March in Figures: Inflows to DeFi and Bitcoin’s Recovery Amid the Banking Crisis

Bitcoin closed its best quarter since early 2021; Fear and Greed index at yearly high; DeFi liquidity inflows. March ForkLog recap.

Key highlights

- Bitcoin closed its best quarter since the start of 2021. Leading cryptocurrencies were in demand amid the crisis in the U.S. banking sector.

- “Fear and Greed Index” updated its annual high, signalling investor optimism.

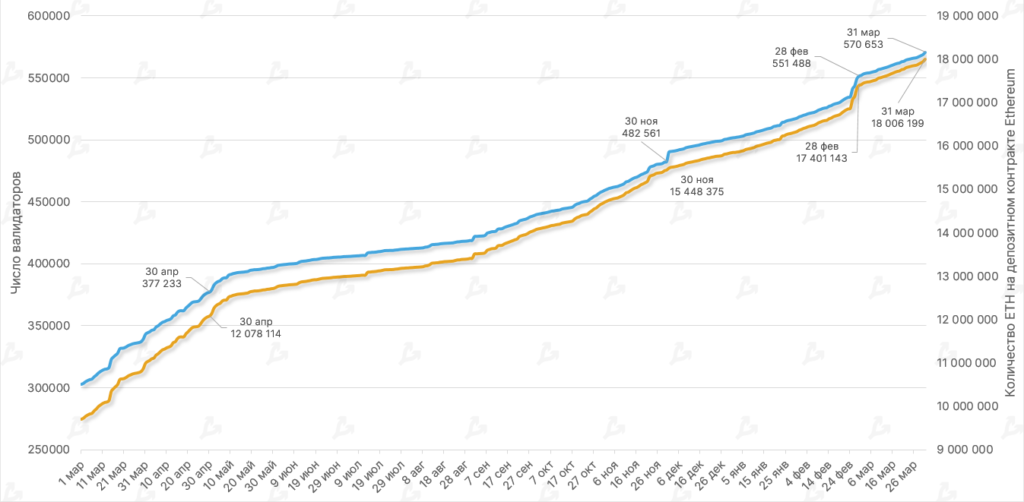

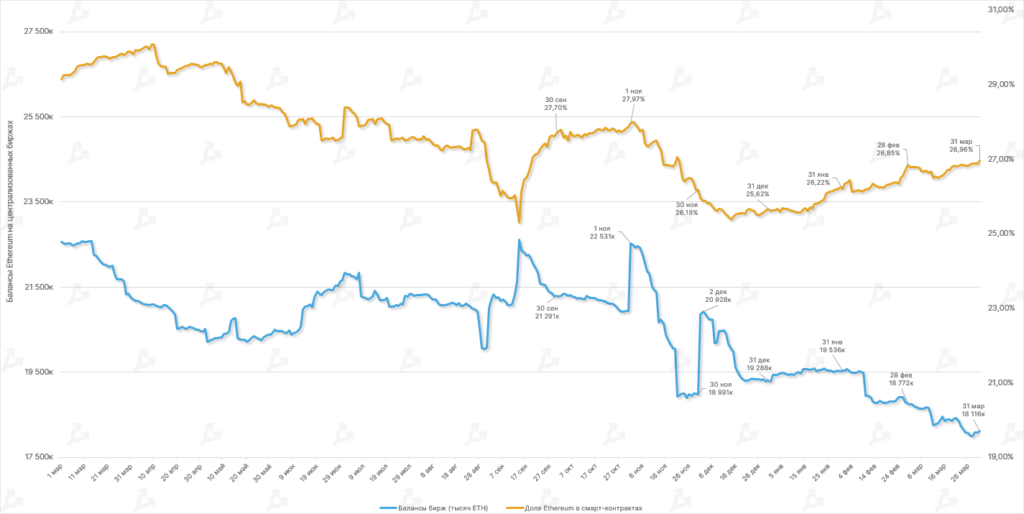

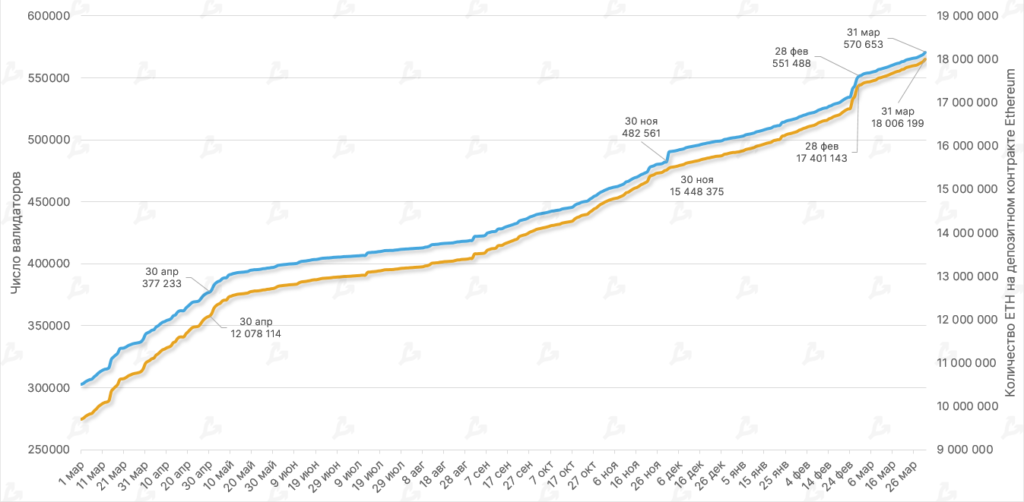

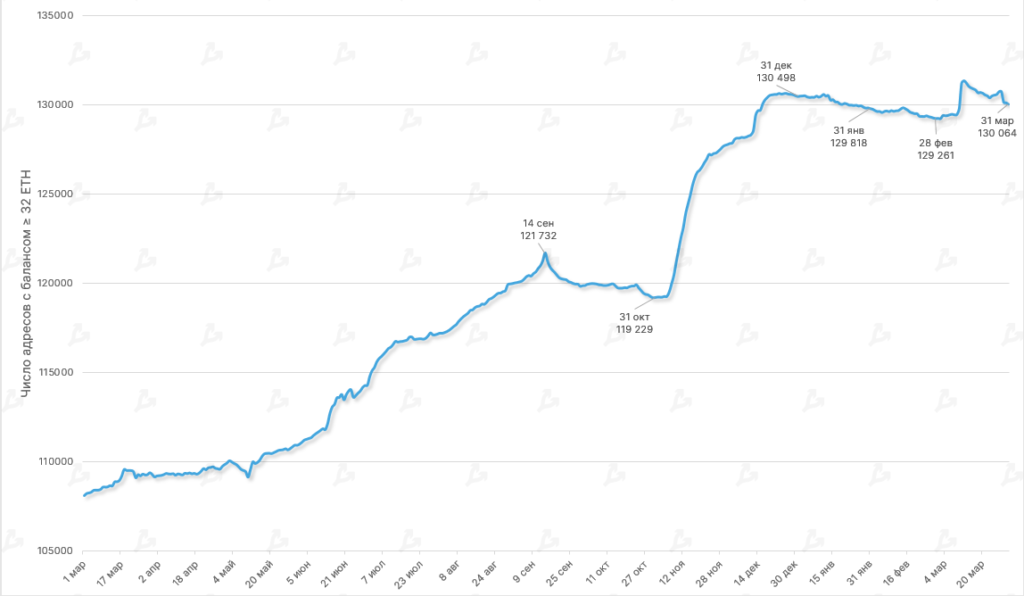

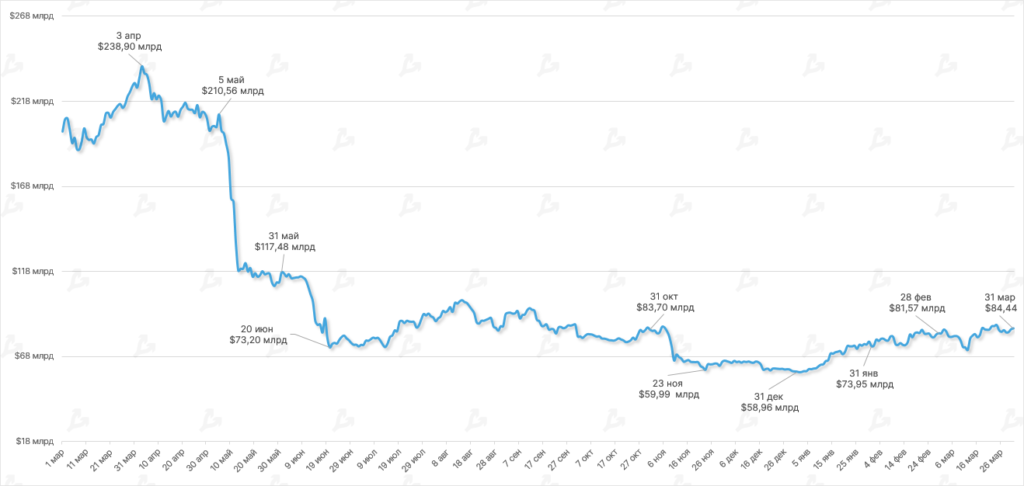

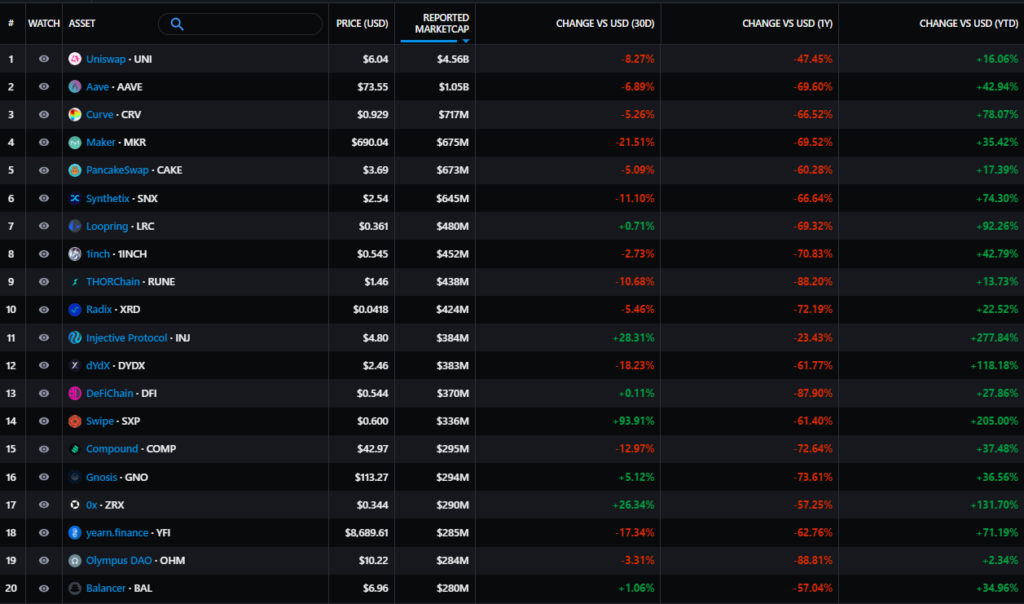

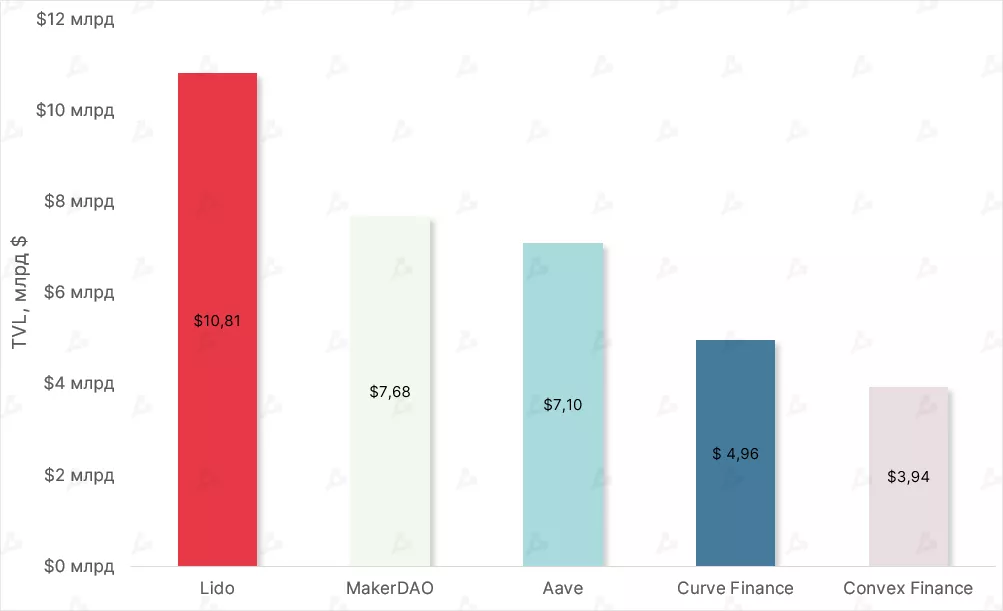

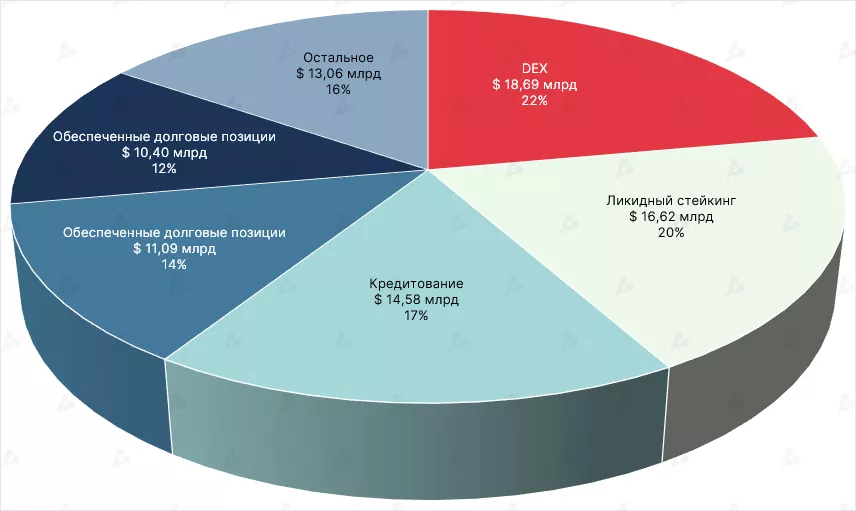

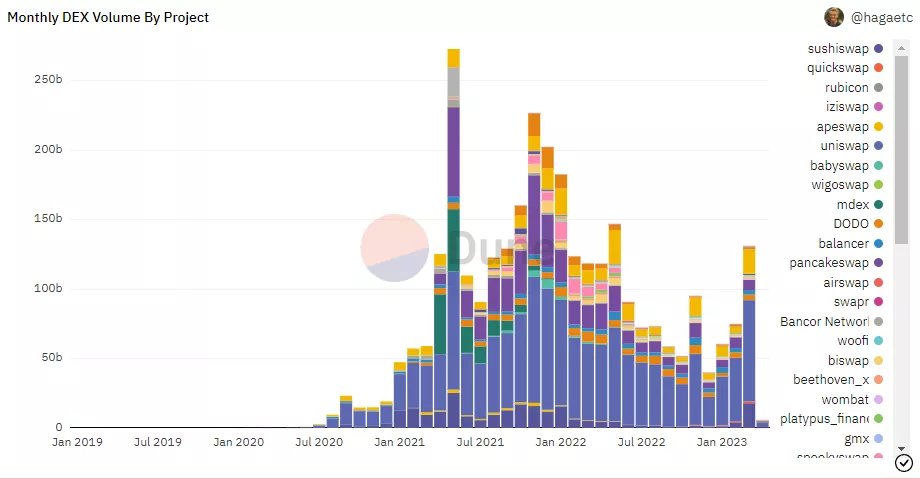

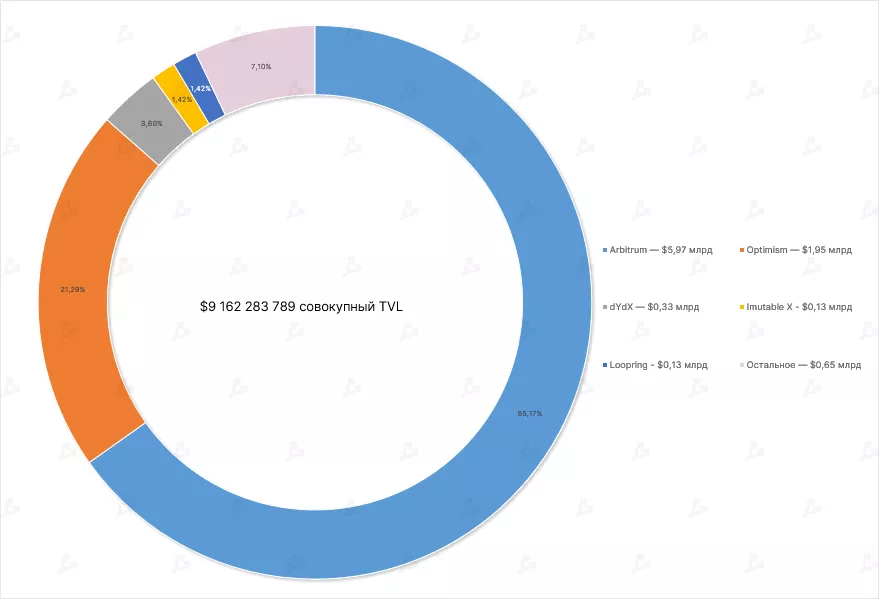

- Liquidity inflows continued into the decentralised finance sector.

