Nine European Banks Collaborate to Launch Euro Stablecoin

Aiming to offer an alternative to dominant American stablecoins.

Major European banks have formed a consortium to issue a stablecoin pegged to the euro, in compliance with MiCA regulations. The aim is to offer an alternative to the dominant American stablecoins in the market.

Participants in the project include ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International.

The stablecoin will enable instant, round-the-clock payments and settlements with low fees. Credit institutions will also be able to offer clients additional services, including wallets for storing the asset.

The founding banks have registered a separate company in the Netherlands, which will allow them to obtain an electronic money issuer license from the local central bank. Upon regulatory approval, the consortium will appoint a CEO for the project. It is currently open to new participants.

The euro stablecoin is scheduled for release in the second half of 2026.

“Digital assets have the potential to transform the financial landscape—not only through new forms of money but also by offering significant efficiency and savings for both the financial sector and clients,” stated Flaminia Lucia Franca, a representative of Danske Bank.

Dominance of American Stablecoins

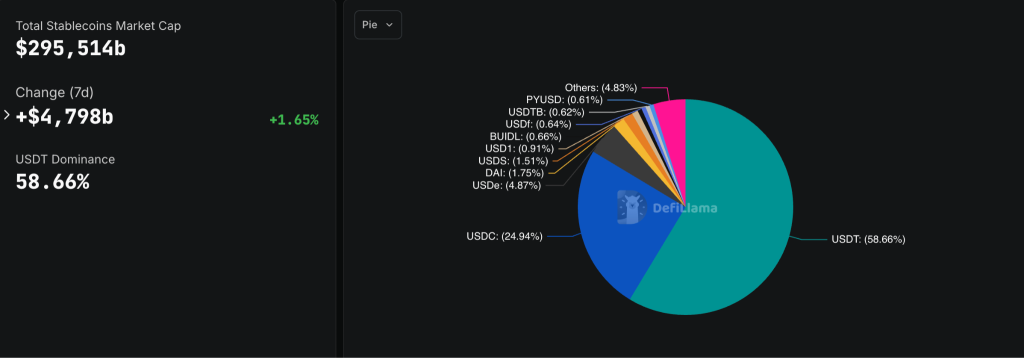

As of writing, the stablecoin sector’s market capitalization is estimated at $295 billion. The dominant player remains the American stablecoin USDT from Tether, holding a 58.6% market share.

The second most prevalent is USDC from Circle, accounting for 29.9% of the segment.

The market value of euro-based stablecoins exceeds $562 million, according to CoinGecko. In this category, the largest asset by capitalization is EURC, which Circle launched in December 2023 on the Solana blockchain.

As of early 2025, ten issuers have obtained MiCA licenses, allowing them to issue stablecoins in the European Economic Area.

In April, media reported on the issuance of a regulated stablecoin in Europe by ING Bank. Later, two companies supported by Tether—StablR and Oobit—introduced stablecoins compliant with the new regulations.

In June, the crypto asset division of the French financial conglomerate Societe Generale, SG-FORGE, announced the launch of USD CoinVertible (USDCV).

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!