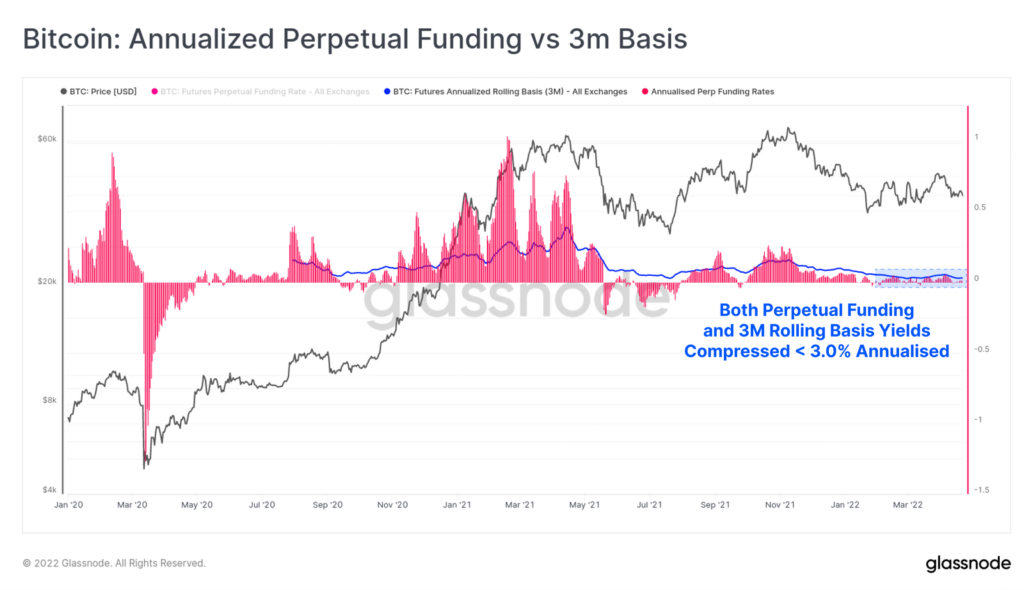

On an annual basis, the funding rate, as well as the cost of rollover into the next quarterly futures for market makers, have looked unattractive. Analysts say such market conditions create prerequisites for capital to flow into segments with different risk-reward profiles, especially given the jump in annual inflation to 8.5% in the United States.

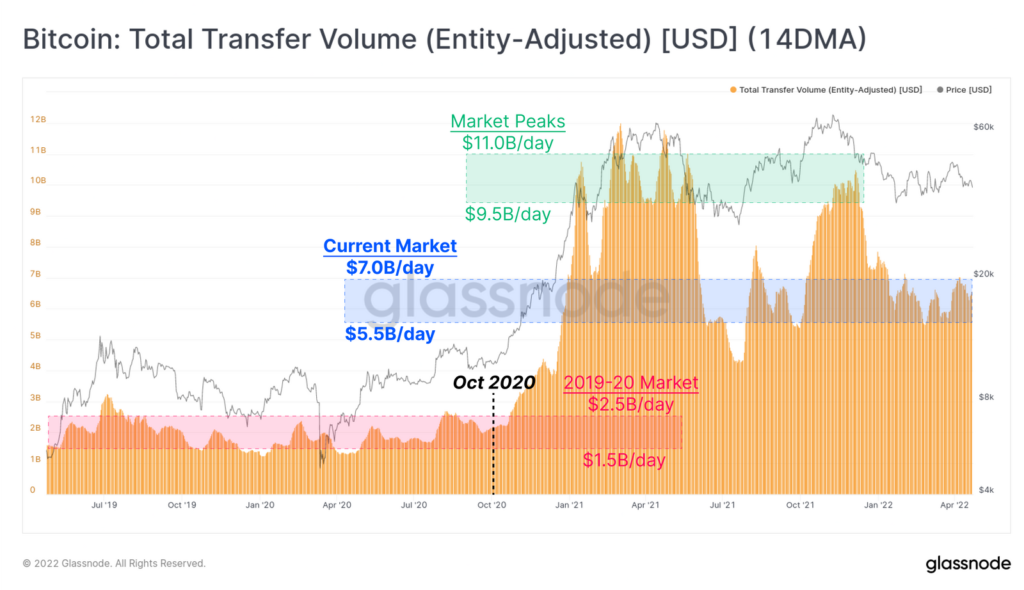

There is a decline in network activity. The daily on-chain value transferred ranges between $5.5 billion and $7 billion. This is about 40% below the peak seen during the bull market, though higher than levels seen in 2019-2020.

Experts noted that since October 2020 the share of transactions valued at $10 million and above has risen from 10% to 40%. They attributed this to the growing influence of institutional traders and wealthy individuals.

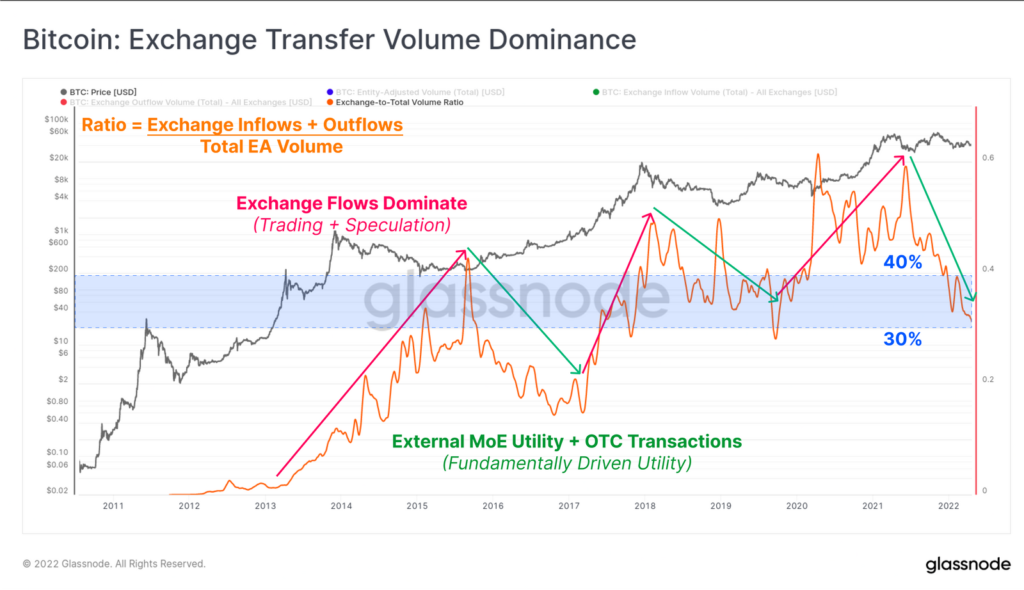

Another positive factor for mid-term prospects is the cyclic divergence between inflows/outflows related to cryptocurrency exchanges and the overall transaction volume. The indicator has fallen to 32%.

For analysts, this signals a shift from speculation to fundamentals-driven activity such as off-exchange transactions, hodler coin accumulation, and custody operations.

Back in April, bitcoin prices hit a local low below $38,500.

BitMEX co-founder Arthur Hayes called a likely drop to $30,000 for bitcoin by the end of Q2 2022, due to Nasdaq’s decline.

Earlier, Glassnode analysts stated that the process had completed of reallocating coins from speculative investors to hodlers and suggested Bitcoin may have bottomed.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!