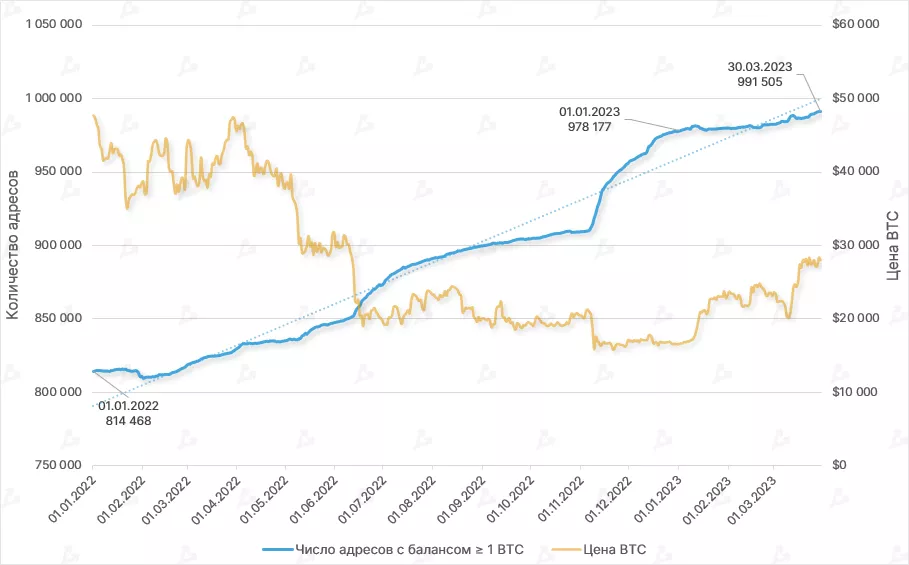

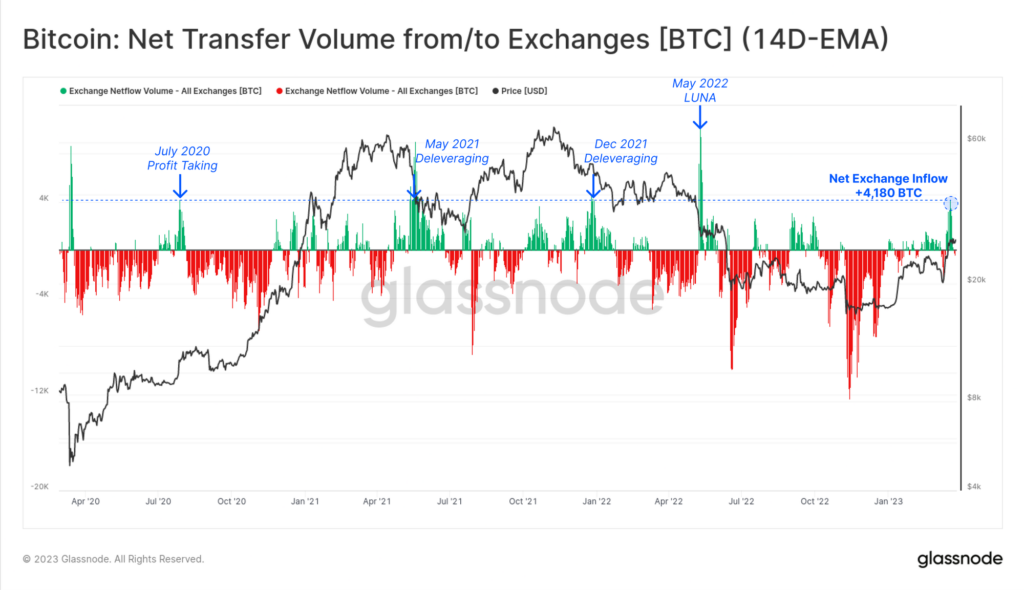

- On-chain indicators signal the potential for further upside in the first cryptocurrency.

- Profit-taking was largely concentrated on centralised exchanges by speculators. Hodlers remain steadfast.

