Fed Minutes Release Triggers Bitcoin Selling

Bitcoin prices slid to a two-month low below $28,400.

The negative momentum followed the release of протокола к последнему заседанию ФРС, which permitted further tightening of policy.

Further rate increases will be possible if inflation does not fall sharply, as forecast by the Fed.

Among the risks, officials cited stronger economic growth, as well as the end of improvements in supply chains and a rebound in commodity markets. The latter two factors have contributed in recent months to a slowdown in consumer price growth.

Some committee members noted that its decisions should balance the risks of unintended policy tightening against the costs of insufficient rate hikes.

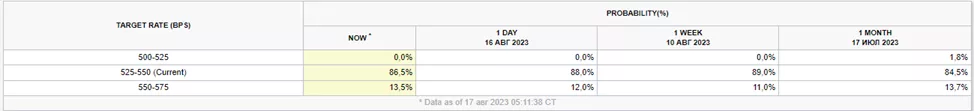

On July 26, the Federal Reserveraised the target range for the federal funds rate by 25 basis points—to 5.25-5.50% annually. The decision followed after a pause at the June meeting .

Earlier, the U.S. Bureau of Labor Statistics stated that consumer inflation on an annual basis decelerated from 4% to 3%. Against this backdrop, Fed Chair Jerome Powell said the agency would continue to raise interest rates, but not as aggressively as before.

The futures market remains skeptical about tightening policy in September, though the probability of such a scenario after the minutes rose from 12% to 13%. In November and December such odds are traders’ estimates as one to two. No significant repricing occurred over the past 24 hours.

According to the minutes, the Fed staff’s baseline forecast no longer assumes a recession this year. In March, amid the banking crisis, such a scenario was not ruled out .

As reported in August 2023, Zak Pandl, Grayscale Investments’ managing director of research, linked the possibility of a crypto market rebound with a “soft landing” of the US economy .

Earlier, Mike Novogratz, Galaxy Digital’s CEO, arrived at similar conclusions .

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!