Bitcoin slips below $18,000 as Fed raises rates

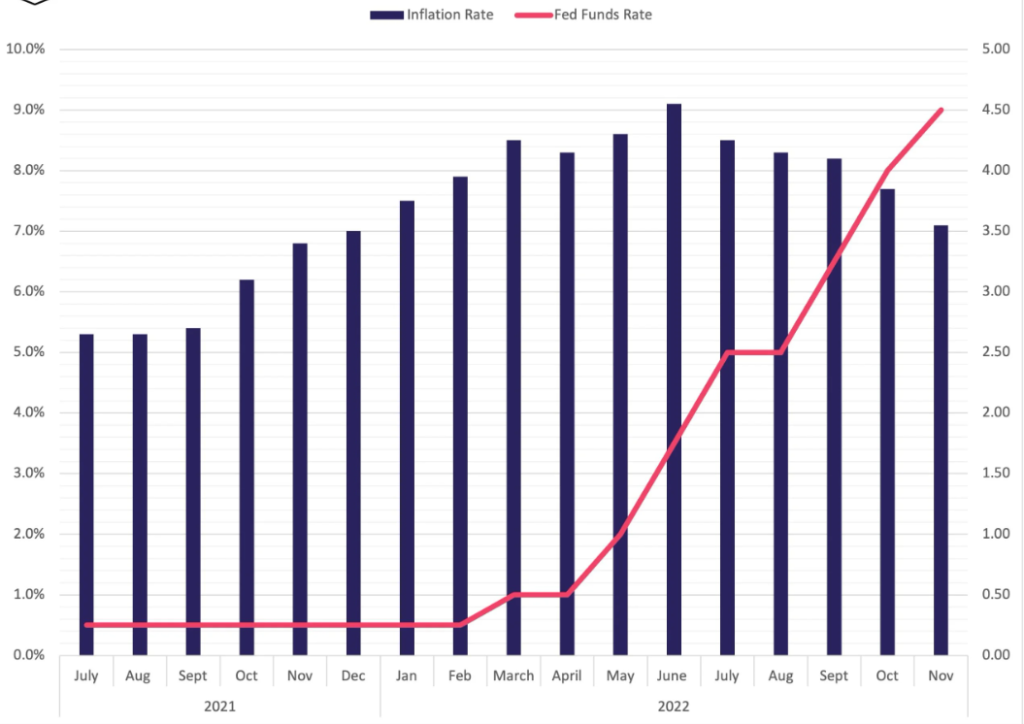

On Wednesday, December 14, the Federal Reserve raised the target range for the federal funds rate by 50 basis points—to 4.25-4.50% per year. The move marks the highest level since 2007.

The decision was broadly expected by market participants and was the seventh rate move this year. The Fed has slowed the pace of increases—after four consecutive 75‑basis-point hikes.

Bitcoin price reacted with volatility and slipped below the $18,000 level.

In the Fed’s press release, the central bank notes heightened attention to inflation risks, despite modest growth in spending and production, and a relatively low unemployment rate.

The main drivers of inflation remain demand-supply imbalances, as well as higher costs of food and energy.

Over the long run, the Fed aims for full employment and a 2% inflation target. Earlier in November, the Fed raised the target range by 75 basis points—to 3.75-4% per year. Bitcoin’s price reacted with only a modest decline.

Follow ForkLog’s Bitcoin news on our Telegram — updates on cryptocurrencies, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!