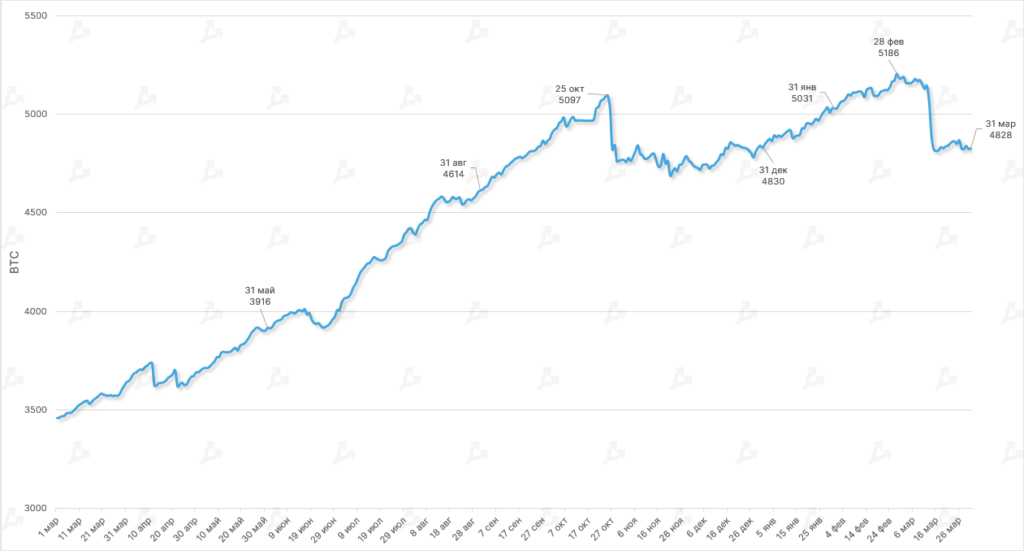

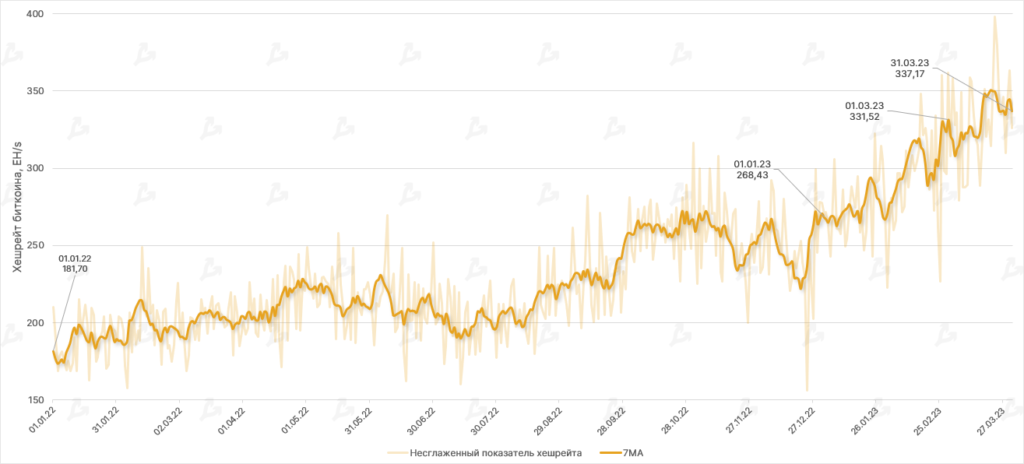

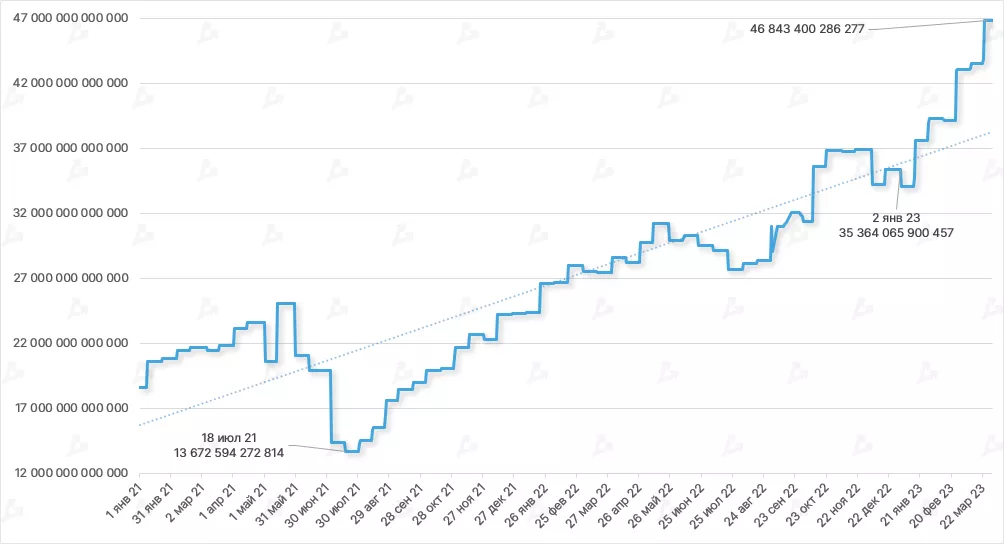

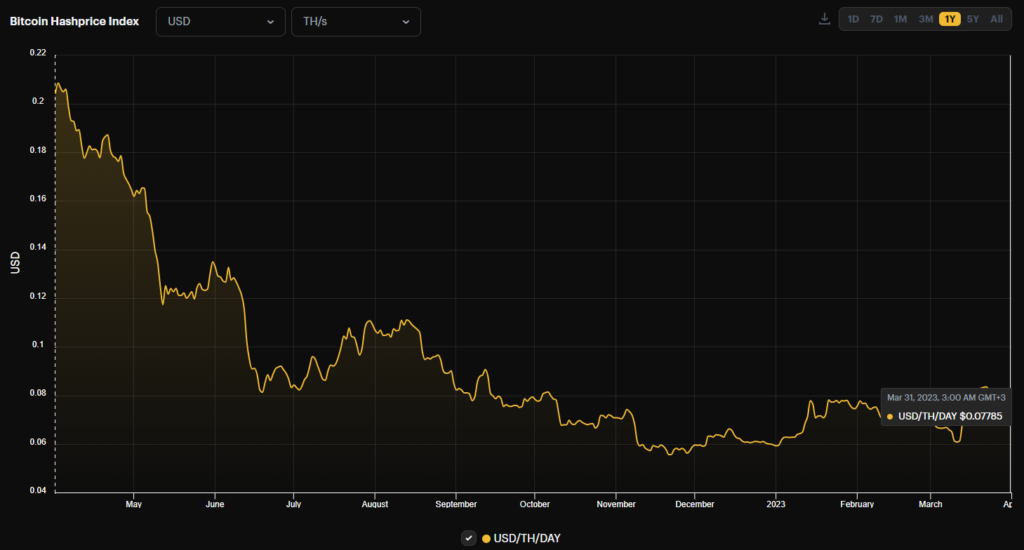

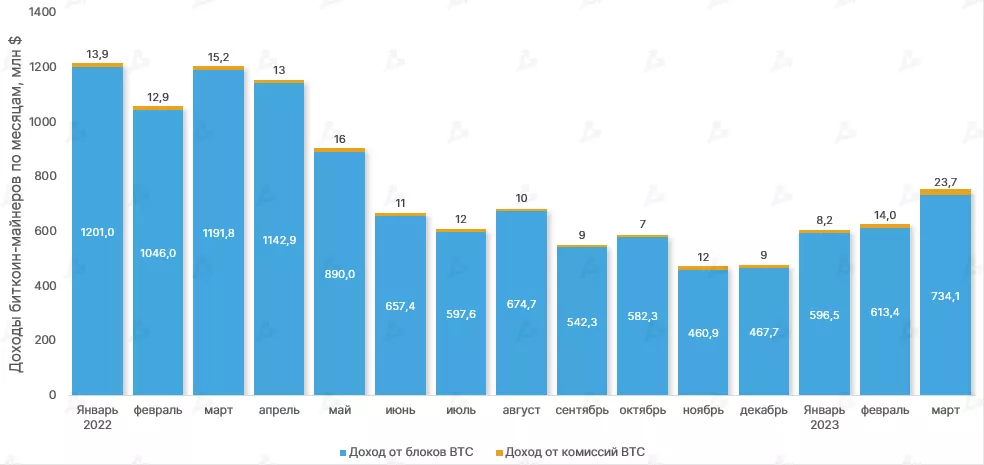

