Experts Predict Capital Inflows Into Bitcoin After Fed Pivot

The transition of the Fed from tightening to easing monetary policy could have a positive impact on cryptocurrencies. This was reported by The Block analysts.

According to specialists, the turn will be a signal of reduced risk appetite among investors, which will trigger capital inflows into digital assets, including cryptocurrencies.

The reduction of the Fed’s key rate could coincide with the halving expected in April 2024, which historically led to a substantial price rally, they added.

“From a historical and technical standpoint, this is a bullish event, although a temporary pullback on the ‘selling on the news’ could be possible,” the experts noted.

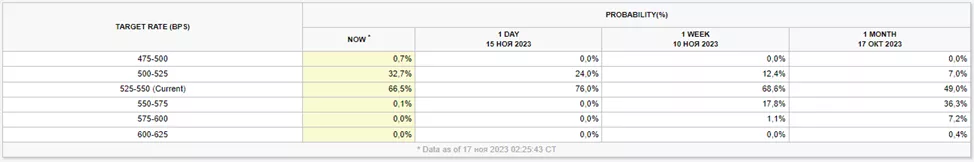

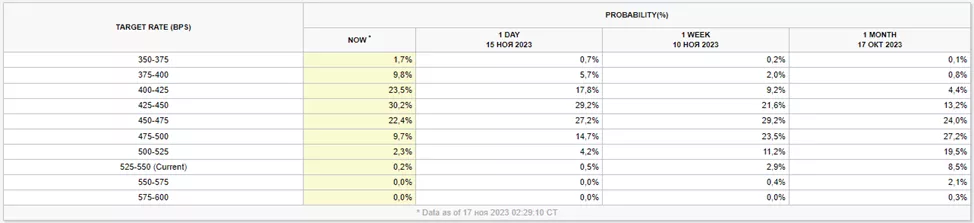

Fed rate expectations

According to the futures market, the probability of a 25 basis point cut in the key rate at the March 2024 meeting is priced at 33.4% (a month earlier it was 7%). On December 13 the Federal Reserve will hold policy unchanged, according to the consensus forecast.

Overall, over the course of next year the market is pricing in a total easing of policy by 100 basis points with a 2-to-1 odds.

CoinShares head of research James Butterfill pointed to historical cases where accommodative monetary conditions led to the price of digital gold higher.

“From a historical and technical standpoint, this is a bullish event, although a temporary dip on the ‘selling on the news’ could be possible,” the analysts noted.

Head of Markets at YouHodler, Ruslan Lienha, agreed with expectations for monetary loosening, but offered a more conservative view. In his view, the Fed will begin loosening no earlier than the second half of 2024. This could keep pressure on risk assets, including Bitcoin, he explained.

“We will see the full impact on Bitcoin’s supply later, when the global economy overcomes current difficulties. If authorities manage to chart a path to a soft landing, the price of the first cryptocurrency will rise significantly by the end of 2024,” Lienha added.

Earlier, Glassnode analysts estimated the available supply at 2.33 million BTC (a multi-year low).

Bullish signals

The analyst noted the prevailing bullish sentiment among traders.

“Rising market capitalization of stablecoins, together with rising prices for tokens, will demonstrate market liquidity saturation and point to sustained growth,” Liënha explained.

From 19 October to 10 November, Tether minted an additional 4 billion stablecoins USDT, according to Whale Alert.

Bitfinex proposed tracking Bitcoin’s supply dynamics — the number of coins in the hands of hodlers and speculators, as well as the age bands of spent bitcoins (SOAB).

“SOAB recently demonstrated that a price decline over a week to roughly $34,500 actually increased the concentration of supply in the cohort of holders who bought 6–18 months ago. That category, it seems, is waiting for the halving,” the analysts explained.

This occurred amid a substantial reduction in the supply of coins among short-term holders, according to the specialists.

“Seasoned investors who time the market precisely are actually increasing their assets, while new market participants panic-sell when prices fall below their purchase price or plunge,” Bitfinex concluded.

Earlier, on 14 November it was reported that inflation cooling in the US resumed. Macro data contributed to strengthening expectations of a Fed policy pivot.

Earlier, Matrixport forecast Bitcoin’s price rise to $40,000-45,000 in 2023.

Before this, analysts said that Bitcoin shorts would be hit by the “Santa Claus squeeze”.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!