How SegWit, Lightning and Batching Lower Bitcoin Transaction Fees

Since its inception, Bitcoin has led in mass adoption and market capitalization, remaining the most secure cryptocurrency in terms of 51% attack resistance.

Despite the modest throughput of the blockchain, dictated by a high degree of decentralization and the characteristics of the Proof of Work (PoW) algorithm, the average fee per Bitcoin transaction has long hovered near its historical lows.

Even during periods of on-chain activity surges, sending funds on Bitcoin remains cheaper than the equivalent operation on Ethereum.

Drawing on Galaxy Digital Research’s findings, ForkLog examined the reasons behind the substantial decline in Bitcoin network fees.

- The decline in the average Bitcoin network transaction fee is driven by the adoption of innovative technologies, not by a drop in on-chain activity during a bear market.

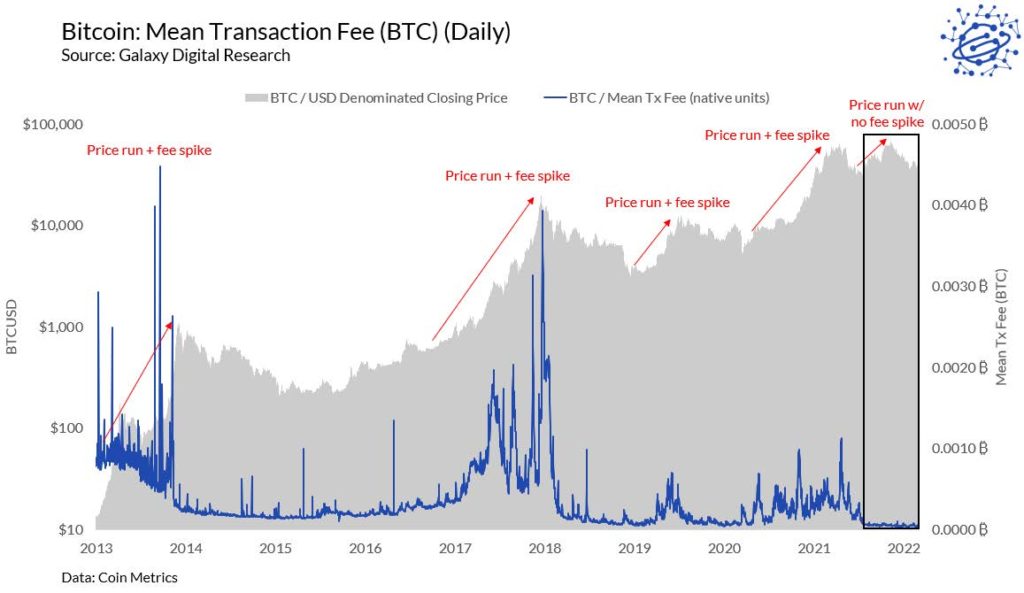

- The trend toward lower fees has been evident since June 2021, amid a significant rise in SegWit transaction share, exchange adoption of batching, and the growth of the Lightning Network.

- Tether’s decision to stop issuing USDT on Omni Network in favor of faster blockchains also played a significant role.

Low Fees Despite Volatility

During periods of livelier markets, fees in the Bitcoin network and other PoW-based cryptocurrencies typically rise. Amid volatility, on-chain activity often increases, and with it the competition for space in a block.

Since 2012 this has been the pattern—bull markets were accompanied by rising fees. Yet there is an exception: in 2021, when Bitcoin’s price reached an all-time high (ATH) near $69,000, fees remained at historically low levels.

The chart above shows Bitcoin price dynamics and the average daily transaction fee. The latter is calculated by dividing the total fees in BTC by the number of daily transactions.

