Fed raises key rate; Bitcoin holds above $28,500

On Wednesday, May 3, the U.S. Federal Reserve (Fed) повысила the target range for the federal funds rate by 25 basis points, to 5–5.25% per annum.

The decision came in line with market expectations. The Fed said inflation in the United States remains elevated. It remains committed to returning the inflation rate to 2%.

“Economic activity grew at a modest pace in the first quarter. Hiring has been resilient in recent months, and the unemployment rate has remained low. Inflation remains elevated,” the press release said.

On April 12, the U.S. Bureau of Labor Statistics published the consumer price report. The index reading came in slightly above analysts’ expectations — up 0.1% month over month and 5% year on year.

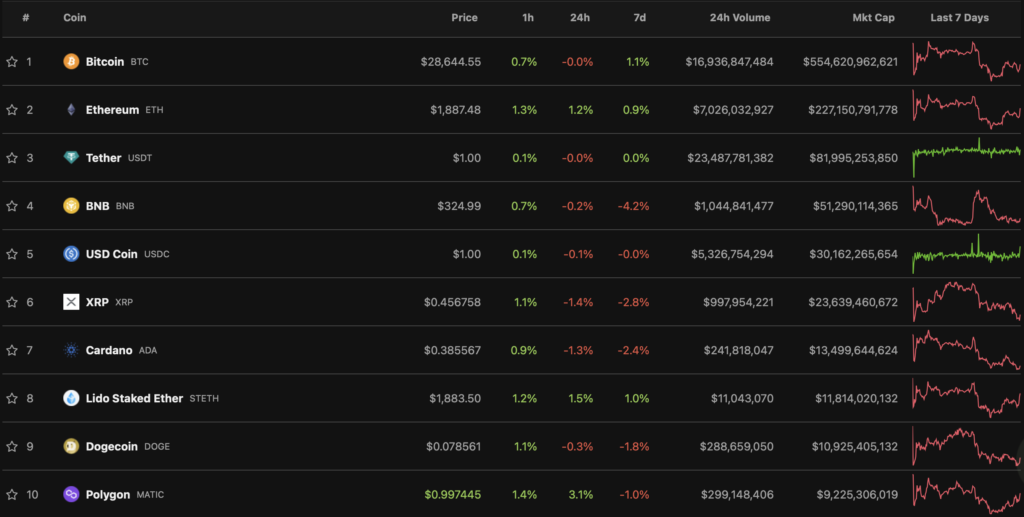

Both stock and crypto markets reacted to the news in a subdued fashion. According to CoinGecko, the prices of the largest-cap digital assets did not show significant movement.

At the time of writing, the total market capitalization of digital assets stood at $1.23 trillion.

Earlier, Fed Chair Jerome Powell, in a congressional appearance, said there was a high likelihood of further tightening of monetary policy. However, the collapse of American credit institutions and the Swiss investment bank Credit Suisse prompted investors to expect softer steps from the regulator.

Earlier, in February, the Fed raised the target range by 25 basis points to 4.5–4.75% per annum. Bitcoin prices reacted by rising above $23,000.

In March, Bitcoin held above $28,000 on the back of the Fed’s decision to raise rates to 4.75–5% per annum. By the end of the month, Bitcoin tested above $29,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!