July 2022 in Numbers: market braces for The Merge and exits the zone of extreme fear

Key

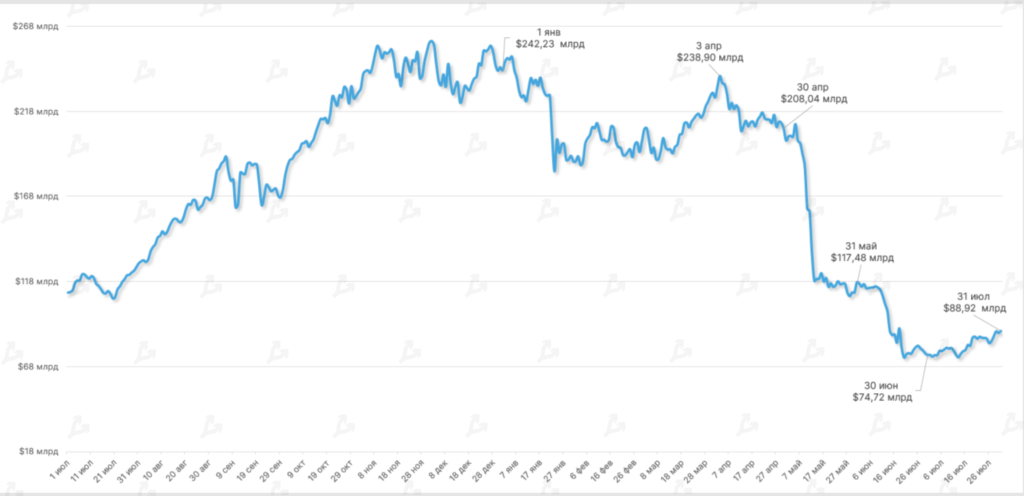

- Market capitalization surpassed $1 trillion as crypto markets consolidated.

