Terra’s death spiral: how and why LUNA and UST collapsed

The collapse of algorithmic stablecoin UST and the highly capitalised token LUNA proved a real shock for the crypto industry — within days the savings of many users and the multi-million assets of major companies were devalued.

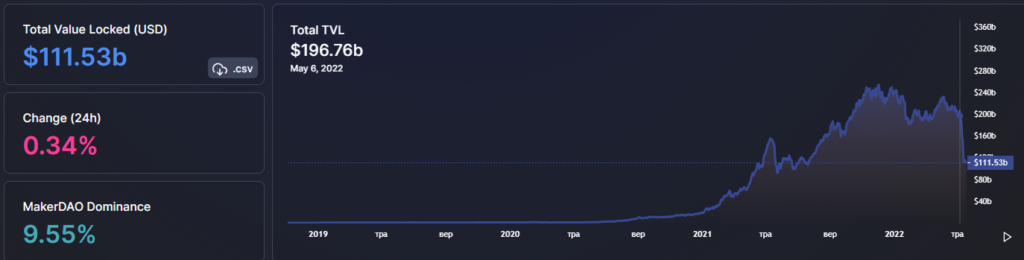

Shortly before the collapse, the Terra ecosystem Terra trailed only Ethereum in TVL, which includes MakerDAO, Uniswap, Compound and other veterans of decentralized finance. The Anchor platform was in third place in the overall DeFi Llama ranking.

The dizzying rise of Terra USD (UST) and the popularity of algorithmic stablecoins inspired many developers to create similar projects and reserve crypto funds.

But everything changed in a matter of days: UST suddenly lost its peg to the dollar, and the associated token LUNA almost became worthless.

ForkLog examined the causes of what happened, assessed current and potential future consequences for the industry, and the project’s chances of recovery.

- The collapse of LUNA and UST shook the crypto community’s confidence in the prospects of algorithmic stablecoins.

- The Terra ecosystem collapse attracted regulators’ attention and mainstream media.

- The collapse of LUNA and UST hit the broader market, creating serious problems for a number of DeFi projects.

Colossus on feet of clay

Even at the height of LUNA and UST’s popularity, skeptics remained, doubting the infallibility of Terra’s mechanisms. For example, at the end of 2021, user FreddieRaynolds in a series of tweets warned the community about the project’s vulnerability to well-coordinated attacks requiring substantial capital.

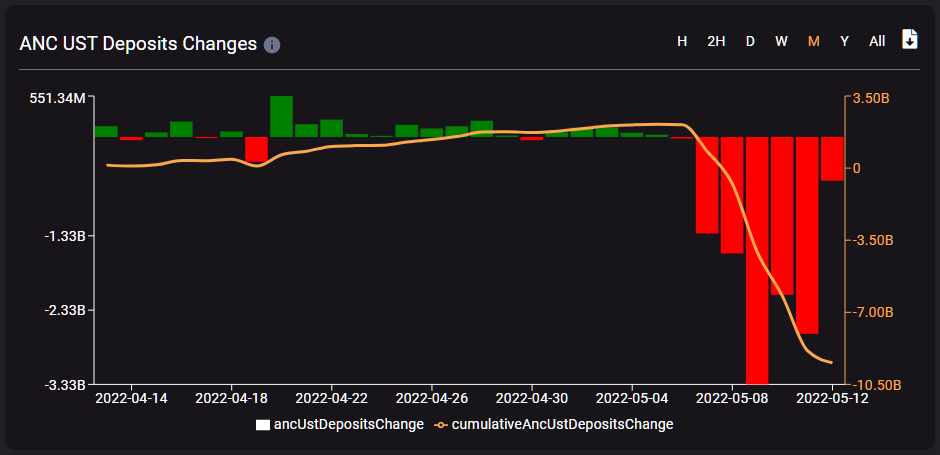

In early May, just before Terra’s collapse, the Anchor deposit rate was reduced for the first time to just below 18%. The move was intended to smooth rising distortions and address several problems, including the depletion of the project’s reserves.

In response, users began withdrawing assets from the protocol en masse. On 7 May, Anchor deposits exceeded 14 billion UST, and a day later the figure stood at 11.77 billion UST (-16%).

