DeFi Bulletin: TVL Slows Its Decline as ECB and Fed Leaders Urge Faster Regulation

The decentralized finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors. ForkLog has gathered the most important events and news of the past weeks into a digest.

Key metrics of the DeFi segment

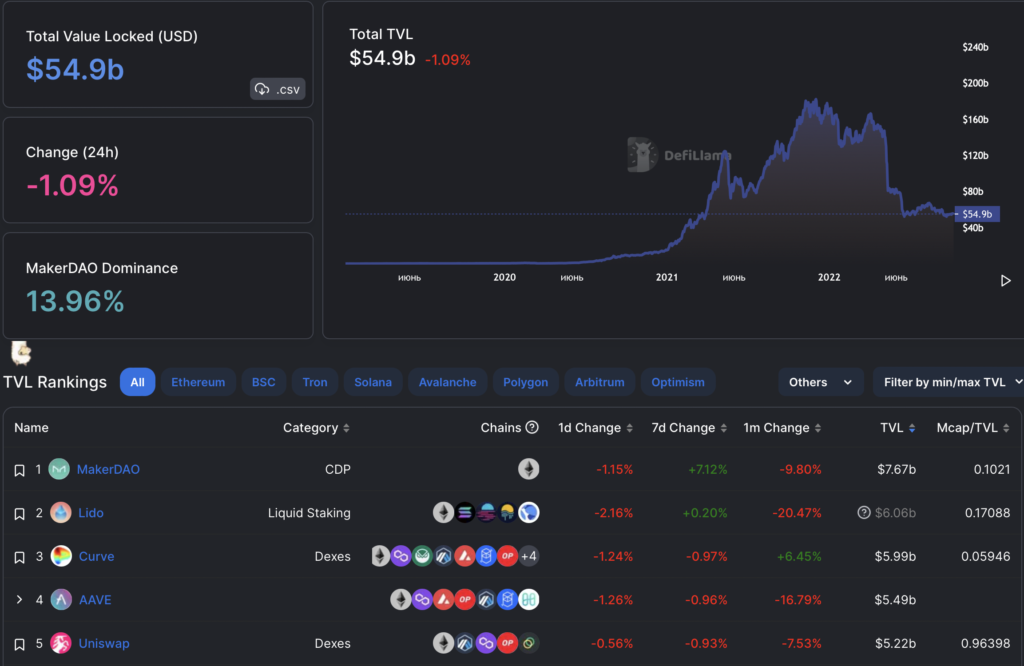

The total value locked (TVL) in DeFi protocols fell to $54.9 billion. MakerDAO led with $7.67 billion, while the second and third places are held by Lido ($6.06 billion) and Curve ($5.99 billion), respectively.

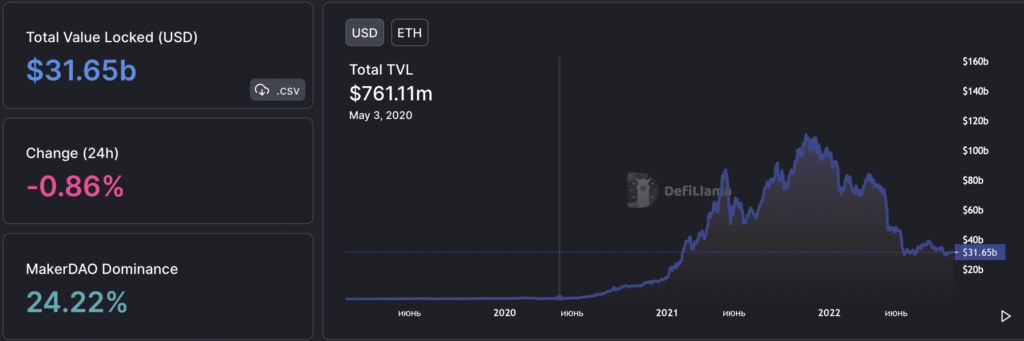

TVL in Ethereum applications fell to $31.65 billion. Over the last 30 days the metric fell by 6% (on 9 September it stood at $33.63 billion).

Trading volume on decentralized exchanges (DEX) over the last 30 days was $40.6 billion.