- Hashrate and mining difficulty for digital gold reached new highs again.

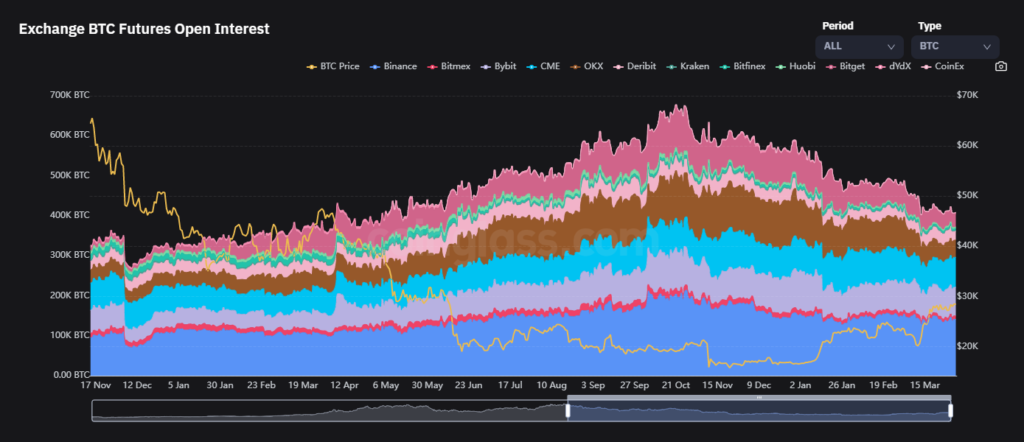

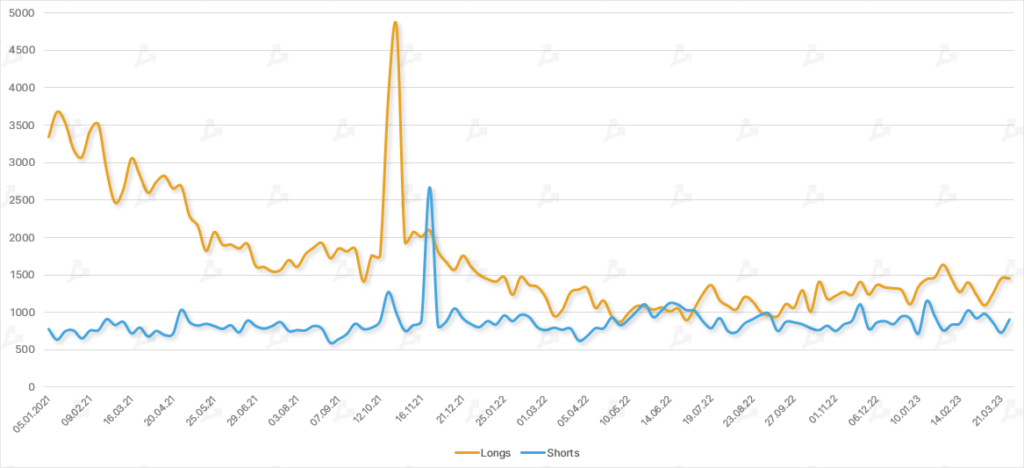

- Investors showed strong interest in crypto derivatives. Open interest in options reached an all-time high.