Against the backdrop of capital outflows from the flagship Terra project, Curve Finance said someone had begun selling UST en masse, causing the stablecoin to briefly lose its peg to the US dollar (at one point on 8 May the asset traded near $0.98). The developers noted the actions “faced strong resistance” in the form of counter-sales of ETH and stETH.

News of Curve Wars ?⚔️

Yesterday, someone started selling UST en masse, so it started to depeg. However, that was met with a great resistance, so the peg was restored. To get enough USD for that, a lot of ETH and stETH were sold also.

Aftermath? High Curve trading vol (>uni3) pic.twitter.com/ZChdZiVzcK

— Curve Finance (@CurveFinance) May 8, 2022

The head of security at the Polygon project, Mudit Gupta, noted that the UST incident was accompanied by a string of suspicious transactions.

According to him, on May 7 Terraform Labs removed 150 million UST liquidity from Curve, after which an unknown newly created address transferred over 84 million UST to the Ethereum network. A few minutes later ETH was dumped, Gupta noted.

Shortly after that the company withdrew an additional 100 million UST from Curve.

When the price of the stablecoin started to fall, an unknown market participant began selling ETH and buying UST. The latter traded below the peg, allowing for profit.

The founder of Terraform Labs, Do Kwon, explained that the company withdrew 150 million UST from Curve in preparation for launching the 4pool. After that, it withdrew another 100 million UST “to reduce the imbalance.”

Kwon stressed that Terraform Labs had nothing to do with the 84 million UST operation. He also added that the company had no motive to depeg the stablecoin from the U.S. dollar.

And not sure what possible profit would have been gained even if we tried — 50bp spread on UST while luna giganuked?

— Do Kwon ? (@stablekwon) May 8, 2022

To stabilise the situation and bolster UST, the non-profit organisation Luna Foundation Guard (LFG) provided loans to OTC firms — in $750m in BTC and $750m in stablecoins.

“Traders will trade capital on both sides of the market, helping to achieve both the first and the second objectives, ultimately maintaining the parity of the LFG reserve pool (denominated in BTC) as market conditions gradually stabilise,” the foundation said.

Soon after, the organisation published its new Bitcoin address and noted that it would continue to provide loans to market makers.

Against these events, the market continued to fall. By May 10, Bitcoin’s price had tested support near $30,000. Most altcoins fell even more steeply. Panic swept the market.

Against the backdrop of the market crash, UST lost its peg again to the U.S. dollar. In the night of May 10, the asset traded below $0.62.

An analyst at The Block, Larry Cermak, noted that Jump Crypto, Alameda Research and other Terra-supporting entities allocated an additional $2 billion “to rescue UST.” However, in his view the only way to save the asset is to fully collateralise it.

I personally think the only way to save it now is by fully (or potentially very close to fully) collateralizing. Otherwise I don’t see it ever being used again

— Larry Cermak (@lawmaster) May 10, 2022

On Wednesday, May 11, Terra USD again lost its peg to the U.S. dollar — its price fell below $0.23. The LUNA token used to issue the stablecoin fell more than 80%.

Sources The Block reported plans for LFG to raise $1 billion to stabilise the stablecoin. According to the article’s sources, the organisation sought funding from “some of the largest investment firms and market makers in the industry,” offering investors to buy LUNA at a 50% discount as part of the deal.

However, according to The Block Research analyst Miki Honkasalo, the attempt to raise funds by LFG “failed.”

Researcher Hasu compared the project to a Ponzi scheme, noting that, “UST is worse than BitConnect.”

On May 11, Do Kwon presented a plan to restore the price of the algorithmic stablecoin.

According to him, the necessary step before taking further measures would be to absorb the supply from holders of UST seeking to exit the asset.

The plan envisaged accelerating LUNA issuance. Under the mechanism, 1 UST should always be exchangeable for $1 in LUNA. In Kwon’s view, this “will allow the system to absorb UST more quickly.”

Against concerns about hyperinflation, LUNA’s price fell below $1, and UST settled around $0.5. The ecosystem’s loss of trust dragged the price of the Anchor token (ANC) down as well.

