US rescue saves SVB and Signature Bank depositors; stablecoins narrow the depegging.

The US Treasury, The Fed and FDIC announced the rescue of SVB and Signature Bank — on March 13 depositors will have access to their funds at the expense of shareholders and some holders of unsecured bonds.

On March 10, the California Department of Financial Protection and Innovation closed SVB and appointed the FDIC as receiver.

Regulators said the move was necessary to shore up confidence in the banking system amidst a sharp fall in the capitalization of regional lenders. The FDIC’s losses in reimbursing uninsured depositors will be covered by a special bank assessment.

The backing of the agencies will not involve taxpayers’ funds, the statement said.

The Federal Reserve Board authorised access to financing for banks to ensure their ability to meet depositors’ demands.

In addition, the SVB measures will also affect Signature Bank. The latter, together with Silvergate, is a cornerstone bank for participants in the crypto industry.

Paxos said it held $250 million on accounts at Signature Bank, as well as an undisclosed amount of private deposits. The latter significantly exceeded the FDIC per-account limits in each case.

Paxos currently holds $250M at Signature Bank and holds private deposit insurance well in excess of our cash balance and FDIC per-account limits. Seeking private deposit insurance is part of our conservative approach to managing customer assets exceeding FDIC insurance limits.

— Paxos (@PaxosGlobal) March 12, 2023

«All PUSD reserves are fully collateralised and can be redeemed 1:1 in US dollars at any time», the company asserted.

According to Paxos, 90% of the stablecoin’s backing is placed in short-term US Treasuries and сделках РЕПО overnight. Such a structure helps reduce risks to the US banking system.

Coinbase also said that it would be able to convert USDC to US dollars on March 13, following the authorities’ statements. In light of regulator actions regarding Signature Bank, the exchange is conducting similar operations through other institutions.

As of close of business Friday March 10 Coinbase had an approximately $240m balance in corporate cash at Signature. As stated by the FDIC, we expect to fully recover these funds. https://t.co/XY5L7m4RMs

— Coinbase (@coinbase) March 12, 2023

«On Coinbase’s balance sheet, it held $240 million. […] We expect full recovery of these funds», the company said.

Ранее компания Circle promised to cover “any shortfall” in the backing of the USDC stablecoin.

The TrueUSD issuer commented on the Signature Bank situation in a similar vein. Techteryx emphasised that the bank’s closure affected a ‘small number’ of users.

The US Government announced the closure & backstopping of Signature Bank. As a result, TrueCoin paused TUSD minting & redemption for our small number of Signature Bank users. Minting & redemption continues unaffected across the rest of our banking network.https://t.co/kLKvrRUhE1

— TrueUSD (@tusdio) March 13, 2023

«On Coinbase’s balance sheet, it held $240 million. […] We expect full recovery of these funds», the company said.

According to the dashboard, the company held $852.3 million of the $2.09 billion in stablecoin reserves on Signature Bank accounts.

CTO Paolo Ardoino of Tether assured that the issuer of USDT has no relation with Signature Bank.

#tether doesn’t have any exposure to Signature Bank.

— Paolo Ardoino ? (@paoloardoino) March 12, 2023

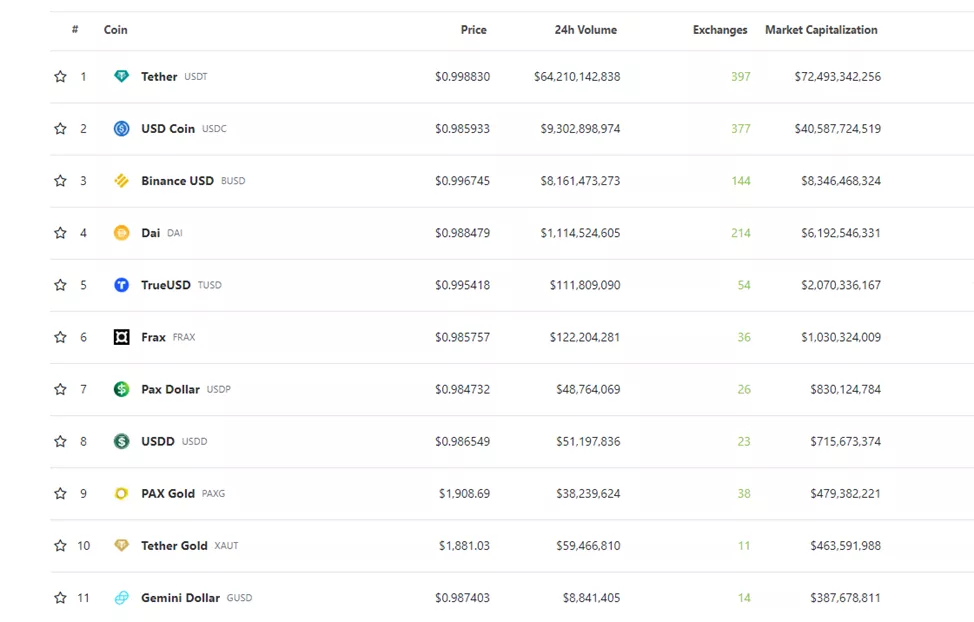

The statements by U.S. banking regulators helped narrow the discount of stablecoins to parity. As of writing, the smallest discounts were for USDT, TUSD and BUSD.

Prices of USDC, DAI, FRAX, USDP, USDD and GUSD still deviate by more than 1%.

The SVB rescue helped reduce the risk of a bank run across the U.S. banking system and prompted a revision of expectations about the Federal Reserve’s future policy path.

According to futures, at the March 22 meeting the market expects a 25 basis-point hike with a 93.7% probability. On Friday, with odds of 4:6, traders did not rule out a move twice as large.

Against this backdrop, the cryptocurrency market cap over the last 24 hours rose by 7.8%. Bitcoin rose 9.4%, to $22,300; Ethereum up 9.3%, to $1,600.

Earlier, the MakerDAO community voted to adjust protocol parameters to limit the impact of USDC’s problems on DAI.

Because ofthe USDC depeg, the parity to the dollar was lost by the algorithmic stablecoins, which had allowed using the asset as collateral for issuance.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!