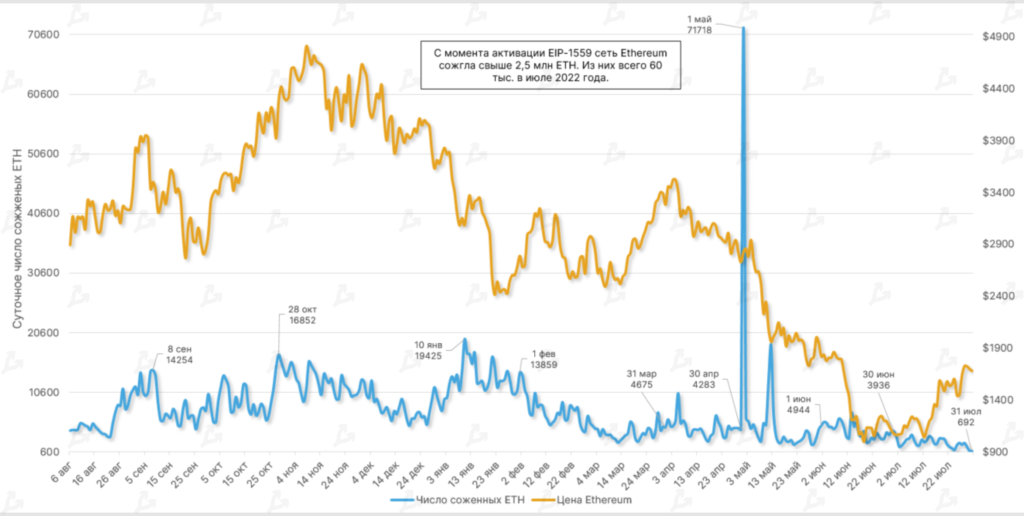

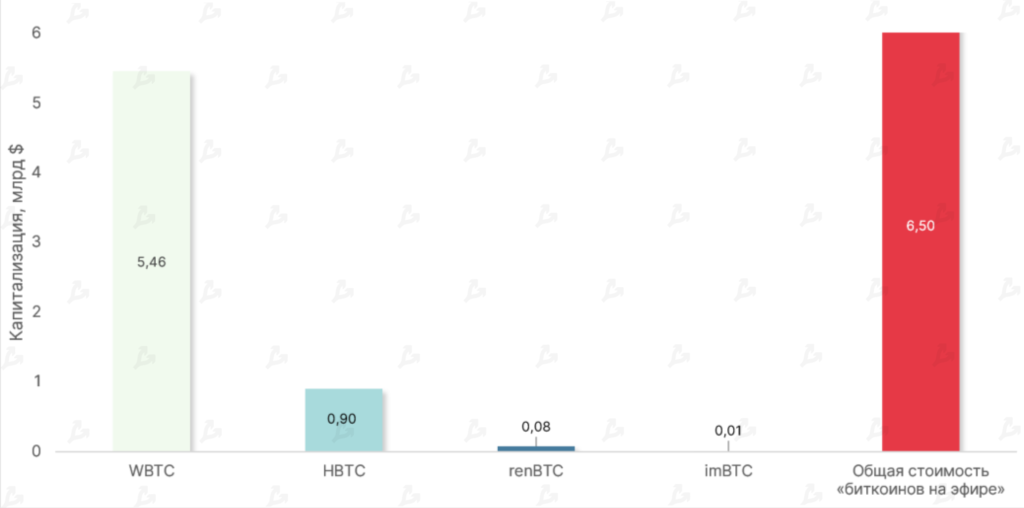

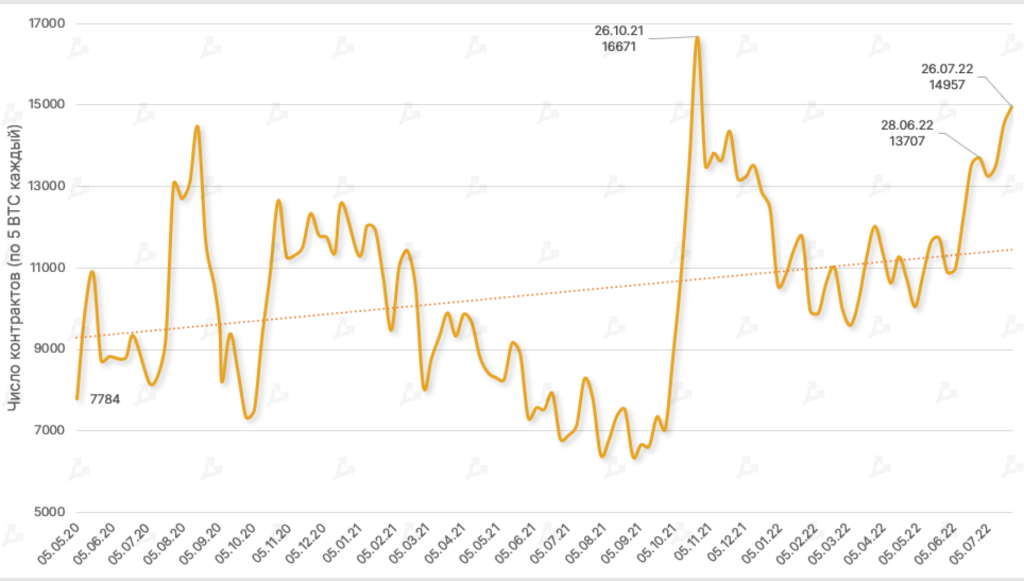

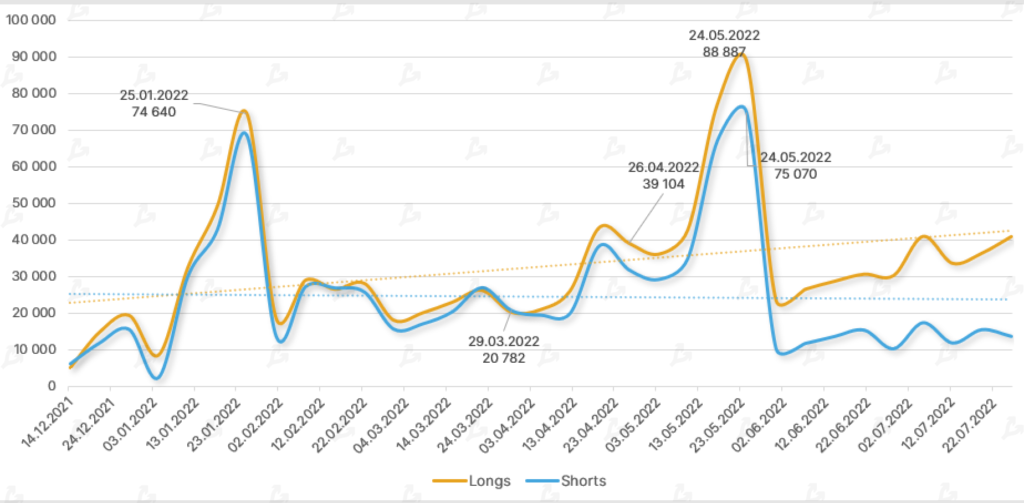

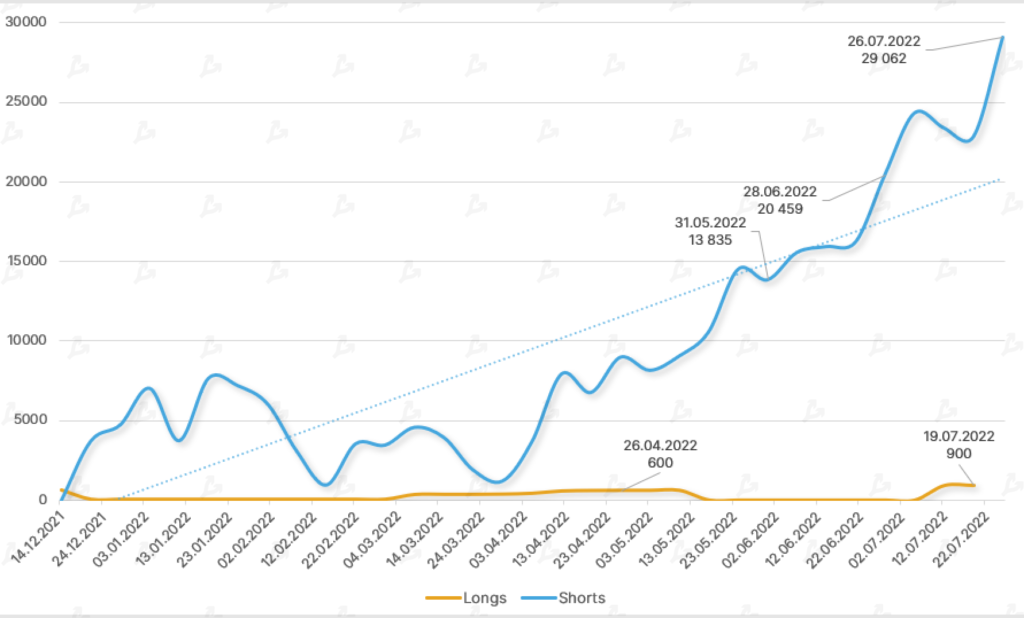

- Interest in Ethereum-based derivatives rose on The Merge expectations.

