Analysts point to investor apathy in crypto funds

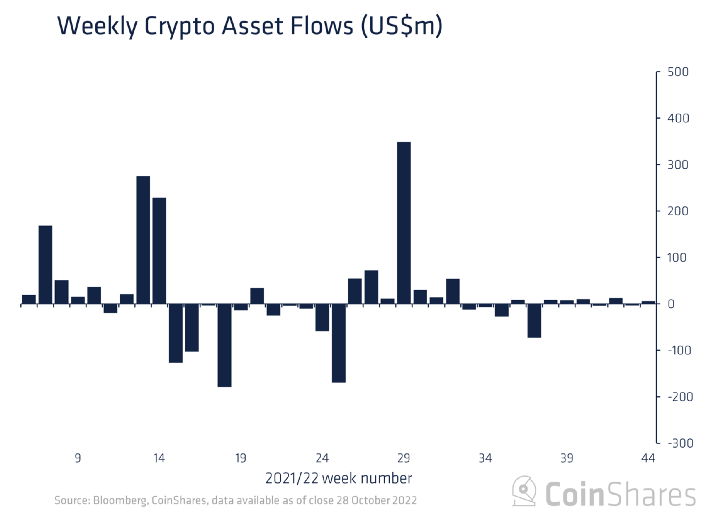

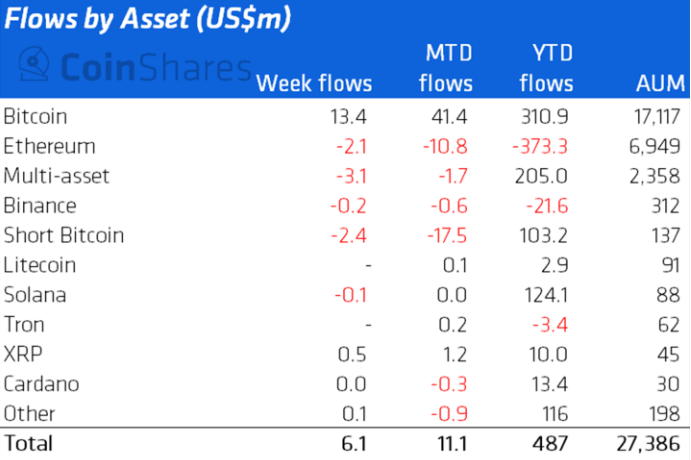

Inflow to cryptocurrency investment products from Oct 22 to Oct 28 amounted to $6.1 million, versus an outflow of $5 million a week earlier. Analysts from CoinShares said this.

Investors have remained apathetic for seven straight weeks, analysts said.

Trading volume rose 77% to $1.3 billion, but remained at extremely low levels. By comparison, a year ago the figure averaged about $7 billion.

In traditional Bitcoin funds there was inflow of $13.4 million ($4.6 million a week earlier).

Among products that allow shorting the first cryptocurrency, $2.4 million was pulled. Since mid-September, the figure has reached $20 million (15% of AUM).

Outflows from Ethereum funds totaled $2.1 million versus $2.5 million a week earlier. Negative momentum continued for the fourth week in a row.

Among basket-based altcoin products, $3.1 million was pulled. XRP-based funds attracted $0.5 million.

Earlier, trader Tone Vays predicted, that the price of the first cryptocurrency would reach $100,000 in 2023.

Read ForkLog Bitcoin news on our Telegram — crypto news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!