Analysts say the bear market in Bitcoin has ended

Bitcoin price sits above an accumulation cluster of $16,000–$25,000, where most coins have moved to buyers. On-chain indicators show the bear phase in Bitcoin’s market has ended, according to Glassnode.

Is the #Bitcoin bear market over?

With a rally 100% off the lows, $BTC is trading above a very large cluster of supply, that formed the 2022 floor.

This week, we investigate indicators showing if the market making a robust bear market recovery…or not.https://t.co/eeQ1xeE07I pic.twitter.com/PKHJc7EF18

— glassnode (@glassnode) April 17, 2023

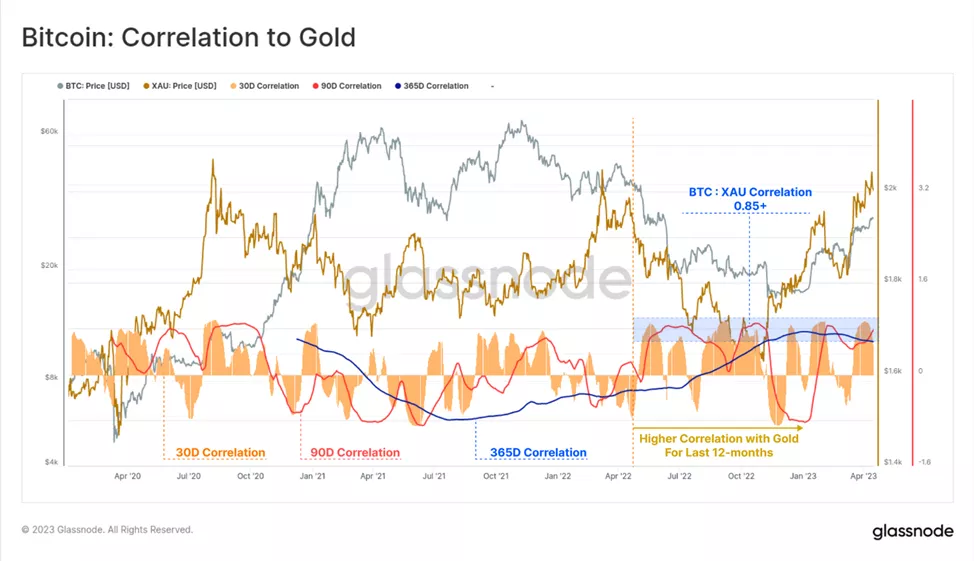

One of the drivers of the price doubling from November lows was turmoil in the US banking sector and, as a result, a rise in the perception of Bitcoin as a ‘safe-haven asset’.

Analysts noted a strengthening of the correlation between gold and its digital counterpart on a 30-day, three-month and yearly basis as demand for ‘hard money’ grows.