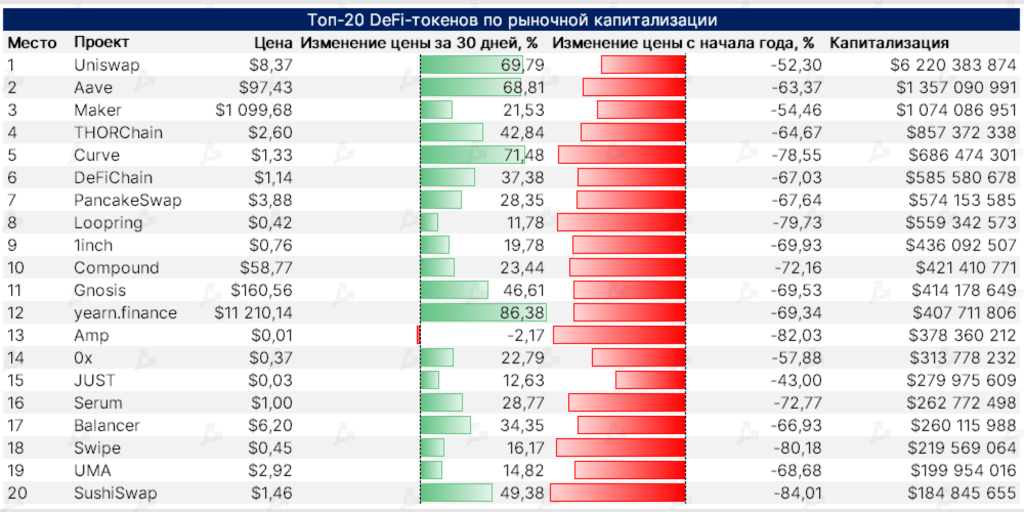

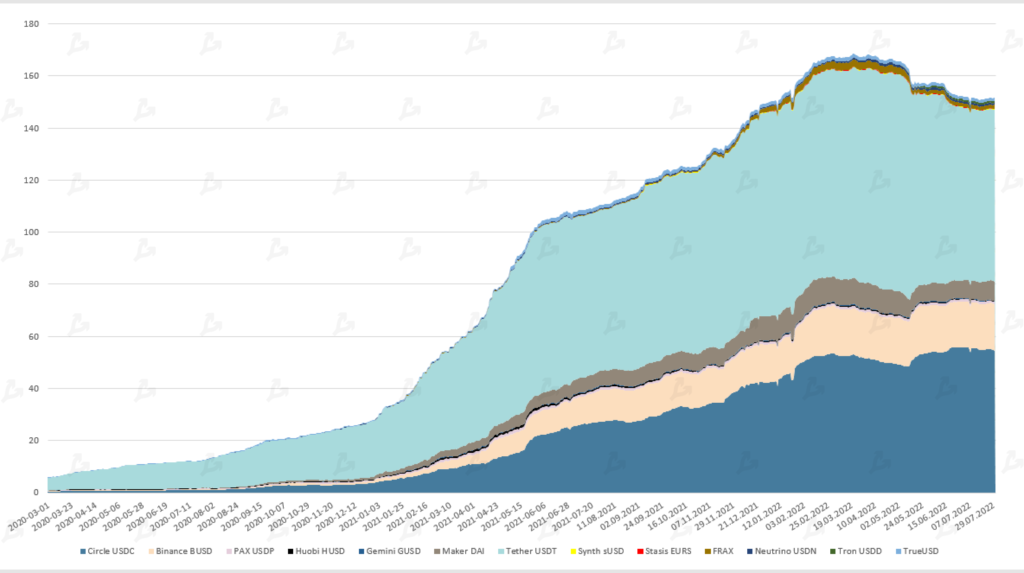

- DeFi protocols Aave and Curve announced launches of algorithmic stablecoins.

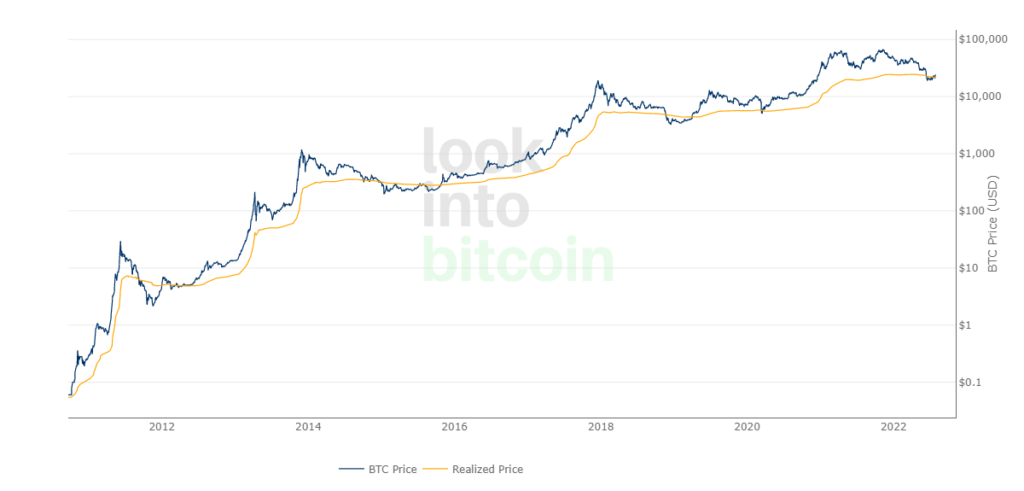

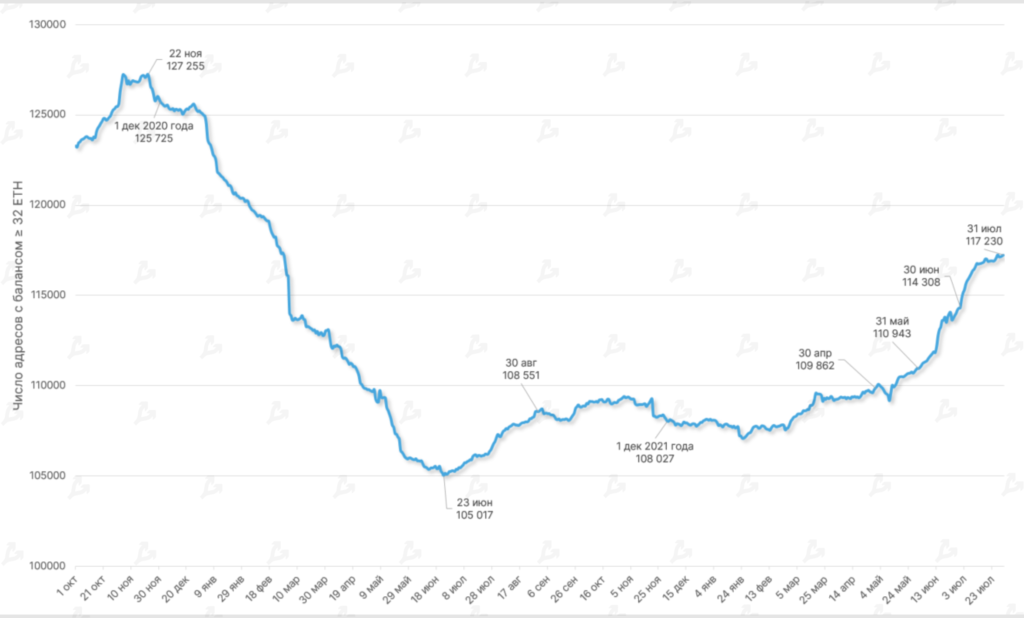

- On‑chain indicators point to a market cycle bottom and improving investor sentiment.

