Week in review: Binance accused of handling Bitzlato transactions; nearly $700m seized from Bankman-Fried

Binance was accused of processing Bitzlato transactions worth $346 million; nearly $700 million was seized from Sam Bankman-Fried; Ethereum developers implemented a shadow fork of the Shanghai upgrade; and other events from the past week.

The local Bitcoin rally continued

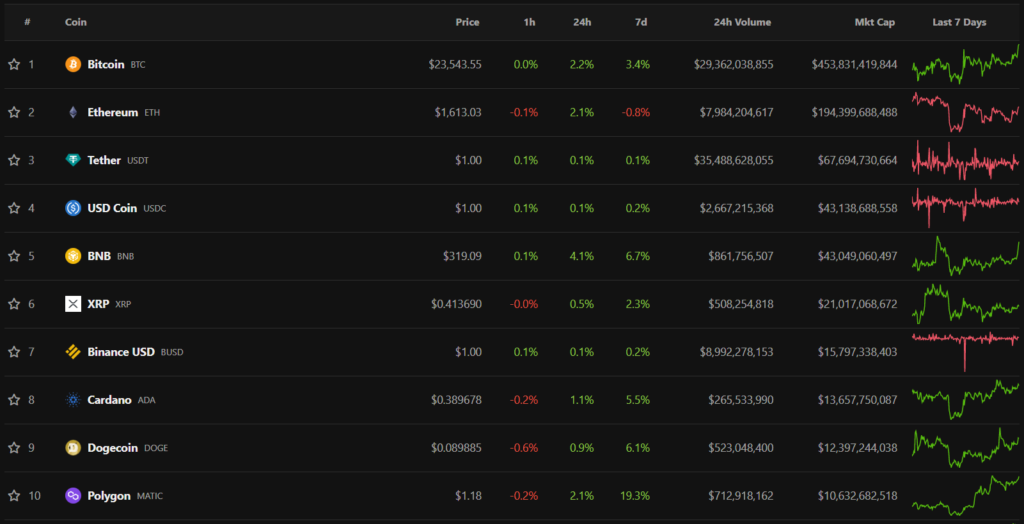

Over the week, the price of the leading cryptocurrency rose by 3.5%. On Wednesday, quotes approached the $25,000 level, which some analysts call the key for the rally to continue.

Bitcoin was trading near $23,550 at the time of writing.

Nearly all top-10 cryptocurrencies by market capitalization finished the week in the green. The exception was Ethereum, whose prices declined slightly. The best performance was shown by the Polygon (MATIC) token — its price rose 19.3%.

The total market capitalization of the cryptocurrency market stood at $1.11 trillion. The Bitcoin dominance index rose to 41%.

Binance accused of processing Bitzlato transactions worth $346 million

According to Europol, the Bitzlato converted assets linked to criminal activity amount to around €1 billion ($1.08 billion). Transactions were carried out in Bitcoin, Dash, Litecoin, as well as dollars and Russian rubles. The agency announced the arrest of Bitzlato’s CEO, CFO and CMO in Spain and two other senior executives in Cyprus and the United States.

According to Reuters, between May 2018 and September 2022 Binance processed 20,000 BTC worth $346 million for Bitzlato.

Nearly $700 million seized from Sam Bankman-Fried

U.S. federal prosecutors seized assets worth $697 million from FTX founder Sam Bankman-Fried.

The sum largely consists of 55.2 million Robinhood shares, valued at about $526 million. The list also includes three accounts at Silvergate Bank with more than $6 million in the name of the Bahamas-based subsidiary of the exchange FTX Digital Markets. Another nearly $50 million are held in Moonstone Bank.

This week in Washington listed for sale a townhouse belonging to Sam’s brother, Gabe Bankman-Fried, for $3.28 million. Shortly before the collapse of FTX, Guardians Against Pandemics hosted two parties at this house — for “high-ranking Democrats” and Republican leaders.

FTX bankruptcy lawyers asked the court to allow calling the founder Sam Bankman-Fried, his family and several former top executives of the company, as well as former Alameda Research CEO Caroline Ellison.

Apple, Google and Amazon among FTX creditors

FTX’s lawyers filed a court filing listing the creditors in detail across more than 100 pages. The list includes government agencies from several countries, tech companies, airlines and hotel operators.