Uniswap continues to dominate the non-custodial exchange market — accounting for 63.4% of total turnover. The second DEX by volume is Curve (13%), the third is DODO (9.5%).

ECB and Fed chiefs call for stronger regulation of the DeFi sector

In an online discussion organized by the Bank of France, argued that tightening regulation of the DeFi sector is warranted in light of its development.

The head of the US Federal Reserve (Fed) Jerome Powell said there are structural issues in the DeFi ecosystem. In his view, one of them is a lack of transparency.

«The good news, I think, is that from a financial stability perspective, the interaction between the DeFi ecosystem and the traditional banking system is not particularly large at this point,» Powell noted.

However, Powell warned that this situation «will not persist forever». He pointed to a real need for more appropriate regulation as the DeFi sector expands.

Powell’s remarks paralleled recent findings by BIS researchers: they argue that the lack of a clear regulatory framework poses long-term risks to financial stability from DeFi.

ECB President Christine Lagarde reminded of the Terra crash. In her view, this case “justifies” tighter regulation.

«If we do not participate in this game, if we do not participate in experiments and innovations with regard to central bank digital currencies, we risk losing the anchor role we have played for many decades»,

Agustín Carstens, head of the Bank for International Settlements, also alluded to the Terra incident. He noted the role of stablecoins in DeFi and said their collateralisation is “often ineffective.” The official suggested the sector has “structural problems and internal weaknesses.”

Opinion: CBDCs will bring stability to the DeFi sector

Thomas Moser, a member of the Swiss National Bank’s board, said that CBDC can interact with the DeFi sector and provide it with greater stability.

In his words, centralisation and decentralisation in digital currencies “can work together.” He cited stablecoins USDT and USDC as examples.

However, a central bank digital currency outperforms “stablecoins,” as it “does not carry counterparty risk,” added Moser. He noted that Bitcoin and Ethereum are not suitable for supporting sustainable DeFi growth due to volatility.

MakerDAO to Invest $500 Million in U.S. Treasuries

The MakerDAO community — one of the oldest DeFi projects — endorsed a proposal to move stablecoins from reserves into short‑term U.S. Treasuries and corporate bonds in the amount of $500 million.

The DAO, operating within the project, gave the green light to a $1 million test transaction. The rest of the funds will be allocated to securities in the coming days.

Participants explained the move as an effort to strengthen the project’s balance sheet using liquid, low‑risk traditional assets.

To implement the plan, the project partnered with Monetalis, a DeFi-focused consultancy.

80% of the allocated amount will be placed in short‑term U.S. Treasuries, with the remaining 20% in corporate bonds. The $500 million will be split evenly between asset managers Sygnum Bank and Baillie Gifford, with Monetalis’ involvement.

Investments in DeFi

According to TechCrunch sources, the Uniswap Labs team is at early stages of talks to raise between $100 million and $200 million at a valuation of around $1 billion.

Polychain and an unnamed Singapore sovereign fund reportedly show interest in participating in the round. The raised funds are planned to be used to expand the product lineup.

Crypto startup Immunefi, which helps DeFi projects run bug-bounty programs, closed a Series A funding round of $24 million.

The funds will be used to develop a new version of the platform, expand the team from 50 to 100 people, and increase rewards for white-hat hackers.

Exponential, a platform for sourcing investments and assessing risk in the DeFi sector, raised $14 million in a seed round led by Paradigm.

Financing was also provided by Haun Ventures, former Andreessen Horowitz partner Katie Haun, FTX Ventures, Solana Ventures, Polygon, Circle Ventures and more than 80 angel investors.

Hacks and scams

The decentralized cross‑chain exchange Transit Swap lost around $21 million in a hacking attack. The attacker exploited a bug in the service’s smart contract.

Later, the team said the hacker returned 70% of the stolen funds. He was invited to contact the developers.

Also on ForkLog:

- The Bancor DeFi protocol community proposed burning 1 million BNT tokens.

- 1inch will integrate Unstoppable Domains service.

- Opium Protocol added support for Binance soulbound tokens in NFT avatars.

- The co‑founder of the bankrupt QuadrigaCX launched a DeFi protocol.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!