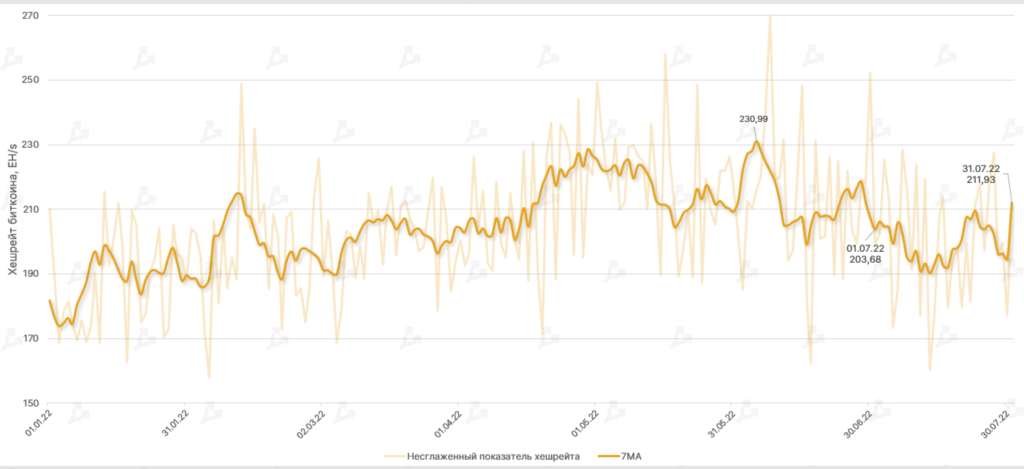

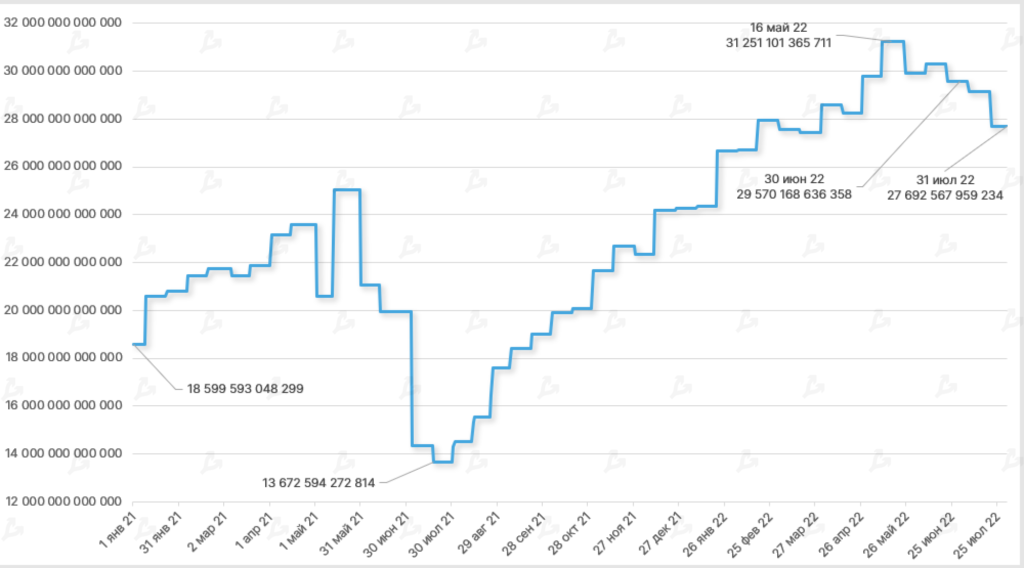

- Mining difficulty continues to fall, but hash rate is already turning up.

- “Fear and Greed Index” has moved beyond the “extreme fear” range.

- With risk adjustments, Ethereum has become one of the most efficient assets.

