Fed raises key rate; Bitcoin edges lower

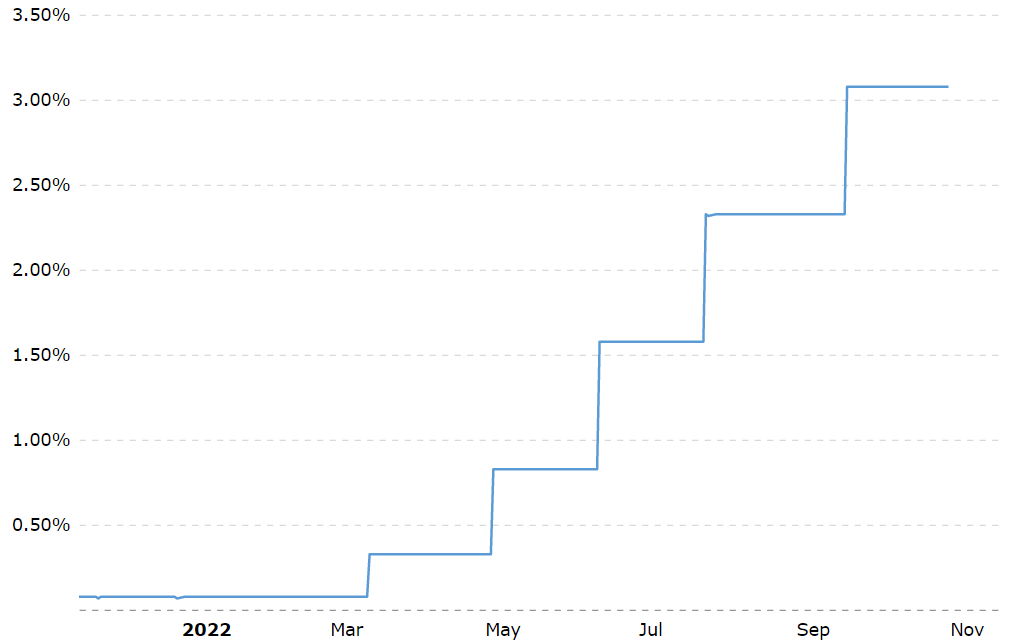

On Wednesday, November 2, the U.S. Federal Reserve (Fed) raised the target range for the federal funds rate by 75 basis points — to 3.75–4.00% per year.

This marks the sixth rate hike in 2022 and the fourth in a row with a 75bp move. The rate is now at its highest level since 2008. According to Bloomberg, the last time the agency acted so aggressively was in the 1980s.

The regulator noted an elevated inflation rate, which in September stood at 8.2% year over year. In the statement, they also stressed that the “additional pressure” on the U.S. and global economy is being exerted by Russia’s war against Ukraine.

[FOMC] is firmly committed to returning inflation to the 2% target. […] The Committee will be prepared to adjust its monetary policy stance if risks emerge that could threaten the achievement of its goals,” — the press release says.

The U.S. stock market reacted negatively to the decision. After the trading session on November 2, the Nasdaq Composite fell 3.36%, the S&P 500 lost 2.5%, the Dow Jones Industrial Average — 1.55%.

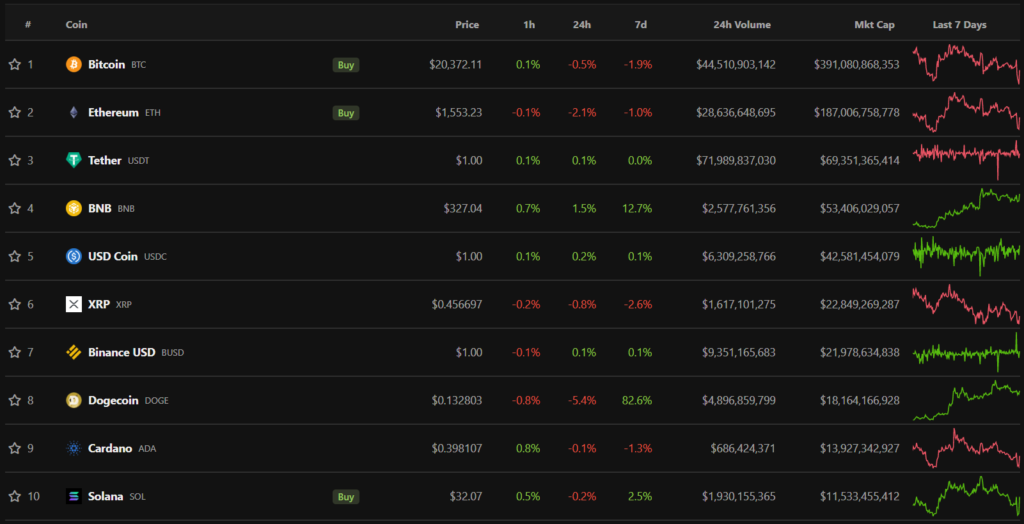

According to CoinGecko, the U.S. rate hike hardly affected the crypto market. The total market capitalization of digital assets declined by 0.5%.

In March, the Fed for the first time since 2018 raised the target range for the federal funds rate to 0.25–0.50%. The local crypto rally continued through April — Bitcoin and Ethereum reached annual highs.

In May the Fed again raised the rate — by 50 bps. In the wake of the news, Bitcoin crossed the $40,000 mark, but on the same day fell below $36,000, which marked the start of a protracted correction.

In June the Fed raised the key rate by 75 bps for the first time since 1994. The rate reached 1.5–1.75%, and Bitcoin reacted with a brief rally to $22,000, before slumping below $18,000.

By the next month, the rate increase to 2.25–2.5% led to a crypto market upswing. Bitcoin then surpassed $22,000, and Ethereum hit $1,500.

As a reminder, in September the regulator raised the rate to 3–3.25%. Bitcoin reacted by slipping below $19,000.

Follow ForkLog’s bitcoin news on our Telegram — news on cryptocurrencies, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!