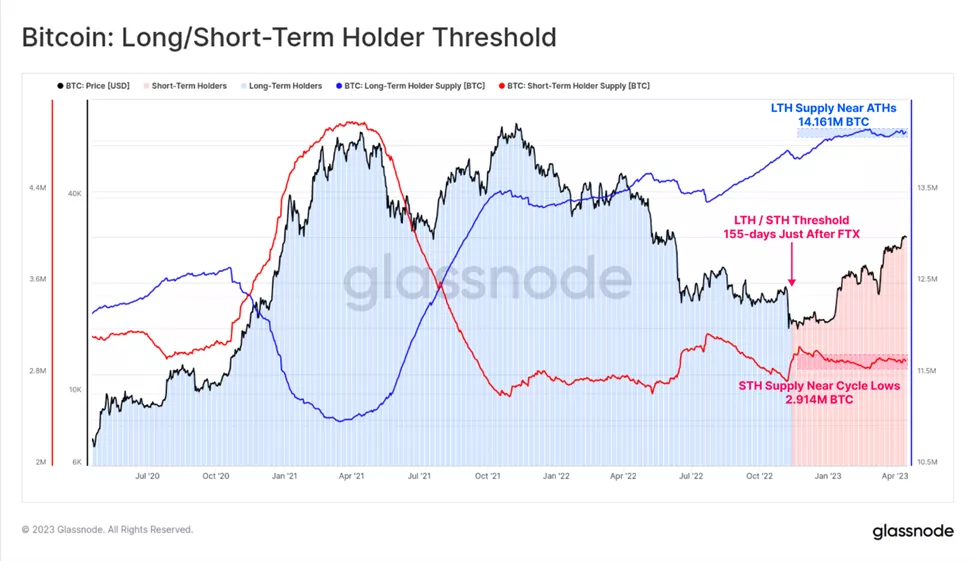

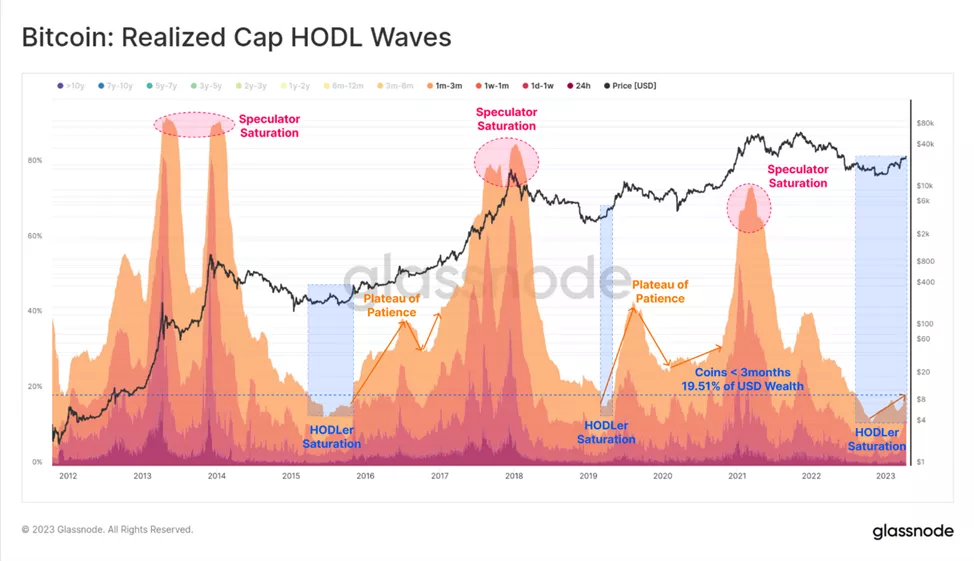

Experts found a predominance of purchases among hodlers prior to the FTX collapse (they currently hold 14.16 million BTC) and, overall, neutral sentiment among speculators after that episode in history — the number of coins they have held over the last 155 days hovered near the current 2.914 million BTC.

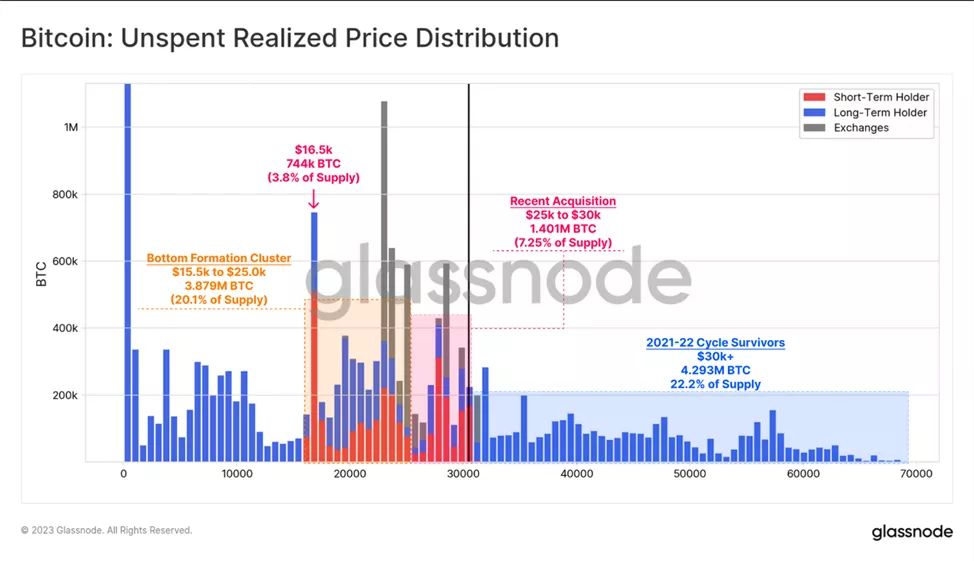

By price levels and groups, analysts identified three important clusters:

- < $25,000 — the majority of coins changed hands between June 2022 and January 2023, roughly evenly split between hodlers and speculators;

- from $25,000 to $30,000 — recent acquisitions (7.25% of BTC in circulation), reflecting a combination of profit-taking and technical buying after breaking the $25,000 psychological level;

- > $30,000 — ‘survivors’ of bear market, long-term investors (22.2%).