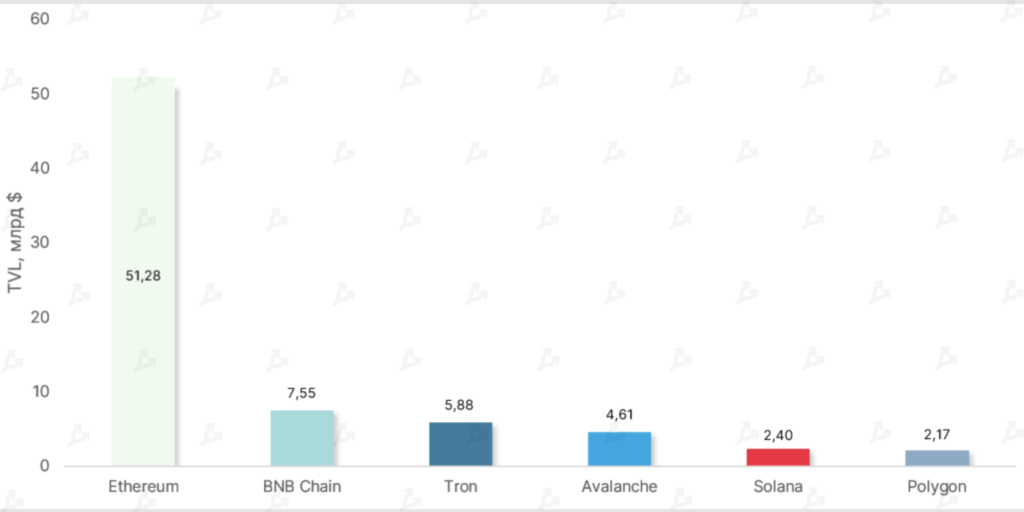

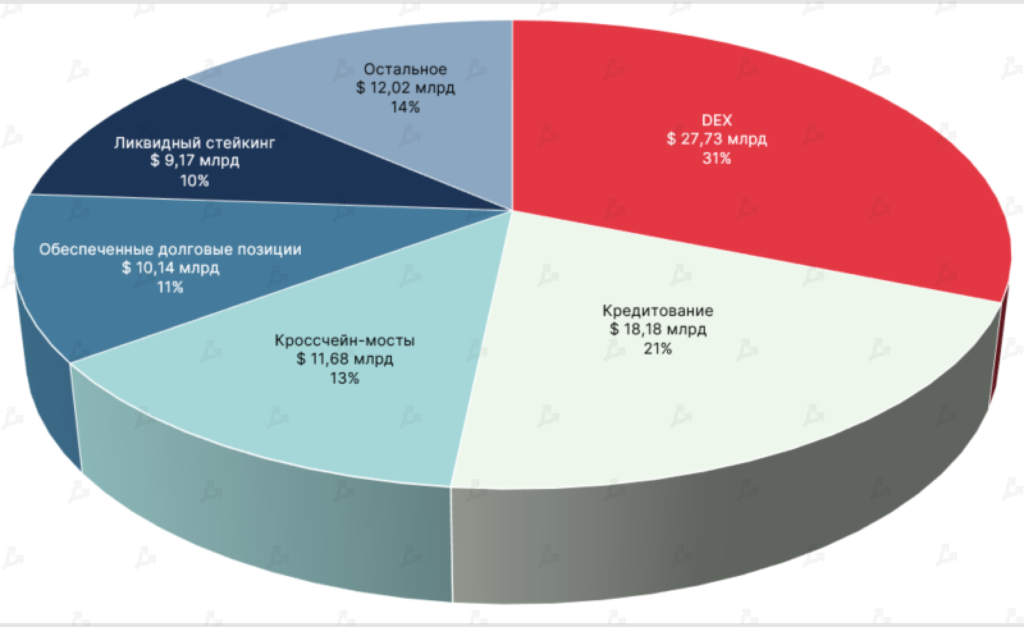

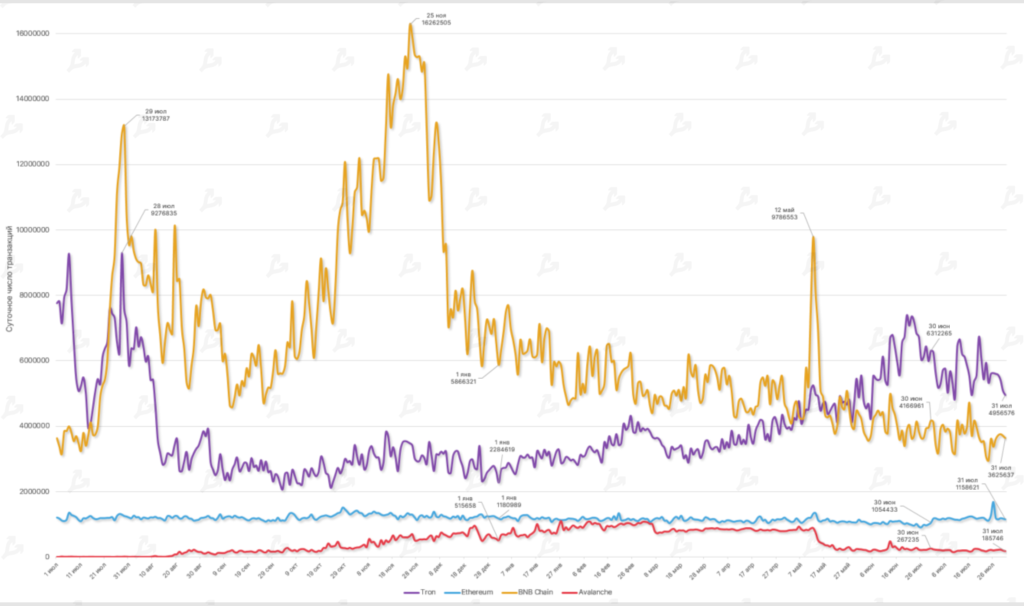

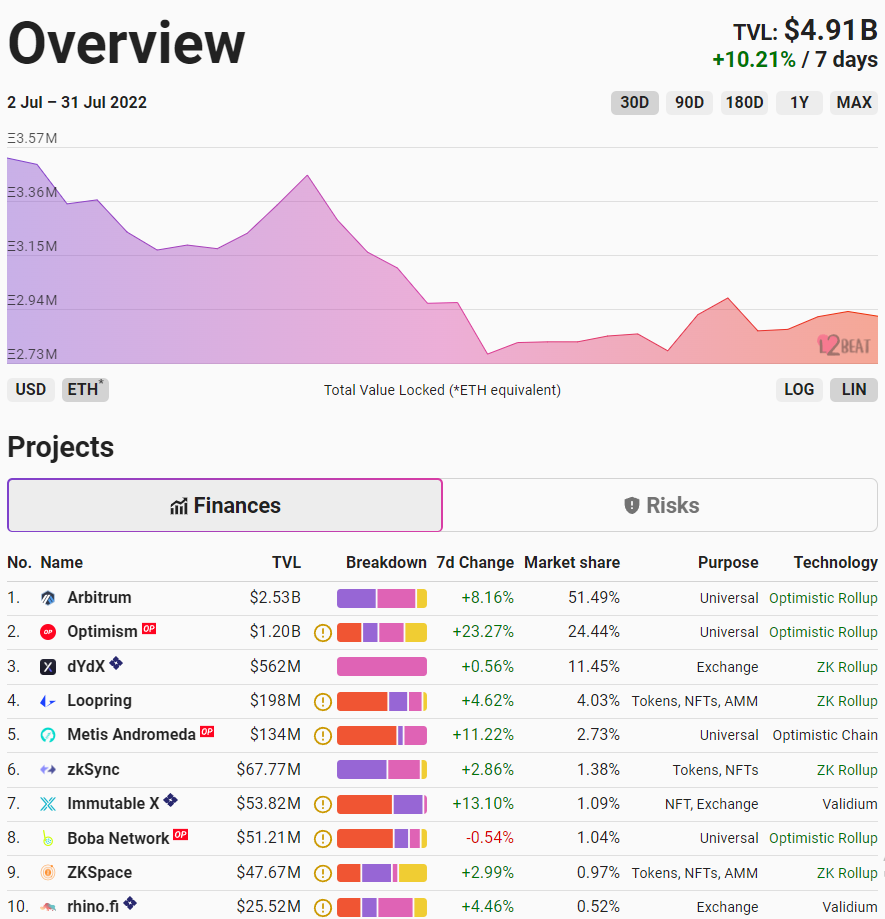

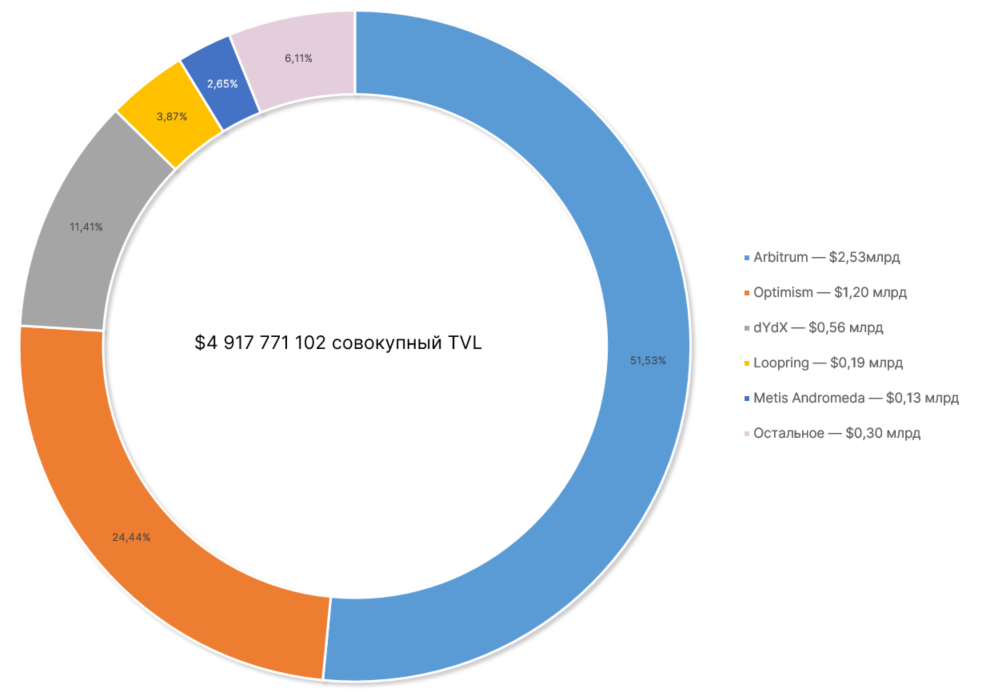

- The Tron ecosystem rose to third place by volume of assets locked in DeFi apps.