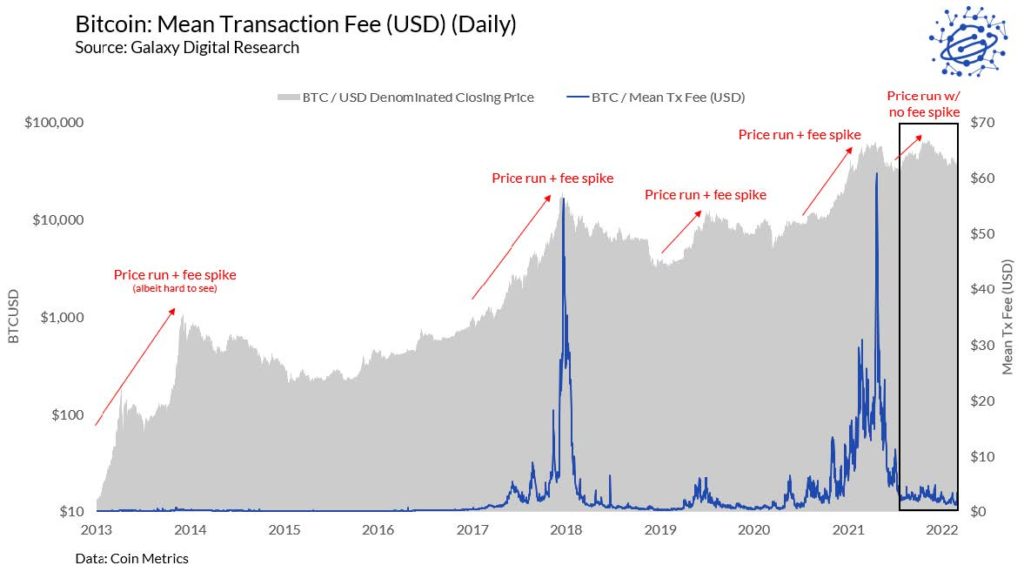

The next chart illustrates the dynamics of the average fee per transaction in USD terms against the trajectory of Bitcoin’s price.

It is observable that since mid-2021 the indicator has also hovered near historic lows despite Bitcoin’s price climbing to ATH.

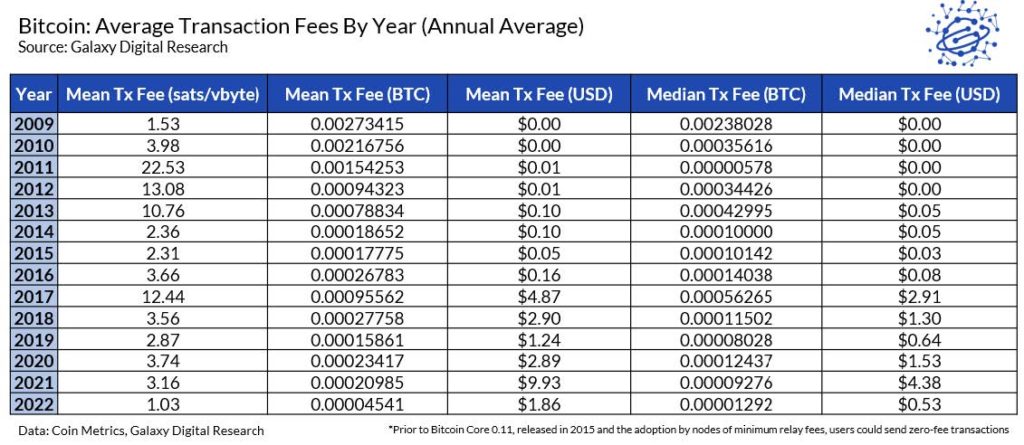

According to Galaxy Digital Research, in 2022 the average Bitcoin transaction fee was 0.00004541 BTC per transaction, while the median was 0.00001292 BTC. The latter is the lowest on record, except for 2011.

The table shows that the annual average of 0.00004541 BTC is a historical minimum.

If we count in dollars, 2022 was not a record: $1.86 — average fee, $0.53 — median. The first figure is the lowest since 2019, but BTC price then was about 10% of today. The median value of $0.53 is a record since 2016.