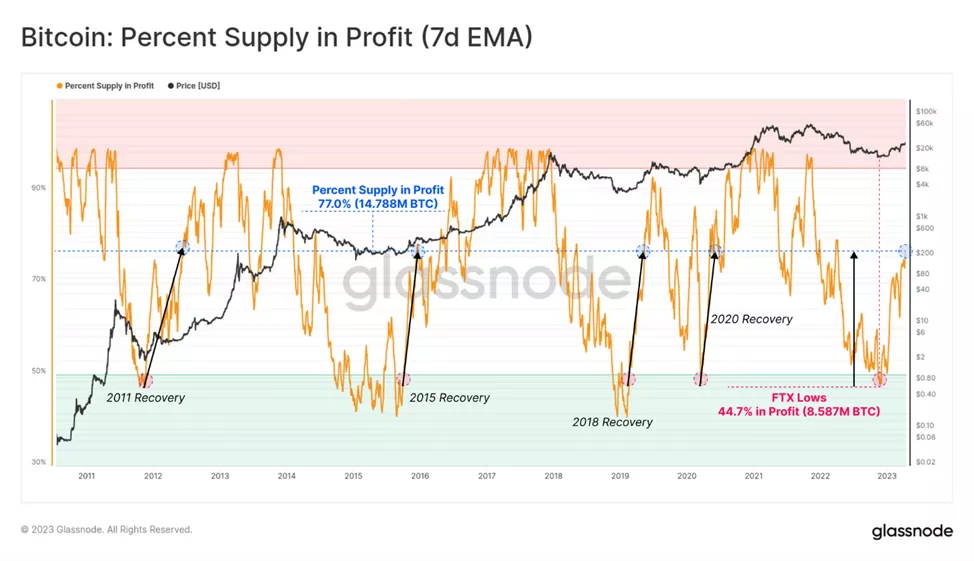

Experts noted that market strength since the start of the year is underpinned by a surge in the number of coins held in profit.

The bear market bottom is characterised by widespread capitulation, accompanied by a corresponding influx of demand to absorb it. When price exits the zone forming a medium-term extreme, the coins bought back move back into profit.

In 2023, 6.2 million BTC—about 32.3% of supply—had this status, illustrating the sizable cost basis at prices below $30,000, the analysts said.

Even as the price has doubled from the lows, analysts do not observe a substantial uptick in spending on older coins. The chart below shows that coins aged less than three months still account for less than 20% of ‘the wealth’, a level typically associated with bear-cycle bottoms.

The flip side is also true — the share held by owners of coins older than three months sits at 80%, despite the crypto winter of 2022.

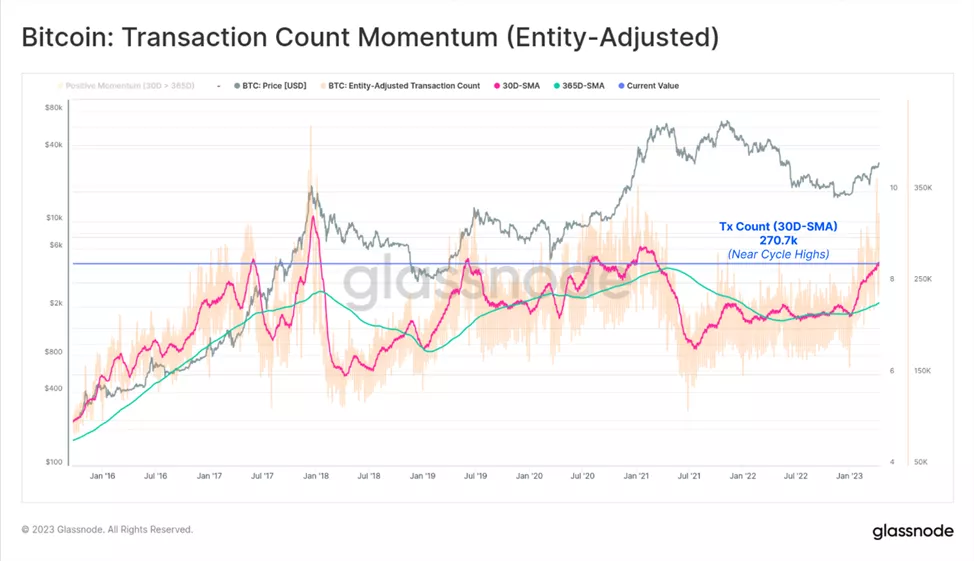

In conclusion, analysts note high on-chain activity. The daily transaction count exceeds 270,000, which could push the monthly metric toward a cyclic high. Partly, analysts attribute the trend to sustained interest in the Ordinals project — the number of Bitcoin NFTs has surpassed 1 million.

As reported, Ark Invest analyst Yasin Elmandjra forecast Bitcoin reaching the $1 million mark in the next decade.

According to a survey, major players in the industry remain bullish and foresee a rise to $100,000. Analysts at Bank of America also allowed for a continued rally of digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!