The bankrupt platform was also a debtor to banks, charitable organisations, venture firms, media and several crypto companies — Coinbase, Galaxy Digital, Yuga Labs, Circle, Bittrex, Sky Mavis, Chainalysis, Messari, Binance units and Anchorage.

The list also includes major tech companies such as Apple, Netflix, Amazon, Meta, Google, LinkedIn, Microsoft and Twitter.

Tesla Bitcoin holdings unchanged

For Q4 2022, the negative revaluation of 9,720 BTC on Tesla’s balance sheet amounted to $34 million. No Bitcoin-related operations were conducted in the latest reporting period.

Ethereum developers implemented a shadow fork of the Shanghai upgrade

The Ethereum team successfully implemented a shadow fork of Shanghai to test the impact of the planned upgrade on the mainnet. During testing, developers identified a number of issues due to an incorrect Geth configuration. After fixes, all nodes operated in concert. Shanghai on the mainnet will be deployed in March this year.

Coinbase manager uncovered possible insider trading on Binance

The former concerns of the community about insider trading on Binance were confirmed by Coinbase director Conor Grogan. Analyzing the activity of several linked anonymous wallets over more than a year and a half, he found a common pattern: before listing on Binance, accounts bought significant amounts of tokens and dumped them as soon as trading began.

The activity touched Rari Governance (RGT), Ethernity Chain (ERN), Tornado Cash (TORN), Ramp (RAMP) and Gnosis (GNO).

El Salvador president accused of silencing country’s achievements after Bitcoin adoption

President Nayib Bukele said that foreign media create a negative image of El Salvador after the legalization of the first cryptocurrency, ignoring the country’s achievements.

Bukele pointed to “hundreds” of articles criticizing the government’s Bitcoin policy and spoke of a possible default. However news about the country’s external debt repayment was largely ignored by major media, the president stressed.

Earlier, Dante Mossi, head of the Central American Bank for Economic Integration, said Bitcoin and other cryptocurrencies are “negligible” among the population of El Salvador.

What to discuss with friends?

- Miner solo with 10 TH/s hash rate mined a Bitcoin block.

- TON validators will vote to “freeze” 194 inactive addresses with coins worth $2.5 billion.

- South Korean authorities announced a search for the founder of Bithumb. The exchange’s offices were raided.

- The Aptos token price rose more than 400% in a month.

GGC International filed suit against Roger Ver

GGC International, tied to Genesis Global Capital, accused the Bitcoin.com founder Roger Ver of failing to settle debts on cryptocurrency option trades totaling $20.86 million.

Roger Ver said he had $21 million and explained the move as an attempt to obtain “solvency guarantees” for Genesis, which was one of the conditions of the signed agreement.

Celsius proposed issuing a token to settle obligations

In bankruptcy proceedings Celsius Network is considering issuing a token to satisfy creditor claims. Lawyers noted this would yield greater restitution than selling illiquid assets at current low prices.

An idea to follow Bitfinex’s example was proposed by Celsius investors. The crypto exchange reimbursed losses from the 2016 hack in this way.

CAR to develop regulatory framework for crypto legalization

The authorities of the Central African Republic will develop a legal basis for legalising digital assets and accelerating development of the national economy. This was stated by President Faustin-Archange Touadéra.

A dedicated committee has been formed to implement the initiative, responsible for drafting a bill on cryptocurrency use and tokenisation. It includes 15 specialists from five CAR ministries.

Russia’s Duma outlined miners tax calculation principle

Mining taxation in Russia will be conducted analogously to other business and depend on the form of registration.

Lawmakers are considering treating mining as one of the forms of entrepreneurial activity, so tax rates could apply “as for all.” A single imputed income tax — from 7 to 15% — or a profit tax — 20% — could be established.

The State Council’s Energy Committee has recommended to the government a total ban on mining in residential buildings to prevent fires.

Also on ForkLog:

- Binance customers complained about account blocks.

- The head of the SEC described three ways to identify fraudulent crypto projects.

- The difficulty of Bitcoin mining again reached an all-time high.

- Russians began to buy data to circumvent blocks on Bitcoin exchanges.

What else to read?

Armed with technical-analysis tools, on-chain indicators and expert opinions, ForkLog has analysed the current market situation and determined whether Bitcoin has fuel for a rally in 2023.

In traditional digests, ForkLog has gathered the main weekly events in cybersecurity and artificial intelligence.

The DeFi sector continues to attract heightened attention from crypto investors. ForkLog has gathered the most important events and news of recent weeks in a digest.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!