With Bitcoin Core 0.11.0 released in July 2015, a minimum fee of 1000 satoshis was introduced. This was done to counter spam attacks.

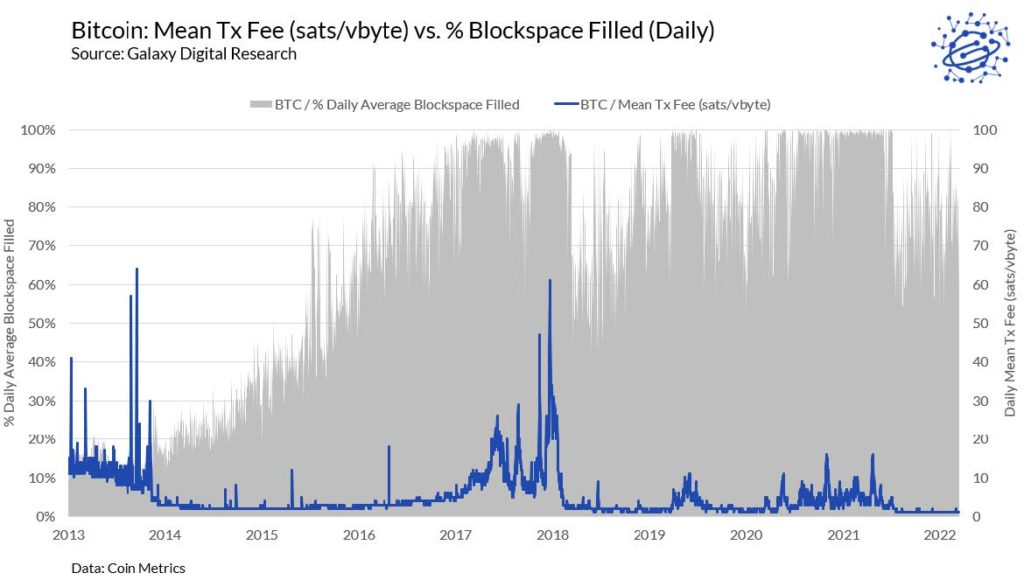

During periods of high demand for block space in the mempool, there are typically many unconfirmed transactions. Competing, users raise the fee to get their transaction included more quickly in a block.

Transactions with higher fees are usually confirmed faster because they are economically prioritized by miners. For on-chain analysts, block fullness is an important indicator of market activity.

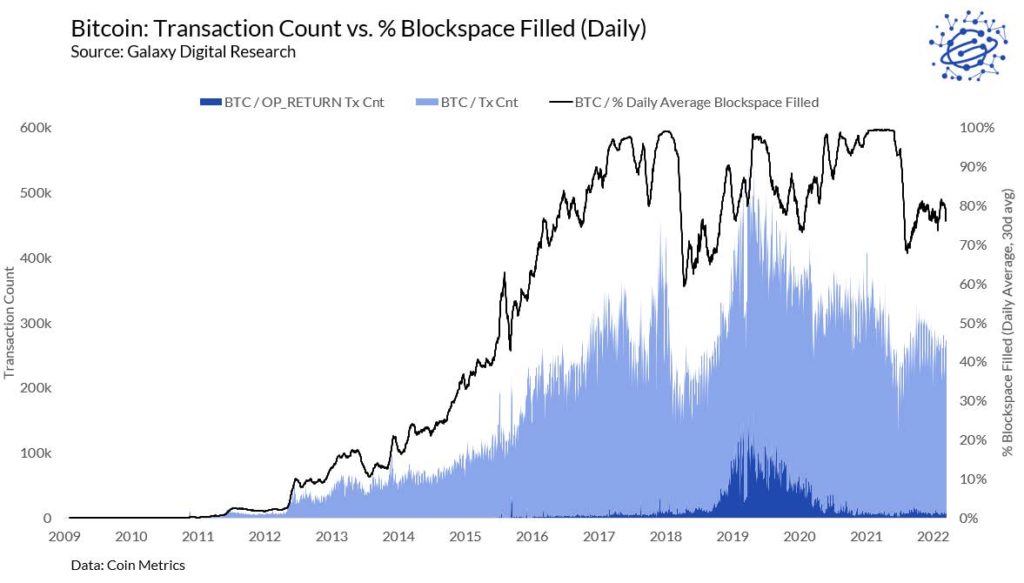

In the graph below you can see that the blocks were “full”:

- in 2017, when Bitcoin approached near $20,000;

- in 2019 — amid a price recovery to around $13,000;

- throughout 2020 and into the first half of 2021 — as Bitcoin surged toward its all-time high.

But since June 2021, blocks have not been filled to capacity up to date. At the same time, fees have remained at extremely low levels.

“Even amid rising prices to new highs in fall 2021, when Bitcoin reached $69,000, blocks were not filled to capacity and fees did not rise,” shared Galaxy Digital Research’s analysts.

According to them, the last nine months are “the only period in Bitcoin’s modern history” when, despite record BTC/USD prices, blocks were not fully filled.

“When blocks are not filled in a high-demand environment, fees can rise, but not as sharply,” the analysts explained.

Segregated Witness

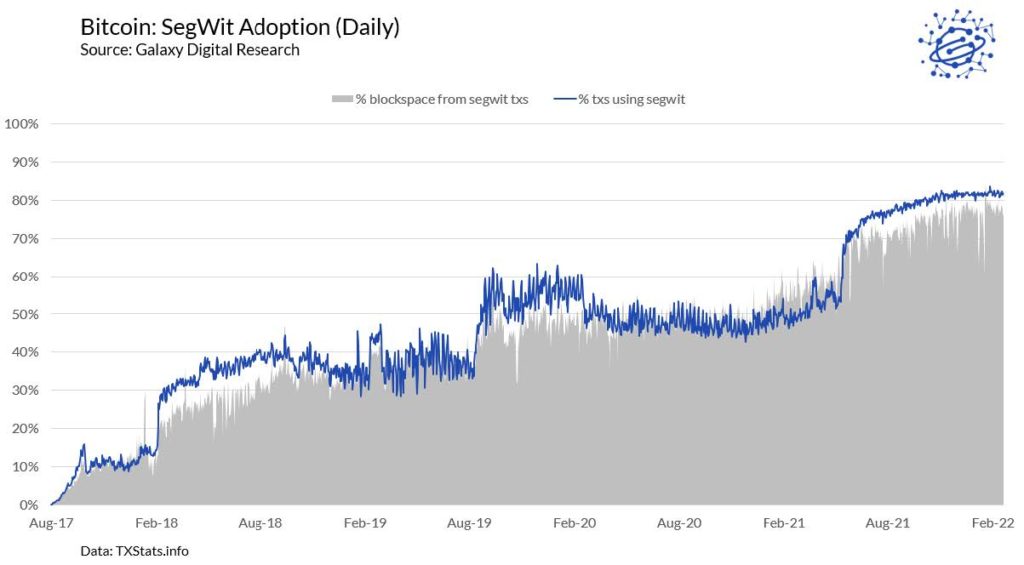

One of the main factors behind reducing the load on Bitcoin’s blockchain was the rising share of SegWit transactions.

Segregated Witness or SegWit — a protocol upgrade implemented in August 2017 via a soft fork (BIP-148). It raised Bitcoin’s blockchain efficiency without increasing block size, resolved the malleability problem, and paved the way for the second-layer network Lightning Network.

To address scalability, Segregated Witness extracts transaction signatures and places them in a separate data structure. When the signature is removed from the transaction input, its size decreases by about 47%. As a result, a block can accommodate nearly twice as many transactions.

Moreover, removing the signature from transaction inputs increases the block capacity from 1 MB to about 4 MB.

It took about five years for the share of SegWit transactions to exceed 80%.

Batching

The use of batching by exchanges has positively affected Bitcoin’s blockchain performance, i.e., combining transactions into a single batch.