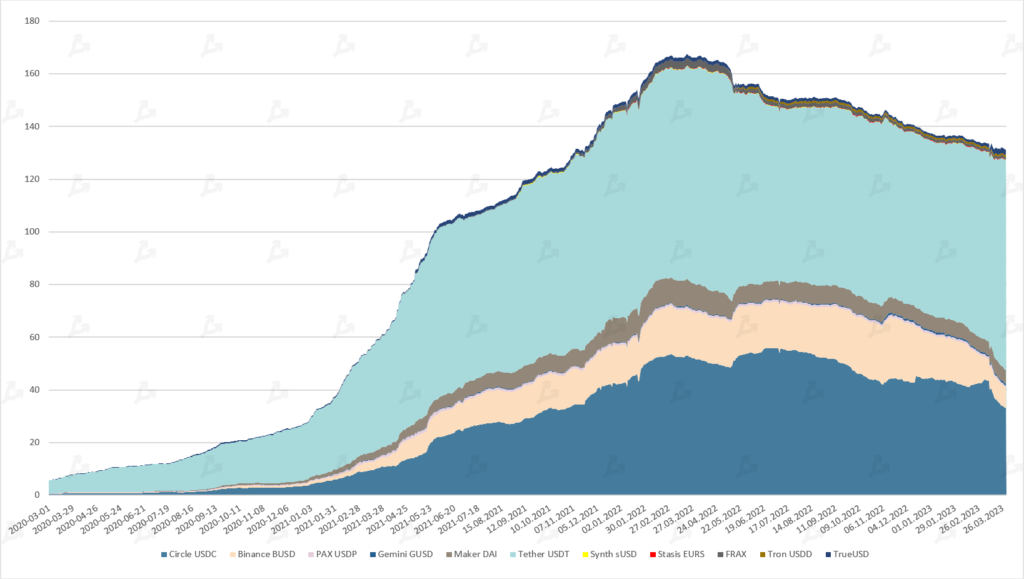

- Depeg of USDC led to significant changes in the stablecoins segment.

Dynamics of Leading Assets

- U.S. regulators charged several industry figures (Huobi, Coinbase, Justin Sun, SushiSwap). Despite the negative reaction to Bitcoin and the market (on March 10 the price dipped to $20,000), sentiment quickly turned bullish.

- A banking crisis began in the United States and amid macroeconomic instability, the crypto market posted notable gains, and its market capitalization returned to above $1 trillion. On March 30, Bitcoin hit a local high above $29,000.

- By the month’s end, Bitcoin was up 22.96% and Ethereum 13.46%. In Q1 2023, both cryptocurrencies rose by 71.77% and 52.15%, respectively.

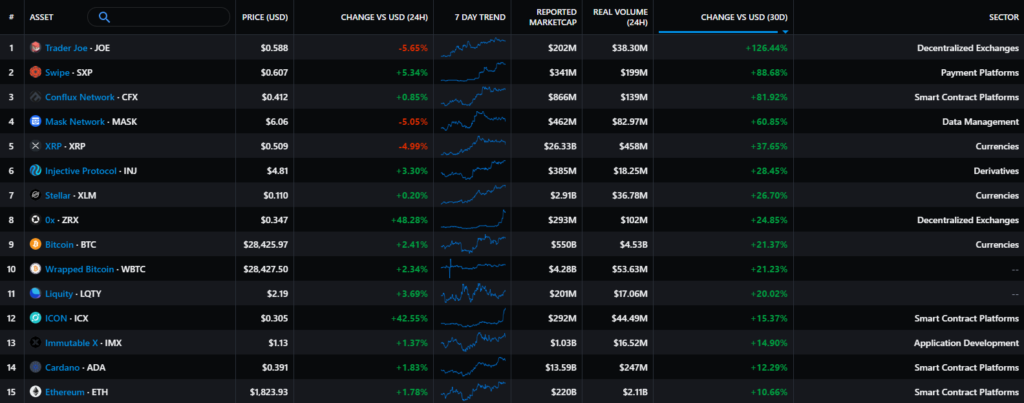

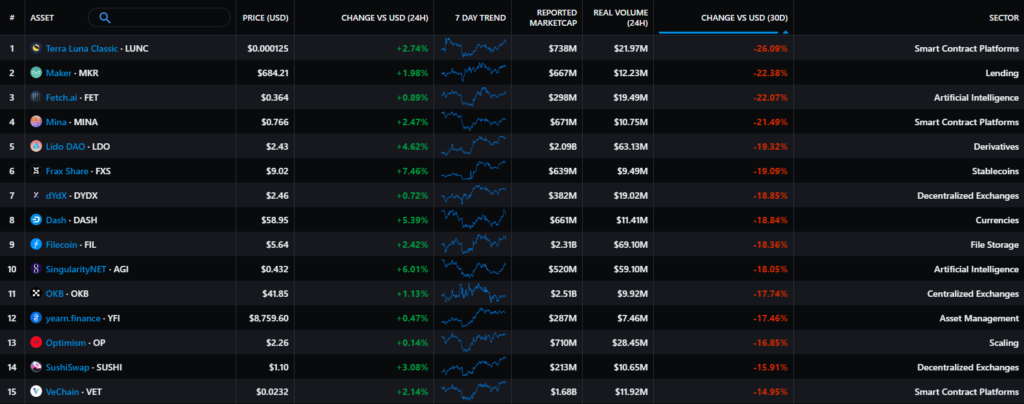

Among the successful projects in March, the Avalanche-based token Trader Joe (JOE) stood out. Platform trading volume rose significantly thanks to the prior integration of a new liquidity-provision model. Additionally, the DEX added support for Arbitrum, and after listing, its DAO received a substantial ARB allocation. Other gainers include Swipe (SXP) and Conflux (CFX). The former announced a rebranding to Solar, and the latter expanded in Asia with new partnerships.

Losers of the month included Terra Luna Classic (LUNC) — amid the arrest of Terraform Labs founder Do Kwon — as well as Maker (MKR) and Fetch.ai (FET).

