Ethereum activates The Merge, blockchain shifts to PoS

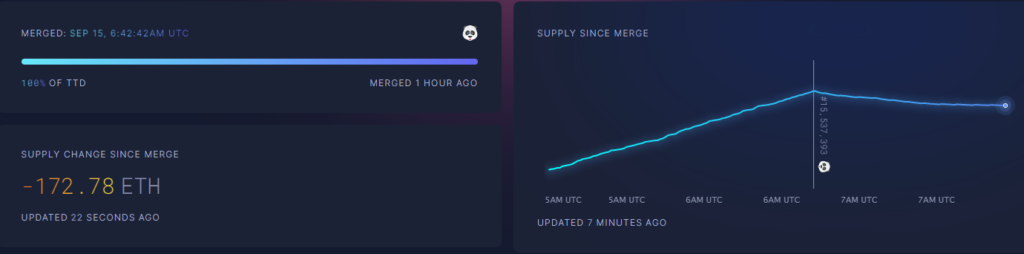

On September 15 at 9:42 (Kyiv/Moscow time), developers activated the major update The Merge on the Ethereum mainnet. The blockchain has been switched to the Proof-of-Stake (PoS) consensus algorithm.

Merge TTD hit! pic.twitter.com/eVcHiHto5u

— foobar (@0xfoobar) September 15, 2022

The activation occurred at block #15,537,393. The “tips” in the next block amounted to 44.5 ETH.

First block post merge — 44.5 ETH in tips.https://t.co/B4EqW9Qvne pic.twitter.com/I49KEQKT3m

— DeFiyst (@DeFiyst) September 15, 2022

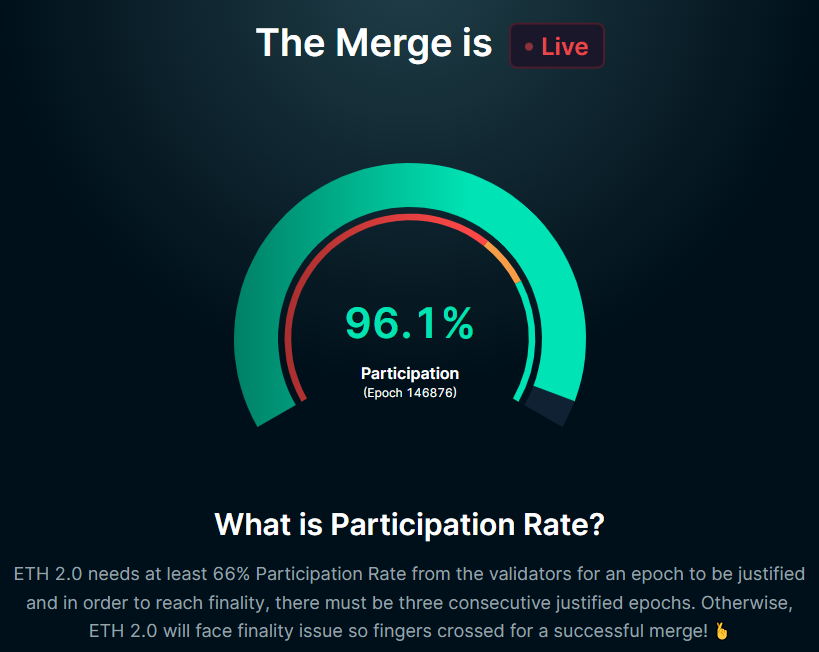

Validator participation exceeded 96% with 66% of eligible stake, according to Nansen.

Ethereum Foundation participants, during a call, noted that about 4% of validators “fell out of the network” after The Merge. They said this is not enough to harm the system in any way. To return validators to the network, they need to “fix some configuration issues”.

In a discussion with ForkLog, Bybit representatives suggested that in the near term Ethereum volatility and related crypto assets may rise. In the long term, The Merge will serve as the foundation for future system updates and “the creation of a base layer for a new Internet”.

“The merge is an incredibly important milestone in the development of Ethereum and decentralized finance applications, NFT and other on-chain projects. Because ETH, the native asset of the network, accounts for 20% of total market capitalization, the project’s success will have a significant impact on the ecosystem,” experts said.

Meanwhile, the price of Ethereum remains largely unchanged — around $1,600, with no significant volatility.

According to Ultrasound Money, Ethereum’s supply since The Merge has fallen by 172 ETH due to higher on-chain activity and the resulting rapid burning of transaction fees.

The average gas cost for ETH transfers on the Ethereum network remains relatively low — 14 gwei (about $0.40).

Famed artist Beeple shared an image in honor of the momentous event — a stylised Ethereum logo.