In early 2020, Coinbase began using this technique.

“When batching transactions, Coinbase users can save more than 50% on network fees. Batching also helps free up space in the blockchain and increases Bitcoin’s scalability for all network users,” said representatives of the largest cryptocurrency exchange in the United States.

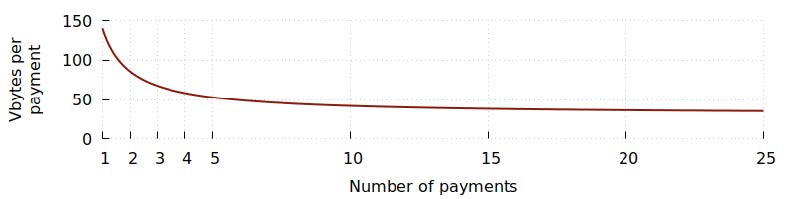

As a result, a single transaction that bundles the sending requests of several users takes less space in each block than the same number of individually processed transactions.

One Bitcoin Optech article states that adding four additional recipients to a typical one-input Bitcoin transaction can save the sender more than 60% on fees.

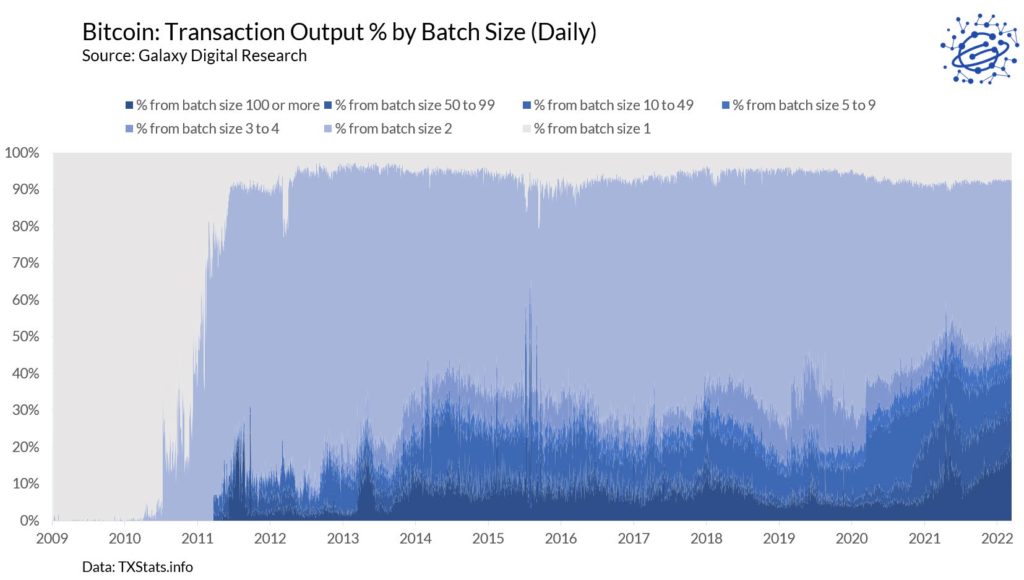

According to Galaxy Digital Research, the surge in batching activity was notable in May 2021, coinciding with the “start of the low-fee period.”

“Wider batching adoption significantly reduces block space per payment,” the researchers stressed.

Transaction Activity

On-chain activity has been steadily decreasing since 2019, when the daily count exceeded 500,000 transactions.

The chart below illustrates:

- the dynamics of block fullness;

- the dynamics of transaction counts, including those using the OP_RETURN function.

“The volume of OP_RETURN transactions that use Bitcoin to store arbitrary data instead of moving funds spiked in late 2018 after the VeriBlock project launched,” the researchers noted.

VeriBlock, a project that uses the Bitcoin blockchain to secure altcoins, launched its mainnet in March 2019. At that time, according to The Block’s analysts and veteran crypto industry figure James Lopp, the share of OP_RETURN transactions was at least 25%.