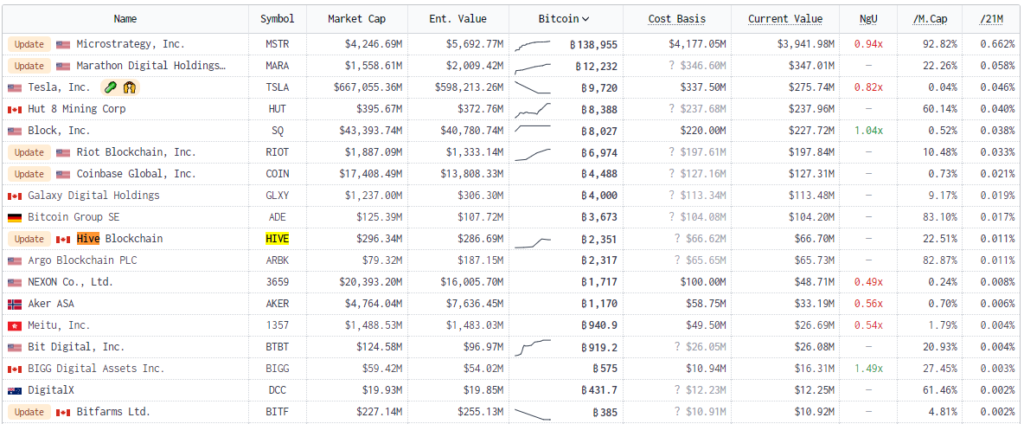

Stocks of crypto-related companies

Mining equities performance

Marathon Digital (MARA):

+21.45%

Market sentiment, correlations and volatility

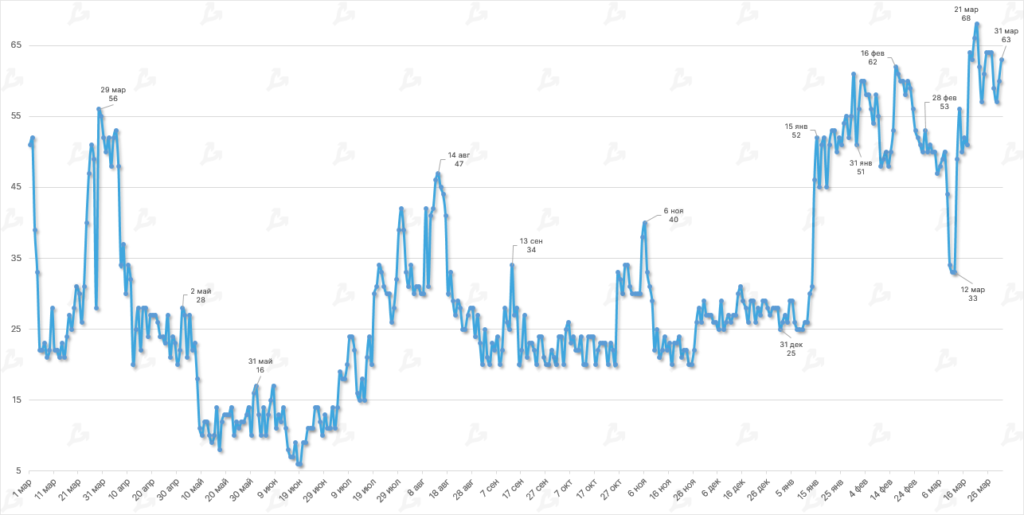

- In March, the Fear and Greed Index updated its annual high, ahead of the next Federal Reserve meeting, reaching 68. This level is consistent with November 2021 when Bitcoin prices neared $20,000 and then moved to an all-time high.

- The index’s low of 33 was recorded on March 12. The drop was attributed to panic following the depeg of the USD Coin (USDC) from the U.S. dollar.

- The index’s trajectory points to investor optimism despite banking sector concerns and intensified regulatory pressure on sector players. This may signal the start of a new bull run.

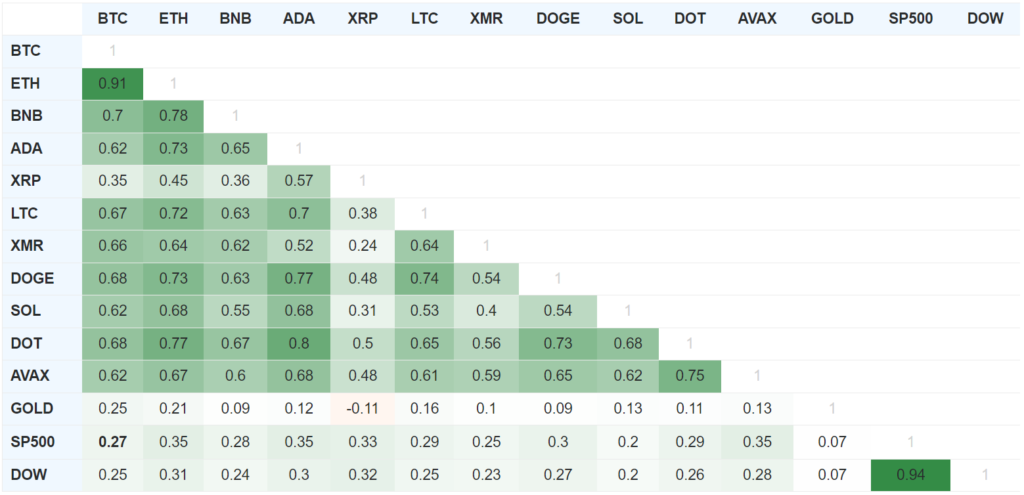

- In March, Bitcoin’s statistical correlation with the U.S. stock market weakened significantly. Its correlation with the S&P 500 fell to 0.27 (0.42 in February), and with the Dow Jones index to 0.25 (0.38 the previous month).

- Bitcoin price and gold moved in lockstep; however, the correlation between the two assets strengthened to 0.25 from 0.15 in February. Against the backdrop of the banking crisis, the digital asset demonstrates better performance relative to traditional financial instruments.

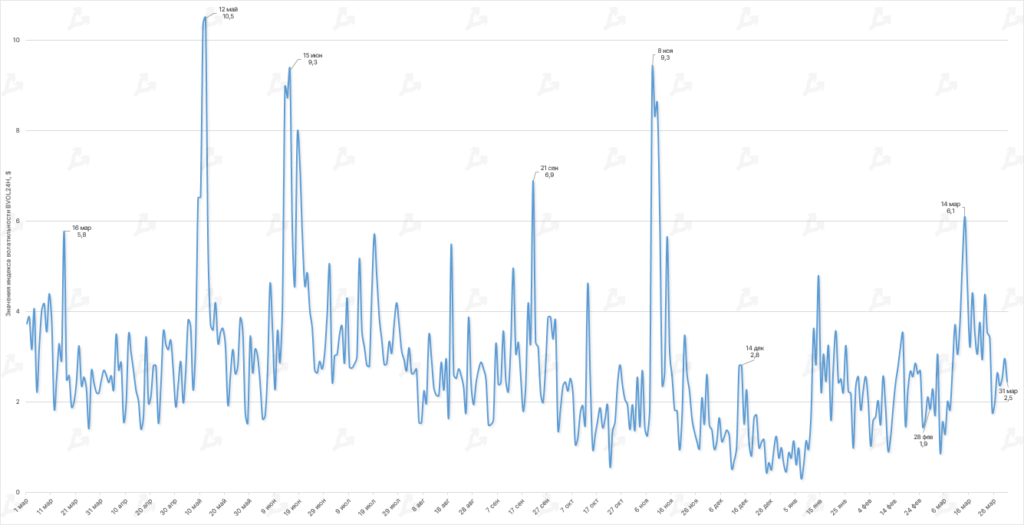

- The average BVOL24H over the last month stood at $3, higher than February’s $2.1.

