French Bank ODDO BHF to Launch Euro-Backed Stablecoin

ODDO BHF to launch EUROD stablecoin on Polygon, bridging traditional finance and crypto.

Founded 175 years ago, the French bank ODDO BHF has announced the launch of the EUROD stablecoin, pegged to the euro, on the Polygon network.

Discover $EUROD, a new step in ODDO BHF’s digital asset journey ⬇️

In a market dominated by USD-backed stablecoins, ODDO BHF is launching $EUROD, a euro-denominated stablecoin designed to bring institutional trust to the crypto ecosystem for on-chain settlements and payments.… pic.twitter.com/XDExwMNr57

— EUROD (@EUR_OD) October 15, 2025

The stablecoin will be listed on the Spanish crypto platform Bit2Me, supported by telecom giant Telefonica and financial institutions Unicaja and BBVA. The initial offering will consist of 5.1 million coins.

EUROD is positioned as a low-volatility digital version of the euro, compliant with MiCA regulations. The asset is intended for both retail and institutional users.

Bit2Me CEO Leif Ferreira described the release of the stablecoin as a bridge between traditional finance and the crypto industry. Previously, the platform raised €30 million in investments with participation from Tether, the company behind USDT, to expand in the EU market.

At the end of September, nine banks formed a consortium to issue a euro-backed stablecoin. The aim is to offer an alternative to the dominant US fiat-pegged coins in the market.

In June, the crypto asset division of Societe Generale, SG-FORGE, announced the launch of EURCV.

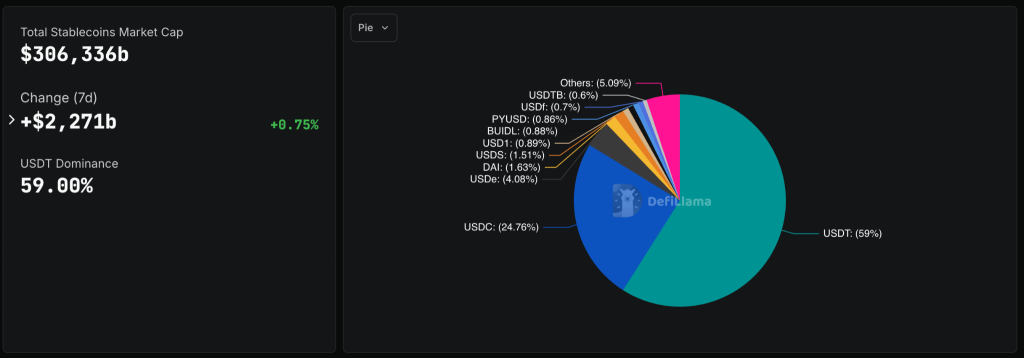

As of writing, the market capitalization of the stablecoin sector is estimated at $306 billion. USDT remains the dominant player, holding a 59% share.

Taiwanese Stablecoin Project Lists on Nasdaq

Taiwan-based stablecoin company OwlTing has secured approval for a direct listing on the Nasdaq exchange. Trading of the firm’s shares under the ticker OWLS will commence on October 16.

In 2023, OwlTing launched the OwlPay platform, enabling companies to use stablecoins for transactions with international suppliers.

The company’s CFO, Winnie Lin, emphasized that OwlTing plans to continue investing in new technologies, expanding its international presence, and enhancing compliance with local regulations.

“We focus on providing secure and cost-effective stablecoin-based payment solutions that create long-term value for shareholders worldwide,” she added.

Researchers at Bernstein forecast a threefold increase in the market capitalization of Circle’s USDC. According to their estimates, by the end of 2027, the asset’s market share in the stablecoin sector will rise to 33%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!