THE MERGE pic.twitter.com/7tdfNZiuuv

— beeple (@beeple) September 15, 2022

In December 2020, developers launched the Beacon Chain, a PoS-based blockchain that ran in parallel with the Ethereum mainnet for nearly two years, but it did not undertake any economic activity besides staking ETH. The Merge effectively represents the merger of the two chains.

The transition from Proof-of-Work (PoW) to PoS is the most important and complex upgrade in the history of the blockchain. One of the project’s founders and ConsenSys founder Joseph Lubin called the update the third major milestone in the industry after Bitcoin’s emergence and Ethereum’s creation.

The Merge aims to make the second-largest cryptocurrency more environmentally friendly. The update will also lower ETH issuance, since staking rewards are substantially smaller than PoW mining rewards. According to developers, factoring in the August 2021 London hard fork, the network will become deflationary.

At the same time, 1inch Network co-founder Anton Bukov told ForkLog that ordinary Ethereum users will not notice a meaningful impact from the move to PoS.

“Ethereum users as a smart contract platform will notice only the regularity of block production (exactly 12 seconds instead of the current ~13.5 seconds and with a wide dispersion from 1 to 60 seconds). ETH holders as a cryptocurrency will enjoy energy consumption of the network reduced by about 99%,” he said.

Bukov added that the changes in block time will raise the blockchain’s throughput by roughly 10% and may lower fees, including for transactions on Layer 2 networks.

Despite the advantages of moving to PoS, not all community members are happy with The Merge. In July 2022 influential miner Chandler Guo proposed launching an Ethereum fork, which would continue to operate on the PoW algorithm.

Potential forks were supported by some crypto exchanges, including Binance and Bybit. Against the PoW fork stood several projects such as Uniswap and OpenSea.

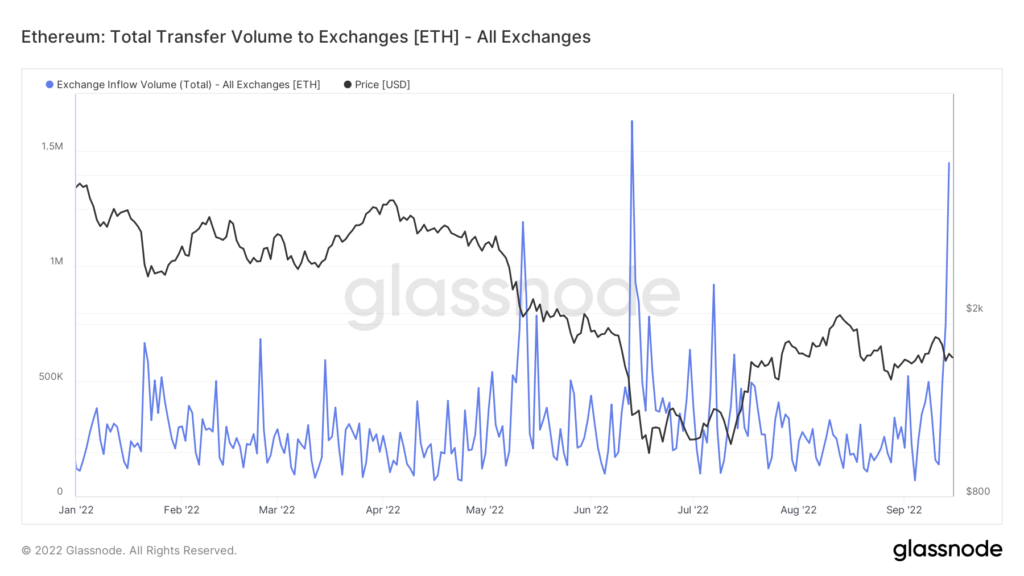

The ETHW announcement generated some buzz in the community. According to Glassnode, on September 14 there was the largest inflow of cryptocurrency to centralized exchanges since June 2022. The dynamic is also linked to users wanting to obtain the tokens of the new network.

Demand for Ethereum grew on decentralized platforms as well. According to The Defiant, as of September 14, users borrowed all available cryptocurrency on Aave — about 643,660 ETH (over $1 billion).

The hype around ETHW led to borrowing interest rates on the protocol climbing to above 190%. In the night of September 15, platform-related fees exceeded $1.5 million.

1.5 milly of fees today on @AaveAave. pic.twitter.com/6YDDaW3NiN

— Marc «Aavechan.lens» Zeller 👻 💜 (@lemiscate) September 15, 2022

The ETHW Core team intends to launch mainnet 24 hours after The Merge. The network snapshot was performed 48 hours before the anticipated activation time.

Read ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!