As shown in the chart above, the project’s activity soon declined, as did the number of corresponding transactions.

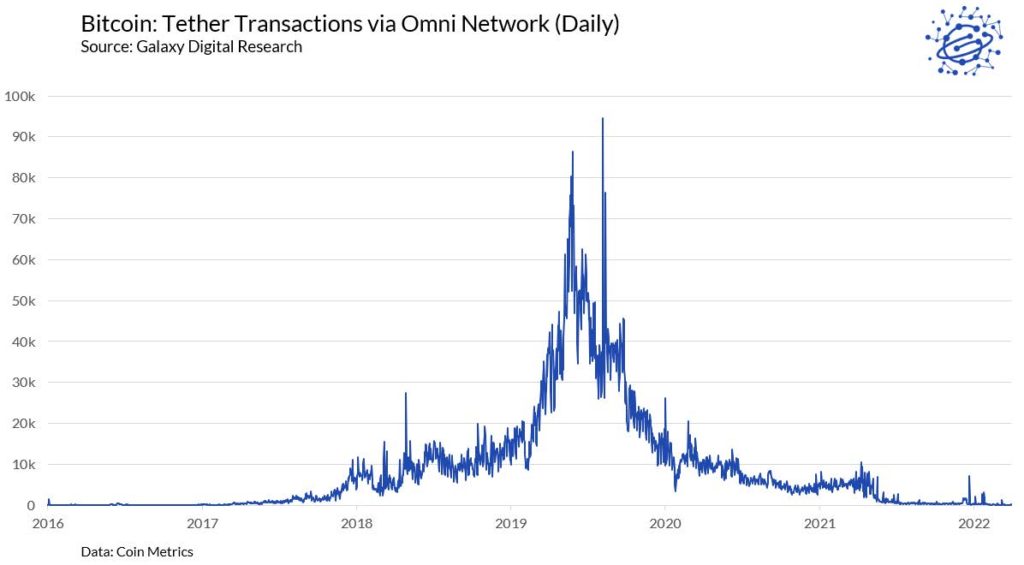

In addition to VeriBlock, OP_RETURN was used by Tether to support the USDT stablecoin on the Bitcoin-linked Omni Network.

In early 2019, Tether began actively integrating other blockchains, including Ethereum. As a result, USDT transactions on Omni Network began to decline steadily.

“Despite Tether essentially stepping away from Omni Network years ago, the last remnants of BTC-based USDT disappeared around May 2021. This also aligned with the start of the current low-fee era,” the Galaxy Digital Research researchers noted.

Lower Miner Sell Pressure

In May–June 2021, Chinese miners under government pressure began moving equipment en masse to other countries — mainly to the United States, Canada and Kazakhstan.

The chart below shows that since roughly the second half of last year there has been a noticeable decline in outflows from Bitcoin addresses of individual miners (1-hop). The start of this process also coincided with the start of the “era of low fees”.

In early 2022, the metric hovered near historical lows, indicating a substantial decline in miner selling pressure.

“Moderate selling pressure, despite hash rate recovery, is partly explained by miners migrating to North America and the rise of publicly traded mining companies. The latter are increasingly financing their operations through debt and equity rather than selling coins,” the Galaxy Digital Research analysts noted.

In early April, the share of publicly traded mining companies in Bitcoin’s hashrate reached 19%. According to Arcane Research, in January 2021 the corresponding figure was just 3%.

