Bitcoin Indicators Suggest Potential Bearish Turn

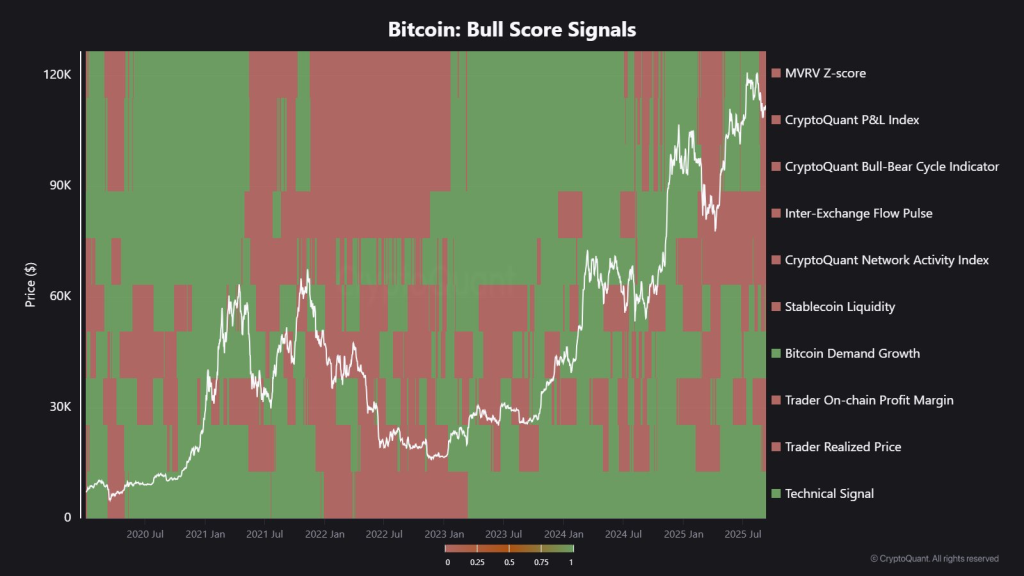

Only two components of the Bull Score Index remain positive.

On the night of September 12, the price of the leading cryptocurrency recovered above $116,000. However, CryptoQuant analyst Maartunn noted a concerning signal: nearly all key indicators of the bull market have turned bearish.

🐻 Caution Ahead?

8 out of 10 signals in the CryptoQuant Bull Score Index are flashing bearish for Bitcoin.

Momentum is clearly cooling. pic.twitter.com/WszRLeYMfp

— Maartunn (@JA_Maartun) September 11, 2025

Out of ten components of the Bull Score Index, only two remain positive: “Bitcoin demand growth” and “Technical signal”. The other indicators — MVRV-Z Score, profit/loss index, market cycle indicator, and stablecoin liquidity — have entered the “red zone.”

The expert noted a clear cooling of investor sentiment.

A similar situation was last observed in April when Bitcoin’s price fell to $75,000. For comparison, in July, when the price was $122,800, eight out of ten indicators were bullish.

Macroeconomic Influence

On September 11, the US released consumer price index (CPI) data for August, which matched forecasts. Unexpectedly, jobless claims hit a record high since October 2021, with 263,000 claims against the expected 235,000.

Weekly jobless claims just hit 263,000. That’s the highest weekly number since October 2021. pic.twitter.com/5hoLBpNCEM

— Josh Schafer (@_JoshSchafer) September 11, 2025

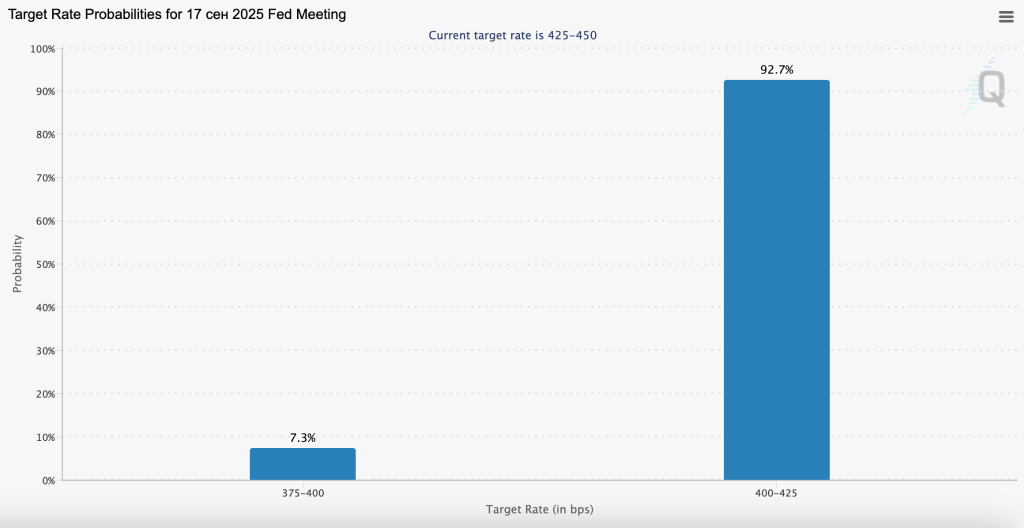

Growing concerns about labor market weakness further strengthened market participants’ confidence in a monetary policy easing by the Federal Reserve. At the time of writing, 100% of investors are betting on this outcome.

“The market expects a 0.75% rate cut by the end of the year. Although inflation is rising, employment issues are becoming too serious to ignore. Next week will be critically important,” noted analysts at The Kobeissi Letter.

What’s Next?

Bitcoin’s climb above $116,000 for the first time since mid-August was seen by market participants as a signal for further growth.

PPI much lower than expected, CPI as expected.

Conclusion: Inflation not as bad as expected — bring on the rate cut later this month.

News now behind us, time to resume the scheduled programme: higher.#Bitcoin pic.twitter.com/QpCxixMfER

— Jelle (@CryptoJelleNL) September 11, 2025

“Inflation is under control — we expect a rate cut this month. The news is accounted for, and the market is ready to move up,” noted investor Jelle.

Trader BitBull stated that surpassing $113,500 and holding above this level opened the possibility for testing historical highs.

$BTC has reclaimed a very crucial level.

The $113.5K level which acted as a resistance has now been flipped into support.

Now the next key level for Bitcoin is to reclaim $117K level, and a new ATH will be confirmed. pic.twitter.com/3QdrCtH4ho

— BitBull (@AkaBull_) September 11, 2025

However, many experts anticipate further testing of the current support’s strength before moving to a phase of setting new price records.

Analyst Skew warned of a “liquidation trap.” He suggested that the market might artificially trigger a mass stop-loss of traders who opened long positions after the CPI release.

He pointed to a liquidity cluster of 2000 BTC in areas below the current price of digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!