CFTC Report: Large CME Players Build Long Bitcoin Futures Positions

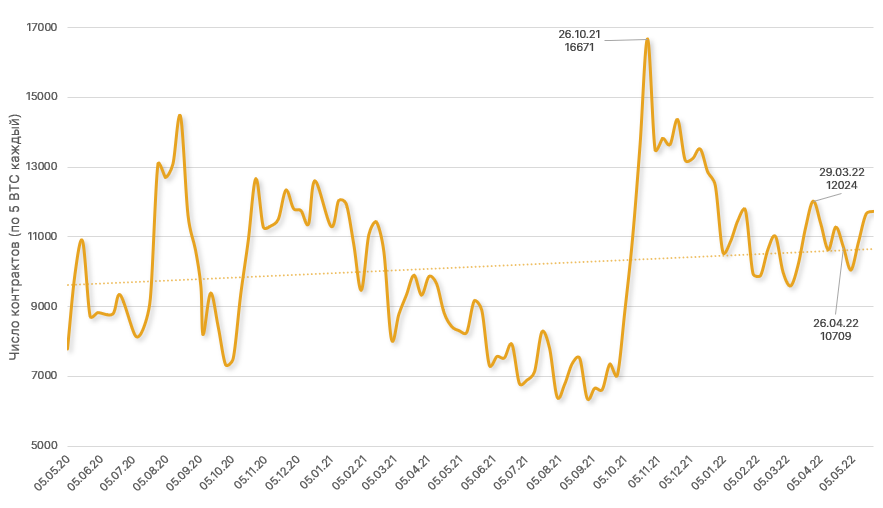

Open interest in Bitcoin futures on the regulated exchange CME is gradually stabilising after a prolonged decline. This is evidenced by data from the CFTC.

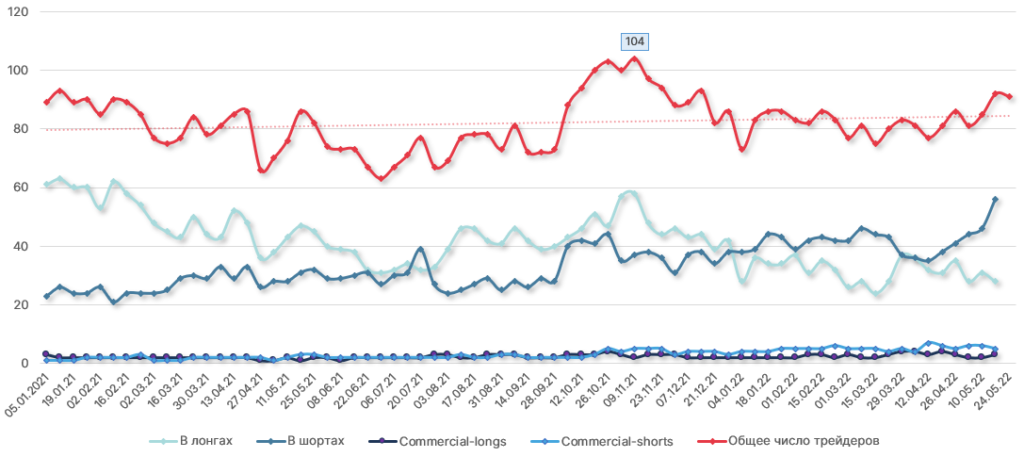

The chart below shows that the downtrend began in late October, interrupted in early March.

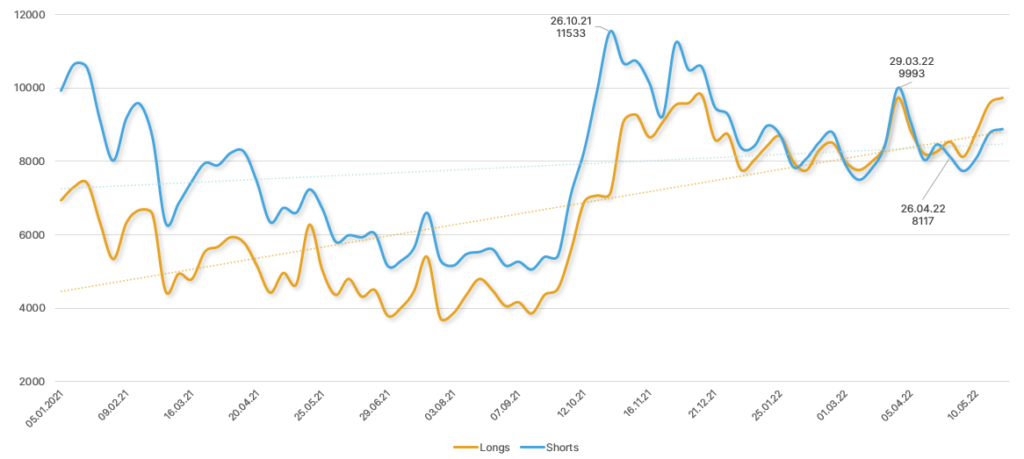

Longs of hedge funds and other large players (Non-Commercial) are increasingly prevailing over shorts. Previously, short positions dominated in this category.

