Ethereum Price Tests $4700 as Experts Predict Surge to $10,000

Ethereum price hits $4700; experts foresee $10,000.

The price of the second-largest cryptocurrency by market capitalization has reached $4700. Against this backdrop, analysts at XWIN Research have suggested the asset could rise to $10,000.

Could Expanding M2 Push ETH Toward $10K?

“If global liquidity continues to expand and the structural outflow from exchanges persists, Ethereum could realign with M2 growth and enter a new revaluation phase. In that scenario, $10K is far from unrealistic.” – By @xwinfinance pic.twitter.com/mk4jOUFcdX

— CryptoQuant.com (@cryptoquant_com) October 6, 2025

At the time of writing, the coin is trading at $4655. The altcoin’s price is approaching its all-time high, with just 5.8% to go, according to CoinGecko.

Experts have noted that over the past three years, the M2 money supply has resumed growth. Bitcoin was the first to react to the “wave of liquidity,” showing a high correlation of 0.9.

Since 2022, the price of the leading cryptocurrency has surged by 130%. During the same period, Ethereum has only increased by 15%.

However, on-chain data suggests a potential narrowing of the gap. The reserves of the leading altcoin on exchanges have fallen to 16.1 million ETH, more than 25% since 2022. This indicates a structural decrease in selling pressure.

The net inflow of the asset to trading platforms remains negative. The Coinbase Premium Index has turned positive again, indicating renewed interest from U.S. institutions.

Analysts noted that Ethereum historically lags behind Bitcoin in the early stages of monetary policy easing cycles. When the dominance of digital gold falls below 60%, capital flows into altcoins. Researchers believe this trend is repeating.

If global liquidity continues to grow and the outflow of ether from exchanges persists, the asset could enter a new revaluation phase. In such a scenario, a price of $10,000 seems achievable, concluded XWIN Research.

SharpLink’s Holdings

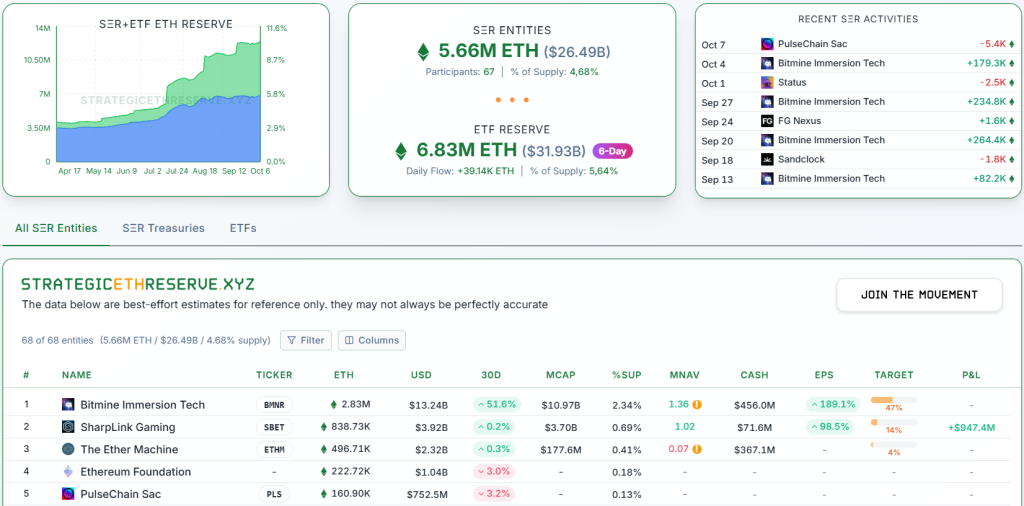

SharpLink’s unrealized profit from investments in the second-largest cryptocurrency by market capitalization has exceeded $900 million.

SharpLink’s unrealized profit now surpasses $900M since launching the ETH treasury strategy on June 2, 2025.

During that time, ETH concentration doubled, making every share more valuable.

With 839k ETH on our balance sheet and no debt, SharpLink’s in a strong position to keep… pic.twitter.com/4HlQWRZjvw

— SharpLink (SBET) (@SharpLinkGaming) October 6, 2025

The company holds approximately 839,000 ETH with no debt obligations. The firm described this as “the strength of a productive and profitable asset like Ethereum.”

Altcoin-focused companies have collectively purchased 5.6 million ETH worth $26.4 billion.

In September, CryptoQuant expert known as CryptoMe suggested a new rally for the second-largest cryptocurrency by market capitalization.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!