- The indicator reached a high of $6.1 on March 14, when prices rose above $26,000.

Macro backdrop

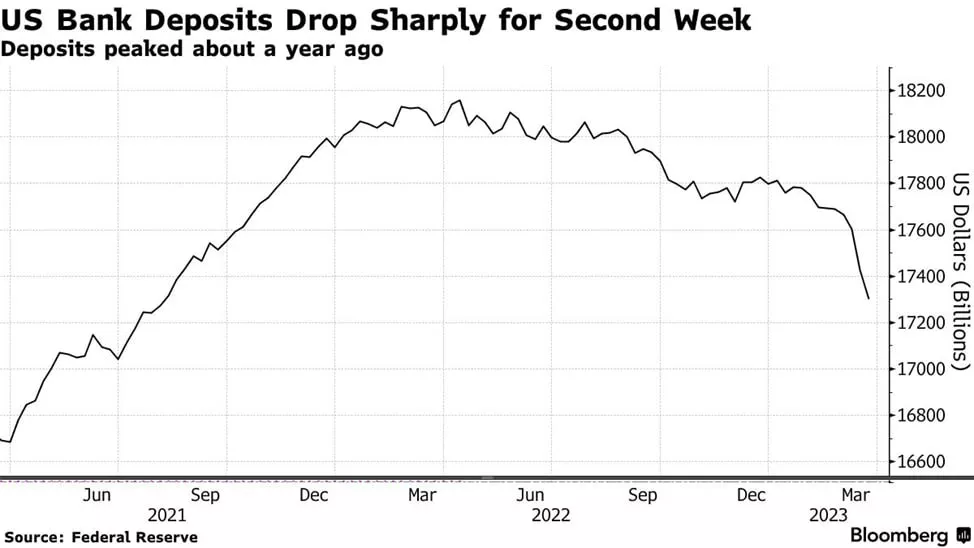

- The U.S. banking crisis has cooled. A ninth straight week of falling deposits in the sector (including $125.7bn from March 16–22) and FDIC reserve exhaustion signal continued risks in the system.

- William Barr, Deputy Treasury Secretary and FDIC Chair Martin Greenberg and Janet Yellen expressed confidence in the health of credit institutions. Under the BTFP Federal Reserve System allocated $64.4bn; total across all banking support programs stands at $383bn.

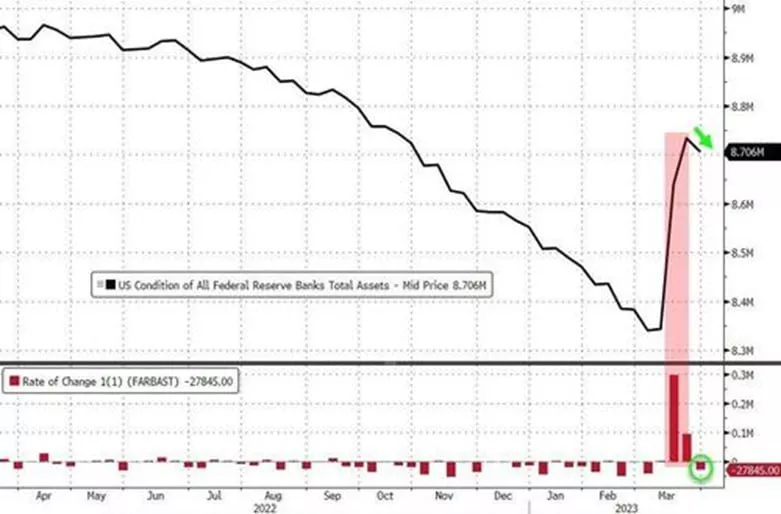

- Over the past three weeks, the central bank’s balance sheet rose by $304bn, retracing almost two-thirds of the QT reduction since April 2022.

- Stabilising sentiment reopens the case for a 25 basis point hike by the Fed at the May 3 meeting. The probability rose to 48.4%. During the peak of banking turmoil, traders leaned toward a cut or keeping rates unchanged.

- In March the Fed raised the target range to 4.75–5%. The path forward will depend on banking sector developments and upcoming macro data—especially services inflation and employment (April 7).

- The Fed’s liquidity injections helped the S&P and Nasdaq-100 close the first quarter up 7% and 20.5%, respectively. Bitcoin tested the level above $29,000.

On-chain data

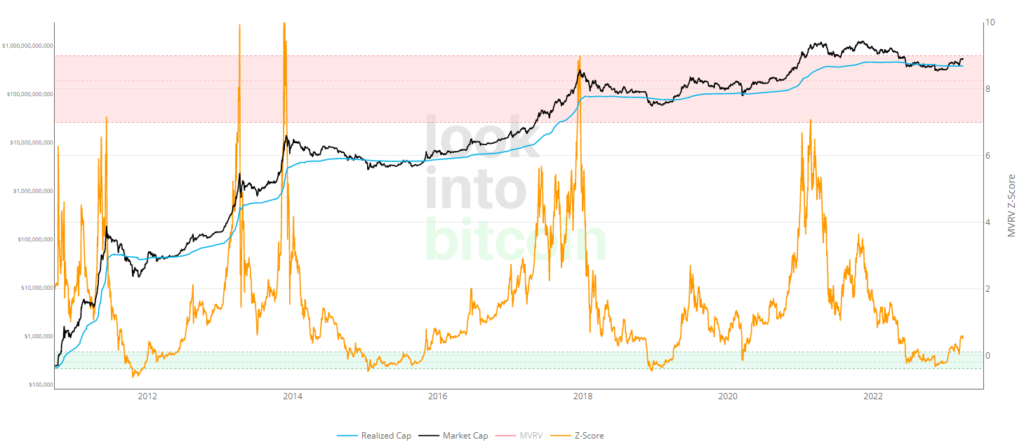

- The MVRV Z-Score reached its highest level since the start of May 2022 — 0.6. The last time the metric was at such a level was ahead of the Terra collapse.

- A gradual move away from oversold green zone suggests continued market recovery.