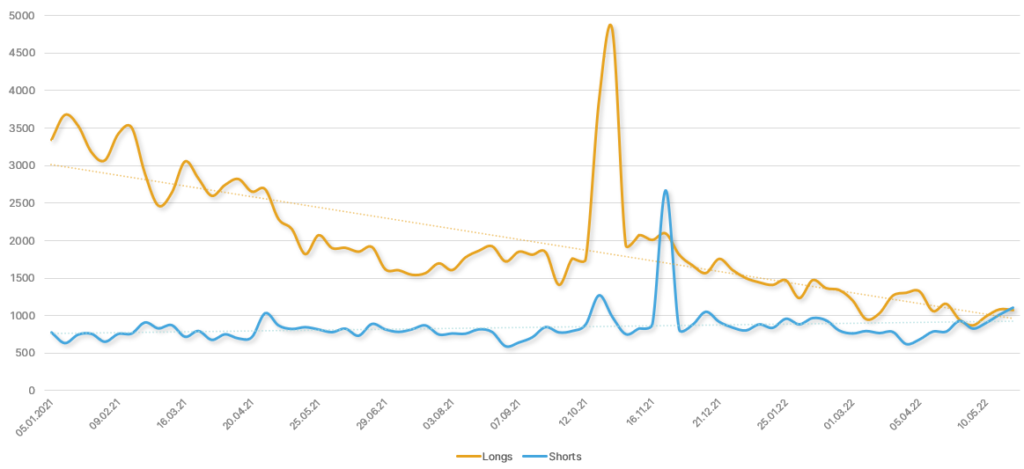

Among retail traders, shorts have come to dominate over longs. Although Nonreportable are usually optimistic relative to others, larger market participants.

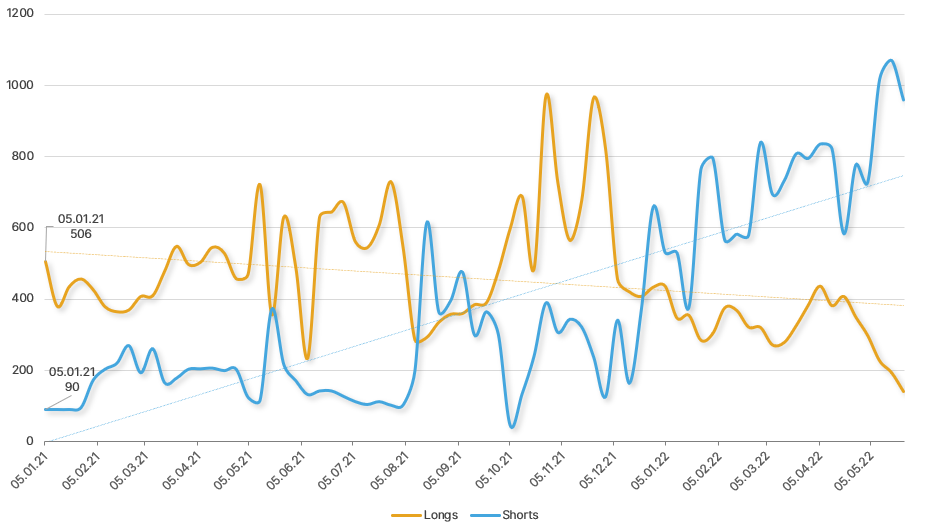

Among the few institutional players, the number of short positions is growing.

The total number of participants trading Bitcoin futures on CME is gradually increasing.

Against the backdrop of shifts in the Bitcoin futures market, the fear index has been at extremely low levels since the beginning of May.

The RSI indicator on the weekly chart has approached the deeply oversold zone.

Based on the factors above, a Bitcoin price rebound is likely soon, or even a trend reversal.

Earlier, Glassnode noted persisting uncertainty in the cryptocurrency market.

Subscribe to ForkLog’s news on Telegram: ForkLog Feed — full news feed, ForkLog — the most important news, infographics and opinions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!