Lightning Network

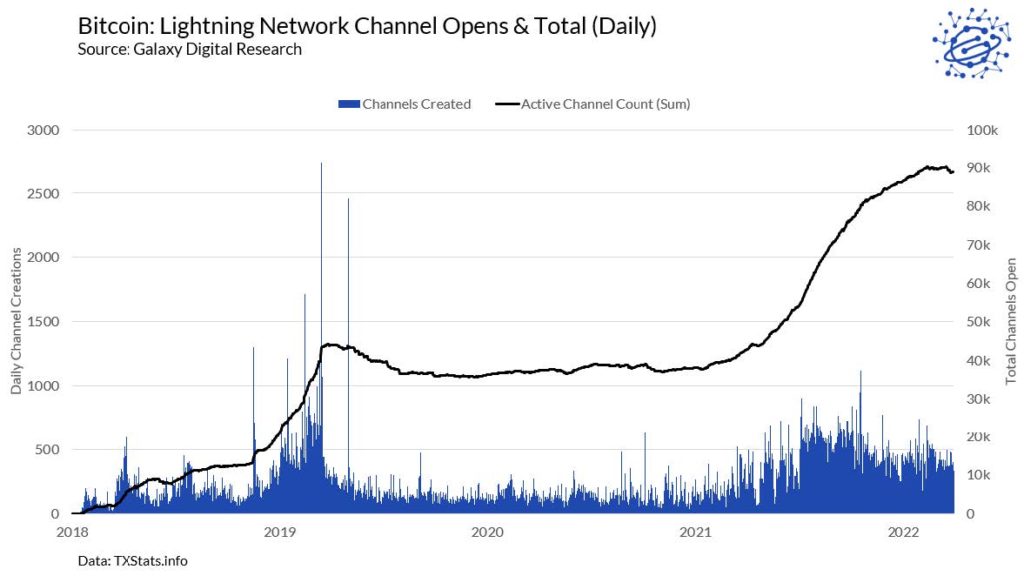

Against the backdrop of the start of the “low-fee era” activity in the Lightning Network (LN) also surged.

The chart below shows a rapid growth in the number of LN channels since June 2021.

“We view the growth in Lightning channels as an indicator of rising demand for highly efficient Bitcoin transactions that can replace on-chain operations,” the Galaxy Digital Research analysts noted.

According to them, the aforementioned decline in on-chain transaction counts could be partly explained by the adoption of the Lightning Network.

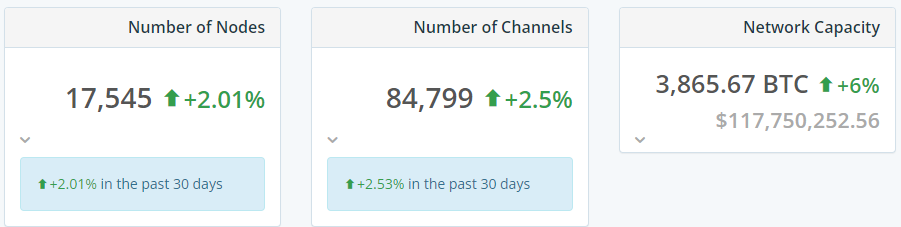

As of writing (23 May 2022), the LN network supports 17,545 active nodes linked by 84,799 payment channels.

Taproot

In November 2021, the Taproot upgrade was activated. The largest upgrade to Bitcoin since SegWit activation includes several important technical improvements, chief among them the implementation of Schnorr signatures and the Merkleized Abstract Syntax Tree (MAST).

The upgrade is intended to increase privacy, efficiency, and scalability for Bitcoin.

In on-chain analysis, Taproot makes complex operations (for example, those requiring multiple signatures or delayed fund releases) indistinguishable from ordinary ones.

The data size required to perform complex transactions is reduced. This helps lower user fees.

Additionally, Taproot lowers LN payments, making them more flexible and private.

Conclusions

In previous years, Bitcoin was often criticised for its low throughput and expensive transactions. Yet thanks to the deployment and gradual adoption of cutting-edge technologies, the situation has changed fundamentally.

Now, even during periods of high market volatility, blocks are not filled to capacity, and the average fee per transaction rarely exceeds $2.

Despite regular attacks by critics, Bitcoin has been and remains digital gold — so far no crypto asset has surpassed its market capitalization. The secret to its success lies not only in the pioneer advantage—the developers and the community have made a substantial contribution, without which SegWit, Lightning Network and Taproot would not exist.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!