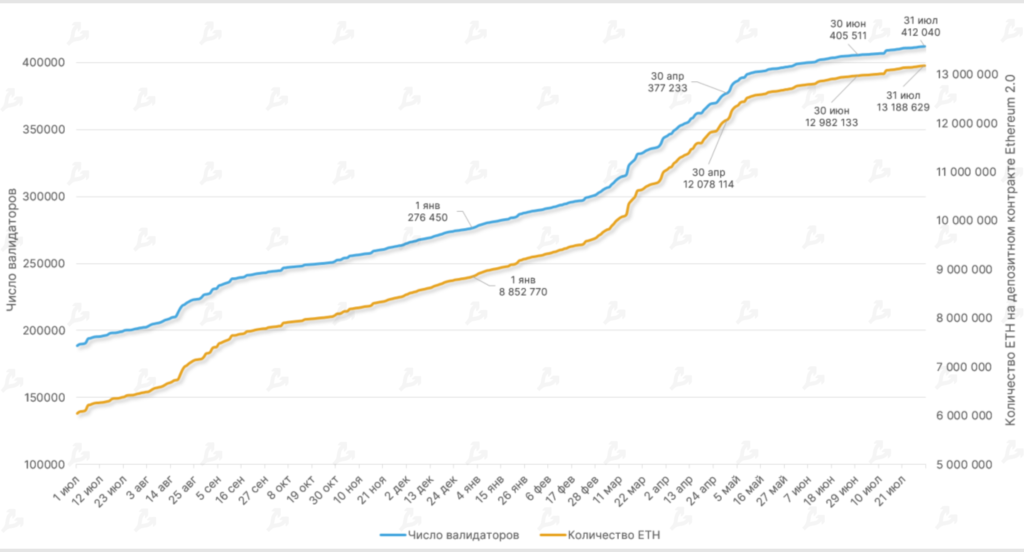

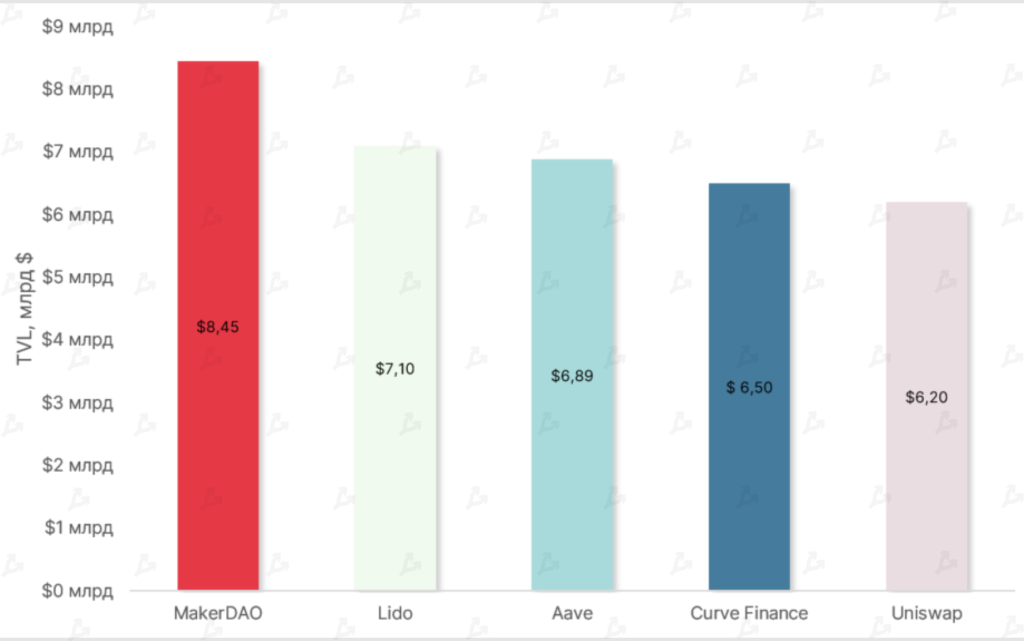

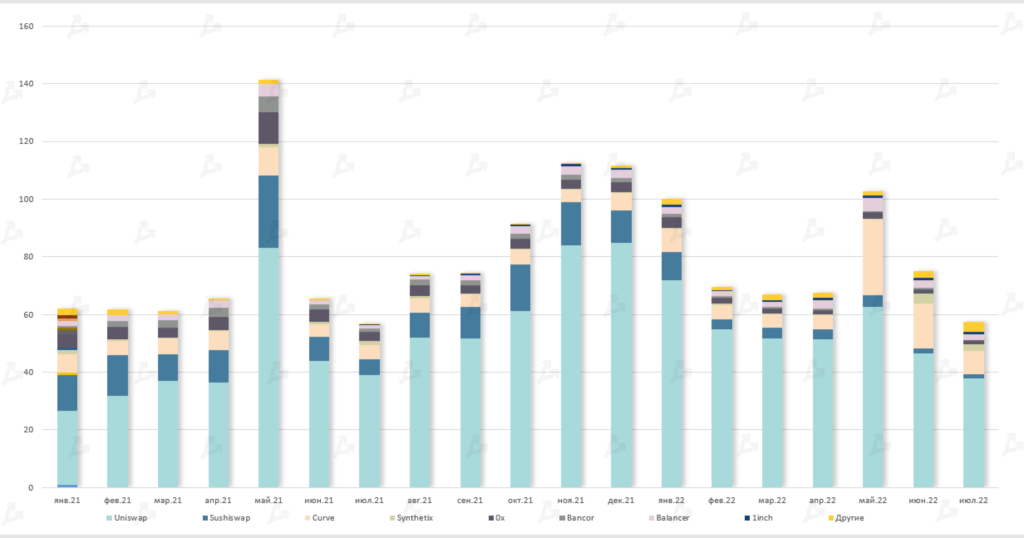

- The popularity of liquid staking projects is rising.

Performance of Leading Assets

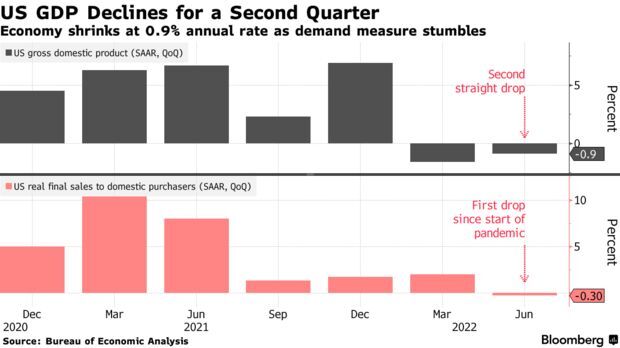

- In July, leading cryptocurrencies and most altcoins consolidated after the biggest monthly drop since 2011. The move occurred as the Federal Reserve hiked rates and US GDP contracted.