Major South Korean exchanges reacted to the sudden LUNA drop: Coinone suspended trading of the asset, Korbit and Bithumb issued investor warnings.

The Binance Futures derivatives platform delisted perpetual contracts on LUNA settled in the base asset.

Online chatter suggested that BlackRock and Citadel Securities had taken 100,000 BTC from Gemini and swapped 25,000 BTC for UST; they allegedly contacted Do Kwon and proposed a large discount for UST to buy a big block of cryptocurrency.

Then BlackRock and Citadel allegedly dumped the assets, triggering a crash in UST, LUNA and the entire market.

“BlackRock and Citadel knew that Anchor, which owned a sizeable stake in LUNA, was a Ponzi scheme, and this collapse would trigger a larger outflow than Anchor could cover. It would allow them to buy Bitcoin cheaply to cover their loan and keep the spread,” the theory went.

Grownups across the space spread the claim, including IOHK chief Charles Hoskinson. He later deleted the tweet and noted that the rumours were unverified.

Gemini said it did not provide a 100,000 BTC loan to institutional counterparties.

BlackRock called the rumours of its involvement in the crash “categorically false” and said the company does not trade the asset. Citadel likewise said it has no dealings with stablecoins, including Terra USD.

On May 12, when LUNA hovered around $0.05, Terraform Labs proposed a range of additional measures to revive the ecosystem. One of the initiatives proposed expanding the base LUNA pool and increasing the cryptocurrency’s issuance, which purportedly would enable faster withdrawal of UST from circulation.

The measures drew criticism online. Some users noted that the latter would only accelerate the ecosystem’s death spiral and lead to the further devaluation of LUNA.

Larry Cermak wrote that the only way out for Terraform Labs is to abandon UST and focus on developing the main network. He stressed that as the ecosystem grows, the project team must extinguish the stablecoin’s debt.

Of course even if they do what I say the chance of success is probably near zero. But right now it’s 100% zero and can’t possibly be better off for legal reasons. Also if Terra has any reserves left, they should absolutely commit that to making users whole

— Larry Cermak (@lawmaster) May 12, 2022

Anchor’s community also prepared an “emergency proposal”: to lower the target annual yield on UST deposits to 4%. Its author, Daniel Hong, explained that this step would curb the addition of UST to the circulating supply.

By then the outflow from Anchor had reached almost 9.5 billion UST.

Developers paused the network several times, explaining the moves as necessary to protect the network from potential governance attacks and to develop a “recovery plan” for the system.

In the wake of the first halt, LUNA traded just above $0.01. On May 13, when the price hit $0.00006, Binance removed nearly all LUNA and UST trading pairs from the spot market. The platform subsequently resumed trading of these assets in BUSD pairs.

The result of Terraform Labs’ “rescue” measures was a surge of LUNA supply to a astronomical 6.5 trillion coins. That contributed to further devaluation of the project’s native token.

Echoes of LUNA

The enormous volatility of LUNA caused price display problems in the decentralized oracle network Chainlink, used by many DeFi projects for operation.

The Venus lending protocol reported a loss of $13.5m due to Chainlink oracle settings, which prevented the price of LUNA from displaying below $0.1.

Venus on #BSC was exploited for $13.5m today because whoever set that min-price limit probably assumed $LUNA would never collapse so hard.

This is wild! #chainlink #LINK https://t.co/6DwXnw2ilY pic.twitter.com/j3mC9hPJJ4

— DefiMoon ?? (@DefiMoon) May 12, 2022

Subsequently the Venus team briefly disabled the protocol, then launched VIP-61 to set the zero collateral factor on LUNA and UST markets.

Defenders of a similar exploit, Blizz Finance on Avalanche, reported a related attack.

In the panic, even the most liquid centralised stablecoins stumbled—USDT depegged, while USDC remained largely intact.

8/ People even started selling $usdt in panic pic.twitter.com/k4BzSNJf1Z

— DeFi Made Here (@DeFi_Made_Here) May 14, 2022

Withdrawing assets from Anchor, followed by the LUNA and UST collapse, hammered not only Terra’s TVL but the DeFi sector’s aggregate metrics as a whole.