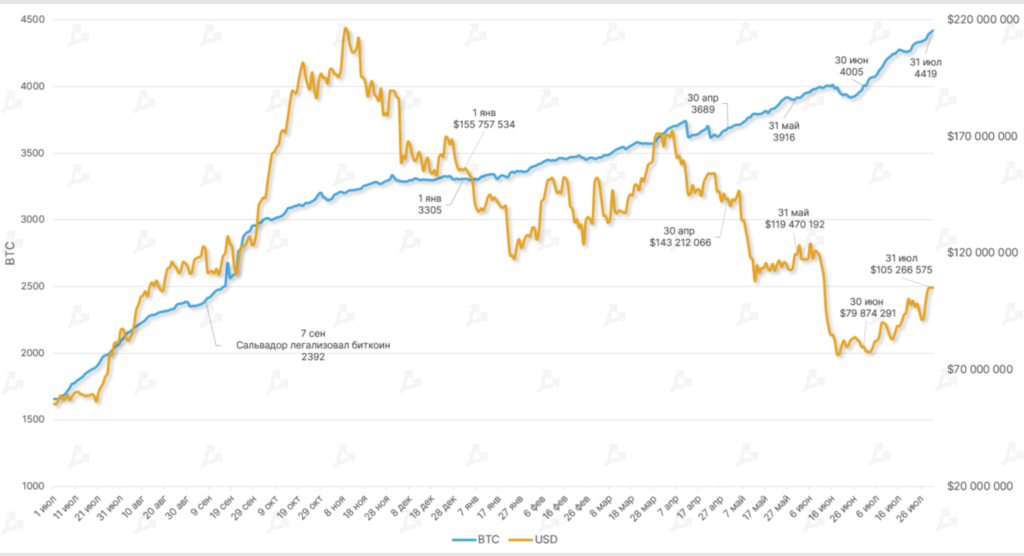

- Bitcoin rose 16.8% for the month, and Ethereum 56.6%. The crypto market capitalization returned to above $1 trillion.

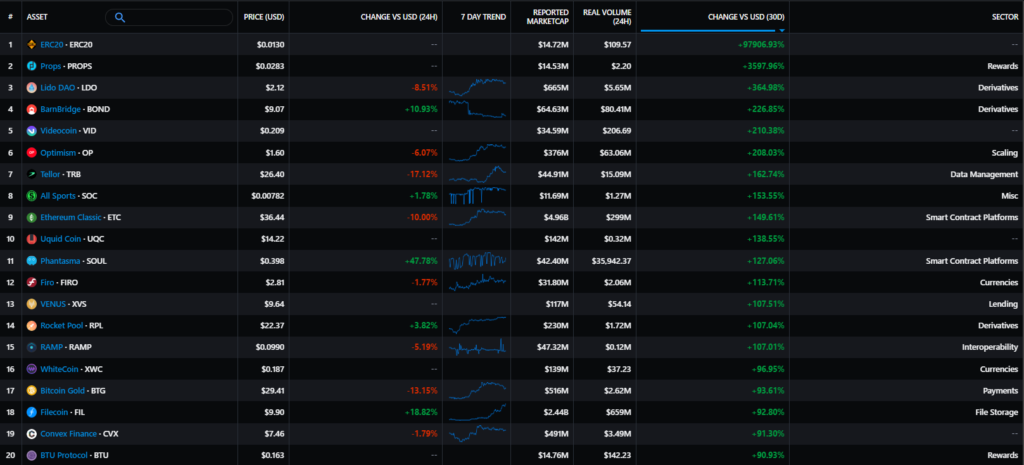

- The LDO token from Lido rose by more than 350% on the back of recovering stETH/ETH peg. Positive momentum was also shown by the OP token of the Optimism L2 protocol (over 200%) amid a series of announcements and the Bedrock upgrade looming.

- Old-guard assets like Ethereum Classic and Bitcoin Gold were not spared. ETC rose by almost 150% after the Ethereum developers announced that the Goerli testnet would move to PoS for the upcoming Goerli testnet. In this light, the community anticipates migration of Ethereum miners to the PoW protocol of a “closely related” network. Given that the ecosystem is already supported by miners and Vitalik Buterin has publicly weighed in, a further ETC rally appears likely as we approach the merge.

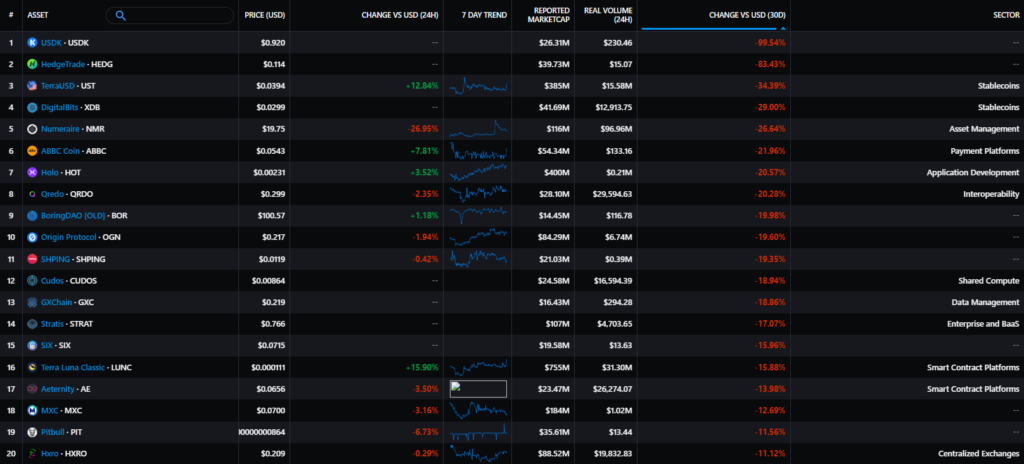

- Among the underperformers were assets of the collapsed Terra ecosystem in light of investigations into its collapse by law enforcement and raids on top executives.