Some market experts say the Terra incident, regardless of the outcome, will have serious consequences for the crypto market. Blogger Dennis Porter noted that regulators are using the UST crash as a main argument for comprehensive stablecoin regulation and the promotion of CBDCs.

U.S. Treasury Secretary Janet Yellen said that the depegging of Terra USD underscored the need for “a regulatory framework for stablecoins that minimises volatility.”

South Korea’s People Power Party member Yun Chan-Hen urged parliamentary hearings on the recent Terra ecosystem collapse.

According to some reports, three Terraform Labs legal team employees resigned after the UST and LUNA crash. It also emerged that one of South Korea’s leading law firms, LKB & Partners, is preparing to sue Do Kwon.

What lies ahead for Terra?

Clearly, the measures taken by the developers only worsened the situation around LUNA and UST. Their result was hyperinflation of the native token and a complete loss of community trust in the project and ecosystem.

In a bid to turn the tide, Kwon proposed rebooting the network with 1 billion tokens. He later said he was “heartbroken” that his invention had caused so much pain to the community.

I still believe that decentralized economies deserve decentralized money. But it’s clear that in its current form UST will not be that money

— Do Kwon (@stablekwon) May 13, 2022

He assured the community that neither he nor the affiliated organisations benefited from what happened. The head of Terraform Labs also stressed that he did not sell LUNA and UST during the crisis.

In the community, the idea of a hard fork and a new token was floated. The distribution of the latter could take place according to a network snapshot taken before the market crash.

The initiative also envisages a new governance mechanism for the blockchain and the creation of a pool to redeem the algorithmic stablecoin UST.

Final SOLUTION for @terra_money @stablekwon and community:

1) Hardfork to TERRA2

2) Snapshot of all holdings before collapse trigger and provide hodlers with new #LUNA2

3) Create new better chain with #LUNA2 #UST2

4) Pool to repay old $UST peg

5) #BUIDLRT!

— Lionel?₿ (@CryptoLionel) May 13, 2022

Binance chief Changpeng Zhao doubted Terra’s hard fork viability. In his view, the new chain would have little intrinsic value.

Zhao also questioned the use of LFG’s Bitcoin reserves. He said the assets should have been directed to supporting UST.

On May 16, LFG representatives said that as a result of UST purchases, Bitcoin reserves were almost exhausted. Of 80,394 BTC as of May 7, only 313 BTC remained.

Many expressed amazement that massive “Bitcoin interventions” had done little to help UST.

The $3bn in reserves were used to market buy $UST and it still depegged. That’s crazy.

— Harry (@CryptoHarry_) May 16, 2022

Some saw a positive in the sense that the first cryptocurrency did not crash after mass sales in an attempt to save Terra.

On May 14, Ethereum founder Vitalik Buterin called for Terra to focus on compensating small investors, backing a Twitter user PersianCapital’s idea.

Days later Do Kwon proposed a Terra hard fork to a new network with an airdrop.

The plan envisaged that the new network would keep the Terra name with the LUNA token. The original blockchain would become Terra Classic with Luna Classic (LUNC) accordingly.

The total LUNA supply would be 1 billion tokens, with a staking reward target of 7%.

However, in a preliminary Terra poll, the majority of Terra’s community did not back the hard fork idea.

Conclusions

The Terra incident is undoubtedly one of the most high-profile events in crypto history. So far no DeFi project had reached such scale before its collapse.

“Rescue measures” by the community merely accelerated the crash. Expanding LUNA’s supply to astronomical levels did not absorb UST, but rather fuelled hyperinflation.

The odds of escaping the “death spiral” became increasingly remote — the almost empty LFG treasury stands as evidence. It remains unclear whether investors will ever be compensated, at least partially.

The future prospects for algorithmic stablecoins remain uncertain, given the loss of trust caused by Terra’s collapse. Developers of some projects, including Tron’s USDD, are not ready to fold. On the other hand, many new algo-stablecoins are losing their pegs.

The path to Terra’s revival, if any, will be long and arduous. After all, the core problem lies not in the technical design or peg mechanism, but in restoring user trust.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full stream of news, ForkLog — the most important news, infographics and opinions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!