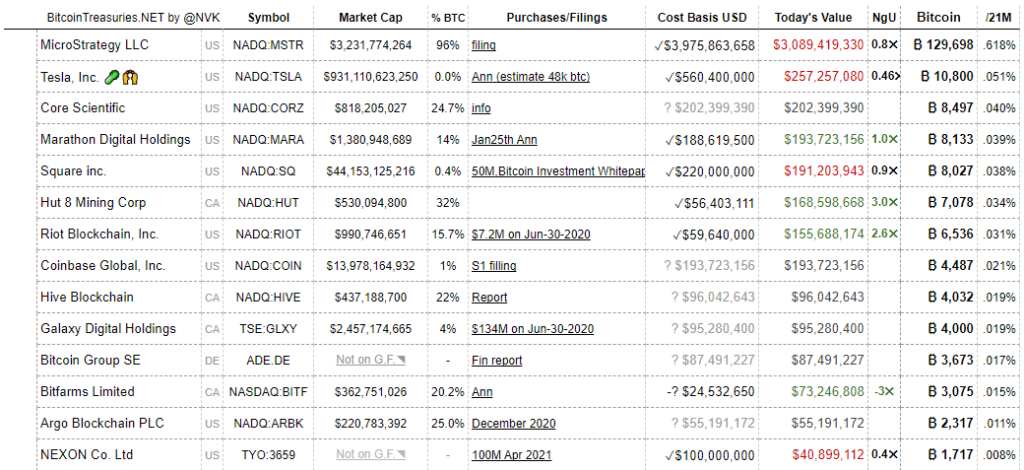

Shares of Crypto-Related Companies

Voyager Digital (VYGVF):

-71.4%

Stock performance of mining companies

Canaan (CAN):

+22.8%

Ebang International (EBON):

+21.6%

Riot Blockchain (RIOT):

+72.6%

Hut 8 (HUT):

+55.9%

Marathon Digital (MARA):

+140%

The bulk of publicly traded crypto miners and related stocks rose in step with the overall market rebound. Voyager Digital was the exception, filing for bankruptcy. Marathon Digital posted a record month, with shares up 140%. The company reiterated its HODL stance despite heavy selling pressure from public miners.

Macro backdrop

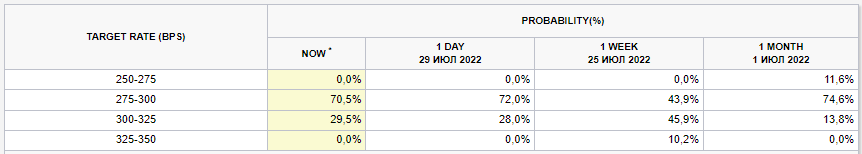

- Following July’s meeting, the FOMC again raised the key rate — by 75 basis points (to 2.25%–2.50%).

- Fed Chair Jerome Powell warned that September could bring a “big uptick” in a key indicator. Yet the market focused on the line that future policy steps will depend on the nature of incoming data.

- Investors began pricing in stronger recession signals in the economy, which were later confirmed in the initial second-quarter GDP estimate. This could lead the Fed to end the tightening cycle sooner than had been anticipated.

- Powell’s two key inflation indicators for the Fed — the PCE Price Index and labor costs — have yet to confirm a peak in inflation.

- The market is pricing in a September rate increase of 0.50% (probability rose from 53.1% ahead of the meeting to 70.5%) with a final 0.25% hikes in November and December.

- By the end of July, the rebound in equities and Bitcoin continued. August could be shaped by the rhetoric of Fed officials (a bullish backdrop could prompt tighter signals) and a fresh batch of macro data in the US. The focus will be on the ISM index (3 August) and the jobs report (5 August). In the inflationary context — the OPEC+ meeting on 3 August.

Market Sentiment, Correlations and Volatility

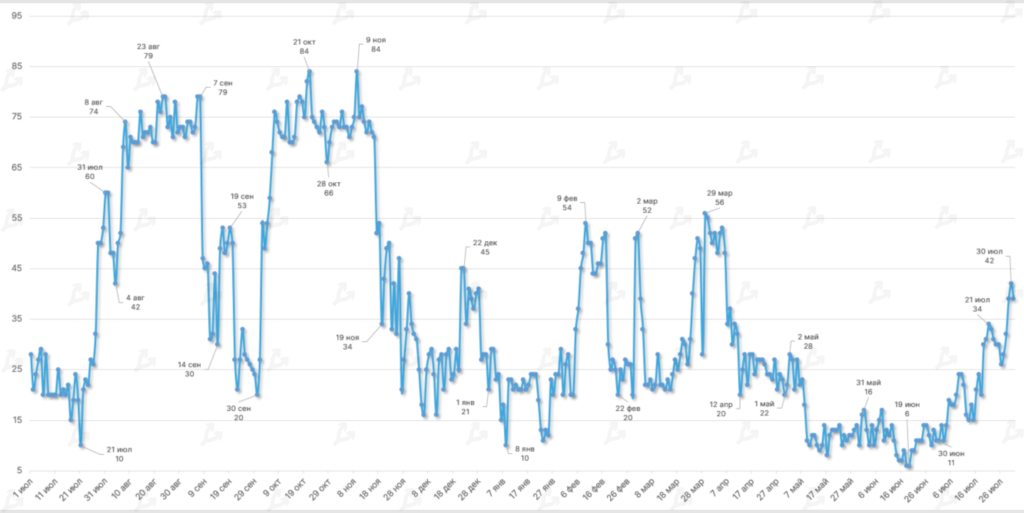

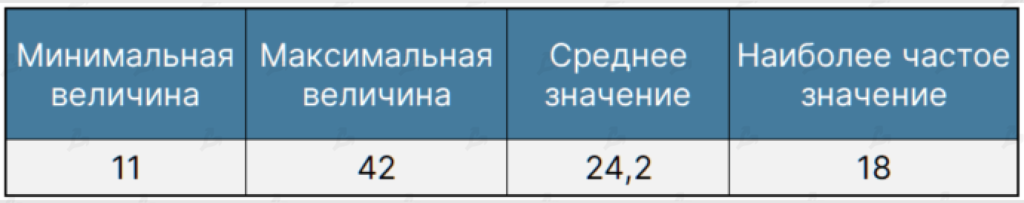

- Compared to June, in July the average Fear and Greed Index rose more than twofold (11.3 vs 24.2). However the indicator did not breach the “fear” band — at a local peak it reached 42.

- Since mid-May the indicator has resided in the “extreme fear” zone and exited it only at the start of the previous month. This signals a shift in investor sentiment and is one of the signs of a potential market-trend reversal.

- Compared with June, in July the average Fear-to-Greed index rose to 11.3 from 24.2. However, the indicator failed to breach the “extreme fear” zone — at the local peak it reached 42.

- Since mid-May the index has been in the “extreme fear” zone and exited it only at the start of the previous month. This points to a shift in investor sentiment and is one of the signs of a potential trend reversal.